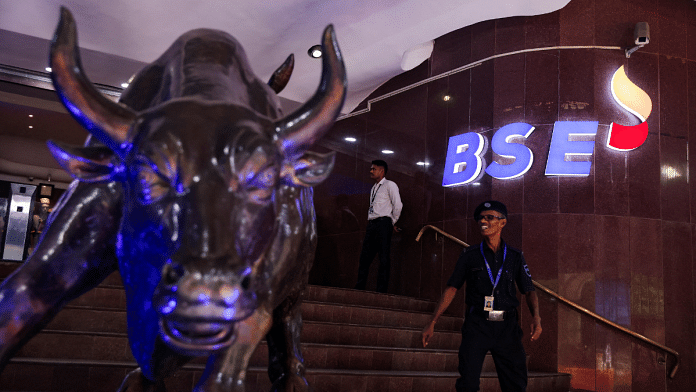

New Delhi : The market capitalisation of companies listed on BSE has touched a milestone of USD 5 trillion, hitting a fresh high on 21 May, exchange data showed on Tuesday.

The ongoing rally in the Indian stock markets helped in reaching this feat.

Market capitalisation or market cap is the total value of a company’s stock, derived by multiplying the stock price with the number of its outstanding shares.

Barring a little volatility, Indian stock indices have been firm over the past several sessions, supported by strong support from a majority of sectoral indices.

With five phases of elections now behind us, it is widely expected by investors that the Narendra Modi-led government will come back to office with a comfortable margin for his third term. This also likely triggered fresh stock buying.

Softer-than-expected US consumer inflation in April and a consistent moderation in inflation in India and the sooner-than-normal arrival of the southwest monsoon in India, as predicted by IMD, mainly buoyed Indian stocks lately. The southwest monsoon is likely to hit Kerala on 31 May, a day before the usual normal date of June 1.

Last week, the Sensex jumped about 2,000 points, on a cumulative basis. On Tuesday, the Sensex closed a shy lower than its Friday closing at 73,953 points (0.07 percent lower).

On Monday, the stock exchanges were shut for general elections in Mumbai.

In early April, the BSE market cap had touched USD 4 trillion, and it took a month and a fortnight to add another trillion.

Firm GDP growth forecasts as the country is set to remain the fastest growing major economy, inflation at manageable levels, political stability at the central government level, and appreciable central bank monetary policy – have all contributed to a bright picture for the Indian economy in recent quarters.

Overseas investors have been net sellers of Indian equities for the past several sessions. Interestingly, domestic institutional investors during the same period stayed net buyers, largely making up for the outflows by the foreign investors.

Foreign portfolio investors (FPIs), who continued to remain net buyers for the third month until mid-April, have cumulatively sold stocks worth Rs 8,671 crore during April, the National Securities Depository Limited (NSDL) showed. So far in May, they have sold stocks worth Rs 28,242 crore.

This report is auto-generated from the ANI news service. ThePrint holds no responsibility for its content.