India’s goods exports contracted for the seventh consecutive month in August, declining by 6.9 percent. On a positive note, the pace of contraction in exports has narrowed as compared to the last four months. While goods imports were also down 5.25 percent as compared to August last year, on a sequential basis, they surged by almost 11 percent.

The recent resurgence in crude oil prices due to production cuts by Russia and Saudi Arabia has contributed to a sharp sequential increase in imports. Elevated oil prices could escalate the pressure on trade and current account deficit in the coming months. Every 10 dollar rise in crude oil prices is seen to widen the current account deficit by 0.4-0.5 percent. This will have a domino impact on the external value of the rupee and on imported inflation. The trajectory of goods and services exports would thus be critical in averting a steep rise in India’s current account deficit.

<iframe loading="lazy" title="Why India should worry that exports to Asia are falling and rising to Europe” width=”696″ height=”392″ src=”https://www.youtube.com/embed/wpRzaaO2-Kw?feature=oembed&enablejsapi=1&origin=https://englishdev.theprint.in” frameborder=”0″ allow=”accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture; web-share” allowfullscreen>

Exports have been impacted due to falling commodity prices and subdued global demand. In the first five months (April-August) of the current financial year, exports have contracted by 11.9 percent. This is in contrast to more than 19 percent growth in the same period last year.

A decline in commodity prices, particularly oil prices, has contributed to a substantial decline in exports. While volume of exports has risen, in value terms petroleum exports declined due to easing of oil prices. Global crude oil prices declined steeply from April-June. By the end of June, prices bottomed out at around USD 72 per barrel and since July, prices have been on an upward trend.

Also read: Cheaper vegetables help ease food & retail inflation, but cereals & pulses continue to cause concern

Commodity-wise performance of exports

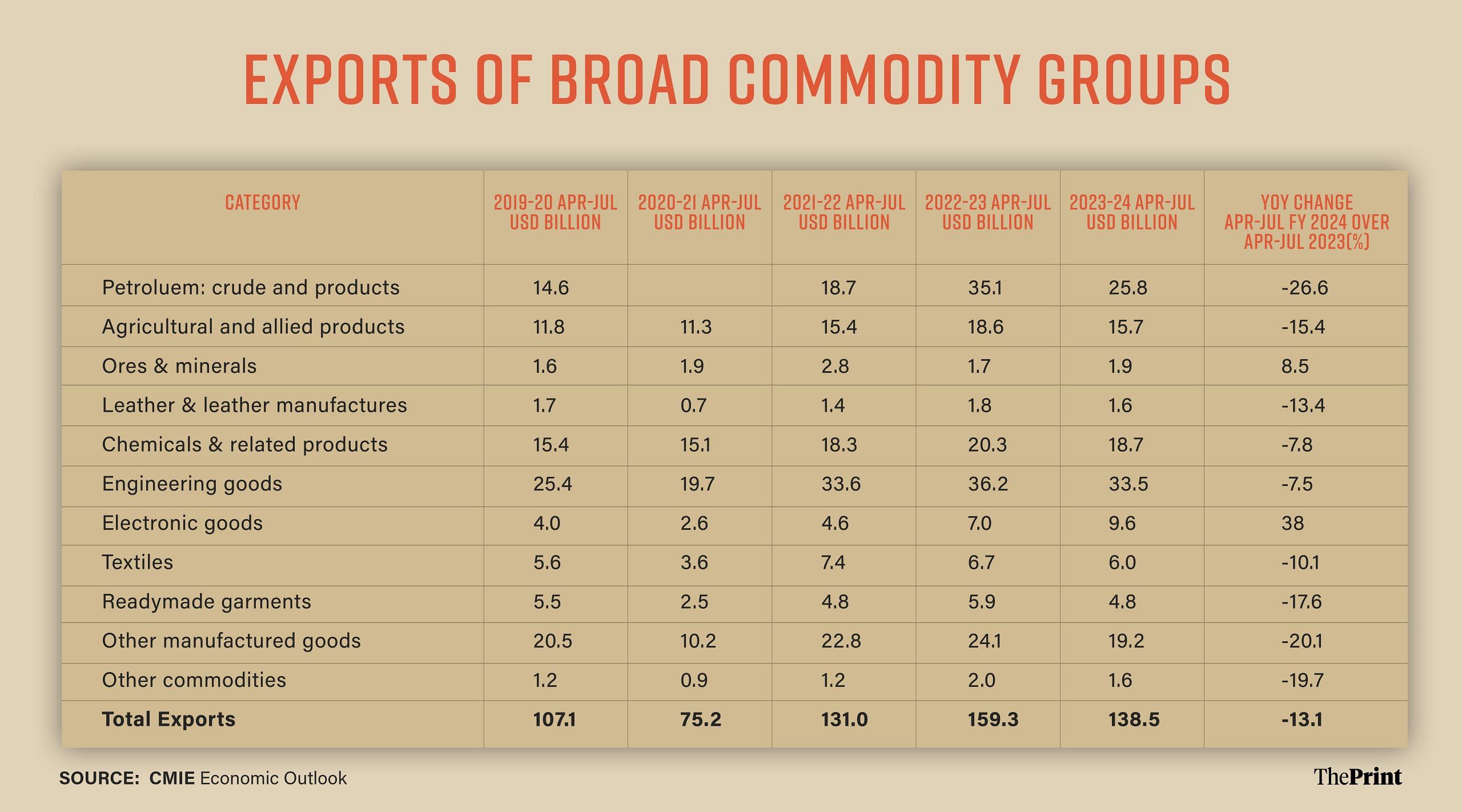

Disaggregated data on commodity exports is available only till July. A comparison of the commodity composition of exports in the April-July period suggests that barring electronic goods, and ores and minerals, other commodities have registered a contraction as compared to April-July of last year.

The table below shows that exports of petroleum products, agricultural and allied products, leather, chemicals, engineering goods, textiles, readymade goods and “other manufactured goods” have been lower this year as compared to last year.

The decline in exports of engineering goods is mainly due to a drop in exports of iron and steel and aluminium. Worryingly, exports of textiles and readymade garments are even below the levels seen in April-July of 2021-22. Exports of gems and jewellery (part of the other manufactured goods) have also plunged in this period. Muted demand and lower import of raw diamonds likely contributed to the slump in gems and jewellery exports.

Destination of exports

In level terms, exports have declined by nearly USD 21 billion as compared to April-July of last year. Of this, exports to the US have declined by USD 3 billion. Exports to Asian markets of Bangladesh, Indonesia, Malaysia and Hong Kong have also plummeted from last year.

Subdued exports are generally understood to be an outcome of muted demand in advanced economies due to sustained monetary policy tightening, but data suggests a slowdown in exports to Asian countries as well.

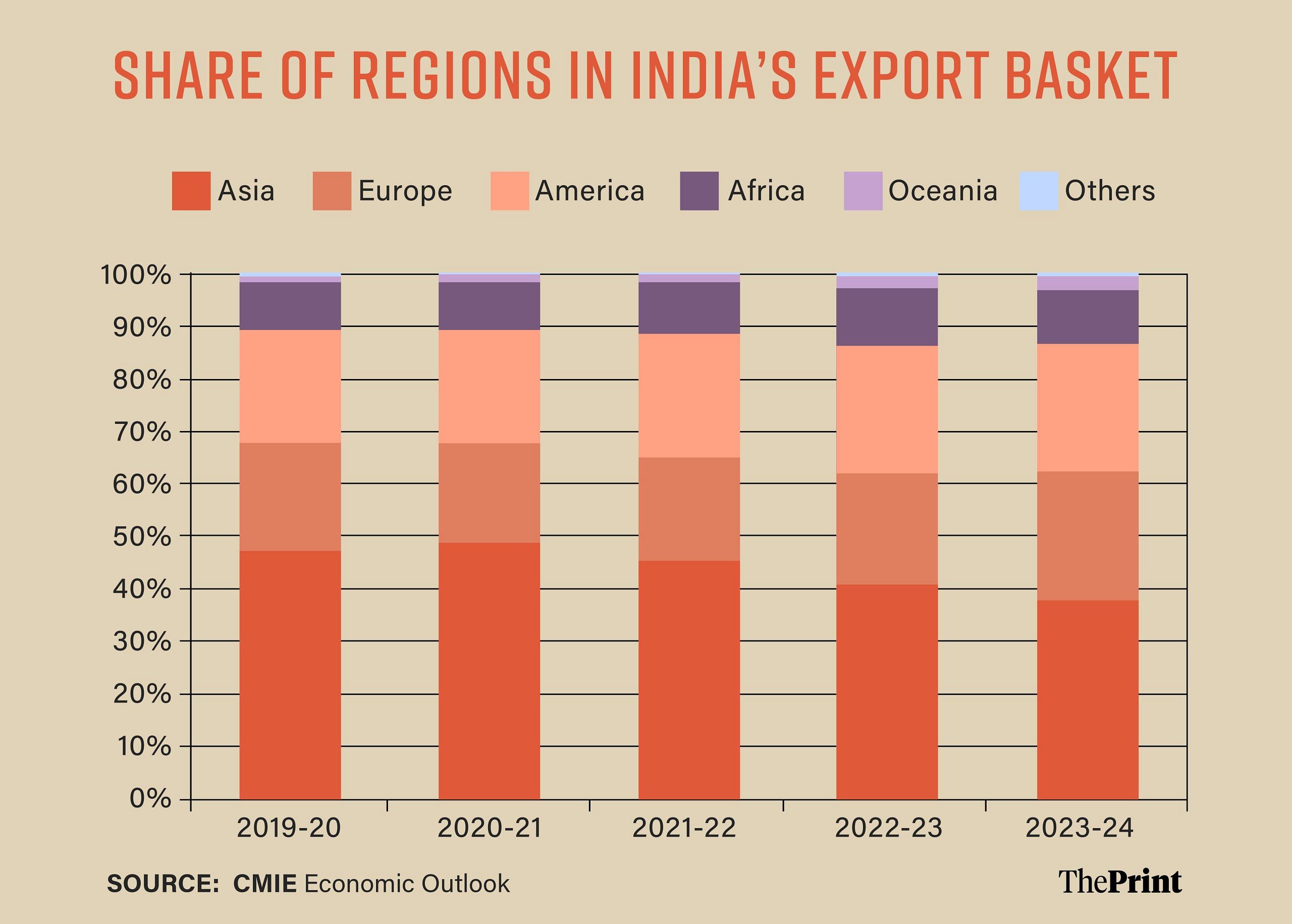

A region-wise analysis suggests that exports to Asia are down by more than 19 percent in the first four months of the current year. Exports to African regions are also down by 19 percent. Exports to the US are down by a lower magnitude of 13 percent. On the other hand, exports to Europe have seen a marginal uptick from April-July of last year to this year. In summary, Indian exports face greater headwinds from Asia as compared to the Western markets.

Structural shift in export destination

A comparison for the April-July period of the last five years suggests that Asia’s share in India’s export basket has fallen from 47 percent in 2019-20 to 38 percent in 2023-24. Particularly, from the Covid period, there has been a sustained decline in Asia’s share. The loss in Asia’s share has been taken up by the US and Europe whose share has increased by nearly 4 percent each from 2019-20 to 2023-24.

A comparison with April-July of the last year suggests that exports to Asia have declined by more than USD 12 billion. Bangladesh, Indonesia, Malaysia, Hong Kong, Sri Lanka and China have been the key contributors of the slump in exports to Asia. The starkest decline is seen in exports to Bangladesh. While decline in exports of petroleum products can be explained by the fall in crude oil prices, decline in exports of agricultural products primarily raw cotton and cereals could need policy attention.

Among the manufacturing products, engineering goods exports have seen a sharp decline in the first four months of the current year as compared to the last year. Exports to the UAE have declined despite signing of the Free-Trade Agreement between India and the UAE last year.

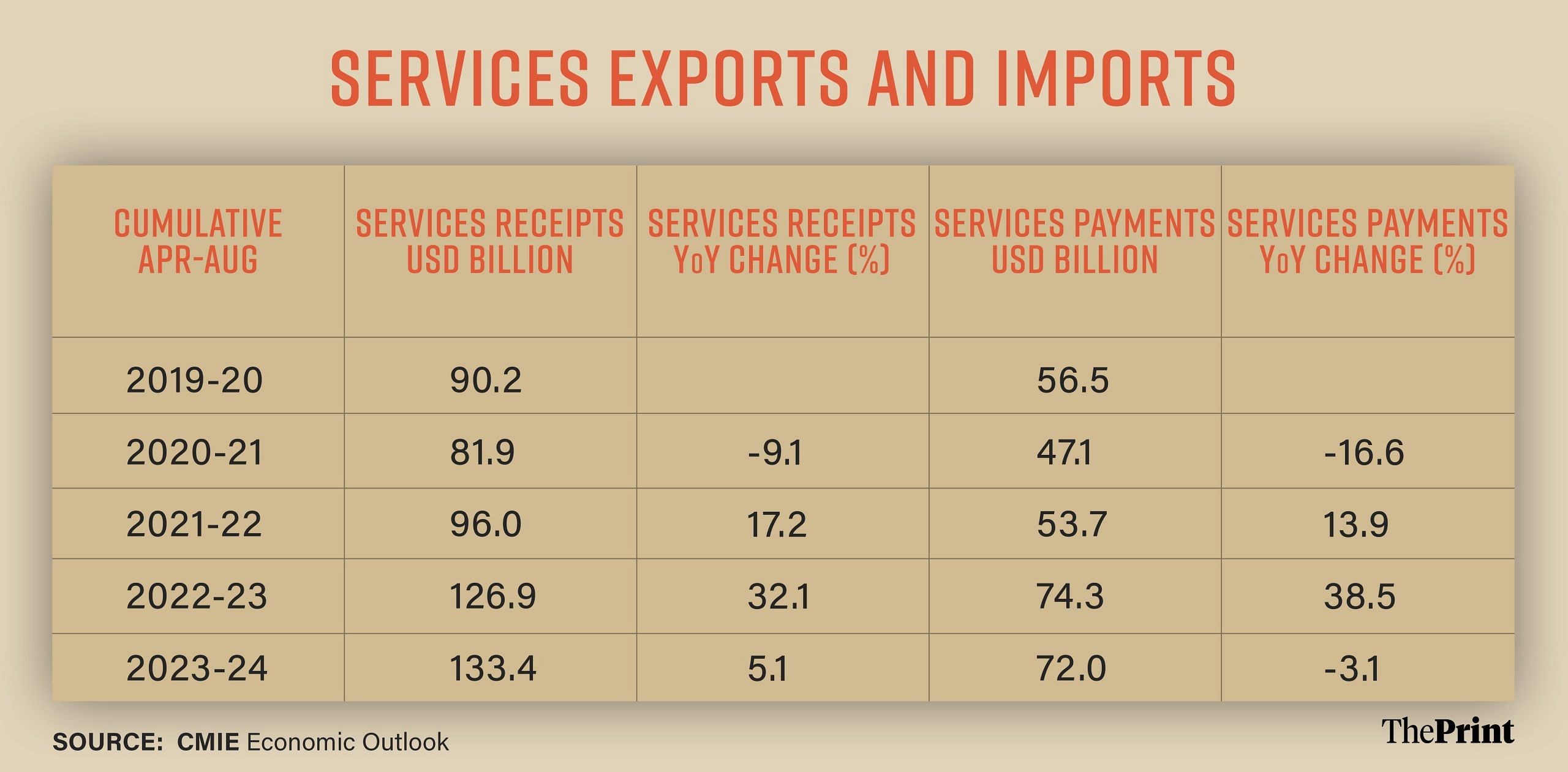

Cushion provided by services exports

In contrast to the goods exports, India’s services exports have shown resilience. In the first five months of the current year, India exported services worth USD 133.4 billion as compared to USD 126.9 billion, a year ago.

With the firming up of commodity prices, goods exports are likely to do better in the coming months. But a broad-based slowdown in exports requires greater policy intervention from the government.

Improvement in logistics, addressing protectionism, diversification of services exports could help in boosting India’s export competitiveness. The International Monetary Fund’s World Economic Outlook suggests that growth slowdown in the current year is concentrated in advanced economies and emerging and developing economies are likely to lead global growth. In this backdrop, it would be critical to focus on Asian markets to boost exports.

Radhika Pandey is an associate professor and Pramod Sinha is a Fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also read: Crypto regulation, debt resolution & more — possible key outcomes of India’s G20 presidency