Last week, Moody’s Ratings downgraded the rating of the United States government to Aa1 from Aaa, citing concerns about its inability to arrest the growing pile of debt. With this downgrade, Moody’s joined Standard & Poor’s and Fitch Ratings in placing the US one notch below the top grade. S&P had downgraded the US back in 2011, while Fitch did so in 2023.

This is for the first time in over a century that the world’s largest and most liquid bond market does not have the Aaa rating. While this may not have an immediate impact, investors will evaluate their appetite and confidence in US government bonds.

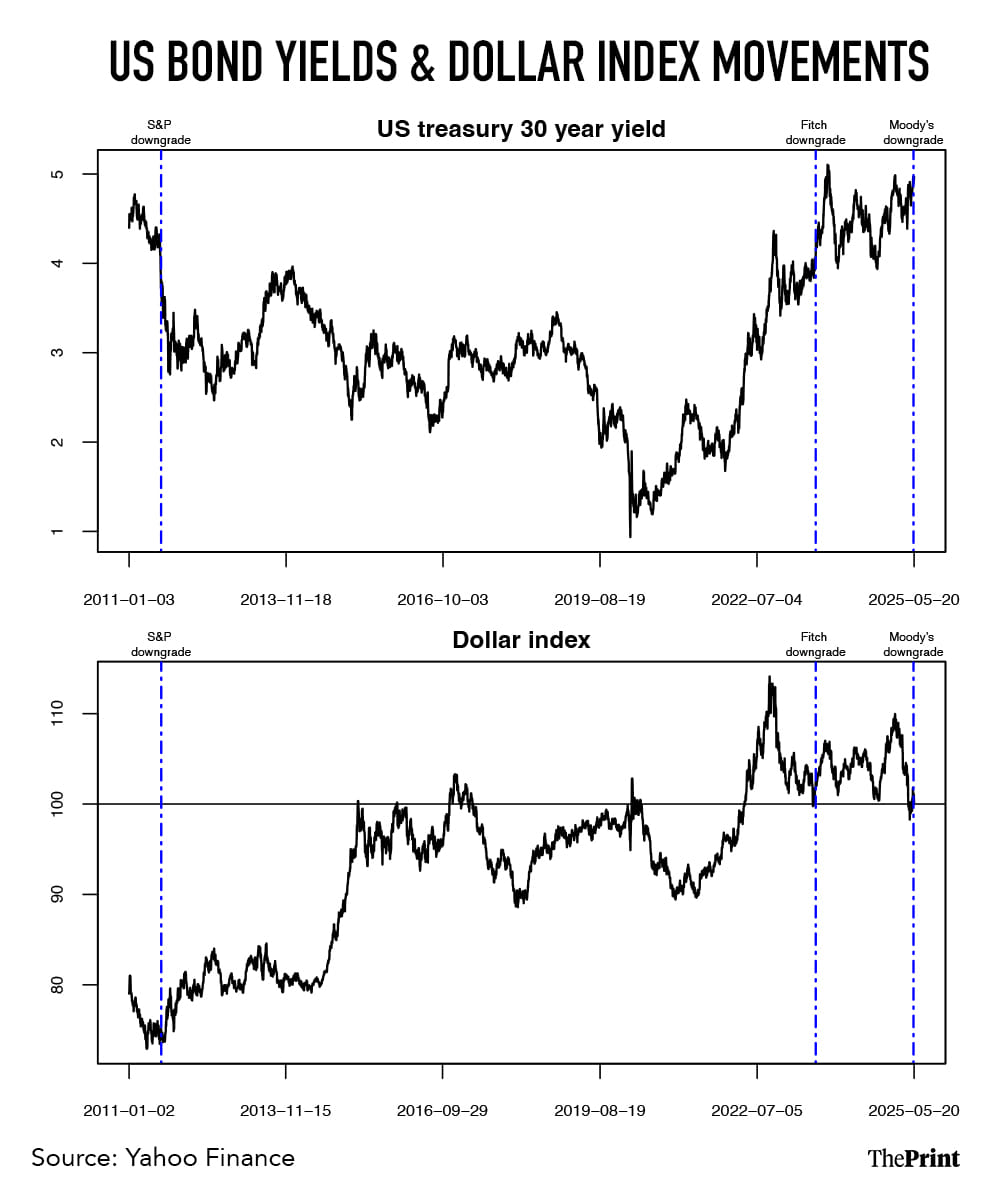

The downgrade has pushed 10-year treasury yields closer to 4.5 percent and 30-year yields near 5 percent, reflecting heightened investor risk perception. The downgrade signals that the era in which the US could borrow unlimited amounts without experiencing higher interest costs and inflation, may be beginning to change.

Decline in fiscal metrics

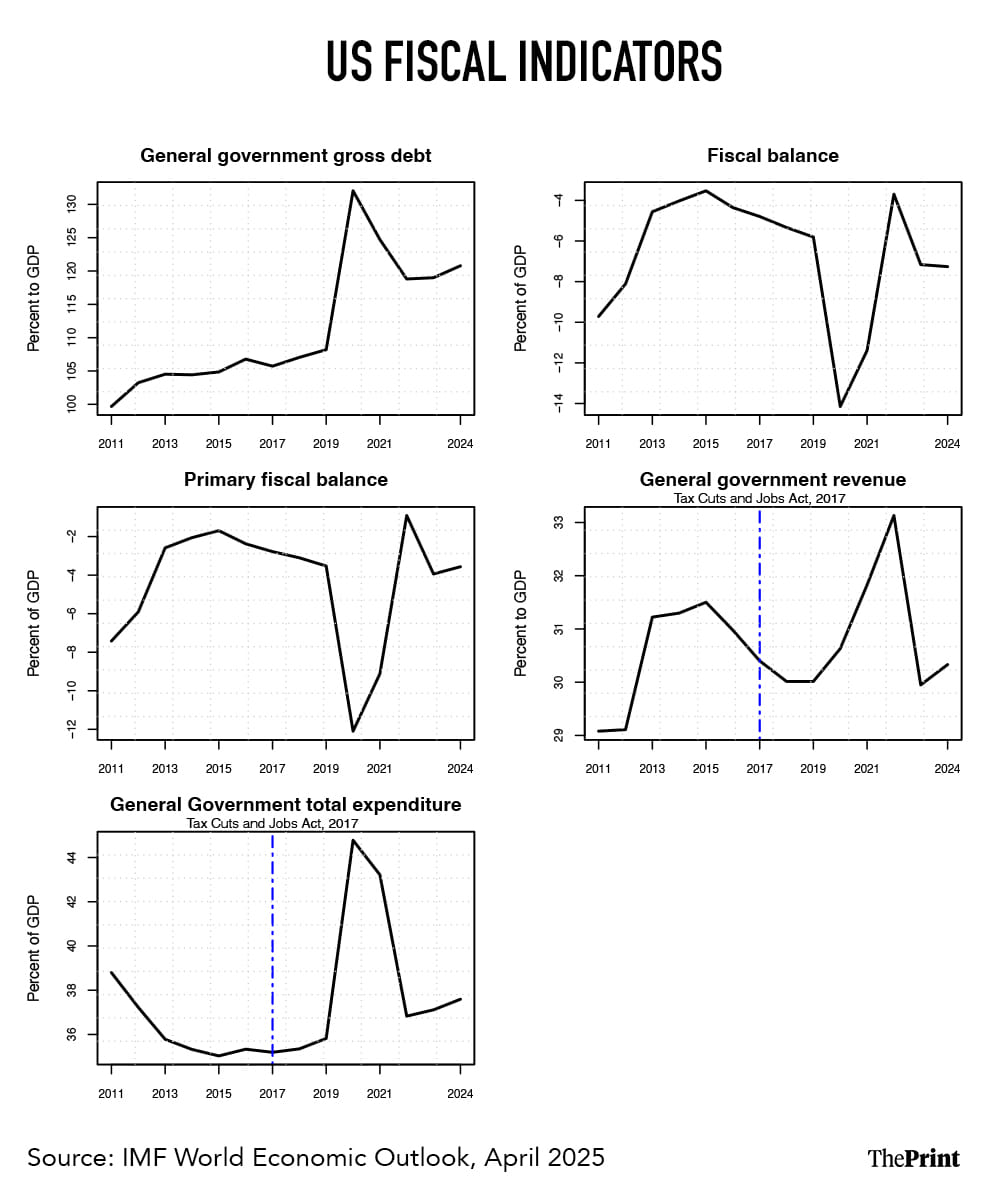

Moody’s highlighted persistently large fiscal deficits in driving the US government’s debt and interest burden as the prime justification for the ratings downgrade. Over the past decade, the US government’s fiscal metrics have deteriorated considerably. While federal spending has increased, tax cuts have reduced government revenue. As an outcome, deficits and debt have grown, and interest payments on government debt have shown a sharp increase.

The decline in revenue is mainly on account of the Tax Cuts and Jobs Act, signed into law in December 2017 during Donald Trump’s first term as president. The Act lowered most individual income tax rates, reducing the top marginal rate from 39.6 percent to 37 percent, and adjusted income thresholds for all brackets. The provisions of the Act lowered the corporate income tax rate from 35 percent to 21 percent.

Most individual income tax provisions are set to expire on 31 December, 2025. Moody’s opines that if the provisions of the Act are extended beyond 2025, it will add USD 4 trillion to the primary federal deficit. The federal fiscal deficit will rise to nearly 9 percent of the gross domestic product by 2035, up from the current levels of 7.6 percent, due to increased interest payments on debt, and relatively low revenue generation. Further, the debt burden is expected to rise to about 134 percent of GDP by 2035 from the present levels of 124 percent.

Notably, the US debt affordability, expressed as the ratio of interest payments to revenues, is facing challenges due to rising interest payments and increasing debt burden. Despite demand, US treasury yields have seen an increase since 2021.

While higher debt and deficits have led to higher interest payments and costs, the current administration’s policy towards tariffs will exacerbate the situation by putting pressure on prices and making it difficult for the Federal Reserve to cut rates, driving up borrowing costs.

Also Read: UK FTA is good news for India amid global turbulence. Domestic reforms must follow market access

Previous instances of ratings downgrade

The previous two instances of downgrade followed political standoff in US Congress over raising the federal debt ceiling, with significant disagreement between Republicans and Democrats on how to address fiscal challenges. While Republicans reject tax increases, Democrats are reluctant towards spending cuts.

The downgrades were also in response to the failure of successive administrations to reverse the trends of large deficits and growing interest costs.

The 2011 downgrade by S&P did not trigger a spike in US treasury securities. In fact, it led to a sharp rally in US bonds due to the flight-to-safety effect. But the 2023 credit rating downgrade by Fitch reflected deepening concerns over rising debt and long-term fiscal challenges.

While the immediate market impact was limited, the 2023 downgrade signaled to global investors that the US government’s financial management and political stability were under increasing scrutiny. The recent Moody’s downgrade has further reiterated concerns over the government’s fiscal challenges.

Previous episodes of downgrade led to dollar strengthening, while emerging market currencies weakened. This time, the dollar could weaken, given the concerns on fiscal sustainability.

Since 21 January, 2025, the US Treasury has been employing extraordinary measures to ensure that the government does not hit the USD 36.1 trillion debt ceiling. According to the Treasury’s assessments, the extraordinary measures can last till August. Before reaching the August “X” date, policymakers will need to agree to either raise or suspend the debt ceiling to avoid a default.

The passing of Trump’s new tax bill or higher borrowings could upend the calculations of the “X date”, and further complicate the task of fiscal management.

Impact on emerging markets

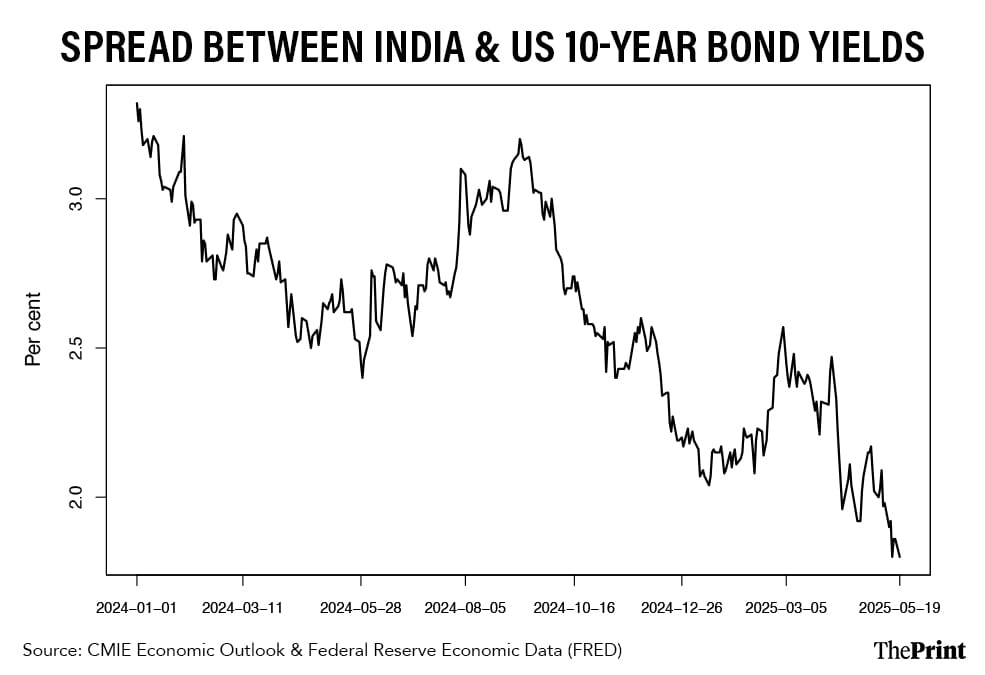

Emerging markets, including India, may face FPI withdrawals, if US yields rise sharply. The yield difference between US and Indian government bonds has been narrowing, and is expected to shrink more after the Moody’s downgrade.

The differential could narrow further, given that the Reserve Bank of India is widely expected to cut rates due to benign inflation. Thus, the rating downgrade and the US policy preference towards higher tariffs would subject emerging markets to bouts of volatile capital flows.

Emerging markets reliant on international debt markets may see higher borrowing costs as risk premiums rise. Countries already struggling with high debt-GDP ratios may face steeper yields on the new issuances.

Radhika Pandey is associate professor and Madhur Mehta is a research fellow at the National Institute of Public Finance and Policy.

Views are personal.

Also Read: Waning trust in US dollar has spurred a rally in Asian currencies. Central banks may have to step in