Suyash Choudhary of IDFC says RBI will risk financial stability and seriously hurt growth if it adds to the two rate increases since June.

Mumbai: In July, Suyash Choudhary warned a liquidity crisis is looming in India and funding costs for companies were set to soar.

Now, as investors get to grips with a cash crunch made worse by the debt crisis at a lender, Choudhary, the head of fixed-income funds at IDFC Asset Management Co., says the Reserve Bank of India may go slow in adding to the two rate increases since June.

“Financial conditions have turned tight, and I think the RBI will have to pace incremental tightening at this juncture,” he said in an interview. “If they don’t, it will risk financial stability and seriously hurt growth.”

India’s authorities are already pulling out the stops to ensure financial stability, with the central bank and the government taking steps last week to boost liquidity and support the rupee. Brokerages including Edelweiss Securities Ltd. and Nirmal Bang Equities Pvt. say that a more targeted approach to improving cash supply is needed as defaults by the IL&FS Group have roiled sentiment and sent volatility in the stock market to a seven-month high.

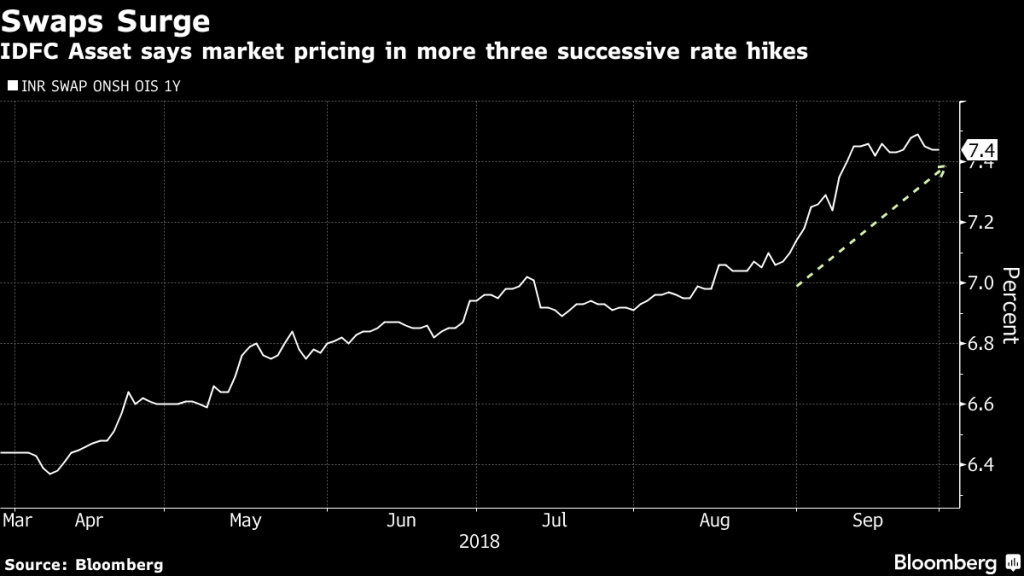

The RBI may deliver two rate hikes by March-end, said Choudhary, even though one-year swap rates are pricing in more than three back-to-back increases. The central bank has raised its policy rate by 50 basis points this year to 6.5 per cent. Most economists in a Bloomberg survey are calling for a 25-basis point increase next week to stem inflationary pressure due to the sharp decline in the rupee, Asia’s worst-performing currency in 2018.

The bond market, Choudhary said, is underpricing liquidity action from the central bank, which he expects will buy at least one trillion rupees ($13.8 billion) of bonds by March end. The RBI has spent 500 billion rupees on debt purchases since 1 April to top up the liquidity sucked by advance tax payments and the central bank’s attempts to support the rupee.

Liquidity requirement

On Thursday, banks were allowed to dip further into statutory reserves to help them meet their liquidity ratio requirement, a step that would boost cash available for lending.

“The action on liquidity coverage ratio is consistent with our view that the RBI will push against incremental tightening in financial conditions,” Choudhary said.

IDFC Asset prefers sovereign papers maturing in five years and AAA corporate bonds as the “best trades to play the fade in excess tightening expectations that are being built in,” Choudhary said. He is cautious on lower-rated and high-carry strategies as the IL&FS crisis has led to a spike in short-term rates and begun to stress financing plans.

For instance, yields on one-year debt of top-rated firms rose 27 basis points in September to 8.72 per cent, the most since May. And three companies pulled 58 billion rupees of debt sales in September, the most in at least a decade.

Given the backdrop, raising borrowing costs further may not help stem declines in the rupee, according to Nomura.

“With currency weakness largely driven by global factors and the real rate cushion already quite high in India, monetary tightening is not necessarily an effective instrument for limiting currency depreciation, analysts at Nomura wrote in a note.

Below are key economic events due next week:

Monday, 1 Oct : Japan Tankan index, South Korea trade, manufacturing PMIs across Asia, Thailand CPI, Indonesia CPI Tuesday, 2 Oct: South Korea industrial production, Australia rate decision, Sri Lanka rate decision Wednesday, 3 Oct: Australia building approvals, Japan services PMI Thursday, 4 Oct: Australia trade balance Friday, 5 Oct: Philippines CPI, Australia CPI, India rate decision, Taiwan CPI. –Bloomberg