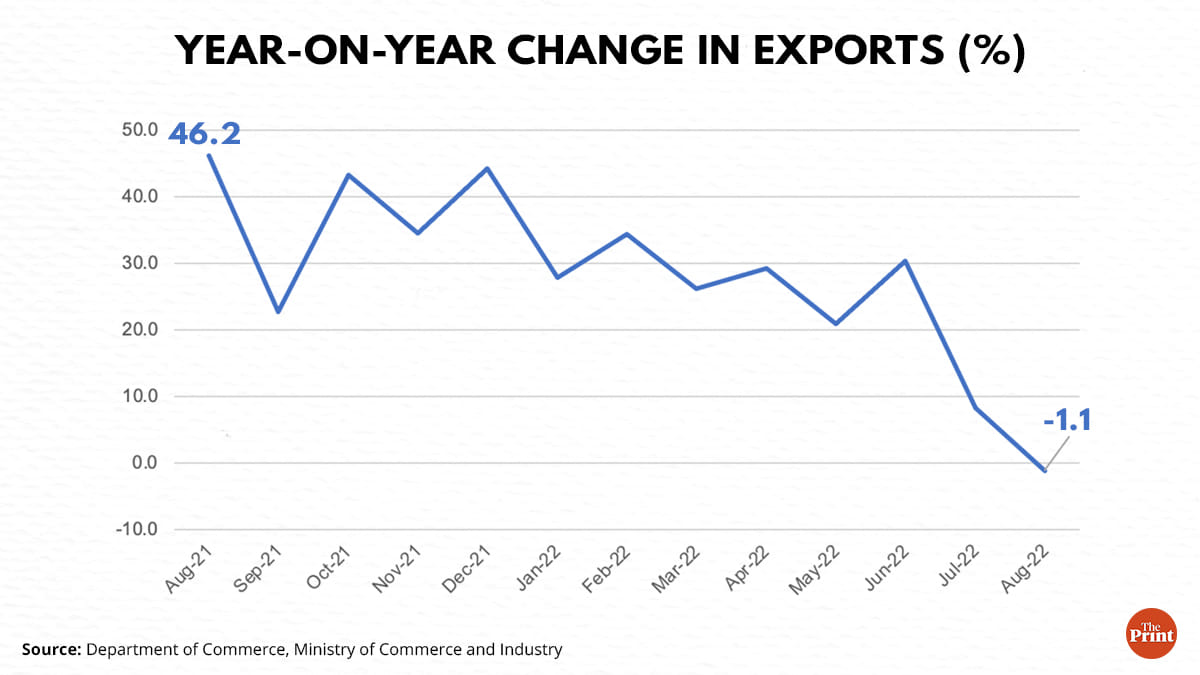

India’s goods exports contracted by 1.1 per cent to USD 33 billion in August. Merchandise imports registered a growth of 37 per cent over August, 2021.

While strong growth in imports is reflective of robust domestic demand, subdued exports indicate slowing global demand. As a consequence of weak exports and strong imports, the merchandise trade deficit has more than doubled since the same month of last year. Widening trade deficit will put pressure on the value of the rupee.

While the world over countries are moving towards protectionism, gradual exchange rate depreciation, expediting Free Trade Agreements, lowering tariffs and addressing supply-side bottlenecks would help in addressing external sector challenges.

What led to fall in exports?

The year-on-year fall in exports was led by sectors such as engineering goods, gems and jewellery, readymade garments of textiles and cotton yarn. Engineering goods, which accounted for more than 25 per cent of total exports in 2021-22, saw the sharpest contraction of more than 14 per cent. Barring petroleum products, exports contracted by more than 2 per cent in August.

The global economic outlook appears bleak, with growth in the two largest economies likely to slow down. The US is already in a technical recession, though there are mixed signals on whether the economy is actually in a recession. The latest remarks by the US Federal Reserve Chair indicate that the Fed will go in for sharper rate hikes to tame inflation. This is likely to further pose a drag on demand.

Economic activity in China has slowed down significantly owing to its zero Covid policy and slump in the real estate sector. As an outcome, Indian exports to China dipped by a third in April-August as compared to the same period last year. The IMF’s July update to the World Economic Outlook has projected the volume of world trade to dip from 10.1 per cent in 2021 to 4.1 per cent in 2022 and further to 3.2 per cent in 2023.

The recent imposition of export duties such as on finished steel is also likely to have an impact on exports. A 15 per cent export duty on steel will make Indian steel expensive abroad, thus forcing steel makers to supply domestically and limit exports.

Also Read: Don’t sneer at 13.5% GDP growth. But consumption, investment critical in future quarters

Changing composition of exports & sensitivity to global growth

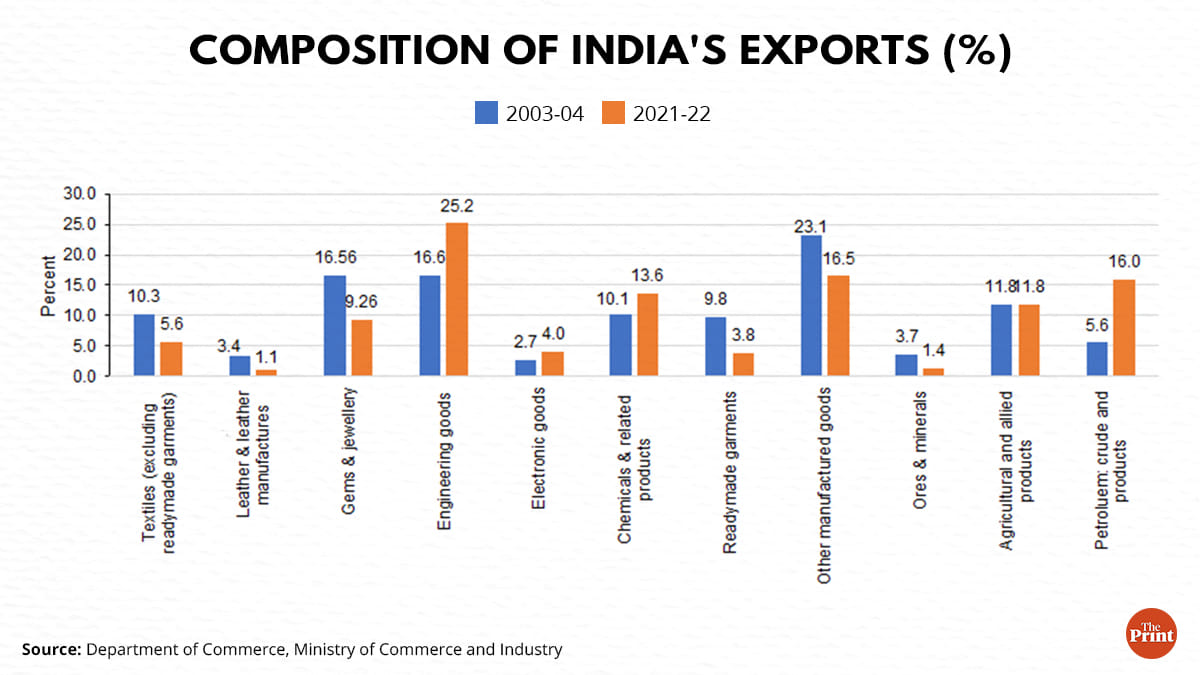

Textiles, leather, gems and jewellery featured as India’s traditional exports. In 2003, these constituted 60 per cent of non-oil exports.

A recent study by Sajjid Chinoy and Toshi Jain shows that in recent years, Indian exports have become much more technology oriented. The share of engineering goods, electronics, and pharmaceuticals/chemical products constitute almost 60 per cent of the non-oil merchandise basket. The share of labour-intensive exports has fallen over the last few years.

The change in the composition of exports has increased the sensitivity to global growth. Sectors such as engineering goods, pharmaceuticals are found to be much more sensitive to global demand. In contrast, India’s traditional exports (textiles, leather, gems, and jewelry) are found to be much less sensitive to global growth.

Services exports have done well till now. They are seen to be more vulnerable to global recession woes than the merchandise exports.

Overvalued exchange rate & exports

The other determinant of exports is the country’s Real Effective Exchange Rate (REER). The REER is a measure of the comparative strength of a nation’s currency against the currency of the nations it trades with. REER is used to determine whether a country’s currency is undervalued, overvalued or fair-valued. A value of 100 or around 100 means the currency is fairly valued. Despite the recent depreciation of the rupee, it is overvalued in REER terms. There is a scope for gradual depreciation based on the REER.

Defending rupee has its trade-offs

The Reserve Bank of India (RBI) should allow the rupee to gradually depreciate. While the rupee has recently weakened, the pace of depreciation has been much lower than some of the other emerging economies. This is due to the RBI’s heavy market intervention in the form of dollar sales. Due to aggressive intervention, foreign exchange reserves have fallen to USD 560 billion for the fortnight ending August, 26th. In a week’s time, the forex reserves have dipped by USD 3 billion. Foreign exchange reserves have declined in 21 out of 27 weeks, since Russia invaded Ukraine.

Depreciation could lead to imported inflation but that’s not the only factor driving the inflation. According to the RBI’s estimates, with every one rupee depreciation of the dollar-rupee rate, inflation rises by about 8-10 basis points. Thus, out of 7 per cent inflation rates, 50-60 basis points is attributable to rupee depreciation.

Global shocks pose policy trade-offs. While defending the currency could limit imported inflation, it will have adverse implications for exports, labour-intensive sectors, jobs and growth.

Expediting Free Trade Agreements & supply side reforms

Many of our competitor nations have Free Trade Agreements (FTA) that allow them greater market access. The government is also expediting FTAs as trade negotiations are underway with the UK, the EU, and other countries which are our traditional trading partners.

Boosting competitiveness is the key to enhancing exports. While India has domestic manufacturing capabilities, access to raw materials and abundant workforce, it needs to work on improving logistics, fast-tracking clearances and approvals, and streamlining cost of credit and power.

Look for other drivers of growth

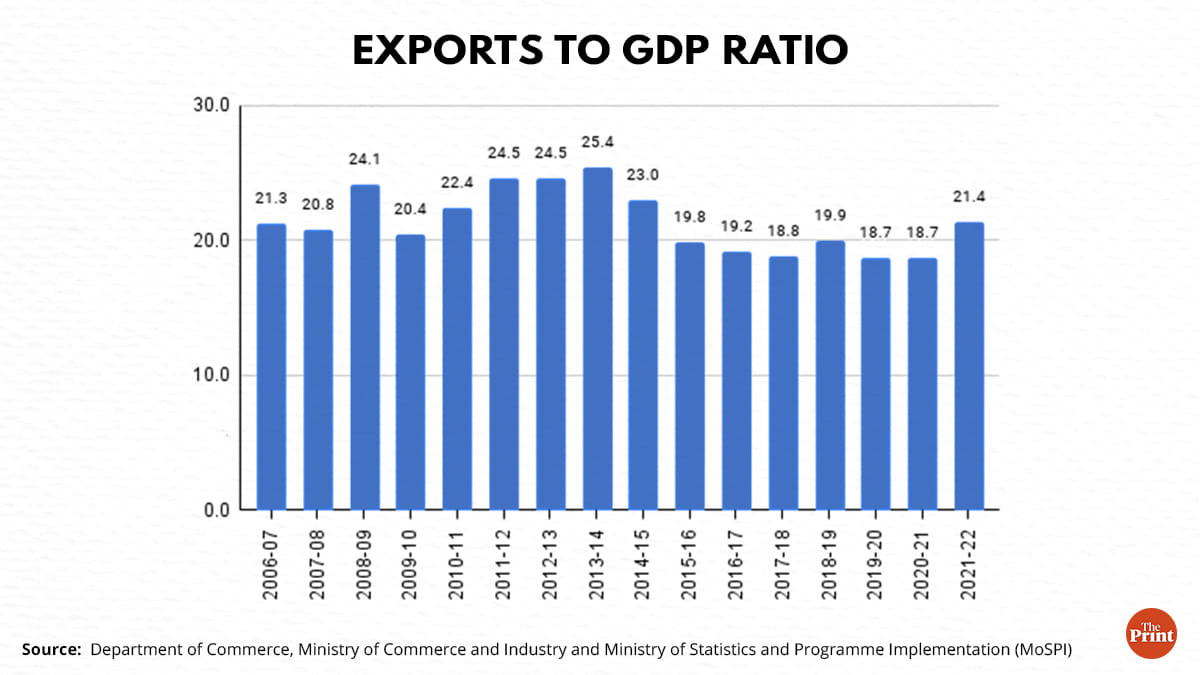

The share of exports of goods and services to GDP rose from 11 per cent in 1998-99 to 25 per cent in 2013-14. Since then, exports’ share has seen a dip. Last year, India saw merchandise exports surge to USD 420 billion, but still the share of exports to GDP was 21.5 per cent.

Amidst a wave of deglobalisation and slowing growth, exports cannot be the sole engine of growth. Domestic consumption and investment has the potential to improve India’s medium-term growth prospects.

Radhika Pandey is a consultant at National Institute of Public Finance and Policy.

Views are personal.

Also Read: Chinese economy has been hit by a perfect storm: Property shock, Zero Covid, climate, Taiwan