As per the Intergovernmental Panel on Climate Change’s (IPCC) 6th assessment report on global climate change, monsoons in India are likely to face, inter alia, (i) increase in the frequency and duration of dry spells, and (ii) intensified monsoon extremes particularly in central India (IPCC 2021). The monsoons of 2021, normal in volume but erratic in pattern, corroborate this prediction. Besides, the government of India has also acknowledged the impact of climate change on Indian monsoons, recently.

With 50 percent of India’s gross cropped area (GCA) of 200 million hectares (Mn. ha) (2017-18) still depending on monsoon rains for meeting irrigation needs (DES, GOI), such climactic vagaries are disconcerting news not just for India’s commitment for the Sustainable Development Goal of ‘zero hunger’ by 2030 but also for Prime Minister Narendra Modi’s dream of augmenting incomes of farmers. About 76 percent of the annual rains in the country fall during the four monsoon months of June-July-August-September (Saini and Gulati 2014). Every time monsoon rains fall by a percentage point, India’s agricultural gross domestic product (GDP) falls on average by about 0.35 percentage points (Gulati, Saini and Jain 2013).

Monsoons 2021: Volume and pattern

This year’s overall monsoon rains were ‘normal’ with a deviation of about 1 percent from its long period average (LPA) value. A month-wise analysis shows that monsoon rains in June were good at 110 percent of its LPA value. It fell in July to 93 percent and further down to 76 percent in August. In September it recovered with bumper rains at 134 percent of LPA. (Figure 1 LHS).

Figure 1 Performance of monsoons in India and regions (% LPA deviation)

The geographical spread of monsoon rains too had variations (Figure 1 RHS). Overall, monsoon rains were normal in northwest India (-4% deviation) and central India (3% deviation), but were in deficit in northeast India (-12% deviation) and in excess in southern peninsula (11% deviation). Central India, however, seems to have faced very high volatility in the 2021 monsoon rains: extreme rain deficit in August (39 percent below LPA) followed by an exceptionally flush September (83 percent above LPA).

Between regions, six meteorological sub-divisions, namely Western Uttar Pradesh, Lakshadweep, Jammu & Kashmir and Ladakh, and the north eastern divisions of Assam and Meghalaya, Arunachal Pradesh, and NMMT (Nagaland, Manipur, Mizoram and Tripura) faced deficient rains (i.e., deviation greater than (-) 20% but lower than (-) 60%) (red in Figure 2). Ten sub-divisions received excess rains (i.e., between 20% and 59%) and amongst them Telangana and Marathwada received the highest.

Figure 2 Indian monsoons 2021 overall performance

Northeast India includes Arunachal Pradesh, Assam & Meghalaya, Nagaland, Manipur, Mizoram, Tripura, Sikkim, West Bengal, Jharkhand, Bihar; Central India includes Gujarat, Madhya Pradesh, Maharashtra, Goa, Chhattisgarh, Orissa; Southern peninsula include A & N Islands, Andhra Pradesh, Tamil Nadu, Puducherry, Karnataka, Kerala, Lakshadweep and Northwest India include Jammu & Kashmir, Himachal Pradesh, Punjab, Haryana, Chandigarh, Delhi, Uttarakhand, Uttar Pradesh, Rajasthan.

Northeast India includes Arunachal Pradesh, Assam & Meghalaya, Nagaland, Manipur, Mizoram, Tripura, Sikkim, West Bengal, Jharkhand, Bihar; Central India includes Gujarat, Madhya Pradesh, Maharashtra, Goa, Chhattisgarh, Orissa; Southern peninsula include A & N Islands, Andhra Pradesh, Tamil Nadu, Puducherry, Karnataka, Kerala, Lakshadweep and Northwest India include Jammu & Kashmir, Himachal Pradesh, Punjab, Haryana, Chandigarh, Delhi, Uttarakhand, Uttar Pradesh, Rajasthan.

As per IMD, the monsoon rains in 2021 are “uniquely placed in the historical records” for the very distinct and contrasting pattern of rainfall variation between the four months. The exceptionally high deficit in August, in particular, emerges to be a very rare phenomenon as in India’s 120 years’ of rainfall history, a deficit greater than 20 percent has appeared only 10 times prior to the current one. The number of instances of excess rainfall have also shot up. In 2017 there were about 1824 instances of ‘very heavy’ and ‘extremely heavy’ rainfall, which increased to 1909 in 2021, a jump of about 85 cases. An exceptional jump can be seen particularly in case of September 2021 where instances of ‘extremely heavy’ rainfall seem to have tripled since 2017.

Also read: Kharif output estimated to hit record 150.50 million tonne this year, Modi govt says

Crops and prices

Kharif is the main cropping season of the country (sowing in June and harvest around October). As per data from IMD, after the onset of monsoon over Kerala on June 3 2021, it continued its advance till June 13. However, after around June 13, 2021 rainfall activities nearly stopped and ‘weak or break monsoon conditions’ prevailed across the country. There was mostly a dry spell till around July 12, 2021.

Due to a long break in monsoon rains, kharif sowing especially of rice, jowar, bajra, moong bean, maize, jute and mesta was delayed. The rainfall activities resumed in middle of July 2021. But the monsoon rains witnessed a second major break or halt in the first week of August. In September, however, the country as a whole, barring northeast India, received excess rains (Figure 1).

The erratic progress of monsoon this year is predicted to impact crop yields via, inter alia:

- 3 Ds (drought, delay and dry spell): that is likely to affect acreage and the yields; and

- Excess rains- which are likely to have damaged crops in the field and those kept in the storage. However, the higher soil moisture from good rains is predicted to boost rabi production next season.

As per the sowing data from the Ministry of Agriculture and Farmers Welfare (MoA) (Table 1), there has been no significant impact on area sown under the major kharif crops of rice, pulses, oilseeds, coarse cereals, sugarcane, cotton, jute and mesta, except in the case of cotton and coarse cereals where the acreage fell by about 6% and 2.5% respectively, compared to the area in 2020. But this fall may not be linked exclusively to the monsoon variations.

According to the IMD terminology, ‘break’ in rainfall activities occurs when the monsoon is interrupted by long spells of deficit rainfall in most regions of the country.

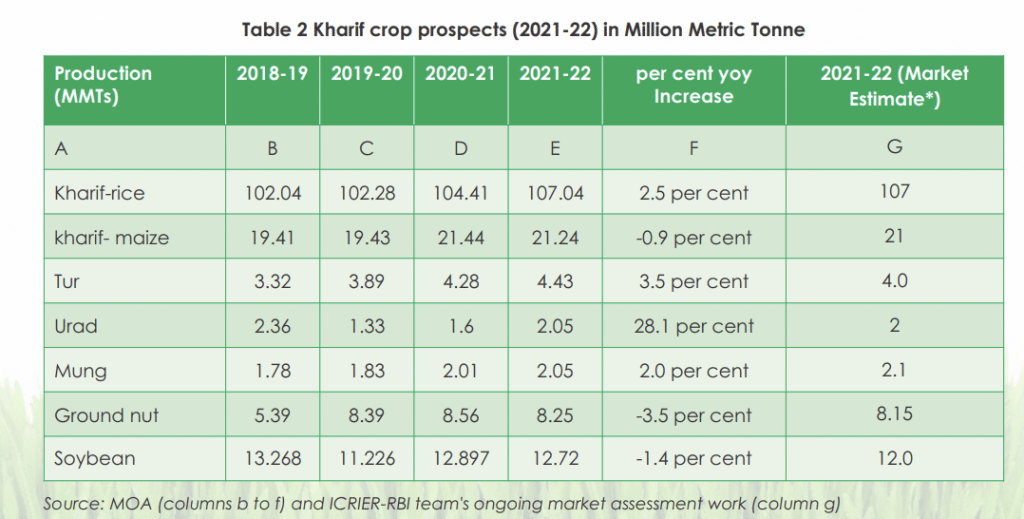

As per the first advance estimate of production for 2021-22, released by MoA on September 21, 2021, production of most kharif crops is likely to be higher this year compared to the last year. There, however, appears to be a marginal annual drop in production of maize, groundnut and soybean (columns b to f in Table 2).

This optimism on part of the government about a record production is not as enthusiastically shared by trade and markets. As part of an ongoing work at ICRIER, markets of selected agricultural commodities are tracked and monitored regularly for price prediction and a regular assessment of production and market arrivals, inter alia, is part of the work. The current estimates of production from the ongoing research are presented in column g of Table 2., As per these estimates, the production of maize, tur, urad, ground nut and soybean are likely to be lower than GOI’s assessment. For moong, on the other hand, traders expect a better harvest than GOI estimates.

Estimates for horticulture crops like onion are not out yet. However, as per our ongoing market assessment research, excess rains in the month of September in the key onion growing regions of Nasik (Maharashtra), Kolar and Chitradurga (Karnataka) and Alwar (Rajasthan) have adversely impacted the yield of kharif crop. Kharif onion, although has around 30-35% share in total annual onion production, is crucial for maintaining supplies during the critical months of October to January period when stored rabi onions plummet to their lowest levels. Excess rains in September seem to have caused some damage to stored rabi onions in Maharashtra. All this is likely to push up onion prices in coming months. The wholesale prices at Lasalgaon, Maharashtra, considered as the benchmark price for onion in the country, have already risen by close to 130% from Rs. 14.55 per kg in September 2021 to Rs 33.50 per kg on October 9, 2021 within a month (Agmarknet: https://agmarknet.gov.in/).

In case of tomato, as per our preliminary assessment, excess rains in September 2021 have damaged about 15% of the crop especially in Karnataka and Maharashtra. Within a month, the benchmark wholesale prices at Kolar (Karnataka) have increased by about 90 percent from Rs. 6 per kg in September to Rs 11.3 per kg on October 9, 2021 (Agmarknet:https://agmarknet.gov.in/). Tomato prices usually spike because of monsoon rains disrupting supply chain logistics at this time.

Also read: Erratic monsoon hits cereal, pulses, oilseed sowing in top producing states amid inflation

In the coming months

October rains are critical: Most of the kharif crops – rice, pulses, oilseeds, coarse cereals, cotton, sugarcane and jute would be ready for harvest during the months of October-December. Excess rains during these months may damage the standing crop and affect yields.

Good rabi crop this year: It is expected that with a normal monsoon, rabi crops, especially, wheat, chana, mustard and other coarse cereals would benefit from the higher soil moisture positively impacting their yields.

Comfort from high stock levels: Due to the exceptionally high levels of rice stocks of 26.83 MMTs on September 1, 2021 (against the stocking norm of 10.2MMTs for October 1) with the Food Corporation of India (FCI), even if rice yields this year are lower, the rice prices are unlikely to feel any pressure. In case of pulses, National Agricultural Cooperative Marketing Federation of India (NAFED) has stocks of 1.13 MMTs of gram, 0.2 MMTs of tur and about 0.33 MMTs of moong (as on October 1, 2021). During July-September 2021, NAFED offloaded about 0.3 MMTs of gram in the open market and discussions are on to offload more stocks in the coming festive seasons if need arises.

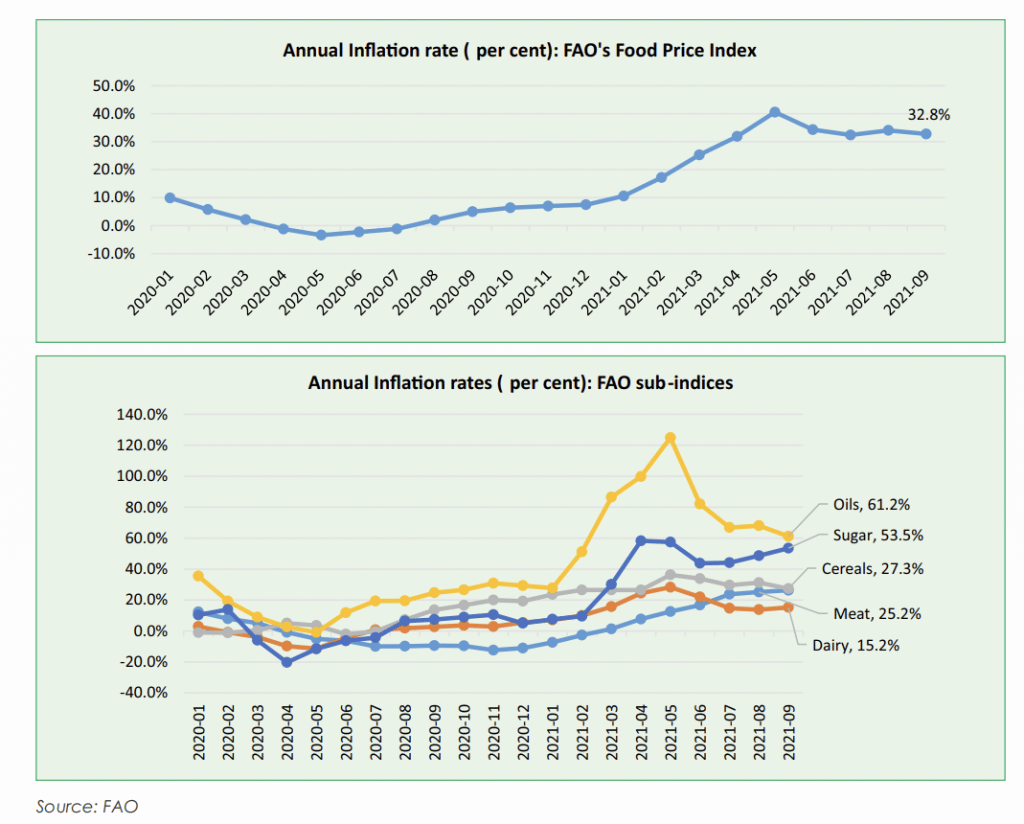

Global prices continue to haunt: Globally, food has been getting expensive, particularly since January 2021(LHS Figure 3). In September this year, FAO’s food price index showed an annual inflation rate of about 33%. All sub-indices showed an inflation rate of more than 15%, with oils and sugar, particularly, with annual inflation rates of 61% and 53% respectively (RHS Figure 3). Global prices transmit into domestic borders via trade. In case of edible oils, around 60% of domestic consumption is met via imports. As per the monthly data on prices from the World Bank Pink Sheets, in September 2021 the palm oil (constitutes about 54% of total Indian edible oil import bill) was globally selling at $1181 per MT that was about 50% higher than last year’s price, and the soybean oil (constitutes around 25% of edible oil imports) that was selling at $1399 per MT showed an annual inflation rate of about 54%. In this September, even the rapeseed oil prices were seen selling at $1629 per MT up by about 74% since last year. Contagion of this global inflation into domestic markets appears inevitable.

Figure 3 Global agricultural and food prices

Saini is the visiting Senior Fellow and Das is Senior Consultant at ICRIER’s Agriculture Policy, Sustainability and Innovation (APSI) team. This article was first published in APSI’s second quarterly publication — AF-TAB – Agri-Food Trends and Analytics Bulletin — and has been republished here with permission.