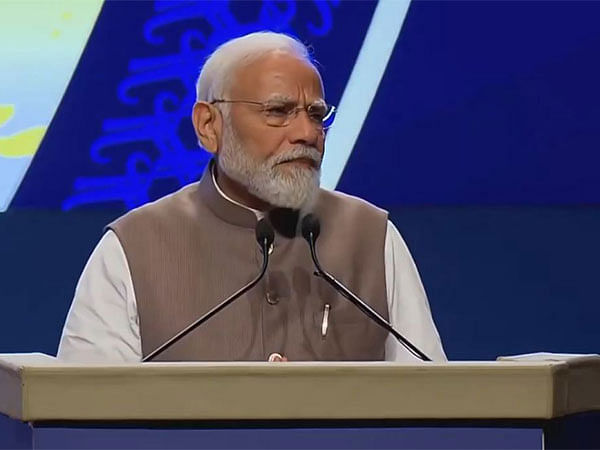

Mumbai (Maharashtra) [India], April 1 (ANI): Speaking at the 90th-anniversary celebration of the Reserve Bank of India (RBI), Prime Minister Narendra Modi on Monday asked the central bank to assess a newer banking structure to fund future needs.

PM Modi said an assessment of the credit needs should be done by the RBI, keeping in mind the growth prospects and potential of the country.

Modi said there may be a requirement for newer ways of “financing, operating and business models” in the changing landscape. The banking industry needs to move forward to ensure that it can fund the credit needs of the projects necessary for the country’s future growth.”

The PM said there are challenges confronting the industry along with this, artificial intelligence and blockchain, are changing the face of banking, and cyber security amid the increasing reliance on digital banking and innovations like fintechs. “In such a situation, we need to think about the changes that will be required in the country’s banking sector and its structure,” he said.

The RBI function was attended by India’s bigwigs like Reliance Group Chairman Mukesh Ambani, Tata Sons Chairman N Chandrashekaran, and Mahindra Group Chairman Anand Mahindra along with the country’s top bankers.

PM Modi also asked RBI to assess the credit needs of the country, keeping in mind the growth prospects and potential of India.

PM Modi did not mention, corporate ownership of banks which has been a controversial issue in the past, but asked business houses to pump in the required capital for the funding needs of the economy.

Former RBI Governor Raghuram Rajan and then deputy governor Viral Acharya have flagged the risk of conflict of interest in such a structure where corporate or large industrial houses own lenders. Some big business houses had applied unsuccessfully to get a universal banking licence.

In 2020, an RBI working group suggested that rules be changed to allow large corporate houses to promote banks, but the central bank has not taken a decision on it. Presently, large business houses have promoted non-banking finance companies as part of their financial sector play.

Amid concerns about the high private sector debt-to-GDP ratio in many countries, Modi suggested that the RBI should undertake a study in the Indian context. Modi said India has become the engine of global growth with the contribution of about 15 per cent of the incremental global growth. (ANI)

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.