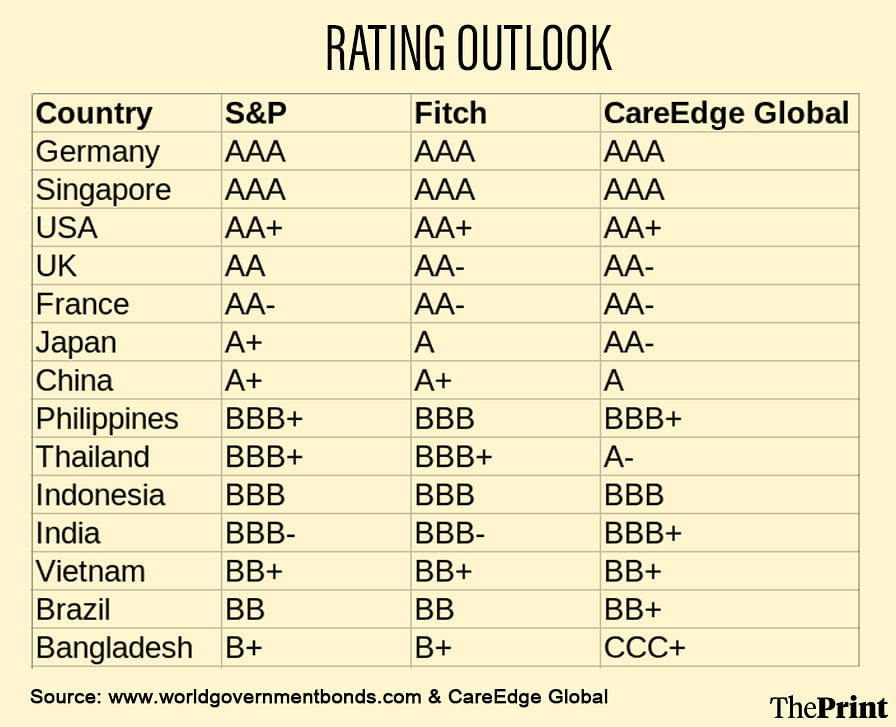

On 3 October, CareEdge became the first Indian agency to enter the global sovereign ratings space through its subsidiary CareEdge Global IFSC Limited. In its inaugural report covering 39 countries, CareEdge assigned BBB+ (investment grade) rating to India, while the United States was rated AA+.

Till now, three rating agencies—Fitch, S&P Global and Moody’s—have dominated the sovereign ratings space. Their rating assessments have been subject to criticism for a number of reasons, including opacity of methodology and over-reliance on perception-based indicators.

There is scope for considering improvements to the methodology, for instance, through diversifying the data sources for qualitative assessment. At the same time, the metrics that constrain India’s ratings upgrade need to be monitored.

SCRA methodology

Sovereign Credit Rating Agencies (SCRAs) provide an independent evaluation and assessment of the ability of issuers to meet their debt obligations. They are important as their ratings typically determine the extent and cost of the access the countries have to international capital markets.

The ‘willingness and capacity to pay’ is the central metric for rating of sovereigns. To capture this, SCRAs look at a host of qualitative factors, such as institutional strength, political stability, judicial independence and soundness of the banking system, to mention a few. These are complemented with quantitative factors, such as the macroeconomic performance (covering variables, like GDP growth and inflation), public finances and external finances.

The fundamental factors that feed into the ratings analysis are comparable, but each SCRA differs in how these variables are weighted and aggregated into a single rating.

India at the cusp of investment grade

Currently, the most prominent sovereign ratings are those given by S&P, Moody’s and Fitch. There is a degree of convergence in their ratings, with all of them ranking India merely at the cusp of investment grade (BBB-). Even a single downgrade could result in India being in the below investment grade, or ‘speculative’ category. This is despite marked improvement in India’s macroeconomic performance over the last decade.

Additionally, to assess the willingness to pay, there is a large component of subjective assessment, mainly via World Governance Indicators (WGI). The reliance on governance indicators is premised on the notion that there exists a linear relationship between economic growth and governance, which may not be applicable for developing and emerging economies.

A recent paper by the Office of the Chief Economic Adviser, Ministry of Finance shows that over reliance on qualitative variables lends a degree of opaqueness to the methodology, making it challenging to quantify the impact on credit ratings. Another study shows that SCRAs place greater emphasis on “expert” judgement relative to the results of quantitative data analysis, leading to a bias in rating against poor countries.

SCRAs could reduce reliance on WGI and take into consideration similar indices constructed by the Economist Intelligence Unit and Global Competitiveness Report of the World Economic Forum. These sources may not cover as many countries as the WGI, but cover a broader set of indicators and have a sufficient sample of countries.

Credit positives

Globally, India fares well with respect to macroeconomic performance and the strength of the external sector, with the country set to remain the fastest growing major economy in the current year.

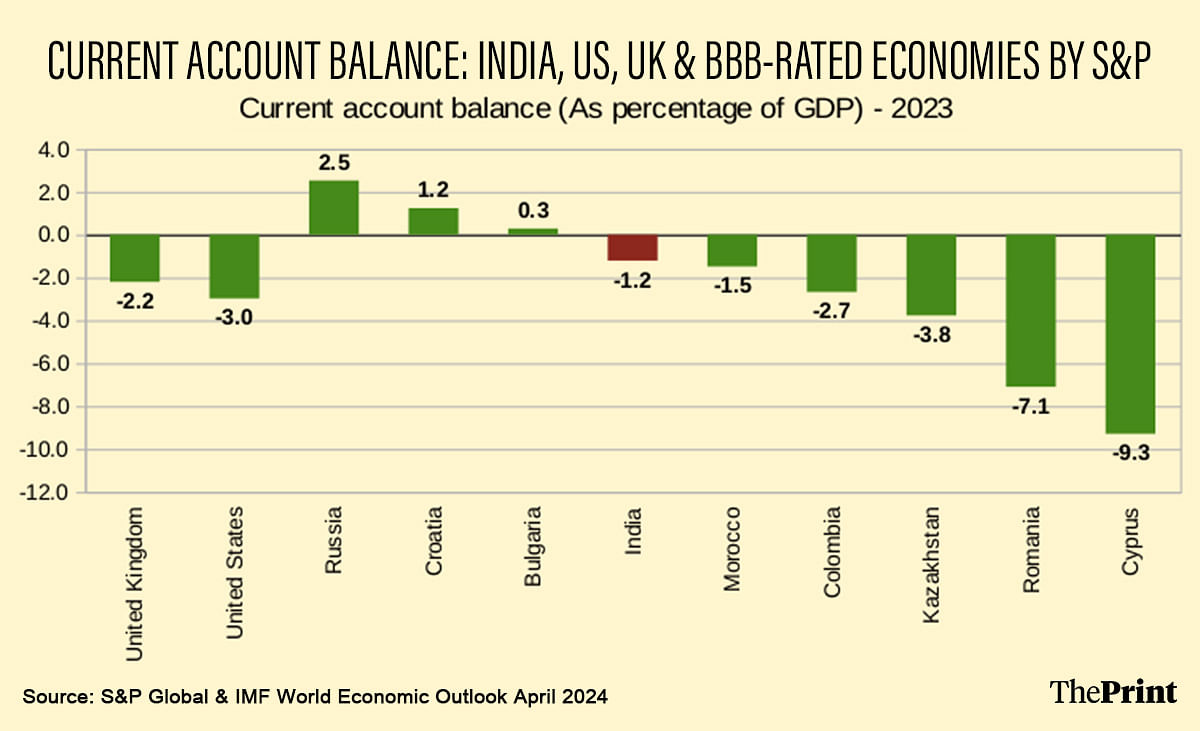

The 250 basis point rate hike in the post Covid period by the Reserve Bank of India has not had a disruptive impact on growth. On the external front, India’s current account deficit (CAD) was at 0.7 percent of Gross Domestic Product last year, much better than that of the US and UK that have higher ratings than India. The modest CAD, coupled with strong foreign investment inflows and robust export of services, indicate the strength of the external sector.

Issues constraining India’s rating

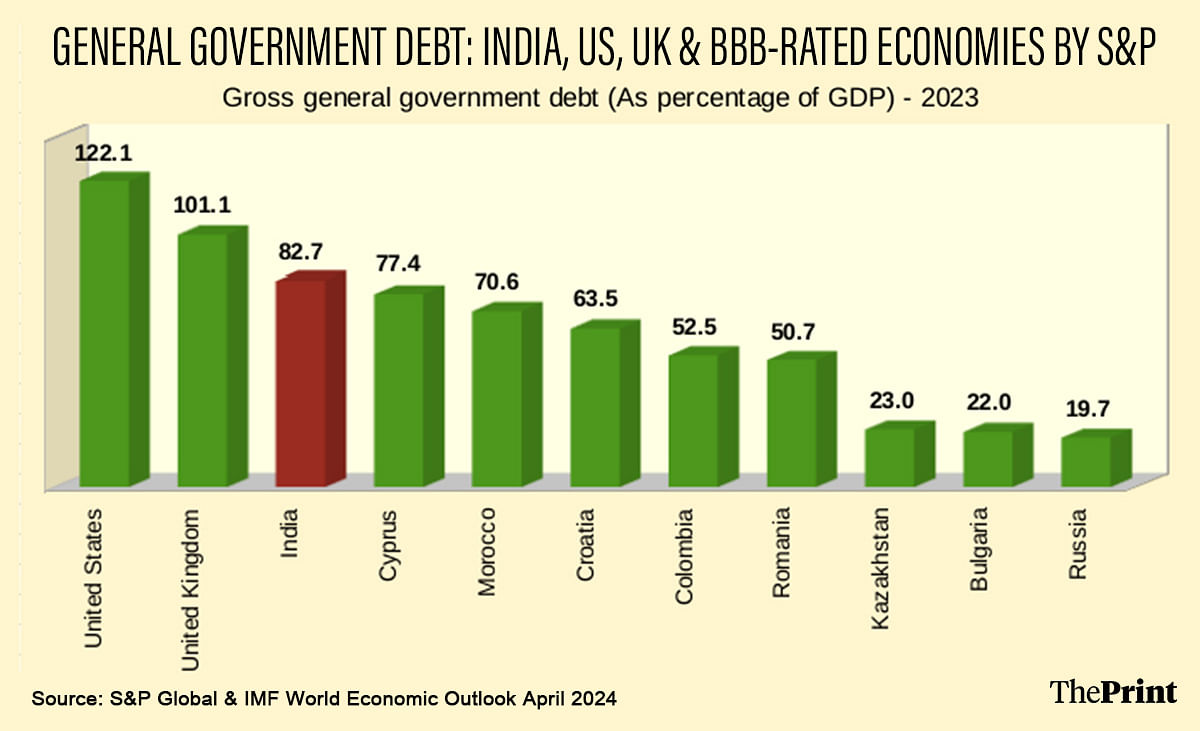

The metrics that constrain India’s credit rating relate to its debt profile. India’s general government debt at 83.4 percent of GDP in FY 2023-24 is significantly higher relative to the pre-pandemic average of 68.8 percent. The general government debt and interest payment burden remain high relative to India’s annual revenues (the latter is referred to as debt affordability).

According to Fitch, for India, the interest payments to revenue ratio at around 25 percent remains elevated, well above the 9 percent ‘BBB’ median, constraining the flexibility to pursue alternative spending objectives.

Desirability of competition

The dominance of just three agencies is primarily because reputation for high quality credit ratings is built over a long period of time, often decades. Therefore, it is difficult for new entrants to establish themselves. The sovereign ratings space is characterised by oligopolistic competition, wherein there is ‘convergence’ of methodologies, as well as the fact that one agency cannot ignore the rating actions of the others.

Since the global financial crisis of 2008, there has been increased scrutiny towards credit rating agencies, given their inability to predict the event or its aftermath. Increased competition, by facilitating the entry of smaller agencies, has been touted by regulators worldwide as a way of improving rating outcomes.

The recent entry of India’s Care Ratings in the sovereign ratings space is, therefore, a welcome development. Care Ratings notes that “transparency and objectivity” are the key pillars of its methodology. To this end, it has clearly explained the weights given to each of its five broad pillars. It places a significant focus on quantitative metrics (which it calls primary factors) to inform the aforementioned pillars.

Moreover, it has included forward-looking themes in determining sovereigns’ ability to service their debt. An example is environmental sustainability (proxied by share of clean energy in total energy consumption). Sustainability will become increasingly important as countries are exposed to transition risks in fulfilling their Nationally Determined Contributions (NDCs) under the 2016 Paris Agreement.

However, any meaningful competition by newer agencies is predicated by their acceptance and usage by a wide range of actors, both nationally and internationally. These would include not only financial market participants (such as banks, investment funds, insurers etc.), but also national (governments and regulators) and supranational entities (such as the Basel Committee on Banking Supervision or BCBS, which defines Basel norms).

Lack of acceptance will mean that existing agencies will continue to dominate, with all of their associated existing challenges.

Radhika Pandey is associate professor and Utsav Saksena is a research fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: US Fed’s rate cut is likely good news for India. It may also help temper RBI’s stance