Singapore: As the war in Ukraine and sanctions on Russia drive a relentless surge in oil prices, equities in India and South Korea are looking more vulnerable.

With Brent crude crossing $110 a barrel, that clouds the outlook for two of Asia’s larger oil importers — which are also home to the region’s worst-performing currencies this year. While stocks in Mumbai and Seoul have already taken hits from concerns over Federal Reserve interest-rate hikes and a related technology selloff, analysts see both as more susceptible to risk-off sentiment.

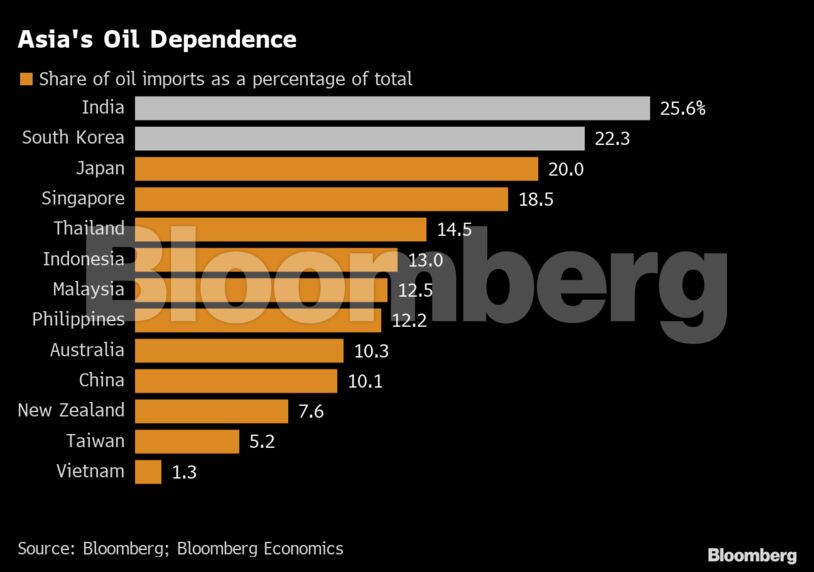

Rising costs could squeeze companies’ profits at a time when growth in Asia’s earnings estimates is lagging global peers. Higher oil prices “are particularly negative for India, Korea and Taiwan, which are large oil importers,” Morgan Stanley strategists including Jonathan Garner wrote in a note.

Down more than 9%, South Korea’s Kospi Index is the worst performer among major Asian benchmarks this year. India’s S&P BSE Sensex has lost almost 6% and was the biggest loser in the region on Wednesday. The broader MSCI Asia Pacific Index is down 6.4%.

Bloomberg Intelligence estimates an 80-100 basis points upside risk to a 5.9% average inflation forecast for India in the year starting April if commodity prices remain high. The governor of the Bank of Korea last week warned that the war could further fuel inflation that’s projected to stay above 3%.

Foreign funds are net sellers of Indian and Korean stocks this year and Nomura Holdings Inc. sees room for further declines following Russia’s invasion of Ukraine. Indian equities have seen an outflow of $9.3 billion so far in 2022, the most among emerging Asia markets tracked by Bloomberg, excluding China. South Korean stocks have seen $3.1 billion withdrawn.

“While foreign ownership of markets like India, Korea has declined amid recent selling, foreigners’ holding of equities is still much larger currently vs pre-Covid levels due to valuation-driven gains in these markets,” Nomura strategists led by Chetan Seth wrote in a report Monday.

Foreign holdings of shares in South Korea and India were at $620 billion and $639 billion as of December and January respectively, more than 30% higher than 2019 levels for both markets, according to the Nomura report. –Bloomberg

Also read: Modi govt should cut palm oil imports, stop expanding cultivation, says RSS-linked farmer body