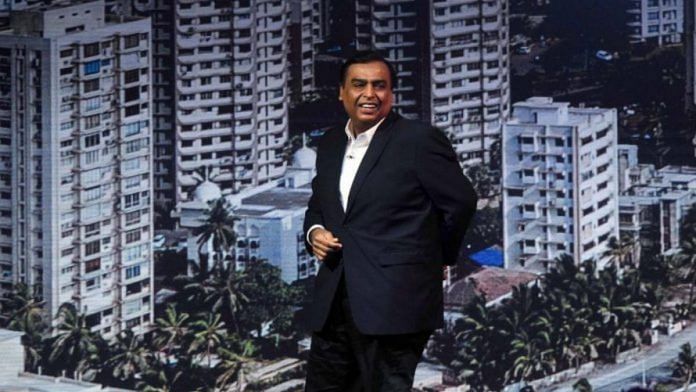

Mumbai: Saudi Arabia’s Public Investment Fund, or PIF, plans to invest about $1.3 billion in Mukesh Ambani’s retail unit as Asia’s richest man continues to add marquee backers in a fundraising spree that has now surpassed $6.4 billion.

The sovereign wealth fund will pick a 2.04% stake in Reliance Retail Ventures Ltd. for 95.55 billion rupees ($1.3 billion), parent Reliance Industries Ltd. said in an exchange filing Thursday. The stake sale values India’s largest retailer at about $62.4 billion, it said.

| Investor | Date Announced | Amount (INR Billions) | Stake (%) |

|---|---|---|---|

| PIF | Nov. 5 | 95.55 | 2.04 |

| ADIA | Oct. 6 | 55.1 | 1.20 |

| TPG | Oct. 3 | 18.4 | 0.41 |

| GIC | Oct. 3 | 55.1 | 1.22 |

| Mubadala | Oct. 1 | 62.5 | 1.4 |

| General Atlantic | Sept. 30 | 36.8 | 0.84 |

| KKR & Co. | Sept. 23 | 55.5 | 1.28 |

| Silver Lake +co-investors | Sept. 9, 30 | 93.8 | 2.13 |

| Total | 472.75 | 10.52 |

Source: Company Filings

Key insights

- This will be the third investment for PIF in the conglomerate, helmed by Ambani, 63, as he seeks to transform Reliance Industries into a retail and technology behemoth and pivot away from its staple oil-refining business that he inherited in 2002.

- The deal caps an active year for the PIF, which was transformed from a sleepy domestic focused holding company into an international investor, as part of Crown Prince Mohammed Bin Salman’s plans to pare the economy’s reliance on oil sales.

- The west Asian nation is also investing a lot in building ties with India, a key market for its crude oil. Reliance has been in talks with Saudi Aramco for a stake sale in its refinery unit, although the transaction is yet to fructify.

- For Reliance, this deal underscores investors’ faith in Ambani’s ability to tap growth in offline and online retail in the country of a billion-plus consumers.

- The transaction also builds on Reliance’s runaway success in raising more than $20 billion by selling about 33% of its technology venture, Jio Platforms Ltd., to investors including Facebook Inc. and Google.

- Investor demand to buy into Ambani’s retail unit has been so strong that the group had to put some investors such as Carlyle Group Inc. and Softbank Group Corp. on a waitlist, people familiar with the matter had said in September.

Market performance

- Shares of Reliance Industries have soared 30% this year while the broader gauge S&P BSE Sensex has gained 0.2%.

Also read: Why the Mukesh Ambani vs Jeff Bezos fight could be more of a waiting game