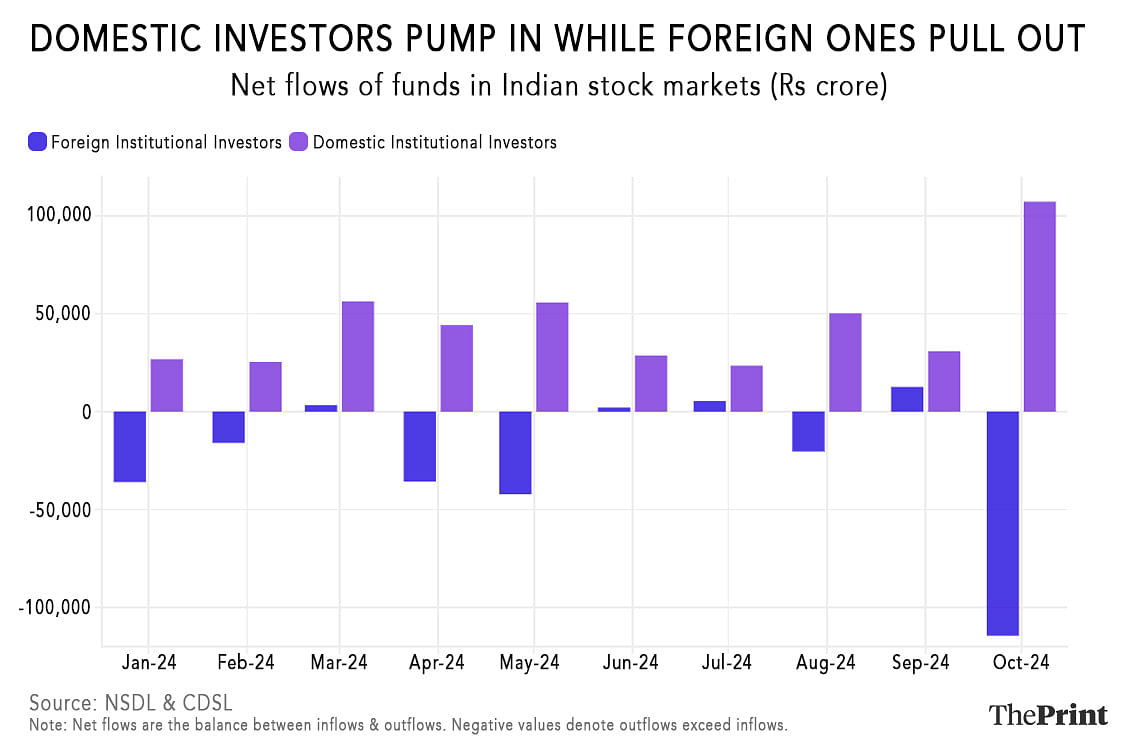

New Delhi: While foreign institutional investors (FIIs) pulled out a historic Rs 1.14 lakh crore from Indian stock markets in October 2024, the highest ever monthly outflow, domestic investors remain a strong stabilising force, pumping increasing amounts into Indian markets.

In October, while net flows of FII funds into Indian markets ended in the negative, domestic institutional investors (DIIs) pumped in nearly the same amount—Rs 1.07 lakh crore. Net flows take into account the inflows and the outflows, so a negative figure denotes that outflows have exceeded inflows.

In the calendar year 2024, till October, the FIIs have seen net outflows of Rs 2.41 lakh crore, while DIIs have pumped in nearly double that into the markets at Rs 4.48 lakh crore.

Experts said that the consistent withdrawal by the FIIs is primarily due to the high valuations of Indian equities, making Chinese and Hong Kong markets more attractive for these investors. Furthermore, the earnings growth of top corporates in India for the second quarter of FY25 (July-September 2025) has fallen short of expectations, indicating a slowdown in the Indian economy.

However, despite the surge in FII outflows in October, experts remain relatively sanguine for two broad reasons: the outflows are still only a minuscule fraction of the total assets FIIs have in India and domestic investor appetite still remains robust, lending much-needed stability to the market.

Also Read: How Hyundai zoomed to biggest IPO milestone in India, where other foreign carmakers struggled

Can’t call it a ‘pullout’

V.K. Vijayakumar, the chief investment strategist at Geojit Financial Services, told ThePrint that the record sell-off by FIIs in October is not them “pulling out” money because the total sales only amount to just 1 percent of the assets under management (AUM)—or the total market value of the investments—of FIIs in India. Cumulative FII investment in India stood at about Rs 17.76 lakh crore till August 2024, according to Central Depository Services (India) Limited (CDSL) data.

“So we can’t say that they’re pulling out. Of course, they have sold and it is the highest selling in a single month in absolute terms,” he said, giving valuations reaching very high levels and worse-than-expected Q2 earnings of firms in India as reasons.

Trivesh D, chief operating officer of Tradejini, too, added that Indian equities have hit high valuations, which can make FIIs cautious, especially when combined with a lacklustre Q2 earnings season.

“Additionally, geopolitical tensions are fuelling concerns, especially with rising crude oil prices, which could escalate further, potentially impacting markets negatively. Meanwhile, China and Hong Kong are offering lower valuations and government stimulus support, which have FIIs eyeing those regions as attractive alternatives,” he said.

Trivesh added that FIIs are also diversifying into European markets for currency stability, suggesting this outflow isn’t solely due to Indian market factors.

Corporate performance has been a dampener

As an explanation for the high valuations in the Indian markets, Vijayakumar pointed to Nifty trading at around 24,000, which is 24 times the FY25 estimated earnings of the companies listed in the index.

“So these are much higher than historical averages. The only reason we have such elevated valuations is there is a relentless flow of domestic money today. We have earlier seen higher PE (Price to Earnings) ratios but this time the added concern is that the Q2 results of companies were worse than expected and it is indicating a slowdown in the economy,” Vijayakumar added.

Hence, he added, that the earnings of Nifty 50 companies have been revised downwards. Last three years, he noted that India saw good GDP as well as earnings growth. For instance, in FY24, the Nifty 50 earnings growth was 25 percent while the country’s GDP growth stood at 8.2 percent.

This year, the consensus earnings after the Q2 numbers have been revised to less than 10 percent. “This is a sharp dip from last year’s 25 percent growth to below 10 percent growth this year. This is an indication that things are not so good,” Vijayakumar said.

Further, GDP growth for FY25 is expected to slow to around 7 percent.

In a November 4 note, Siddhartha Khemka, head of research and wealth management at Motilal Oswal Financial Services Ltd, said that the earnings growth of 166 Motilal Oswal coverage companies that announced their Q2FY25 results until 31 October declined by 8 percent year-on-year—the lowest in 17 quarters.

Likewise, according to data compiled by Bank of Baroda Research, the growth rate in the net profit of 197 companies declined to 6.1 percent in Q2 of 2024-25 as against 27.4 per cent (Rs 78,224 crore) in the same period of last year.

Expensive India vs cheap China

Explaining the attractiveness of the China market, Vijayakumar said that the Chinese and Hong Kong markets have been underperforming.

“China has been underperforming as FPIs (foreign portfolio investments) had almost deserted China because of the number of domestic issues there and also the poor performance of the markets,” he said. “Government has been controlling business and a lot of restrictions were being imposed.”

He added that the FIIs lost heavily when the Chinese authorities said that only the public sector would operate in the education sector. He also pointed out that Chinese real estate, which accounted for 24 percent of the country’s GDP, is also in a crisis, so stock valuations became very cheap.

However, the Chinese government has now announced an ambitious stimulus package that has renewed interest in its markets.

“In India, valuations, as we know, are 24 times, in China and Hong Kong it dipped below 10. And the Chinese government has announced a massive stimulus programme—both fiscal and monetary stimulus. So these low valuations and the stimulus has raised hopes of a Chinese economic revival or at least an earnings revival and a lot of money moved. And this movement of money was from the most expensive emerging market (India) to China,” he explained.

FII selling likely a temporary phenomenon

While it is difficult to estimate how long FII selling will last, experts believe that it may be a temporary phenomenon.

“It appears to be a short-term tactical trade to exploit the hugely divergent valuations,” Vijayakumar reasoned. “What aggravated the selling by FIIs in India is the news of consensus earnings downgrade in FY25. What can also signal that this was a short-term tactical trade, is that even though FIIs sold stocks worth over Rs 1 lakh crore in October through the stock exchanges, they bought stocks worth Rs 19,842 crore through the primary market.”

He said that in the primary market—the market where new stocks can be bought, say, after an initial public offering (IPO)—there are still fair valuations as what was seen with Hyundai’s recent IPO.

On 17 October, the auto major made history with the country’s largest ever IPO in the primary market, worth Rs 27,856 crore.

“And therefore, they are buying whenever the valuations are fair and selling when the valuations become unsustainable,” Vijayakumar added.

Trivesh added that while this FII selling is notable, the trend may not persist at current levels. Indian markets have been on a prolonged bull run, leading to inevitable corrections and profit-booking. As valuations normalise, the pace of withdrawals could slow, especially if global conditions stabilise, he said.

Will domestic investors save the day?

Trivesh said that in October, the Nifty 50 and Sensex took a hit, falling 6.22 percent and 5.83 percent, respectively. However, it’s not all bad news, he said, adding that domestic investors are stepping up.

“DIIs and retail investors, thanks to the ongoing systematic investment plans (SIPs), are likely to soften the blow. India’s broader growth story still holds, which should help keep the longer-term outlook steady, even if there is some choppiness ahead,” he said.

He added that domestic investors have become a major stabilising force thanks to India progressing from being a “country of savers” into a “country of investors” thanks to a generational shift.

“This trend is clearly visible in the consistent SIP inflows and growing retail participation, which are helping offset the FII pullbacks,” Trivesh said, added that this domestic resilience is likely to cushion Indian markets from prolonged volatility, but if the FII sell-offs continue, it can be a matter of concern.

Vijayakumar, too, said that the stock market fall could have been far worse had domestic investors not steadied the ship.

“When you have this kind of selling by FIIs, under normal circumstances this would have resulted in a 10-15 percent crash in the market, but it did not happen mainly because of this mitigation of the correction by the DII buying,” Vijayakumar said.

‘Newbies’ are rising to the occasion

Vijayakumar also highlighted the impact of new investors. There are about 17.5 crore demat accounts in the country now, as against only 4.09 crore in April 2020.

“So, about 75 percent of the demat account holders in the market now are newbies who entered the market in the last four years,” Vijayakumar explained. “They have not seen a bear market.”

Asked about what is giving DII confidence to buy, Vijayakumar said, more than the DII confidence, it is the confidence of the new investors.

“A very healthy trend even in this elevated valuations context is that SIP inflows into the market have been steadily going up,” he said. “Last month, it was Rs 24,500 crore. And it is the experience of SIP investing that if you have a three-year time horizon, 99 percent of the time you make money. That has been the experience all these years. So many investors are now investing through the SIP route.”

This, he said, was a healthy trend, bolstered by bulk investments in the markets, insurance money coming in, and funds from the national pension scheme (NPS) also flowing in.

“All these are supporting the market,” Vijayakumar said.

(Edited by Sanya Mathur)

Also Read: What is satellite spectrum allocation that led rivals Jio & Airtel to join hands against Starlink