Higher oil prices and coal shortages risk fanning inflation and slowing economic growth in India ahead of a central bank meeting while punishing the nation’s currency and bonds.

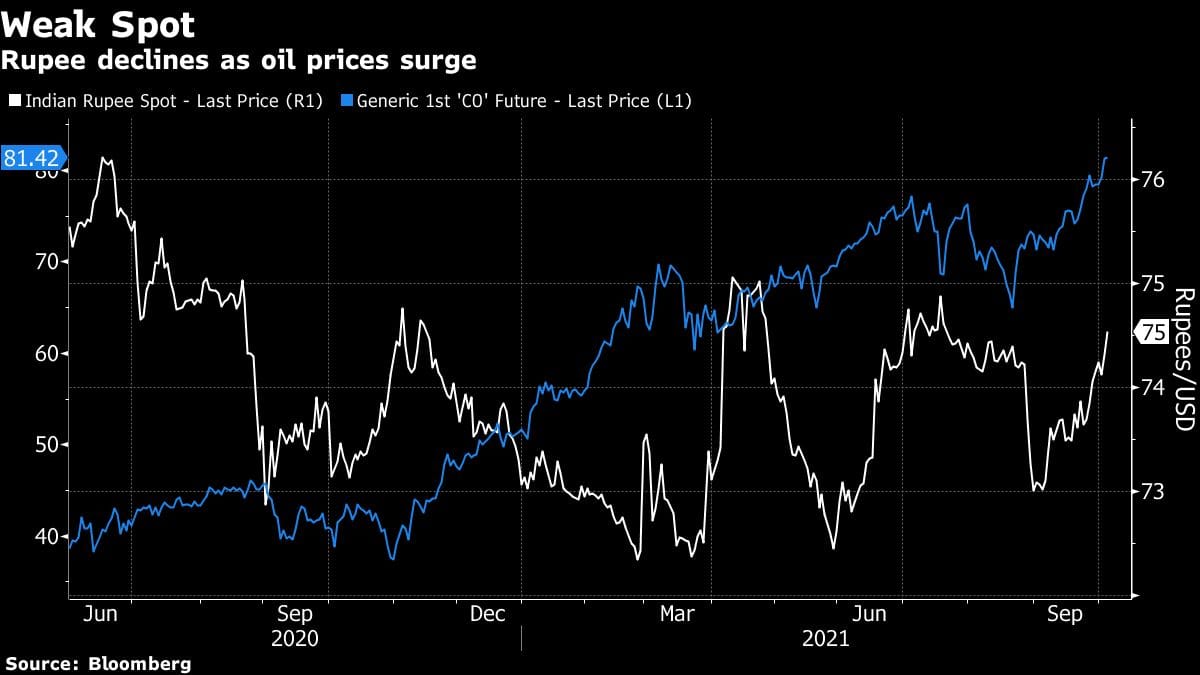

A lack of coal means factories could shut while forcing India to import more fossil fuels at a time when crude prices at a seven-year high are already weighing on the energy-hungry nation. The threat of inflation and worsening external deficit have led to a 14 basis-point surge in the nation’s benchmark bond yields over the past two weeks and a decline in the rupee to its lowest since April.

“This is a negative economic shock since it will result in higher inflation, lower growth, and potentially wider twin deficits,” said Sonal Varma, chief economist for India and Asia, ex-Japan, at Nomura Holdings Inc. in Singapore. “Continued rise in inflationary pressures could result in demand weakness over time,” she said.

India is dependent on coal for meeting about 70% of its electricity needs, while buys about 85% of its oil requirements from overseas.

While gains in consumer prices are, for now, within the Reserve Bank of India’s 2%-6% target range, the core measure — which strips out the volatile food and energy components — is expected to stay sticky around the 6% mark at least for the next six months, according to Deutsche Bank AG.

Faster inflation on account of supply disruptions will be a challenge for the CPI-targeting RBI, which is intent on keeping borrowing costs at a record low to support durable economic growth. While emerging market peers such as Russia and Brazil have raised rates to combat price pressures, economists surveyed by Bloomberg see India’s policymakers keeping the key rate steady at 4% on Friday.

Traders will eagerly look forward to the RBI’s views on the surge in global commodity prices, and its assessment of inflation and liquidity, even as they have started pricing in policy normalization through tapering of bond purchases and liquidity withdrawal.

Citigroup Inc. expects the RBI to raise its reverse repurchase rate — which marks the lower bound of the central bank’s policy corridor — by 15 basis points to 3.50%.

The rupee declined 0.7% to 74.9850 per dollar on Wednesday and is Asia’s worst-performing currency this month, while 10-year bond yields surged to 6.29% in intraday trade, the highest since April 2020.

“The energy crisis and tighter global financial conditions may imply that foreign investors start asking for a higher risk premium from EM and could start pressuring EM assets, including India,” said Madhavi Arora, lead economist at Emkay Global Financial Services Ltd. “The surge in oil prices amid changing global dynamics could add further complications to RBI’s reaction function.”—Bloomberg

Also read:Power crisis deepens in India with 4 days of coal reserves left