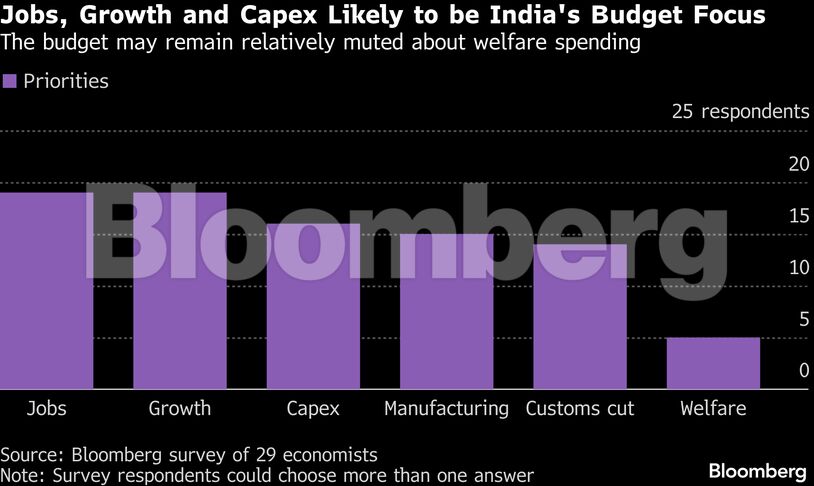

New Delhi: Prime Minister Narendra Modi’s budget is likely to focus on measures to create jobs for millions of Indians joining the workforce each year, while shielding the economy from global uncertainties and tariff tensions, according to a survey of economists by Bloomberg News.

Employment support and steps to boost growth emerged as top budget priorities for Finance Minister Nirmala Sitharaman, according to a survey of 29 economists. They expect the government to raise spending on roads, ports and railways, expand incentive schemes to boost exports, and reform the import-duty regime.

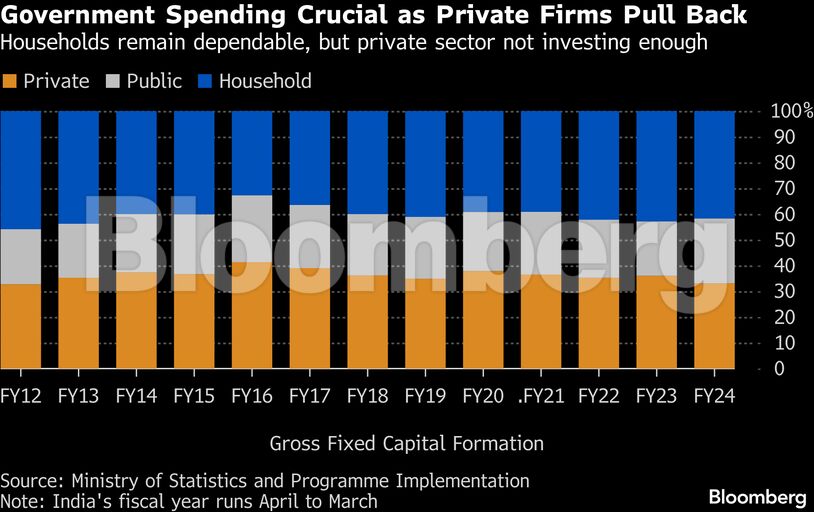

A shaky global backdrop and weak private investment are pushing the government to maintain higher spending to support demand and safeguard jobs and incomes. The private sector’s share of new investment fell to its lowest level in a decade in the year ended March 2024, according to ICRA. To compensate, the government increased its share of capital spending by 30% that year.

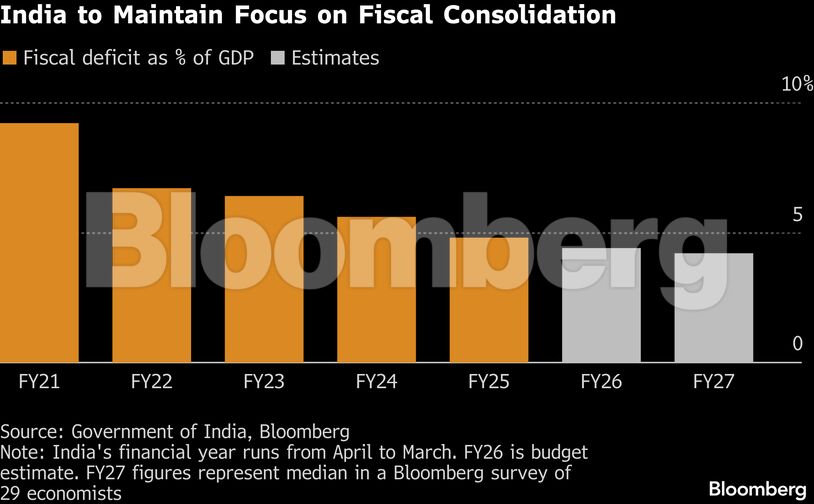

The ruling party is expected to adhere to fiscal consolidation, even as it might announce some new social schemes in five states to shore up popular support. Economists expect Sitharaman to reduce debt and curb the budget deficit to 4.2% of gross domestic product in the fiscal year beginning April.

Below are some of the key numbers analysts will be watching.

Deficit and Debt

In last year’s budget, Sitharaman vowed to stick to fiscal consolidation and drew up a roadmap to reduce federal debt to 50% of GDP, plus or minus one percentage point, by 2030-31.

Economists including Rahul Bajoria and Smriti Mehra of BofA said the revised framework gives the government greater flexibility to pursue a slower pace of deficit reduction while gradually lowering debt-servicing costs that rose sharply during the Covid pandemic. Fiscal deficit is seen at 4.2% of GDP next year, down from 4.4% in the current year, according to the survey.

India’s general government debt climbed to an estimated 81.29% of GDP by March 2024 from 69% in 2015, according to the International Monetary Fund, largely attributed to heavy borrowing during the pandemic era. While it has started to ease, a rise in state borrowings have blunted the overall improvement. The consolidated gross fiscal deficit rose to 3.3% of GDP in 2024-25 after staying below 3% over the previous three years, the Reserve Bank of India said in a report.

Growth

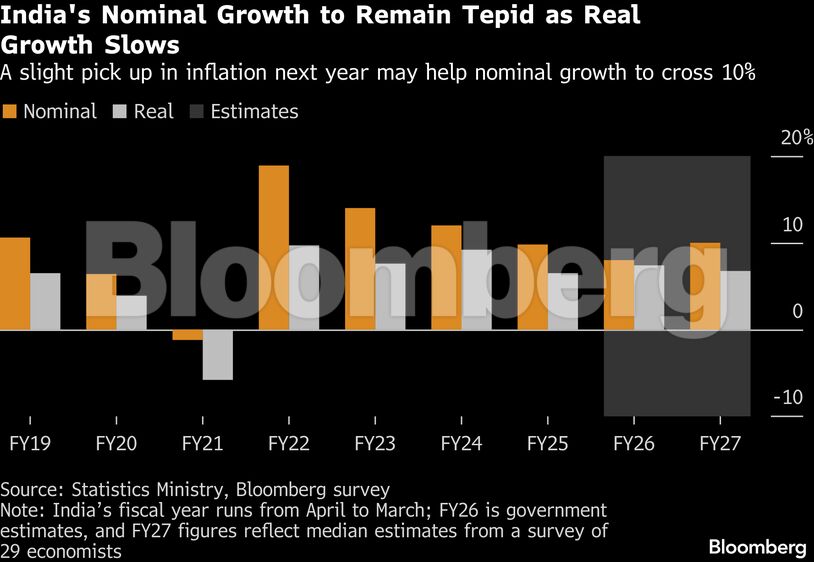

Economists expect growth of 6.5% to 7% in the next fiscal year, with inflation around the central bank’s 4% target. That implies nominal growth of 9.5% to 10.5%, an assumption critical in determining the growth in government and corporate revenues, suggesting pressures could persist next year.

The Economic Survey released yesterday expects growth to marginally slow, pegging it between 6.8% and 7.2% in the year starting April 1. Expansion is estimated at 7.4% in the current fiscal year ending March 31.

Revenue

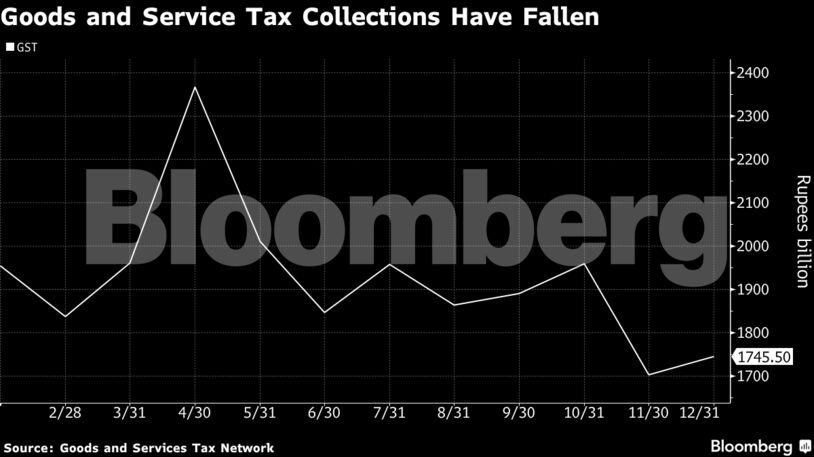

The cut in goods and services tax and personal income tax last year to cushion the impact of a 50% tariff shock from the US has led to a sharp drop in revenues. Survey participants see net taxes at 28.3 trillion rupees ($308 billion), as well as 500 billion rupees from disinvestment. It is also banking on dividend from the RBI and other financial institutions.

Corporate and income tax collections will need to rise 11.7% and 43% year-on-year, respectively, in the remaining four months of the fiscal year to meet budgeted targets, said Radhika Rao, an economist at DBS Bank Ltd. Any shortfall is likely to be offset through a recalibration of spending, she said, without jeopardizing the fiscal deficit target of 4.4% for the current year.

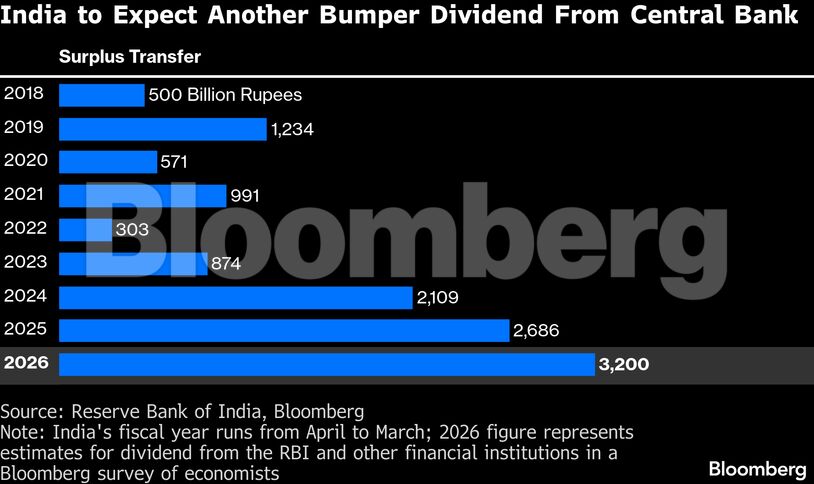

RBI Dividend

Economists expect dividend transfers of about 3.2 trillion rupees this year, supported by large dollar sales by the RBI to curb the rupee’s decline. In fiscal 2024-25, the central bank transferred 2.69 trillion rupees to the government.

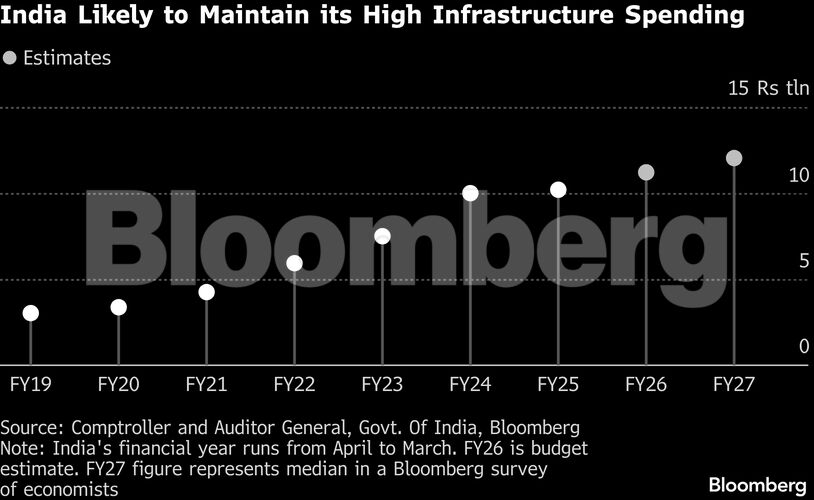

Capital Expenditure

Capital expenditure is set to remain a key focus in the budget. The government is likely to allocate about 12.04 trillion rupees for capex, or nearly 3% of GDP, according to the Bloomberg survey. Some economists cautioned, however, that the government may be nearing a saturation point in expanding and executing large infrastructure projects.

Defense-related capital spending is projected to rise to 2.3 trillion rupees from 1.8 trillion rupees last year, reflecting elevated border tensions following India’s conflict with Pakistan in May.

Markets borrowing

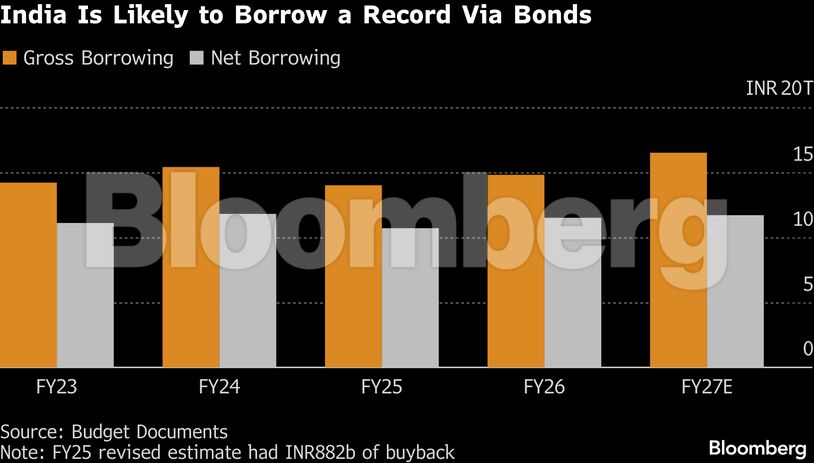

Despite its commitment to reducing debt, the government is likely to resort to record bond borrowing. Economists expect gross market borrowing of 16.5 trillion rupees and net borrowing of 11.6 trillion rupees.

The heavy calendar could add pressure on the central bank to support the borrowing plan via secondary-market purchases, said Citigroup Inc. economists Samiran Chakraborty and Baqar M. Zaidi. Survey participants see the 10-year government bond yield ending December 2026 at around 6.7%.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.