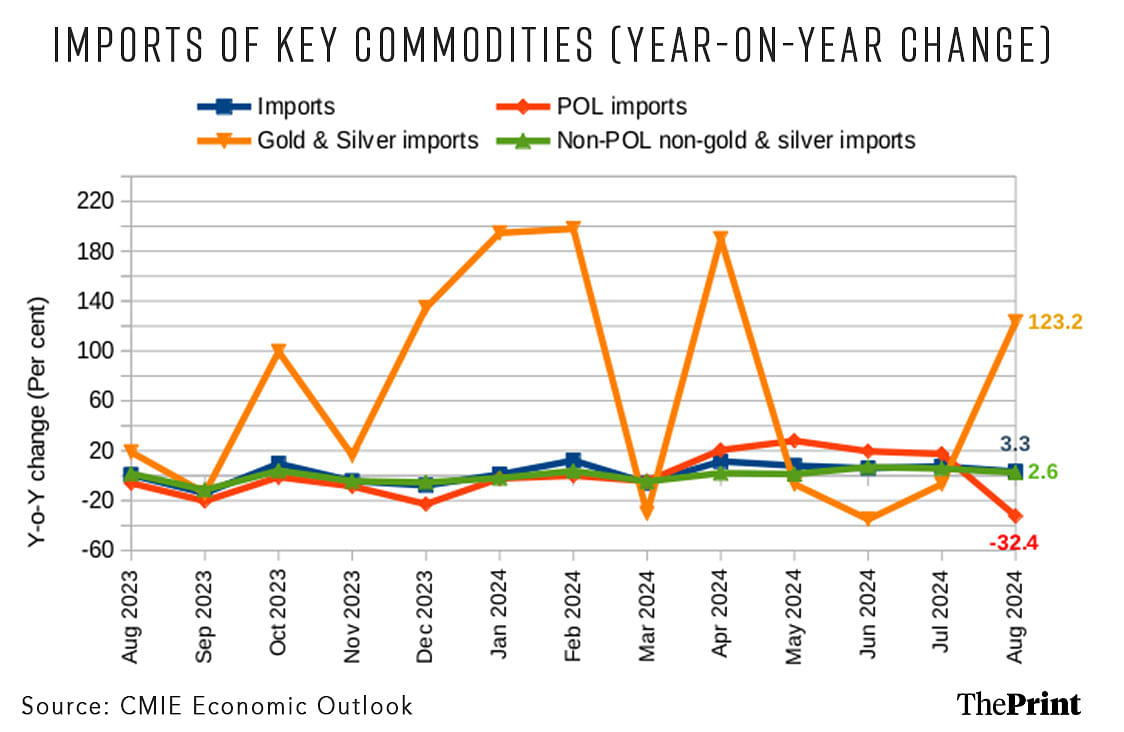

India’s goods exports contracted by 9.3 percent to USD 34.71 billion in August, while the import bill rose by 3.3 percent to USD 64.36 billion, fuelled by a record surge in gold imports.

Consequently, the trade deficit widened to a 10-month high of USD 29.65 billion—the second highest monthly gap in goods trade. Subdued global demand leading to softening of oil prices and rise in freight costs, and escalation of geopolitical tensions have contributed to a slowdown in exports.

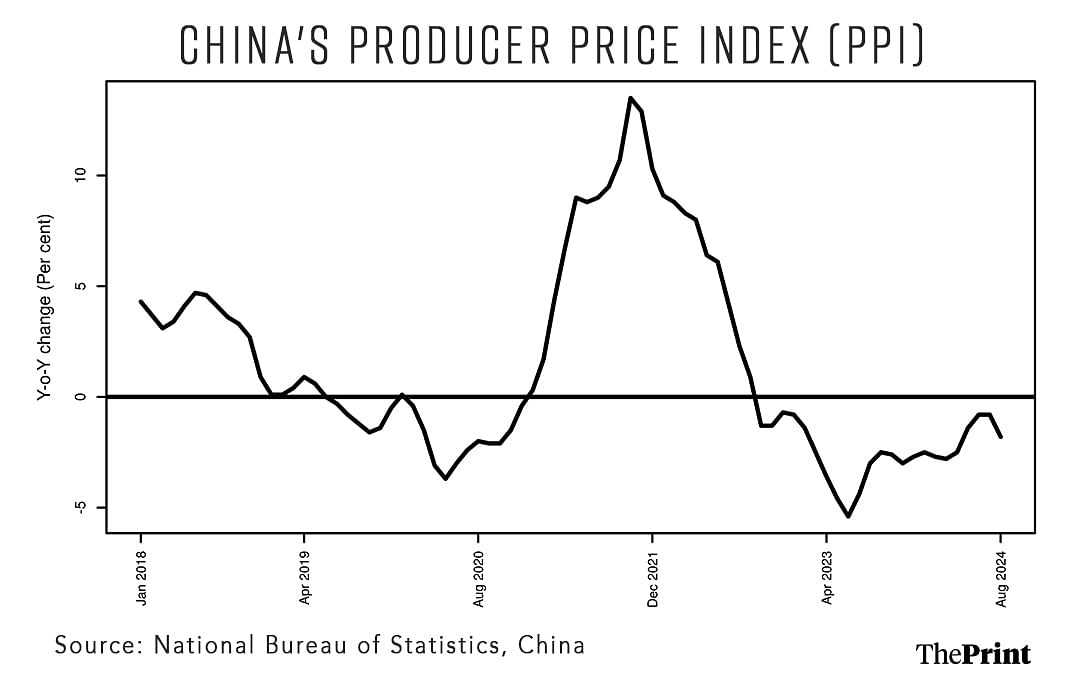

Beyond the global headwinds, the substantial decline in China’s export prices, driven by overcapacity and tepid domestic demand, is reshaping global trade dynamics. This could have a negative impact on manufacturers in other countries, including India. Sectors, such as steel and textile, are being hit due to the export of deflation by China.

The steep rise in the trade deficit in August could expand the current account deficit in the July-September quarter, although the growth in services exports and remittances could offer some cushion.

Also Read: US Fed’s rate cut is likely good news for India. It may also help temper RBI’s stance

Increase in logistics cost & subdued global demand

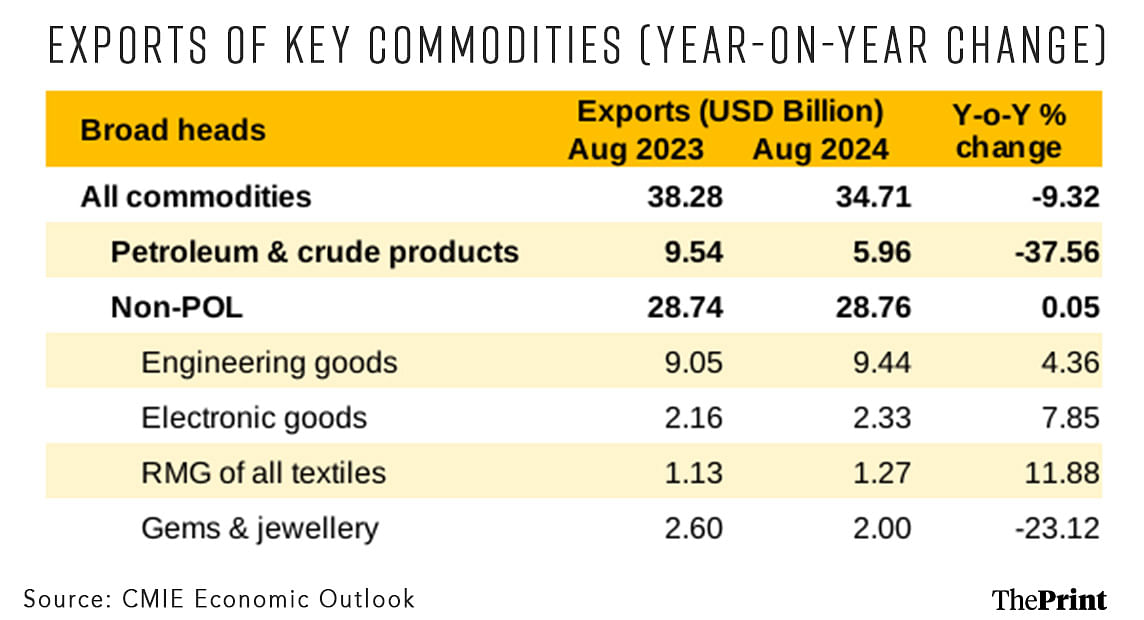

The decline in overall exports was driven by a drop in exports of petroleum and gems and jewellery. India’s petroleum exports, accounting for 17 percent of the goods exports, registered a steep contraction of 38 percent in August due to the ongoing disruptions at the Red Sea. The recent sharp decline in global crude oil prices could cause oil exports to slide further in the coming months.

Meanwhile, non-oil exports rose marginally by 0.05 percent in August.

Among these, shipments of gems and jewellery contracted by 23 percent due to lower demand amid geopolitical tensions. The uncertainty owing to elections in 60 plus countries, along with low demand from major markets, have caused a slump in exports of gems and jewellery. With a growing pile of unsold inventory, the imports of rough diamonds and other precious stones have also taken a hit.

Amid growing concerns over the Chinese slowdown, iron ore exports contracted by 55 percent. China is India’s largest importer of iron ore.

Readymade garment exports rise despite challenges

Despite global challenges and high logistics costs, exports of readymade garments grew by an impressive 12 percent in August. Cumulatively, the April-August period witnessed a growth of more than seven percent in such exports.

The Indian players are seen to be exploring the possibility of gaining a greater export share in countries, such as Japan, Australia, Korea etc. The Free Trade Agreement with Japan allows duty-free access for Indian apparel to Japanese markets. Exports to Japan grew 25 percent in July and 10.7 percent in the April-July period.

Other major drivers of export growth in August include engineering goods, organic and inorganic chemicals, electronic goods, readymade garments of all textiles, and drugs and pharmaceuticals.

Also Read: Bad economics of freebies is triggering financial crises for some states. Fiscal discipline is key

Electronic goods log fastest growth in exports

Exports of electronic goods grew by 21.8 percent in the April-August period, making it the fastest growing sector amongst the top 10 merchandise exports from the country. This strong growth is attributed to one component: exports of mobile devices, which now account for almost 60 percent of the electronic goods exports.

Exports of engineering goods grew by 4.36 percent in August. Destination-wise data available till July shows a contraction in exports to Germany, Bangladesh, and Russia, among others.

Record surge in gold imports

Driven by a sharp reduction in import duty and anticipation of growing demand ahead of the festive season, India’s gold imports jumped by more than 104 percent, reaching USD 10 billion in August.

Additionally, the decrease in import duty from 15 percent to six percent has contributed towards proper accounting of gold imports, which may have previously been unreported. This also led to a surge in import figures.

The surge in gold prices after the 50 basis point rate cut by the US Federal Reserve and the recent economic stimulus measures in China could weigh on the trajectory of gold imports in the coming months.

While petroleum crude and products (POL) imports contracted by 32 percent, non-oil imports rose by almost 16 percent in August.

China’s export of deflation & the spillover impact

China is facing a persistent deflation due to weak domestic demand and a protracted real estate slump. Its Producer Price Index has been in contraction for almost a year now.

What has led to the sustained deflation? In the absence of a strong real estate sector, the policy focus shifted towards boosting manufacturing and infrastructure investment to support a five percent GDP growth. Easy availability of capital through financial repression provided the necessary support to these sectors.

In an environment of weak domestic demand and high debt, this strategy has resulted in excess capacity creation. China’s dominance in the manufacturing segment has exacerbated challenges for other countries as they are witnessing a flood of cheap Chinese goods. For instance, aggressive exports of low-priced steel by China is hurting the Indian steel industry as they cannot match the price of Chinese steel, which is subsidised at multiple levels.

The persistent deflation in China has also impacted sectors, like solar panels, electric vehicle batteries, and others, fuelling a wave of trade restrictions and disputes.

China must reassess its policies to avoid distortion of global trade.

Radhika Pandey is an associate professor and Rachna Sharma is a fellow at the National Institute of Public Finance and Policy (NIPFP).

Views are personal.

Also Read: India saw slower growth in Q1, but consumption, non-govt investment, manufacturing were reassuring