The Reserve Bank of India will likely try to manage the pace of moves in the rupee rather than defend specific levels as the currency plumbs record lows, according to strategists.

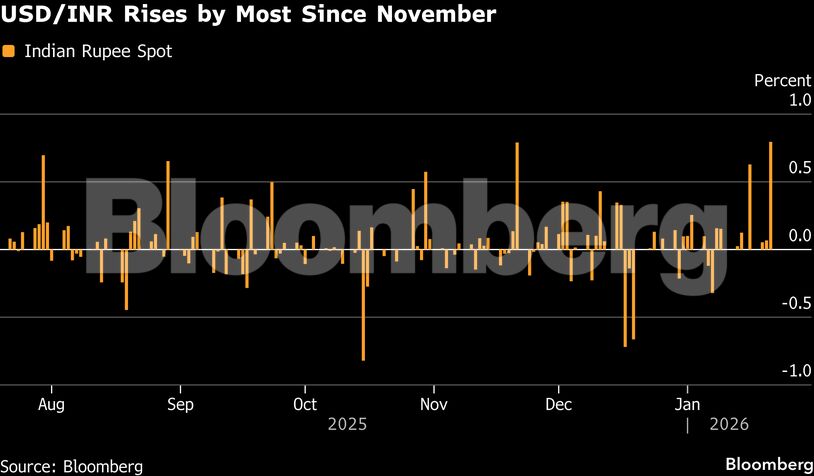

The rupee saw its worst day in two months on Wednesday as it slid to a record low of 91.7450 to the dollar. It rose 0.2% to 91.55 on Thursday. The currency was Asia’s worst performer last year and some strategists are calling for further weakness. Barclays Bank Plc forecasts it’ll be at 94 to a dollar by the end of the year, while UBS Group AG expects it to hit that level by March 2027.

“The RBI is correct to moderate the pace of depreciation while keeping domestic liquidity considerations in mind,” said Gaura Sen Gupta, chief economist at IDFC First Bank Ltd. “They don’t seem to be defending a level.”

The rupee has been buffeted by equity outflows, with a record $19 billion last year and a further $2.9 billion this month amid valuation concerns, steep US tariffs and delays in a trade deal. Bloomberg Index Services Ltd. this month deferred adding India to its global aggregate bond index, dashing hopes for fresh fixed-income inflows. Foreign direct investment has also slowed.

Foreign outflows, importer dollar demand, lack of progress on a trade deal, and disappointment over the delay on the Bloomberg index have contributed to the rupee’s fall, according to Mitul Kotecha, head of FX and EM macro strategy for Asia at Barclays Bank.

Bloomberg LP is the parent company of BISL, which administers indexes that compete with those from other providers.

After the rupee broke key levels so quickly, slightly below 92 will be the next threshold to watch for, said Michael Wan, senior currency strategist at MUFG Bank Ltd. The RBI may just slow the pace of depreciation for now, he said.

The RBI has spent $45 billion since October to defend the currency, according to estimates by Kotak Mahindra Bank. Traders said the central bank supported the September low of 88.80 to a dollar for about two months before it was breached. And it still has about $687 billion of reserves, should it wish to intervene further.

“The authorities’ approach will likely remain passive and focused on smoothening volatility,” said Vivek Rajpal, an Asia strategist at JB Drax Honore in Singapore.

Some Asian central banks have been vocal about stepping in to check their currencies’ weakness. Bank Indonesia has said it will heighten forex intervention in order to stabilize and strengthen the rupiah, which also slid to a record low this week. South Korea’s President Lee Jae Myung has talked up the beleaguered won, saying it may strengthen to around the 1,400 mark to the dollar in one to two months.

RBI Governor Sanjay Malhotra said that the exchange rate is market-determined and the central bank’s job is to ensure orderly movements and curb excess volatility, in remarks to a television channel last week. A 3% annual depreciation in the rupee is par for the course, given India’s inflation differential with peers, he said.

With consumer inflation at 2% year-over-year and limited spillovers from currency weakness onto equities, UBS strategists including Manik Narain predict the RBI won’t jump in too much to defend specific levels.

“Policymakers may let the rupee adjust further,” they said.

This report is auto-generated from Bloomberg news service. ThePrint holds no responsibility for its content.