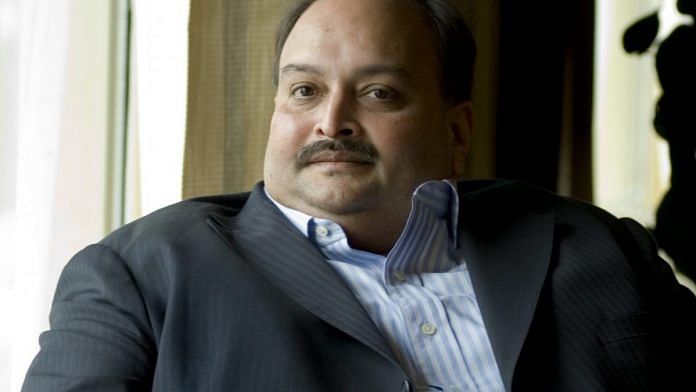

Mehul Choksi, accused in the Rs 11,000-crore PNB scam, claims he has an Antiguan passport for business expansion and blames bank for fraud.

New Delhi: Gujarat-based diamond merchant Mehul Choksi, who is allegedly involved in the Rs 11,000-crore PNB fraud, has told ABP News that the Modi government has made him a “soft target” as it is under pressure ahead of the 2019 general elections.

In a detailed interview to the news channel in Antigua, Choksi, the uncle of absconding businessman Nirav Modi, claimed to have not committed any fraud and said he was being implicated as part of a “political conspiracy”.

“It is a big political conspiracy, I would say. There is too much pressure on the government to bring someone back and I have just become a soft target,” he said.

“If none of the defaulters are brought back to the country before this election, then it will definitely affect the result. This must be for the benefit of people of the country, but I want to say that I am not a defaulter. In fact, I am a sufferer,” he said.

“My accounts were sealed, my companies were shut down, false complaints were filed against me,” he added.

According to Choksi, the government had put “all its machinery” against him and so it cannot back out now.

“They cannot go back on their actions now since they have put all the machinery to prove charges against me, which is why they have put several agencies after me to frame me into more criminal cases,” he said.

“Whatever has happened is completely unlawful and against human rights. The government is now after me; they have created an anti-Choksi atmosphere and now they can’t get away from it,” he said.

Choksi claimed that he had only applied for an Antiguan passport to make travelling easier and because he wanted to expand his business to the Caribbean countries. Choksi said he had applied for it in February 2017.

“I wanted to expand my business in the Caribbean countries, which is why I applied for an Antiguan passport a year ago, last February. I took Antiguan passport to make my travel to other countries easy, because of which I am benefiting today,” he said.

Also read: A 2016 affidavit filed in Gujarat HC had warned about Mehul Choksi’s escape from India

‘Bank to blame’

Choksi told ABP News that the bank was to blame for issuing the Letters of Undertaking (LoUs) to various companies and claimed that his firm was just being made the scapegoat.

“My company has not committed any fraud or scam. The bank (Punjab National Bank) is to blame for its complacency. Now, since the CBI report is out, probably many people will be held answerable; so, the bank made us the scapegoat and shifted the blame completely onto us,” he said.

Blaming PNB for inefficiency, Choksi said there have been several instances when the bank did not file information on its import and export transactions with the RBI. He also said that the bank carries out at least 25 to 30 audits in a year and wondered how the fraud went undetected.

“There are so many people working there. It is a big system and yet a fraud of this nature went undetected. Not even a single query was raised. This shows that the bank was complacent,” he said.

Choksi said he was shocked to know that his name featured in the CBI complaint filed on 29 January.

‘Not part of the defaulting companies’

According to Choksi, when the complaint was made by the bank, he was not part of the defaulting companies that, he said, belong to his nephew Nirav Modi. He claimed to have retired from one of the companies in 2002 and insisted that he had nothing to do with it when the LoUs were issued.

“They filed a complaint alleging that I was a partner in the companies along with Nirav Modi. The fact is that I was a partner in one of the companies in 1998 but I retired in 2002. But when I told this to the bank officer, they told me that since their KYC (Know Your Customer) was from 1993 and 1995, when I was a partner, that is why his name was there,” he said.

“After 2000, I left the company and had no business ties with it at all. It only remained on paper. But the agencies never verified these facts and started raiding my offices,” he said.

Also read: Mehul Choksi ferries diamonds not cows, but is still scared of lynching

Choksi said he even called SEBI and CBI on 7 and 8 February to mention that he was not a part of Nirav’s companies mentioned in the complaint but, he added, no one took notice.

“After I found out that my name was still there in the KYC form and that is why it featured in the complaint, I called SEBI and also informed the CBI on 7 or 8 February. By then, however, the Enforcement Directorate, the Income Tax department and the CBI had started the raids against my companies. They blocked all our accounts and pulled back my facilities,” he said.

‘Agencies acted without preliminary checks’

Choksi claimed that at the time the complaint was lodged by the CBI in the scam, he was undergoing cardiac treatment in the US. He alleged that soon after the complaint, the agencies began the raids without making preliminary inquiries.

“They didn’t even know whether or not I was a partner in Nirav’s firms. They virtually stopped my company, which was my major source of income,” he said. “All my bank accounts were sealed, all inventories were shut, all my workers started panicking. Our server was shut down and the companies came to a standstill. It was a shock for me.”

‘Govt looking to save PNB’

Choksi also claimed that the government is trying to save PNB at the cost of his companies.

“If Geetanjali (his flagship firm) was at fault, then why was there no ED or CBI complaint for this long? It is a 50-year-old company and has won many awards. There was no inquiry all these years and now, everyone is suddenly coming for us,” he said.

“The reality is that it has now become a political matter as parties are now crying out that the bank was defrauded and the fraudsters are running away, so I have become the soft target,” he added.

Choksi also urged the government to at least pay the gratuity amount to the employees who, he says, have suffered because of the shutdown of his companies.

“I wish that my 6,000 employees are at least given their gratuity money. I am not asking anything for myself. But the people who have lost their jobs should be called to Surat and should be employed. The government should not ignore them,” he said.

Left alone

Choksi not only feared “being lynched” if he returned to India, but also said he had no one who was ready to stand by him.

“If I call anyone in India today, they don’t talk to me. Be it a relative, a worker, a businessman, friend or family,” he said. “They are scared that if they speak to me, there will be a raid at their house or company or an agency will start following them. There is an environment of fear that has been created”.

“I want to live like a free bird. I miss my country. I have spent my whole life there. I am a believer and I know I will come out clean,” he said.

The interview has been exclusively shared with ThePrint by ABP News

This fraudster is making his frauds political.

May or may not be the truth. What is undeniably true is that the issue of bank NPAs has got deeply politicised, is bound to be a major election issue. More than recovery of lost sums – PNB has taken a huge hit, has lost a big chunk of its net worth due to these capers – what is top concern is to minimise political damage. 2. If Vijay Mallya is willing to return to India, sit with the consortium of lending banks, agree to a substantial settlement, how is the public interest better served by sending him to Arthur Road jail, with a western toilet … For that matter, what has been gained by keeping Sahara Shree in Tihar Jail ? 3. Banking is serious business, a purely commercial activity. If Nirav Modi, Mehul Choksi have stolen thousands of crores and fled, more than ten to twelve trillion of loans have now become NPAs, it means the government is not doing a fantastic job of managing 70% of the India banking system. Itna shauq kya hai banks chalane ka, let men like Aditya Puri people the banking landscape.

you need to post both sides of the story- looks you are supporting him– that is not your job as a newspaper

seems you are taking his side- actually supporting him- why not put up questions to him– may be the intervier did not ask him– then you should either put those questions in the article or not reprint this article– it only gives one side of the story– as a newspaper- that is not your role.