Rana Kapoor’s removal illustrates just how far RBI is preparing to go to root out a system-wide legacy of shoddy lending.

Mumbai: India’s central bank has again shown its teeth as regulator of the country’s private-sector banks with the decision to end Rana Kapoor’s term as chief executive officer of Yes Bank Ltd., the lender he founded 14 years ago.

The Reserve Bank of India will require Kapoor to step down at the end of January, rejecting the lender’s request to extend his tenure by three years, the bank said in a brief statement late Wednesday. Yes Bank’s board will meet on Sept. 25 to decide on future action, the bank added, without giving details.

Kapoor’s removal illustrates just how far the RBI is preparing to go to root out a system-wide legacy of shoddy lending that’s resulted in ballooning bad debts. While the central bank didn’t give a reason for its decision, it had tussled with Yes Bank about how how much of its loans should be recognized as nonperforming.

The RBI has also taken a tough line with other private-sector bank CEOs in recent months. Despite support from shareholders, Axis Bank Ltd.’s head Shikha Sharma in April said she will step down at the end of 2018, more than two years before the proposed end of her term, after the central bank refused to extend her tenure.

“The RBI is snuffing out any hope bankers had about non-compliance being dealt with gently,” said Soumen Chatterjee, head of research at Guiness Securities Ltd. “Senior management now knows that anyone not playing by the central bank’s rule book will be shown the door.”

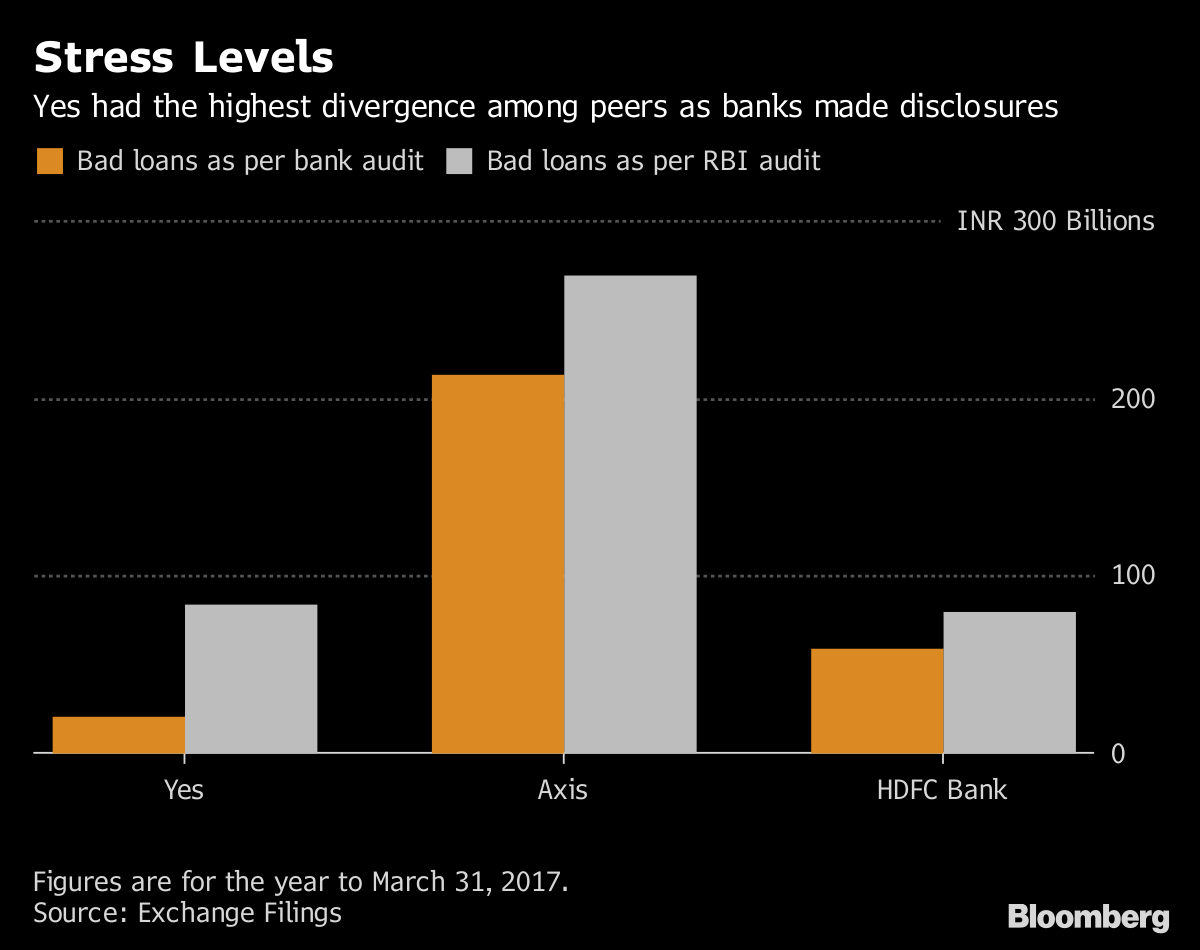

Both Axis and Yes Bank have stood out from their peers in the wake of the RBI’s stricter disclosure standards for bad loans introduced in April 2017. The regulator is seeking to clean up an overhang of more than $210 billion of stressed assets in the banking system, one of the highest in the world, and thereby revive lending growth in Asia’s third-largest economy.

Last year, the RBI ordered lenders to come clean in exchange filings if the difference between the soured credit reported in their results and as assessed in subsequent central bank reviews amounted to more than 15 percent.

Yes Bank later reported a discrepancy of more than 300 percent, one of the highest in the industry; the difference for Axis was 26 percent. Yes Bank has argued that the impact of the divergence on the bank’s results was small because it subsequently recovered many of the loans labeled as problematic by the central bank.

A spokesman for Yes Bank didn’t immediately respond to an email seeking comment, sent Thursday on an Indian public holiday.

Successor Candidate

Senior Group President Rajat Monga, who has been with Yes Bank since its inception, could be an internal candidate to succeed Kapoor, according to Citigroup Inc. analyst Manish Shukla. Citigroup cut its rating on Yes Bank to ‘sell’ from ‘buy,’ saying the premium attached to the shares may be eroded as a result of Kapoor’s departure.

India’s richest banker, Uday Kotak, also received stick from the RBI when it rebuffed a method used by the billionaire to pare his stake in Kotak Mahindra Bank Ltd. to meet regulatory requirements. Kotak’s attempt to comply with a year-end deadline to cut his holding by one-third to 20 percent didn’t get approval from the central bank, the lender said in a exchange filing in August.

Yes Bank is likely to fall when the market reopens on Friday, though the drop may be short lived, according to G. Chokkalingam, managing director at Equinomics Research & Advisory Pvt. “The stock will have only a knee-jerk reaction as it has already fallen a lot and the growth opportunity is very strong in India,” he said.

Shares of Yes Bank fell 1.3 percent to 319.2 rupees in Mumbai on Wednesday, before the bank issued its statement.-Bloomberg