The new scheme hopes to encourage informants to spill the beans about undisclosed assets, both in India and abroad.

New Delhi: An informant who tips off the Central Board of Direct Taxes about hidden stashes of black money or assets will now be rewarded up to Rs 5 crore — a huge jump the government hopes will encourage more people to pass on information to the tax authorities.

The scheme which came into effect Tuesday promises a considerably larger rewards than that promised by the 2007 guidelines.

The Income Tax Informants Rewards Scheme 2018 further assures an even higher prize if the information is about undisclosed foreign assets under the Black Money Act of 2015.

The move is reportedly aimed at encouraging more informants as the previous incentives were thought to be inadequate when it came to information about large sums of money.

The problems with this reward system will however remain the same. The final rewards often come after many years, as defaulters seek multiple legal options which take time to process.

Undisclosed foreign assets

For the first time, information about tax evasion abroad will be regarded as a distinct category and rewarded even more under the fresh guidelines.

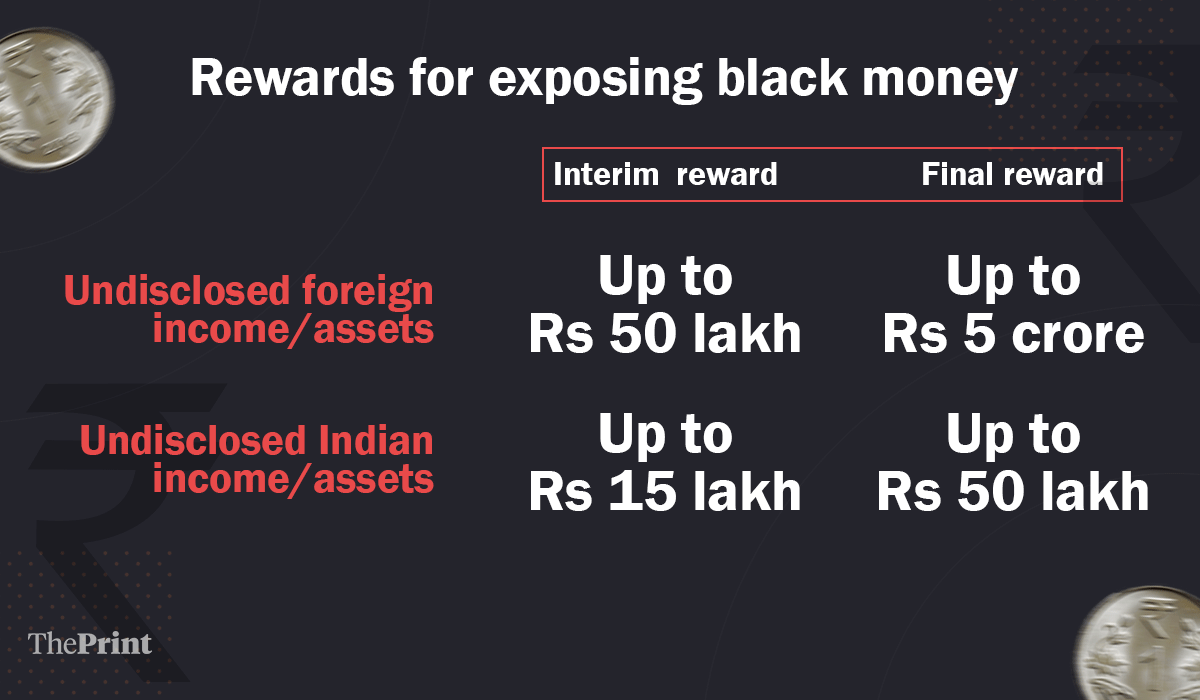

Both an interim award and a final one will be granted to informants if their information leads to a tax discovery.

The interim award will be 3 per cent of the tax liability in case of foreign assets with a ceiling of Rs 50 lakh.

The final reward, which an informant gets after the case is settled, is significantly higher as well. The reward money is 10 per cent of taxes levied and the maximum cap for this is a massive Rs 5 crore.

Undisclosed assets in India

For information about tax evasions in India, the interim award given to the informant will be a maximum of Rs 10 lakh. However, if the cash seized is more than Rs 1 crore, the interim amount alone can go up to Rs 15 lakh.

The final reward is 5 per cent of the tax liability and up to Rs 50 lakh.

Old rules

According to the 2007 guidelines, the informant would get 5 per cent of the tax liability as the interim award with a ceiling of Rs 1 lakh. At the time of the final recovery, the informant would get 10 per cent and a maximum Rs 15 lakh. There were no separate rewards for disclosing foreign assets.

The reward amount was reconsidered if the recovered amount was more than Rs 5 crore.

ir,

This is to inform that ATASH ABRASIVES (GST NO.27AAEPS5541G1ZL) (PAN:AAEPS5541G) having address at 91, nagevi x lane mumbai AND AMITASHA AGENCY (GST NO.27AAFFA6771P1ZU) importers of grinding wheels in china, and making half payment in Havala and making duplicate invoices (CHITTI BILLS) in a long time. Enclosed copy of latest some chitti bills for your referfence. Till date no checking in Sales Tax. The money comes from in Gujarat, Chennai and other places to various Angadias. The two number sales conduct by Mr. Nayan & Mr. Piyush Shah.

Atash Abrasives & Amitasha Agency is two Godowns. One in Godown No.2, Plot No.120, 12/16 Clive Street, Nr. Saikrupa Transport, Dena Bunder, Masjid, Mumbai 400003 and other in Bhiwandi – Godown No. u-7,8 & 9, Jai matadi Compound, Kalaher, Bhiwandi.

In Note Ban time lot of money deposited in various staff memebers in commission basis. Mr. Anil Shah, Proprietor donate to lot lakhs of rupees from his Temple in Vile Parle and Ahmedabad .Please check the Ahmedabad Mercantile Co-Op Bank, Mandvi, Mumbai 400003.

Please check immediately and save lot of tax.

M.V.BHASKARAN

Sir my nsme is santhi my village name nagalapuram (AP)andhara pradesh chithoor (dest) nagalapuram (mandal) block money D rajamanikayam financial license lakuda finance chasthunadu munsfal office lo sir me number naku evandi call chasthanu