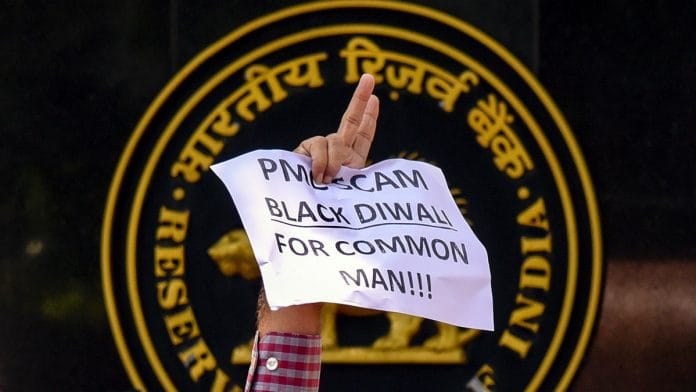

Mumbai: Mumbai police on Thursday arrested two directors of the Housing Development Infrastructure Limited (HDIL) in the PMC Bank scam, a senior official said.

Rakesh Wadhawan and his son Sarang Wadhawan, accused of loan default, have been arrested by the Economic Offences Wing (EOW), the official said.

Properties worth Rs 3,500 crore of HDIL have also been frozen by the EOW, he said.

Disturbing images of distraught depositors. One senior citizen who had 30 lacs in FD has suffered a stroke.

Don’t spread panic.

How can you write such a mindless and stupid comment? Lakhs of unsuspecting depositors of the Bank have suffered due to fraud committed by the management of the Bank in connivance with HDIL.The murky details of the PMC Bank scam are shocking. Loans given to HDIL blatantly flouted all the exposure norms of RBI and yet RBI was unaware of this poisition though the fraud was going on unnoticed for last 8 years. This also makes a case for suspected involvement of the Bank’s statutory auditors who remained unchanged for last 8 years. Out of the total loan portfolio of around Rs.8000 crore, more than 70 per cent or Rs.6600 crore were given to HDIL group, which has defaulted and has become bankrupt. These loans were concealed by creating more than 2000 dummy loan accounts. The statutory auditors simply ignored this fraud. The RBI auditors were also unable to ascertain the factual position and were not vigilant at all. The 70 percent of the loan portfolio is as good as lost and recovery thereof seems to be a long drawn, arduous process. One doesn’t how much can be recovered, though culprits will be arrested and punished. . The Bank simply cannot be revived and no sane bank would like to take over such a lost case. What can the hapless depositors of do now? It is a hopeless situation.