In 6 months, price of Chinese APIs have risen by 25-30%, with Indian firms saying it has made the production of common drugs unviable.

New Delhi: A massive spike in the price of pharmaceutical raw materials imported from China is likely to cause a shortage of commonly-used drugs such as paracetamol — sold under brand names such as Crocin and Calpol — vitamin C, ofloxacin and azithromycin in India.

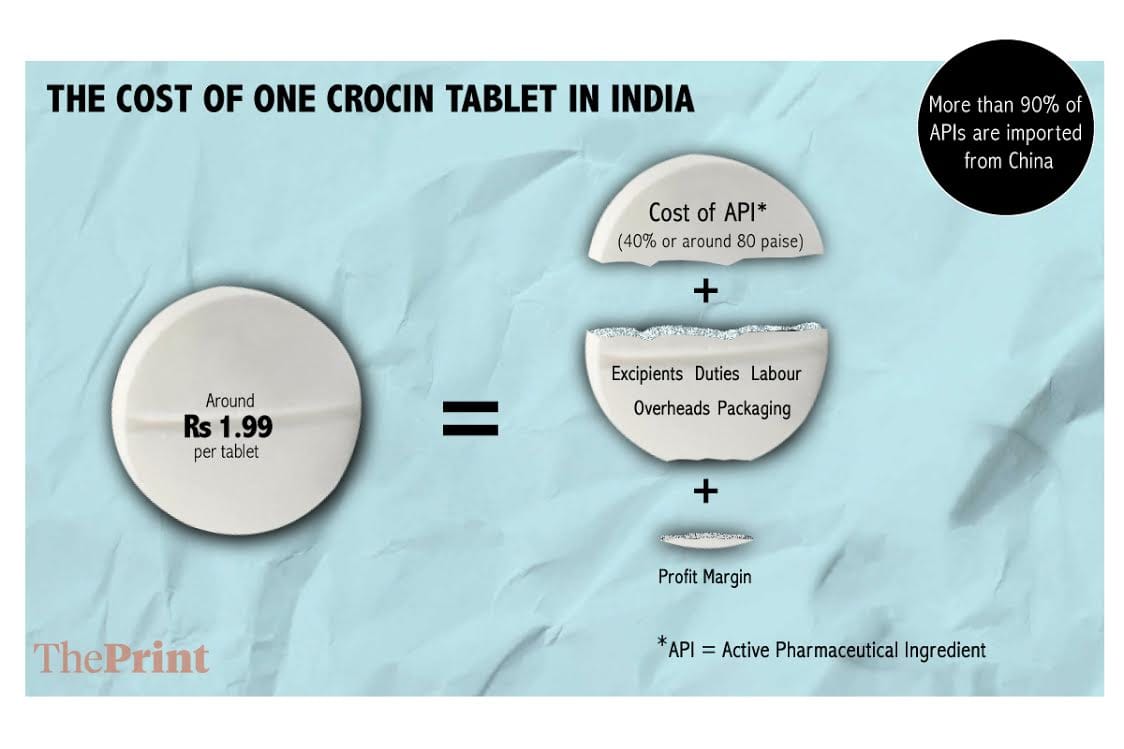

In the past six months, the prices of Chinese active pharmaceutical ingredient (API) — the core substance used in producing medicines — have risen by 25 to 30 per cent on an average. Over 90 per cent intermediaries of APIs, used by Indian drug-makers, come from China.

Drug-makers say the rise in raw material costs has made the production of some commonly available medicines unviable in India. They add that they have now decided to cut production of these medicines if the government fails to step in and provide some relief.

Also read: SCs, STs set to benefit big time from Modi’s mega healthcare scheme

“We are reeling due to a massive surge in prices of raw materials imported from China. It has led to a decline in our margins. With Chinese environment laws getting stringent and their factories being shut, the prices of APIs have doubled and trebled in the last six months,” said Daara Patel, secretary-general of Indian Drug Manufacturers’ Association (IDMA), the country’s largest lobby pharmaceutical companies.

“We cannot pass on the price rise to consumers and we cannot take more losses. Hence, we are compelled to cut or stop the production…where the increase is beyond our absorption limits.”

Crackdown in China, price rise in India

The price rise of APIs is being attributed to a Chinese environment ministry crackdown on violators and officials failing to implement green norms. The communist state has jailed hundreds of officials for failing to check environmental violations uncovered during inspections last year. The crackdown, Indian drug-makers say, has affected the Chinese API market.

In turn, drug manufacturing in India has been hurt.

“In the last six months, the shortage of APIs has led to a massive price increase. For example, the paracetamol API, which used to sell for around Rs 170 per kg six months ago, is now being sold at Rs 380 per kg,” said Vivek Jajodia, chairman at Ethachem, an importer of APIs in India for companies such as Cipla, Lupin, Wockhardt, and Sun Pharma.

“They give us just a couple of hours to book orders. A slight delay leads to a surge in prices by Rs 2-3 per kg. And we fear that these prices will shoot up substantially in December,” Jajodia said.

The woes of drug manufacturers have been compounded by the depreciation of the rupee, which slumped to an all-time low of 70.59 to the US dollar on 29 August, further pushing up the landed cost of imported APIs.

Also read: Expired medicines, no doctors & equipment: What audit of India’s govt health scheme found

“The prices of at least 80 per cent of APIs have spiked phenomenally in the last six months, making their production unviable,” says R.C. Juneja, the chief executive officer of Mankind Pharma, a firm with a turnover of Rs 5,000 crore and a Rs 950-crore operating profit.

He said the drug-makers were “helpless”. “The government won’t allow us to increase the prices of medicines considering it’s an election year and any such move would be non-populist,” Juneja added.

Mankind Pharma manufactures an array of top-selling antibiotics using Chinese APIs.

“The price rise is extraordinary and sustaining production under such circumstances is not possible. Our agent tells us in the morning to book the API before the day’s evening because next morning you never know what the new price would be,” said an API head of one of the largest drug-maker in India, who spoke on the condition of anonymity.

Why prices can’t be raised

Drug companies are bound by regulations that prevent them from raising prices of around 850 drugs, which fall under the National List of Essential Medicines (NLEM). While the companies can’t charge beyond a fixed-ceiling price for these 850 drugs, they are allowed to raise the prices of other medicines by up to 10 per cent annually.

The drug price watchdog, the National Pharmaceuticals Pricing Authority (NPPA), is tasked with regulating the prices of medicines and ensuring their availability.

The NPPA also has a provision, under which a manufacturer cannot stop production of a drug without providing a valid reason, six months in advance.

“It has a provision to notify but we cannot sustain loses by continuing the production for the next six months. If we fail to find a solution, we need to stop production,” said Daara Patel, who represents top drug-makers including Aurobindo Pharma, Cadila Healthcare, Dr. Reddy’s Laboratories and Glenmark Pharmaceuticals.

Also read: Discarded antibiotics make a comeback as fight against superbugs gathers pace

The drug-makers are now planning to reach out to the Niti Aayog to find a solution.

“If the ceiling prices of NLEM drugs are not revised by the government, we might have to resort to bringing down production, which will hamper the availability of drugs,” said a senior official at another drug-maker based out of Mumbai.

“We have sought NPPA’s help several times on the matter. We, however, haven’t seen any action from them that would allow manufacturers to absorb such drastic price fluctuation. We intend to meet Niti Aayog this week.”

S.V. Veerramani, managing director, Fourrts Laboratories, a company which manufactures antibiotics, said pharma firms want the government to allow “pro-rata increase in the maximum retail price, based on the content of the active drug in the formulation, for bulk drugs that now cost at least 20 per cent more”.

“Abnormal API price increase without a corresponding increase in finished product prices affects the viability of the product and may lead to shortages,” he said.