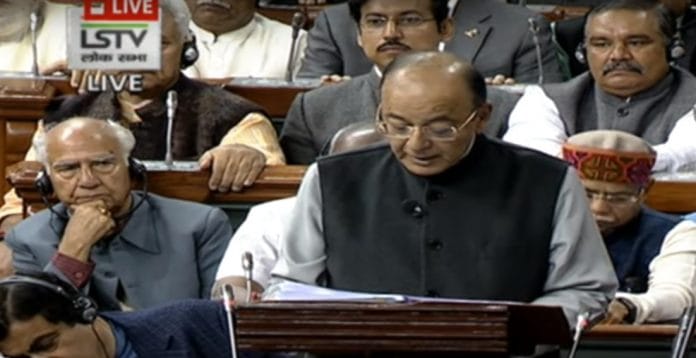

Here’s the full text of the Union Budget presented by Arun Jaitley:

Section I

Governance, Economy and Development

Madam Speaker,

1. I rise to present the Budget for 2018-19.

2. Madam, four years ago, we pledged to the people of India to

give this nation an honest, clean and transparent Government. We

promised a leadership capable of taking difficult decisions and restoring

strong performance of Indian economy. We promised to reduce

poverty, expedite infrastructure creation and build a strong, confident

and a New India. When our Government took over, India was

considered a part of fragile 5; a nation suffering from policy paralysis

and corruption. We have decisively reversed this. The Government, led

by Prime Minister, Shri Narendra Modi, has successfully implemented a

series of fundamental structural reforms. With the result, India stands out

among the fastest growing economies of the world.

3. The journey of economic reforms during the past few years has been

challenging but rewarding. As a result of the reforms undertaken by the

Government, foreign direct investment has gone up. Measures taken by the

Government have made it much easier to do business in India. Natural

resources are now allocated in a transparent and honest manner. There is a

premium on honesty. There was a time when corruption was commonplace.

Today, our people, especially our youths, are curious to lead their

lives honestly. The indirect tax system, with introduction of Goods and

Services Tax, has been made simpler. Benefits to the poor have been

targeted more effectively with use of digital technology. The

demonetization of high value currency has reduced the quantum of cash

currency and circulation in India. It has increased the taxation base and

spurred greater digitization of the economy. The Insolvency and Bankruptcy Code (IBC) has changed the lender-debtor relationship. The

recapitalized banks will now have a greater ability to support growth. All

these structural reforms in the medium and long run will help Indian

economy achieve stronger growth for a long time.

4. Indian economy has performed very well since our Government

took over in May, 2014. India achieved an average growth of 7.5% in

first three years of our Government. Indian economy is now 2.5 trillion

dollar economy – seventh largest in the world. India is expected to

become the fifth largest economy very soon. On Purchasing Power

Parity (PPP) basis, we are already the third largest economy.

5. Indian society, polity and economy had shown remarkable

resilience in adjusting with the structural reforms. GDP growth at 6.3%

in the second quarter signaled turnaround of the economy. We hope to

grow at 7.2% to 7.5% in the second half. IMF, in its latest Update, has

forecast that India will grow at 7.4% next year. Manufacturing sector is

back on good growth path. The services, mainstay of our growth, have

also resumed their high growth rates of 8% plus. Our exports are

expected to grow at 15% in 2017-18. We are now firmly on course to

achieve high growth of 8% plus.

6. We have taken up programmes to direct the benefits of

structural changes and good growth to reach farmers, poor and other

vulnerable sections of our society and to uplift the under-developed

regions. This year’s Budget will consolidate these gains and particularly

focus on strengthening agriculture and rural economy, provision of good

health care to economically less privileged, taking care of senior citizens,

infrastructure creation and working with the States to provide more

resources for improving the quality of education in the country.

7. Prime Minister Shri Narendra Modi has always stressed

importance of good governance. He has articulated the vision of

‘‘Minimum Government and Maximum Governance’’. This vision has

inspired Government agencies in carrying out hundreds of reforms in

policies, rules and procedures. This transformation is reflected in

improvement of India’s ranking by 42 places in last three years in the

World Bank’s ‘Ease of Doing Business’ with India breaking into top 100

for the first time. I would like to congratulate all those who worked to

achieve this.

8. Now, our Government has taken Ease of Doing business further by

stress on ‘Ease of Leaving’ for the common men of this country, especially

for those belonging to poor & middle class of the society. Good governance

also aims at minimum interference by the government in the life of

common people of the country.

9. Government is providing free LPG connections to the poor of this

country through Ujjwala Yojana. Under Saubhagya Yojna 4 crore household

are being provided with electricity connections. More than 800 medicines

are being sold at lower price through more than 3 thousand Jan Aushadhi

Centres. Cost of stents have been controlled. Special scheme for free

dialysis of poor have been initiated. Persons belonging to poor and middle

class are also being provided a great relief in interest rates on housing

schemes. Efforts are being made to provide all government services,

whether bus or train tickets or individual certificates on line. These include

passports which may be delivered at doorstep in two or three days or

Company registration in one day time and these facilities have benefited a

large section of our country. Certificate attestation is not mandatory,

interviews for appointment in Group C and Group D posts have been done

away with. These measures have saved time and money of lakhs of our

youth. Our Government by using modern technology is committed to

provide a relief to those who suffer because of rigid rules and regulations.

10. Madam, while undertaking these reforms and programmes, we

have worked sincerely and without weighing the political costs. Our

Government has ensured that benefits reach eligible beneficiaries and

are delivered to them directly. Many services and benefits are being

delivered to the people at their doorsteps or in their accounts. It has

reduced corruption and cost of delivery and has eliminated middlemen

in the process. Direct Benefit Transfer mechanism of India is the biggest

such exercise in the world and is a global success story.

Section II

Investment, Expenditure and Policy Initiatives

Agriculture and Rural Economy

11. My Government is committed for the welfare of farmers. For

decades, country’s agriculture policy and programme had remained

production centric. We have sought to effect a paradigm shift.

Honourable Prime Minister gave a cla rion call to double farmers’ income

by 2022 when India celebrates its 75th year of independence. Our

emphasis is on generating higher incomes for farmers. We consider

agriculture as an enterprise and want to help farmers produce more

from the same land parcel at lesser cost and simultaneously realize

higher prices for their produce. Our emphasis is also on generating

productive and gainful on-farm and non-farm employment for the

farmers and landless families.

12. Madam Speaker, as a result of the hard work of our country’s

farmers agriculture production in our country is at a record level. Doing the

year 2016-17 we achieved a record food grain production of around 275

million tonnes and around 300 million tonnes of fruits and vegetables.

13. Madam Speaker, in our party’s manifesto it has been stated that the

farmers should realize at least 50 per cent more than the cost of their

produce, in other words, one and a half times of the cost of their

production. Government have been very much sensitive to this resolutions

and it has declared Minimum support price (MSP) for the majority of rabi

crops at least at one and a half times the cost involved. Now, we have

decided to implement this resolution as a principle for the rest of crops. I

am pleased to announce that as per pre-determined principle, Government

has decided to keep MSP for the all unannounced crops of kharif at least at

one and half times of their production cost. I am confident that this historic

decision will prove an important step towards doubling the income of our

farmers.

14. Our Government works with the holistic approach of solving any

issue rather than in fragments. Increasing MSP is not adequate and it is

more important that farmers should get full benefit of the announced MSP.

For this, it is essential that if price of the agriculture produce market is less

than MSP, then in that case Government should purchase either at MSP or

work in a manner to provide MSP for the farmers through some other

mechanism. Niti Ayog, in consultation with Central and State Governments,

will put in place a fool-proof mechanism so that farmers will get adequate

price for their produce.

15. For better price realization, farmers need to make decisions

based on prices likely to be available after its harvest. Government will

create an institutional mechanism, with participation of all concerned

Ministries, to develop appropriate policies and practices for price and

demand forecast, use of futures and options market, expansion of

warehouse depository system and to take decisions about specific

exports and imports related measures.

16. Madam Speaker, last year, I had announced strengthening of

e-NAM and to expand coverage of e-NAM to 585 APMCs. 470 APMCs

have been connected to e-NAM network and rest will be connected by

March, 2018.

17. More than 86% of our farmers are small and marginal. They are

not always in a position to directly transact at APMCs and other

wholesale markets. We will develop and upgrade existing 22,000 rural

haats into Gramin Agricultural Markets (GrAMs). In these GrAMs,

physical infrastructure will be strengthened using MGNREGA and other

Government Schemes. These GrAMs, electronically linked to e-NAM and

exempted from regulations of APMCs, will provide farmers facility to

make direct sale to consumers and bulk purchasers.

18. An Agri-Market Infrastructure Fund with a corpus of `2000 crore

will be set up for developing and upgrading agricultural marketing

infrastructure in the 22000 Grameen Agricultural Markets (GrAMs) and

585 APMCs.

19. Task of connecting all eligible habitations with an all-weather

road has been substantially completed, with the target date brought

forward to March, 2019 from March 2022. It is now time to strengthen

and widen its ambit further to include major link routes which connect

habitations to agricultural and rural markets (GrAMs), higher secondary

schools and hospitals. Prime Minister Gram Sadak Yojana Phase III will

include such linkages.

20. For several years, we have been stating that India is primarily an

agriculture based country. As India is primarily an agriculture based country,

our districts can specialize in some or other agricultural produce and be

known for it. But special attention is lacking in this regard. There is a need

to develop cluster based model in a scientific manner for identified

agriculture produces in our districts in the same manner as we have

developed model for industrial sector.

21. Cultivation of horticulture crops in clusters bring advantages of

scales of operations and can spur establishment of entire chain from

production to marketing, besides giving recognition to the districts for

specific crops. The Ministry of Agriculture & Farmers’ Welfare will reorient

its ongoing Schemes and promote cluster based development of agricommodities

and regions in partnership with the Ministries of Food

Processing, Commerce and other allied Ministries.

22. Our Government has promoted organic farming in a big way.

Organic farming by Farmer Producer Organizations (FPOs) and Village

Producers’ Organizations (VPOs) in large clusters, preferably of 1000

hectares each, will be encouraged. Women Self Help Groups (SHGs) will

also be encouraged to take up organic agriculture in clusters under

National Rural Livelihood Programme.

23. Our ecology supports cultivation of highly specialized medicinal

and aromatic plants. India is also home to a large number of small and

cottage industries that manufacture perfumes, essential oils and other

associated products. Our Government shall support organized cultivation

and associated industry. I propose to allocate a sum of `200 crore for

this purpose.

24. Food Processing sector is growing at an average rate of 8% per

annum. Prime Minister Krishi Sampada Yojana is our flagship

programme for boosting investment in food processing. Allocation of

Ministry of Food Processing is being doubled from `715 crore in

RE 2017-18 to `1400 crore in BE 2018-19. Government will promote

establishment of specialized agro-processing financial institutions in this

sector.

25. Tomato, onion and potato are basic vegetables consumed

throughout the year. However, seasonal and regional production of

these perishable commodities pose a challenge in connecting farmers

and consumers in a manner that satisfies both. My Government

proposes to launch an ‘‘Operation Greens’’ on the lines of ‘‘Operation

Flood’’. ‘‘Operation Greens’’ shall promote Farmer Producers

Organizations (FPOs), agri-logistics, processing facilities and professional

management. I propose to allocate a sum of `500 crore for this purpose.

26. India’s agri-exports potential is as high as US $ 100 billion against

current exports of US $ 30 billion. To realize this potential, export of

agri-commodities will be liberalized. I also propose to set up state-ofthe-art

testing facilities in all the forty two Mega Food Parks.

27. I propose to extend the facility of Kisan Credit Cards to fisheries and

animal husbandry farmers to help them meet their working capital needs.

Small and marginal farmers will get more benefits.

28. Bamboo is ‘Green Gold’. We removed bamboo grown outside

forest areas from the definition of trees. Now, I propose to launch a

Re-structured National Bamboo Mission with an outlay of `1290 crore to

promote bamboo sector in a holistic manner.

29. Many farmers are installing solar water pumps to irrigate their

fields. Generation of solar electricity is harvesting of Sun by the farmers

using their lands. Government of India will take necessary measures and

encourage State Governments to put in place a mechanism that their

surplus solar power is purchased by the distribution companies or

licencees at reasonably remunerative rates.

30. Our Government set up a Long Term Irrigation Fund (LTIF) in

NABARD for meeting funding requirement of irrigation works. Scope of

the Fund would be expanded to cover specified command area

development projects.

31. Last year, I had announced setting up of Micro Irrigation Fund

(MIF) for facilitating expansion of coverage under micro irrigation and

Dairy Processing Infrastructure Development Fund (DPIDF) to help

finance investment in dairying infrastructure. It is now time to expand

such focused investment Funds. I, now, announce setting up a Fisheries

and Aquaculture Infrastructure Development Fund (FAIDF) for fisheries

sector and an Animal Husbandry Infrastructure Development Fund

(AHIDF) for financing infrastructure requirement of animal husbandry

sector. Total Corpus of these two new Funds would be `10,000 crore.

32. Our Government has been steadily increasing the volume of

institutional credit for agriculture sector from year-to-year from `8.5 lakh

crore in 2014-15 to `10 lakh crore in 2017-18. I now propose to raise

this to `11 lakh crore for the year 2018-19.

33. Presently, lessee cultivators are not able to avail crop loans.

Consequently, a significant proportion of arable land remains fallow and

tenant cultivators are forced to secure credit from usurious money

lenders. NITI Aayog, in consultation with State Governments, will evolve

a suitable mechanism to enable access of lessee cultivators to credit

without compromising the rights of the land owners.

34. Government will extend a favourable taxation treatment to

Farmer Producers Organisations (FPOs) for helping farmers aggregate

their needs of inputs, farm services, processing and sale operations.

I shall give details in Part B of my speech.

35. Air pollution in the Delhi-NCR region has been a cause of

concern. A special Scheme will be implemented to support the efforts

of the governments of Haryana, Punjab, Uttar Pradesh and the NCT of

Delhi to address air pollution and to subsidize machinery required for insitu

management of crop residue.

36. Madam Speaker, the present top leadership of this country has

reached at this level after seeing poverty at close quarters. Our leadership is

familiar with the problems being faced by the SC, ST, Backward Classes and

economically weaker sections of the society. People belonging to poor and

middle class are not case studies for them, on the other hand they

themselves are case study.

37. The Lower and Middle Class have been the focus of our Government

during the last three years. This Government is continuously striving to

alleviate all the small and major problems of the poor.

38. We launched Prime Minister’s Ujjwala Scheme to make poor women

free from the smoke of wood. Initially our target was to provide free LPG

connections to about 5 crore poor women. But in view of the pace of

implementation of Ujjwala scheme and its popularity among the women,

we propose to increase the target of providing free connection to 8 crore

poor women.

39. Our Government has launched Prime Minister Saubhagya Yojana for

providing electricity to all households of the country. Under this scheme,

four crores poor households are being provided with electricity connection

free of charge. We are spending `16000 crore under this scheme. You can

very well imagine our anxiety and restlessness even with one hour power

cut. Think about those women and children whose houses will not get

electricity. Their life is going to change because of Pradhan Mantri

Saubhagya Yojana.

40. Swachh Bharat Mission has benefited the poor. Under this mission,

Government has already constructed more than 6 crore toilets. The positive

effect of these toilets is being seen on the dignity of ladies, education of

girls and the overall health of family. Government is planning to construct

around 2 crore toilets.

41. Madam Speaker, a roof for his family is another concern of the poor.

Far from the Benami properties earned by corruption, the poor only desire

to have a roof, a small house by his earning of honesty. Our Govt. is helping

them so that they may fulfil the dream of their own house. We have fixed a

target that every poor of this country may have his own house by 2022. For

this purpose Prime Minister Awas Yojana has been launched in rural and

urban areas of the country. Under Prime Minister Awas Scheme Rural, 51

lakhs houses in year 2017-18 and 51 lakh houses during 2018-19 which is

more than one crore houses will be constructed exclusively in rural areas. In

urban areas the assistance has been sanctioned to construct 37 lakh houses.

42. My Government will also establish a dedicated Affordable

Housing Fund (AHF) in National Housing Bank, funded from priority

sector lending shortfall and fully serviced bonds authorized by the

Government of India.

43. Loans to Self Help Groups of women increased to about Rupees

42,500 crore in 2016-17, growing 37% over previous year. The

Government is confident that loans to SHGs will increase to `75,000

crore by March, 2019. I propose to substantially increase allocation of

National Rural Livelihood Mission to `5750 crore in 2018-19.

44. Ground water irrigation scheme under Prime Minister Krishi

Sinchai Yojna- Har Khet ko Pani will be taken up in 96 deprived irrigation

districts where less than 30% of the land holdings gets assured irrigation

presently. I have allocated `2600 crore for this purpose.

45. As my proposals outlined indicate, focus of the Government next

year will be on providing maximum livelihood opportunities in the rural

areas by spending more on livelihood, agriculture and allied activities

and construction of rural infrastructure. In the year 2018-19, for creation

of livelihood and infrastructure in rural areas, total amount to be spent

by the Ministries will be `14.34 lakh crore, including extra-budgetary and

non-budgetary resources of `11.98 lakh crore. Apart from employment

due to farming activities and self employment, this expenditure will

create employment of 321 crore person days, 3.17 lakh kilometers of

rural roads, 51 lakh new rural houses, 1.88 crore toilets, and provide

1.75 crore new household electric connections besides boosting

agricultural growth. Details are in Annexure I.

Health, Education and Social Protection

46. My Government’s goal is to assist and provide opportunity to

every Indian to realize her full potential capable of achieving her

economic and social dreams. Our Government is implementing a

comprehensive social security and protection programme to reach every

household of old, widows, orphaned children, divyaang and deprived as

per the Socio-Economic Caste Census. Allocation on National Social

Assistance Programme this year has been kept at `9975 crore.

47. We have managed to get children to School but the quality of

education is still a cause of serious concern. We have now defined

learning outcomes and National Survey of more than 20 lakh children

has been conducted to assess the status on the ground. This will help

in devising a district-wise strategy for improving quality of education. We

now propose to treat education holistically without segmentation from

pre-nursery to Class 12.

48. Improvement in quality of teachers can improve the quality of

education in the country. We will initiate an integrated B.Ed. programme

for teachers. Training of teachers during service is extremely critical. We

have amended the Right to Education Act to enable more than 13 lakh

untrained teachers to get trained.

49. Technology will be the biggest driver in improving the quality of

education. We propose to increase the digital intensity in education and

move gradually from ‘‘black board’’ to ‘‘digital board’’. Technology will

also be used to upgrade the skills of teachers through the recently

launched digital portal ‘‘DIKSHA’’.

50. The Government is committed to provide the best quality

education to the tribal children in their own environment. To realise this

mission, it has been decided that by the year 2022, every block with

more than 50% ST population and at least 20,000 tribal persons, will

have an Ekalavya Model Residential School. Ekalavya schools will be on

par with Navodaya Vidyalayas and will have special facilities for

preserving local art and culture besides providing training in sports and

skill development.

51. To step up investments in research and related infrastructure in

premier educational institutions, including health institutions, I propose

to launch a major initiative named ‘‘Revitalising Infrastructure and

Systems in Education (RISE) by 2022’’ with a total investment of

`1,00,000 crore in next four years. Higher Education Financing Agency

(HEFA) would be suitably structured for funding this initiative.

52. Our Government has taken major initiative of setting up Institutes

of Eminence. There has been tremendous response to this initiative by

institutions both in public and private sectors. We have received more

than 100 applications. We have also taken steps to set up a specialized

Railways University at Vadodara.

53. We propose to set up two new full-fledged Schools of Planning

and Architecture, to be selected on challenge mode. Additionally, 18

new SPAs would be established in the IITs and NITs as autonomous

Schools, also on challenge mode.

54. The Government would launch the ‘‘Prime Minister’s Research

Fellows (PMRF)’’ Scheme this year. Under this, we would identify 1,000

best B.Tech students each year from premier institutions and provide

them facilities to do Ph.D in IITs and IISc, with a handsome fellowship. It

is expected that these bright young fellows would voluntarily commit

few hours every week for teaching in higher educational institutions.

55. Now I come to the Health Sector. सर्वे भवन्तु: सुखिन, सर्वे संतु: निरामया is the guiding principle of my Government. Only Swasth Bharat can be a

Samriddha Bharat. India cannot realize its demographic dividend without

its citizens being healthy.

56. I am pleased to announce two major initiatives as part of

‘‘Ayushman Bharat’’ programme aimed at making path breaking

interventions to address health holistically, in primary, secondary and

tertiary care system covering both prevention and health promotion.

57. The National Health Policy, 2017 has envisioned Health and

Wellness Centres as the foundation of India’s health system. These 1.5

lakh centres will bring health care system closer to the homes of people.

These centres will provide comprehensive health care, including for noncommunicable

diseases and maternal and child health services. These

centres will also provide free essential drugs and diagnostic services.

I am committing `1200 crore in this budget for this flagship programme.

I also invite contribution of private sector through CSR and philanthropic

institutions in adopting these centres.

58. Madam Speaker, we are all aware that lakhs of families in our

country have to borrow or sell assets to receive indoor treatment in

hospitals. Government is seriously concerned about such impoverishment

of poor and vulnerable families. Present Rashtriya Swasthya Bima Yojana

(RSBY) provide annual coverage of only `30,000 to poor families. Several

State Governments have also implemented/supplemented health

protection schemes providing varying coverage. My Government has

now decided to take health protection to more aspirational level.

59. We will launch a flagship National Health Protection Scheme to

cover over 10 crore poor and vulnerable families (approximately 50

crore beneficiaries) providing coverage upto 5 lakh rupees per family per

year for secondary and tertiary care hospitalization. This will be the

world’s largest government funded health care programme. Adequate

funds will be provided for smooth implementation of this programme.

60. Madam Speaker, these two far-reaching initiatives under the

Ayushman Bharat will build a New India 2022 and ensure enhanced

productivity, well being and avert wage loss and impoverishment. These

Schemes will also generate lakhs of jobs, particularly for women. The

Government is steadily but surely progressing towards the goal of Universal

Health Coverage.

61. TB claims more lives every year than any other infectious disease.

It affects mainly poor and malnourished people. My Government has,

therefore, decided to allocate additional `600 crore to provide

nutritional support to all TB patients at the rate of `500 per month for

the duration of their treatment.

62. In order to further enhance accessibility of quality medical

education and health care, we will be setting up 24 new Government

Medical Colleges and Hospitals by upgrading existing district hospitals in

the country. This would ensure that there is at least 1 Medical College

for every 3 Parliamentary Constituencies and at least 1 Government

Medical College in each State of the country.

63. Our resolve of making our villages open defecation free is aimed

at improving the life of our villagers. We will launch a Scheme called

Galvanizing Organic Bio-Agro Resources Dhan (GOBAR-DHAN) for

management and conversion of cattle dung and solid waste in farms to

compost, fertilizer, bio-gas and bio-CNG.

64. Pradhan Mantri Jeevan Jyoti Beema Yojana (PMJJBY) has

benefitted 5.22 crore families with a life insurance cover of `2 lakh on

payment of a premium of only `330/- per annum. Likewise, under

Pradhan Mantri Suraksha Bima Yojana, 13 crore 25 lakh persons have

been insured with personal accident cover of `2 lakh on payment of a

premium of only `12 per annum. The Government will work to cover all

poor households, including SC/ST households, under these in a mission

mode.

65. The Government will expand the coverage under Prime Minister

Jan Dhan Yojana by bringing all sixty crore basic accounts within its fold

and undertake measures to provide services of micro insurance and

unorganized sector pension schemes through these accounts.

66. Our commitment towards ‘‘Beti Bachao Beti Padhao’’ is

unflinching. Sukanya Samriddhi Account Scheme launched in January

2015 has been a great success. Until November, 2017 more than 1.26

crore accounts have been opened across the country in the name of girlchild

securing an amount of `19,183 crore.

67. Cleaning the Ganga is work of national importance and it is our

firm commitment. Members will be happy to learn that this work has

gathered speed. A total of 187 projects have been sanctioned under the

Namami Gange programme for infrastructure development, river surface

cleaning, rural sanitation and other interventions at a cost of

`16,713 crore. 47 projects have been completed and remaining projects

are at various stages of execution. All 4465 Ganga Grams – villages on

the bank of river – have been declared open defecation free.

68. To give focused attention and to achieve our vision of an

inclusive society, the Government has identified 115 aspirational districts

taking various indices of development in consideration. The Government

aims at improving the quality of life in these districts by investing in

social services like health, education, nutrition, skill upgradation, financial

inclusion and infrastructure like irrigation, rural electrification, potable

drinking water and access to toilets at an accelerated pace and in a time

bound manner. We expect these 115 districts to become model of

development.

69. Economic and social advancement of hard working people of

Scheduled Castes (SCs) and Scheduled Tribes (STs) has received core

attention of Government. Our Government increased total earmarked

allocation for SCs in 279 programmes from `34,334 crore in 2016-17 to

`52,719 crore in RE 2017-18. Likewise, for STs, earmarked allocation

was increased from `21,811 crore in 2016-17 to `32,508 crore in

RE 2017-18 in 305 programmes. I propose an earmarked allocation of

`56,619 crore for SCs and `39,135 crore for STs in BE 2018-19.

70. Government’s estimated schematic budgetary expenditure on

health, education and social protection for 2018-19 is `1.38 lakh crore

against estimated expenditure of `1.22 lakh crore in BE 2017-18. Details

are in Annexure II. This expenditure is likely to go up by at least `15,000

crore in 2018-19 on account of additional allocation during the year and

extra budgetary expenditure, including through Higher Education

Financing Agency.

Medium, Small and Micro Enterprises (MSMEs) and

Employment

71. Medium, Small and Micro Enterprises (MSMEs) are a major

engine of growth and employment in the country. I have provided

`3794 crore to MSME Sector for giving credit support, capital and

interest subsidy and innovations. Massive formalization of the businesses

of MSMEs is taking place in the country after demonetization and

introduction of GST. This is generating enormous financial information

database of MSMEs’ businesses and finances. This big data base will be

used for improving financing of MSMEs’ capital requirement, including

working capital.

72. It is proposed to onboard public sector banks and corporates on

Trade Electronic Receivable Discounting System (TReDS) platform and

link this with GSTN. Online loan sanctioning facility for MSMEs will be

revamped for prompt decision making by the banks. Government will

soon announce measures for effectively addressing non-performing

assets and stressed accounts of MSMEs. This will enable larger financing

of MSMEs and also considerably ease cash flow challenges faced by

them. In order to reduce tax burden on MSMEs and to create larger

number of jobs, I will be announcing some tax measures in Part B of my

speech.

73. MUDRA Yojana launched in April, 2015 has led to sanction of

`4.6 lakh crore in credit from 10.38 crore MUDRA loans. 76% of loan

accounts are of women and more than 50% belong to SCs, STs and

OBCs. It is proposed to set a target of `3 lakh crore for lending under

MUDRA for 2018-19 after having successfully exceeded the targets in all

previous years.

74. Non-Bank Finance Companies (NBFCs) stepped up financing of

MSMEs after demonetization. NBFCs can be very powerful vehicle for

delivering loans under MUDRA. Refinancing policy and eligibility criteria

set by MUDRA will be reviewed for better refinancing of NBFCs.

75. Use of Fintech in financing space will help growth of MSMEs. A

group in the Ministry of Finance is examining the policy and institutional

development measures needed for creating right environment for

Fintech companies to grow in India.

75. Use of Fintech in financing space will help growth of MSMEs. A

group in the Ministry of Finance is examining the policy and institutional

development measures needed for creating right environment for

Fintech companies to grow in India.

76. Venture Capital Funds and the angel investors need an innovative

and special developmental and regulatory regime for their growth. We

have taken a number of policy measures including launching ‘‘Start-Up

India’’ program, building very robust alternative investment regime in

the country and rolling out a taxation regime designed for the special

nature of the VCFs and the angel investors. We will take additional

measures to strengthen the environment for their growth and successful

operation of alternative investment funds in India.

77. Creating job opportunities and facilitating generation of

employment has been at the core of our policy-making. During the last

three years, we have taken a number of steps to boost employment

generation in the country. These measures include:-

- Contribution of 8.33% of Employee Provident Fund (EPF)

for new employees by the Government for three years. - Contribution of 12% to EPF for new employees for three

years by the Government in sectors employing large

number of people like textile, leather and footwear. - Additional deduction to the employees of 30% of the

wages paid for new employees under the Income Tax Act. - Launch of National Apprenticeship Scheme with stipend

support and sharing of the cost of basic training by the

Government to give training to 50 lakh youth by 2020. - Introducing system of fixed term employment for apparel

and footwear sector. - Increasing paid maternity leave from 12 weeks to 26

weeks, along with provision of crèches.

78. These measures have started showing results. An independent

study conducted recently has shown that 70 lakh formal jobs will be

created this year.

79. To carry forward this momentum, I am happy to announce that

the Government will contribute 12% of the wages of the new employees

in the EPF for all the sectors for next three years. Also, the facility of

fixed term employment will be extended to all sectors.

80. To incentivize employment of more women in the formal sector

and to enable higher take-home wages, I propose to make amendments

in the Employees Provident Fund and Miscellaneous Provisions Act, 1952

to reduce women employees’ contribution to 8% for first three years of

their employment against existing rate of 12% or 10% with no change in

employers’ contribution.

81. The Government is setting up a model aspirational skill centre in

every district of the country under Pradhan Mantri Kaushal Kendra

Programme. 306 Pradhan Mantri Kaushal Kendra have been established

for imparting skill training through such centers.

82. The Government had approved a comprehensive textile sector

package of `6000 crore in 2016 to boost the apparel and made-up

segments. I, now propose to provide an outlay of `7148 crore for the

textile sector in 2018-19.

Infrastructure and Financial Sector Development

83. Infrastructure is the growth driver of economy. Our country

needs massive investments estimated to be in excess of `50 lakh crore

in infrastructure to increase growth of GDP, connect and integrate the

nation with a network of roads, airports, railways, ports and inland

waterways and to provide good quality services to our people.

84. We have made an all-time high allocation to rail and road

sectors. We are committed to further enhance public investment.

Provision of key linkages like coal for power, power for railways and

railway rakes for coal have been rationalized and made very efficient.

Prime Minister personally reviews the targets and achievements in

infrastructure sectors on a regular basis. Using online monitoring system

of PRAGATI alone, projects worth 9.46 lakh crore have been facilitated

and fast tracked.

85. To secure India’s defences, we are developing connectivity

infrastructure in border areas. Rohtang tunnel has been completed to

provide all weather connectivity to the Ladakh region. Contract for

construction of Zozila Pass tunnel of more than 14 kilometer is

progressing well. I now propose to take up construction of tunnel under

Sela Pass. For promoting tourism and emergency medical care,

Government will make necessary framework for encouraging investment

in sea plane activities.

86. Urbanization is our opportunity and priority. My Government has

rolled out two interlinked programmes – Smart Cities Mission and the

AMRUT.

87. Smart Cities Mission aims at building 100 Smart Cities with stateof-the-art

amenities. I am happy to inform that 99 Cities have been

selected with an outlay of `2.04 lakh crore. These Cities have started

implementing various projects like Smart Command and Control Centre,

Smart Roads, Solar Rooftops, Intelligent Transport Systems, Smart Parks.

Projects worth `2350 crore have been completed and works of `20,852

crore are under progress. To preserve and revitalize soul of the heritage

cities in India, National Heritage City Development and Augmentation

Yojana (HRIDAY) has been taken up in a major way.

88. India is blessed with an abundance of tourist attractions. It is

proposed to develop ten prominent tourist sites into Iconic Tourism

destinations by following a holistic approach involving infrastructure and

skill development, development of technology, attracting private

investment, branding and marketing. In addition, tourist amenities at

100 Adarsh monuments of the Archaeological Survey of India will be

upgraded to enhance visitor experience.

89. The AMRUT programme focuses on providing water supply to all

households in 500 cities. State level plans of `77,640 crore for 500 cities

have been approved. Water supply contracts for 494 projects worth

`19,428 crore and sewerage work contract for 272 projects costing

`12,429 crore has been awarded.

90. Reforms are being catalyzed by these missions. 482 cities have

started credit rating. 144 cities have got investment grade rating.

91. My Ministry will leverage the India Infrastructure Finance

Corporation Limited (IIFCL) to help finance major infrastructure projects,

including investments in educational and health infrastructure, on

strategic and larger societal benefit considerations.

92. Our Government has scaled new heights in development of Road

Infrastructure sector. We are confident to complete National Highways

exceeding 9000 kilometers length during 2017-18. Ambitious Bharatmala

Pariyojana has been approved for providing seamless connectivity of

interior and backward areas and borders of the country to develop

about 35000 kms in Phase-I at an estimated cost of `5,35,000 crore. To

raise equity from the market for its mature road assets, NHAI will

consider organizing its road assets into Special Purpose Vehicles and use

innovative monetizing structures like Toll, Operate and Transfer (TOT)

and Infrastructure Investment Funds (InvITs).

93. Strengthening the railway network and enhancing Railways’

carrying capacity has been a major focus of the Government. Railways’

Capex for the year 2018-19 has been pegged at `1,48,528 crore. A large

part of the Capex is devoted to capacity creation. 18,000 kilometers of

doubling, third and fourth line works and 5000 kilometers of gauge

conversion would eliminate capacity constraints and transform almost

entire network into Broad Gauge.

94. There has also been significant improvement in the achievement

of physical targets by Railways as well. We are moving fast towards

optimal electrification of railway network. 4000 kilometers are targeted

for commissioning during 2017-18.

95. Work on Eastern and Western dedicated Freight Corridors is in

full swing. Adequate number of rolling stock – 12000 wagons, 5160

coaches and approximately 700 locomotives are being procured during

2018-19. A major programme has been initiated to strengthen

infrastructure at the Goods sheds and fast track commissioning of

private sidings.

96. A ‘Safety First’ policy, with allocation of adequate funds under

Rashtriya Rail Sanraksha Kosh is cornerstone of Railways’ focus on safety.

Maintenance of track infrastructure is being given special attention. Over

3600 kms of track renewal is targeted during the current fiscal. Other

major steps include increasing use of technology like ‘‘Fog Safe’’ and

‘‘Train Protection and Warning System’’. A decision has been taken to

eliminate 4267 unmanned level crossings in the broad gauge network in

the next two years.

97. Redevelopment of 600 major railway stations is being taken up

by Indian Railway Station Development Co. Ltd. All stations with more

than 25000 footfalls will have escalators. All railway stations and trains

will be progressively provided with wi-fi. CCTVs will be provided at all

stations and on trains to enhance security of passengers. Modern trainsets

with state-of-the-art amenities and features are being designed at

Integrated Coach Factory, Perambur. First such train-set will be

commissioned during 2018-19.

98. Mumbai’s transport system, the lifeline of the City, is being

expanded and augmented to add 90 kilometers of double line tracks at

a cost of over `11,000 crore. 150 kilometers of additional suburban

network is being planned at a cost of over `40,000 crore, including

elevated corridors on some sections. A suburban network of

approximately 160 kilometers at an estimated cost of `17,000 crore is

being planned to cater to the growth of the Bengaluru metropolis.

99. Foundation for the Mumbai-Ahmedabad bullet train project,

India’s first high speed rail project was laid on September 14, 2017. An

Institute is coming up at Vadodara to train manpower required for high

speed rail projects.

100. In the last three years, the domestic air passenger traffic grew at

18% per annum and our airline companies placed orders for more than

900 aircrafts. Regional connectivity scheme of UDAN (Ude Desh ka Aam

Nagrik) initiated by the Government last year shall connect 56 unserved

airports and 31 unserved helipads across the country. Operations have

already started at 16 such airports. सरकार की इस पहल से हवाई चप्पल पहनने वाले नागरिक भी हवाई जहाज में यात्रा कर रहे हैं। Airport Authority of India (AAI) has 124 airports. We propose to expand our airport capacity more than

five times to handle a billion trips a year under a new initiative – NABH

Nirman. Balance sheet of AAI shall be leveraged to raise more resources

for funding this expansion.

101. Our efforts to set up a Coalition on Disaster Resilient

Infrastructure for developing international good practices, appropriate

standards and regulatory mechanism for resilient infrastructure

development are moving well. I propose to allocate `60 crores to kick

start this initiative in 2018-19.

102. The Government and market regulators have taken necessary

measures for development of monetizing vehicles like Infrastructure

Investment Trust (InvIT) and Real Investment Trust (ReITs) in India. The

Government would initiate monetizing select CPSE assets using InvITs

from next year.

103. In the current year, we included, in the scope of harmonized list

of infrastructure, ropeways to promote tourism, logistics parks and

expanded the scope of railways infrastructure to include development of

commercial land around railway stations.

104. Reserve Bank of India has issued guidelines to nudge Corporates

access bond market. SEBI will also consider mandating, beginning with

large Corporates, to meet about one-fourth of their financing needs

from the bond market.

105. Corporate bonds rated ‘BBB’ or equivalent are investment grade.

In India, most regulators permit bonds with the ‘AA’ rating only as

eligible for investment. It is now time to move from ‘AA’ to ‘A’ grade

ratings. The government and concerned regulators will take necessary

action.

106. We will take reform measures with respect to stamp duty regime

on financial securities transactions in consultation with the States and

make necessary amendments the Indian Stamp Act.

107. International Financial Service Centre (IFSC) at Gift City, which has

become operational, needs a coherent and integrated regulatory

framework to fully develop and to compete with other offshore financial

centres. The Government will establish a unified authority for regulating

all financial services in IFSCs in India.

108. Global economy is transforming into a digital economy thanks to

development of cutting edge technologies in digital space – machine

learning, artificial intelligence, internet of things, 3D printing and the

like. Initiatives such as Digital India, Start Up India, Make in India would

help India establish itself as a knowledge and digital society. NITI Aayog

will initiate a national program to direct our efforts in the area of

artificial intelligence, including research and development of its

applications.

109. Combining cyber and physical systems have great potential to

transform not only innovation ecosystem but also our economies and

the way we live. To invest in research, training and skilling in robotics,

artificial intelligence, digital manufacturing, big data analysis, quantum

communication and internet of things, Department of Science &

Technology will launch a Mission on Cyber Physical Systems to support

establishment of centres of excellence. I have doubled the allocation on

Digital India programme to ` 3073 crore in 2018-19.

110. Task of connecting one lakh gram panchayat through high speed

optical fiber network has been completed under phase I of the

Bharatnet project. This has enabled broadband access to over 20 crore

rural Indians in about two lakh fifty thousand villages. The Government

also proposes to setup five lakh wi-fi hotspots which will provide

broadband access to five crore rural citizens. I have provided `10000

crore in 2018-19 for creation and augmentation of Telecom

infrastructure.

111. To harness the benefit of emerging new technologies, particularly

the ‘Fifth Generation’ (5G) technologies and its adoption, the

Department of Telecom will support establishment of an indigenous 5G

Test Bed at IIT, Chennai.

112. Distributed ledger system or the block chain technology allows

organization of any chain of records or transactions without the need of

intermediaries. The Government does not consider crypto-currencies

legal tender or coin and will take all measures to eliminate use of these

crypto-assets in financing illegitimate activities or as part of the payment

system. The Government will explore use of block chain technology

proactively for ushering in digital economy.

113. The system of toll payments physically by cash at road toll plazas

is being fast replaced with Fastags and other electronic payment systems

to make road travel seamless. Number of Fastags has gone up from

about 60,000 in December, 2016 to more than 10 lakh now. From

December, 2017 all class ‘‘M’’ and ‘‘N’’ vehicles are being sold only with

the Fastags. The Government will come out with a policy to introduce

toll system on ‘‘pay as you use’’ basis.

114. In order to create employment and aid growth, Government’s

estimated budgetary and extra budgetary expenditure on infrastructure

for 2018-19 is being increased to `5.97 lakh crore against estimated

expenditure of `4.94 lakh crore in 2017-18. Details are in Annexure III.

Building Institutions and Improving Public Service Delivery

115. Our armed forces have played a stellar role in meeting the

challenges we have been facing on our borders as well as in managing

the internal security environment both in Jammu and Kashmir and the

North East. I would like to place on record our appreciation for the

efforts and the sacrifices made by the three services in defending the

interests of the Nation.

116. Ever since the NDA Government has assumed office in 2014, lot

of emphasis has been given to modernizing and enhancing the

operational capability of the Defence Forces. A number of initiatives

have been taken to develop and nurture intrinsic defence production

capability to make the Nation self-reliant for meeting our defence needs.

Ensuring adequate budgetary support will be our priority.

117. We have opened up private investment in defence production

including liberalizing foreign direct investment. We will take measures

to develop two defence industrial production corridors in the country.

The Government will also bring out an industry friendly Defence

Production Policy 2018 to promote domestic production by public sector,

private sector and MSMEs.

118. Aadhar has provided an identity to every Indian. Aadhar has

eased delivery of so many public services to our people. Every

enterprise, major or small, also needs a unique ID. The Government will

evolve a Scheme to assign every individual enterprise in India a

unique ID.

119. To carry the business reforms for ease of doing business deeper

and in every State of India, the Government of India has identified 372

specific business reform actions. All States have taken up these reforms

and simplifications in a mission mode constructively competing with each

other. Evaluation of performance under this Programme will now be

based on user feedback.

120. Capital of the Food Corporation of India will be restructured to

enhance equity and to raise long-term debt for meeting its standing

working capital requirement.

121. Budgeting of Government of India’s contribution in equity and

debt of the metro ventures floated by the State Governments will be

streamlined.

122. Department of Commerce will be developing a National Logistics

Portal as a single window online market place to link all stakeholders.

123. The Government has approved listing of 14 CPSEs, including two

insurance companies, on the stock exchanges. The Government has also

initiated the process of strategic disinvestment in 24 CPSEs. This includes

strategic privatization of Air India.

124. Process of acquisition of Hindustan Petroleum Corporation by the

ONGC has been successfully completed. Three public sector general

insurance companies National Insurance Company Ltd., United India

Assurance Company Limited and Oriental India Insurance Company

Limited will be merged into a single insurance entity and will be

subsequently listed.

125. The Government introduced Exchange Traded Fund Bharat-22 to

raise `14,500 crore, which was over-subscribed in all segments. DIPAM

will come up with more ETF offers including debt ETF.

126. 2017-18 Budget Estimates for disinvestment were pegged at the

highest ever level of `72,500 crore. I am happy to inform the House

that we have already exceeded the budget estimates. I am assuming

receipts of `1,00,000 crore in 2017-18. I am setting the disinvestment

target of `80,000 crore for 2018-19.

127. Bank recapitalization program has been launched with bonds of

`80,000 crore being issued this year. The programme has been

integrated with an ambitious reform agenda, under the rubric of an

Enhanced Access and Service Excellence (EASE) programme. This

recapitalization will pave the way for the public sector banks to lend

additional credit of `5 lakh crore.

128. It is proposed to allow strong Regional Rural Banks to raise

capital from the market to enable them increase their credit to rural

economy.

129. National Housing Bank Act is being amended to transfer its equity

from the Reserve Bank of India to the Government. Indian Post Offices

Act, Provident Fund Act and National Saving Certificate Act are being

amalgamated and certain additional people friendly measures are being

introduced. To provide the Reserve Bank of India an instrument to

manage excess liquidity, Reserve Bank of India Act is being amended to

institutionalize an Uncollateralized Deposit Facility. Securities and

Exchange Board of India, Act 1992, Securities Contracts (Regulation) Act

1956, and Depositories Act 1996, are being amended to streamline

adjudication procedures and to provide for penalties for certain

infractions. These proposals are in the Finance Bill.

130. For easier access, links to all Detailed Demand for Grants will be

provided at india.gov.in. The Government will also consider feasibility of

providing disclosed fiscal information in a machine readable form.

131. The Government is transforming method of disposal of its

business by introduction of e-office and other e-governance initiatives in

central Ministries and Departments. These initiatives are listed in

Annexure IV.

132. The Government will formulate a comprehensive Gold Policy to

develop gold as an asset class. The Government will also establish a

system of consumer friendly and trade efficient system of regulated gold

exchanges in the country. Gold Monetization Scheme will be revamped

to enable people to open a hassle-free Gold Deposit Account.

133. Outward Direct Investment (ODI) from India has grown to US$15

billion per annum. The Government will review existing guidelines and

processes and bring out a coherent and integrated Outward Direct

Investment (ODI) policy.

134. Hybrid instruments are suitable for attracting foreign investments

in several niche areas, especially for the startups and venture capital

firms. The Government will evolve a separate policy for the hybrid

instruments.

135. The emoluments of the President, the Vice President and the

Governors were last revised with effect from 1st January, 2006. These

emoluments are proposed to be revised to `5 lakh for the President,

`4 lakhs for the Vice President and to `3.5 lakh per month for the

Governors.

136. There has been a public debate with regard to the emoluments

paid to the Members of Parliament. Present practice allows the

recipients to fix their own emoluments which invites criticism. I am,

therefore, proposing necessary changes to refix the salary, constituency

allowance, office expenses and meeting allowance payable to Members

of Parliament with effect from April 1, 2018. The law will also provide

for automatic revision of emoluments every five years indexed to

inflation. I am sure Hon’ble Members will welcome this initiative and will

not suffer such criticism in future.

137. Our country will commemorate 150th birth anniversary of

Mahatma Gandhi, Father of the Nation, from 2nd October, 2019 to 2nd

October 2020. The Government and the People of India will rededicate

them, through their actions, to the ideals that the Mahatma taught and

lived by. A National Committee, chaired by the Prime Minister, which

includes Chief Ministers of all the States, representatives from across the

political spectrum, Gandhians, thinkers and eminent persons from all

walks of life, has been constituted to formulate a Commemoration

Programme. My Government has earmarked `150 crore for the year

2018-19 for the activities leading to the Commemoration.

Section III – Fiscal Management

138. I now turn to the fiscal situation for 2017-18 and fiscal estimates

for 2018-19.

139. In 2017-18, Central Government will be receiving GST revenues

only for 11 months, instead of 12 months. This will have fiscal effect.

There has also been some shortfall in Non-Tax revenues on account of

certain developments, including deferment of spectrum auction. A part

of this shortfall has been made up through higher direct tax revenues

and bigger disinvestment receipts.

140. Total Revised Estimates for expenditure in 2017-18 are `21.57

lakh crore (net of GST compensation transfers to the States) as against

the Budget Estimates of `21.47 lakh crore.

141. Our Government assumed office in May, 2014 when fiscal deficit

was running at very high levels. Fiscal Deficit for 2013-14 was 4.4% of

GDP. The Prime Minister and the Government have always attached

utmost priority to prudent fiscal management and controlling fiscal

deficit. As Hon’ble Members would recall, we embarked on the path of

consistent fiscal reduction and consolidation in 2014. Fiscal Deficit was

brought down to 4.1% in 2014-15 to 3.9% in 2015-16, and to 3.5% in

2016-17. Revised Fiscal Deficit estimates for 2017-18 are `5.95 lakh

crore at 3.5% of GDP. I am projecting a Fiscal Deficit of 3.3% of GDP for

the year 2018-19.

142. In order to impart unquestionable credibility to the Government’s

commitment for the revised fiscal glide path, I am proposing to accept

key recommendations of the Fiscal Reform and Budget Management

Committee relating to adoption of the Debt Rule and to bring down

Central Government’s Debt to GDP ratio to 40%. Government has also

accepted the recommendation to use Fiscal Deficit target as the key

operational parameter. Necessary amendment proposals are included in

the Finance Bill.

PART B

Madam Speaker,

143. I shall now present my tax proposals.

144. The attempts made by our Government for reducing the cash

economy and for increasing the tax net have paid rich dividends. The

growth rate of direct taxes in the financial years 2016-17 and 2017-18 has

been significant. We ended the last year with a growth of 12.6% in direct

taxes and in the current year, the growth in direct taxes up to 15th January,

2018 is 18.7%. The average buoyancy in personal income tax of seven years

preceding these two years comes to 1.1. In simple terms tax buoyancy of

1.1 means that if nominal GDP growth rate of the country is 10%, the

growth rate of personal income tax is 11%. However, the buoyancy in

personal income tax for financial years 2016-17 and 2017-18 (RE) is 1.95

and 2.11 respectively. This indicates that the excess revenue collected in

the last two financial years from personal income tax compared to the

average buoyancy pre 2016-17 amounts to a total of about `90,000 crores

and the same can be attributed to the strong anti-evasion measures taken

by the Government.

145. Similarly, there has been huge increase in the number of returns

filed by taxpayers. In financial year 2016-17, 85.51 lakhs new taxpayers filed

their returns of income as against 66.26 lakhs in the immediately preceding

year. By including all filers as well as persons who did not file returns but

paid tax by way of advance tax or TDS, we can derive the figure of Effective

Taxpayer Base. This number of effective tax payer base increased from 6.47

crores at the beginning of F.Y.14-15 to 8.27 crores at the end of F.Y.16-17.

We are enthused by this success of our measures and we pledge to

continue to take all such measures in future by which the black money is

contained and the honest taxpayers are rewarded. Demonetization was

received well by honest taxpayers as “imandari ka utsav” only for this

reason.

146. Madam Speaker, recognising the need for facilitating compliance,

Government had liberalized the presumptive income scheme for small

traders and entrepreneurs with annual turnover of less than `2 crores and

introduced a similar scheme for professionals with annual turnover of less

than `50 lakhs with the hope that there would be significant increase in

compliance. Under this scheme, 41% more returns were filed during this

year which shows that many more persons are joining the tax net under

simplified scheme. However, the turnover shown is still not encouraging.

The Department has received 44.72 lakh returns for assessment year

2017-18 from individual, HUF and firms with a meagre average turnover of

`17.97 lakhs and an average tax payment of `7,000/- only. The tax

compliance behaviour of professionals is no better; the department has

received 5.68 lakh returns under the presumptive income scheme for

assessment year 2017-18 with average gross receipts of `5.73 lakhs only.

Average tax paid by them is only `35,000/-.

Tax incentive for promoting post-harvest activities of agriculture

147. Madam Speaker, at present, hundred per cent deduction is allowed

in respect of profit of co-operative societies which provide assistance to its

members engaged in primary agricultural activities. Over the last few years,

a number of Farmer Producer Companies have been set up along the lines

of co-operative societies which also provide similar assistance to their

members. In order to encourage professionalism in post-harvest value

addition in agriculture, I propose to allow hundred per cent deduction to

these companies registered as Farmer Producer Companies and having

annual turnover up to `100 crores in respect of their profit derived from

such activities for a period of five years from financial year 2018-19. This

measure will encourage “Operation Greens” mission announced by me

earlier and it will give a boost to Sampada Yojana.

Employment generation

148. Currently, a deduction of 30% is allowed in addition to normal

deduction of 100 % in respect of emoluments paid to eligible new

employees who have been employed for a minimum period of 240 days

during the year under section 80-JJAA of the Income-tax Act. However, the

minimum period of employment is relaxed to 150 days in the case of

apparel industry. In order to encourage creation of new employment,

I propose to extend this relaxation to footwear and leather industry.

Further, I also propose to rationalise this deduction of 30% by allowing the

benefit for a new employee who is employed for less than the minimum

period during the first year but continues to remain employed for the

minimum period in subsequent year.

Incentive for real estate

149. Currently, while taxing income from capital gains, business profits

and other sources in respect of transactions in immovable property, the

consideration or circle rate value, whichever is higher, is adopted and the

difference is counted as income both in the hands of the purchaser and

seller. Sometimes, this variation can occur in respect of different properties

in the same area because of a variety of factors including shape of the plot

and location. In order to minimize hardship in real estate transaction,

I propose to provide that no adjustment shall be made in a case where the

circle rate value does not exceed 5% of the consideration.

Incentivising micro, small and medium entrepreneurs

150. In the Union Budget, 2017, I had announced the reduction of

corporate tax rate to 25% for companies whose turnover was less than `50

crore in financial year 2015-16. This benefitted 96% of the total companies

filing tax returns. Towards fulfilment of my promise to reduce corporate tax

rate in a phased manner, I now propose to extend the benefit of this

reduced rate of 25% also to companies who have reported turnover up to

`250 crore in the financial year 2016-17. This will benefit the entire class of

micro, small and medium enterprises which accounts for almost 99% of

companies filing their tax returns. The estimate of revenue forgone due to

this measure is `7,000 crores during the financial year 2018-19. After this,

out of about 7 lakh companies filing returns, about 7,000 companies which

file returns of income and whose turnover is above `250 crores will remain

in 30% slab. The lower corporate income tax rate for 99% of the companies

will leave them with higher investible surplus which in turn will create more

jobs.

Relief to salaried taxpayers

151. The Government had made many positive changes in the personal

income-tax rate applicable to individuals in the last three years. Therefore,

I do not propose to make any further change in the structure of the income

tax rates for individuals. There is a general perception in the society that

individual business persons have better income as compared to salaried

class. However, income tax data analysis suggests that major portion of

personal income-tax collection comes from the salaried class. For

assessment year 2016-17, 1.89 crore salaried individuals have filed their

returns and have paid total tax of `1.44 lakh crores which works out to

average tax payment of `76,306/- per individual salaried taxpayer. As

against this, 1.88 crores individual business taxpayers including

professionals, who filed their returns for the same assessment year paid

total tax of `48,000 crores which works out to an average tax payment of

`25,753/- per individual business taxpayer. In order to provide relief to

salaried taxpayers, I propose to allow a standard deduction of `40,000/- in

lieu of the present exemption in respect of transport allowance and

reimbursement of miscellaneous medical expenses. However, the transport

allowance at enhanced rate shall continue to be available to differentlyabled

persons. Also other medical reimbursement benefits in case of

hospitalization etc., for all employees shall continue. Apart from reducing

paper work and compliance, this will help middle class employees even

more in terms of reduction in their tax liability. This decision to allow

standard deduction shall significantly benefit the pensioners also, who

normally do not enjoy any allowance on account of transport and medical

expenses. The revenue cost of this decision is approximately `8,000 crores.

The total number of salaried employees and pensioners who will benefit

from this decision is around 2.5 crores.

Relief to senior citizen

152. A life with dignity is a right of every individual in general, more so for

the senior citizens. To care of those who cared for us is one of the highest

honours. To further the objective of providing a dignified life, I propose to

announce the following incentives for senior citizens:

- Exemption of interest income on deposits with banks and post

offices to be increased from `10,000/- to `50,000/- and TDS shall

not be required to be deducted on such income, under section 194A.

This benefit shall be available also for interest from all fixed deposits

schemes and recurring deposit schemes. - Raising the limit of deduction for health insurance premium and/ or

medical expenditure from `30,000/- to `50,000/-, under section

80D. All senior citizens will now be able to claim benefit of deduction

up to `50,000/- per annum in respect of any health insurance

premium and/or any general medical expenditure incurred. - Raising the limit of deduction for medical expenditure in respect of

certain critical illness from, `60,000/- in case of senior citizens and

from `80,000/- in case of very senior citizens, to `1 lakh in respect of

all senior citizens, under section 80DDB.

These concessions will give extra tax benefit of `4,000 crores to senior

citizens. In addition to tax concessions, I propose to extend the Pradhan

Mantri Vaya Vandana Yojana up to March, 2020 under which an assured

return of 8% is given by Life Insurance Corporation of India. The existing

limit on investment of `7.5 lakh per senior citizen under this scheme is also

being enhanced to `15 lakh.

Tax incentive for International Financial Services Centre (IFSC)

153. The Government had endeavoured to develop a world class

international financial services centre in India. In recent years, various

measures including tax incentives have been provided in order to fulfil this

objective. To further this objective, I propose to provide two more

concessions for IFSC. In order to promote trade in stock exchanges located

in IFSC, I propose to exempt transfer of derivatives and certain securities by non-residents from capital gains tax. Further, non-corporate taxpayers

operating in IFSC shall be charged Alternate Minimum Tax (AMT) at

concessional rate of 9% at par with Minimum Alternate Tax (MAT)

applicable for corporates.

Further Measures to control cash economy:

154. Currently, the income of trusts and institutions is exempt if they

utilise their income towards their objects in accordance with the relevant

provisions of the Income-tax Act. However, there is no restriction on these

entities for incurring expenditure in cash. In order to have audit trail of the

expenses incurred by these entities, it is proposed that payments exceeding

`10,000/- in cash made by such entities shall be disallowed and the same

shall be subject to tax. Further, in order to improve TDS compliance by

these entities, I propose to provide that in case of non-deduction of tax,

30% of the amount shall be disallowed and the same shall be taxed.

Rationalisation of Long Term Capital Gains (LTCG)

155. Madam Speaker, currently, long term capital gains arising from

transfer of listed equity shares, units of equity oriented fund and unit of a

business trust are exempt from tax. With the reforms introduced by the

Government and incentives given so far, the equity market has become

buoyant. The total amount of exempted capital gains from listed shares and

units is around `3,67,000 crores as per returns filed for A.Y.17-18. Major

part of this gain has accrued to corporates and LLPs. This has also created a

bias against manufacturing, leading to more business surpluses being

invested in financial assets. The return on investment in equity is already

quite attractive even without tax exemption. There is therefore a strong

case for bringing long term capital gains from listed equities in the tax net.

However, recognising the fact that vibrant equity market is essential for

economic growth, I propose only a modest change in the present regime.

I propose to tax such long term capital gains exceeding `1 lakh at the rate

of 10% without allowing the benefit of any indexation. However, all gains

up to 31st January, 2018 will be grandfathered. For example, if an equity

share is purchased six months before 31st January, 2018 at `100/- and the

highest price quoted on 31st January, 2018 in respect of this share is `120/-,

there will be no tax on the gain of `20/- if this share is sold after one year

from the date of purchase. However, any gain in excess of `20 earned after

31st January, 2018 will be taxed at 10% if this share is sold after 31st July,

2018. The gains from equity share held up to one year will remain short

term capital gain and will continue to be taxed at the rate of 15%. Further,

I also propose to introduce a tax on distributed income by equity oriented

mutual fund at the rate of 10%. This will provide level playing field across growth oriented funds and dividend distributing funds. In view of

grandfathering, this change in capital gain tax will bring marginal revenue

gain of about `20,000 crores in the first year. The revenues in subsequent

years may be more.

Health and Education Cess

156. Madam Speaker, at present there is a three per cent cess on

personal income tax and corporation tax consisting of two per cent cess for

primary education and one per cent cess for secondary and higher

education. In order to take care of the needs of education and health of BPL

and rural families, I have announced programs in Part A of my speech. To

fund this, I propose to increase the cess by one per cent. The existing three

per cent education cess will be replaced by a four per cent “Health and

Education Cess” to be levied on the tax payable. This will enable us to

collect an estimated additional amount of `11,000 crores.

E-assessment

157. We had introduced e-assessment in 2016 on a pilot basis and in

2017, extended it to 102 cities with the objective of reducing the interface

between the department and the taxpayers. With the experience gained so

far, we are now ready to roll out the E-assessment across the country,

which will transform the age-old assessment procedure of the income tax

department and the manner in which they interact with taxpayers and

other stakeholders. Accordingly, I propose to amend the Income-tax Act to

notify a new scheme for assessment where the assessment will be done in

electronic mode which will almost eliminate person to person contact

leading to greater efficiency and transparency.

158. My other tax proposals on direct tax are listed in Annexure 5 of my

speech.

Indirect Tax

159. On the Indirect Taxes side, this is the first budget after the roll out of

the Goods and Service Tax. Excise duties to a large extent and service tax

have been subsumed in GST, along with corresponding duties on imports.

Hence, my budget proposals are mainly on the customs side.

160. In this budget, I am making a calibrated departure from the

underlying policy in the last two decades, wherein the trend largely was to

reduce the customs duty. There is substantial potential for domestic value

addition in certain sectors, like food processing, electronics, auto

components, footwear and furniture. To further incentivise the domestic

value addition and Make in India in some such sectors, I propose to increase

customs duty on certain items. I propose to increase customs duty on

mobile phones from 15% to 20%, on some of their parts and accessories to

15% and on certain parts of TVs to 15%. This measure will promote creation

of more jobs in the country. Details of changes made in rates of customs

duty as well as certain changes made in the excise duty structure are given