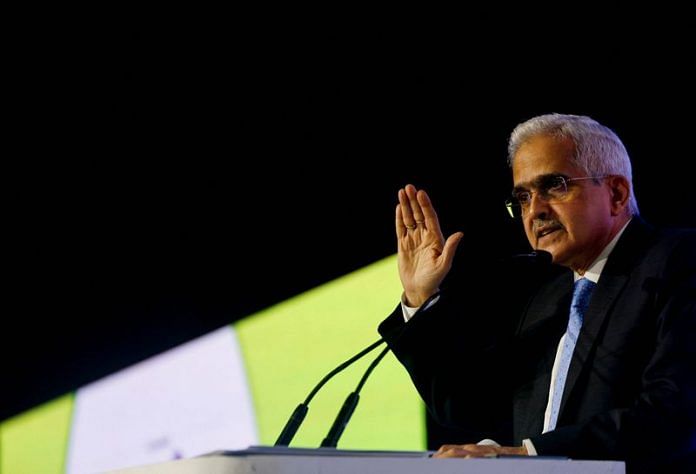

MUMBAI (Reuters) – The head of India’s central bank said on Friday that it would be “very premature” and risky to lower interest rates at this stage.

While inflation is expected to moderate going forward, the central bank would only think of rate cuts when it has confidence that inflation is durably aligned to its medium-term target, Governor Shaktikanta Das said at an event in Mumbai.

The central bank is not “behind the curve” in terms of monetary policy and would base its decisions on incoming data and the outlook on inflation, Das said.

The Reserve Bank of India has kept its rate unchanged for nearly two years even as global central banks, including the U.S. Federal Reserve and the European Central Bank, kicked off rate cuts earlier this year.

Speaking about the rupee, Das said that the RBI is “not managing the exchange rate” but buys dollars when there is an opportunity and supplies them when the currency faces pressure.

The rupee touched a record low of 84.0775 on earlier in the day, pressured by sustained outflows from local equities, although the RBI’s likely intervention prevented sharper losses.

(Reporting by Jaspreet Kalra; Editing by Savio D’Souza)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.