New Delhi: India’s top court is set to rule on Thursday if taxes should be levied on U.S. investment firm Tiger Global’s $1.6 billion stake sale in Flipkart to Walmart in 2018, in what could be a landmark ruling on international tax-treaty use by firms.

Keenly watched by foreign investors, the legal dispute relates to how Tiger Global used the India–Mauritius tax treaty to claim tax exemptions and New Delhi’s fierce objections to it. The ruling will have implications for how India applies tax principles in cross-border deals.

“The ruling is likely to redefine the treaty interpretation law,” said Mukesh Butani, managing partner of Indian law firm BMR Legal, which advises clients on international tax laws and treaties.

Tiger Global and Indian tax authorities have been locked in a legal tussle over its 2018 stake sale in Indian e-commerce company Flipkart to Walmart worth 144.4 billion rupees ($1.6 billion). The deal was part of the U.S. retail company’s $16 billion acquisition of Flipkart that year.

The stake sold at the time, 17% according to local media reports, was held by Tiger Global’s units in Mauritius.

While Indian tax authorities argued Tiger Global wrongly used the India-Mauritius tax avoidance treaty to not pay any tax on its profits, the investment firm argued it can do so as the treaty exempted such a transaction.

The tax authorities say the Tiger Global Mauritius units served merely as a conduit for Tiger Global U.S. – a description the investment firm says is incorrect.

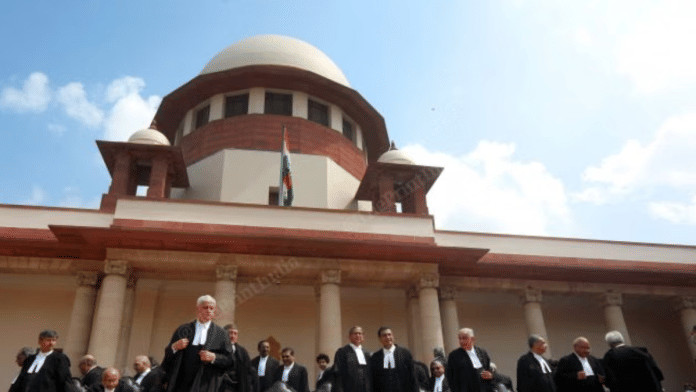

The Supreme Court has been hearing the case since January 2025 as Indian tax authorities challenged a previous Delhi High Court ruling that was in favour of Tiger Global and found no wrongdoing.

Walmart competes with Amazon in India’s thriving e-commerce market, where online shopping has boomed in recent years. Walmart has previously not commented on the matter.

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibility for its content.

Also read: Why Trump wants Greenland: Minerals, Monroe Doctrine 2.0 and countering China