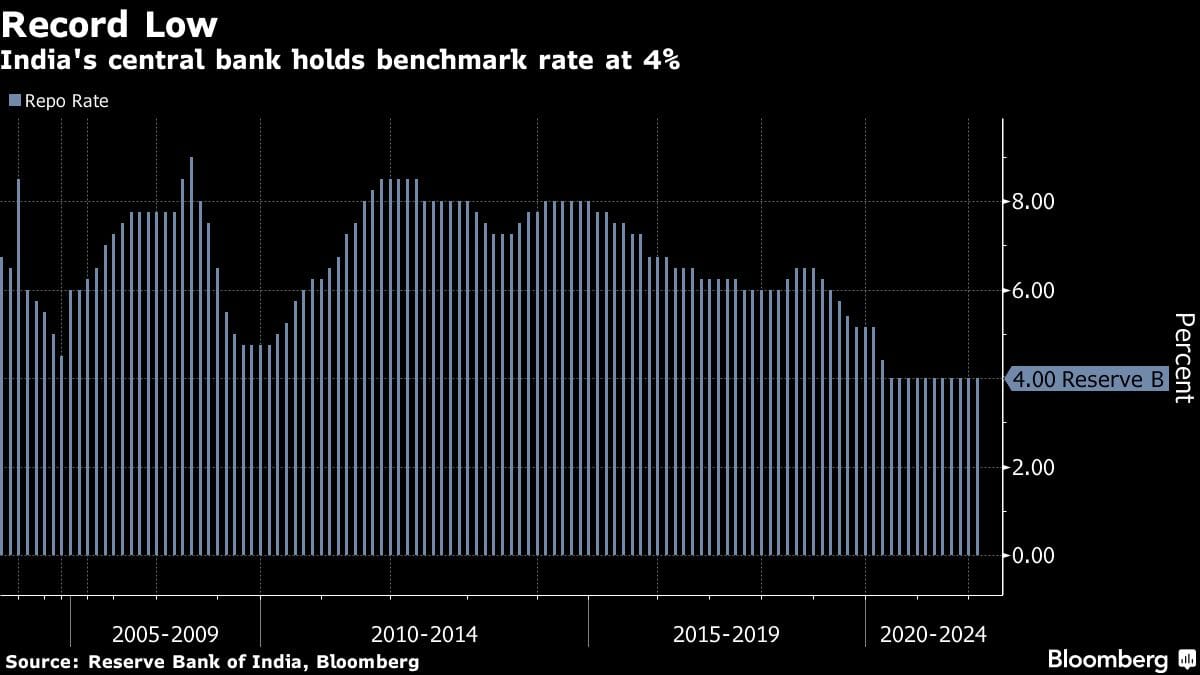

India’s central bank kept borrowing costs at a record-low for a 10th straight meeting, complementing fiscal aid to ensure the economy’s durable recovery from the pandemic.

The Monetary Policy Committee voted to keep the benchmark repurchase rate at 4% as predicted by all but one of the 39 economists surveyed by Bloomberg. The Reserve Bank of India also kept the reverse repo rate — the level at which it absorbs excess cash from lenders — unchanged at 3.35%, Governor Shaktikanta Das said in an online broadcast Thursday.

The six-member rate panel, which has been on pause since August 2020, retained its accommodative policy stance with a 5-1 vote, Das said, signaling the economy needed continued support despite accelerating inflation. While retaining the accommodative stance, he reiterated the “as long as necessary” language used since October 2019.

“Monetary policy actions will be calibrated and well telegraphed,” Das said, underlining that there won’t be any surprises.

Bonds and stocks advanced after the decision, while the rupee slid 0.3% against the dollar after the RBI’s dovish policy outlook.

The decision comes days after Prime Minister Narendra Modi’s administration announced a budget that proposed to borrow and spend big to support the economy’s world-beating recovery. As the government’s debt manager, the RBI has to ensure its $200 billion debt program goes through smoothly, while ensuring stimulus steps don’t fan inflation.

Das said he hopes that the market will “act responsibly” and contribute to “co-operative outcomes” on the government borrowing program.

Inflation outlook

While consumer price-growth has stayed within the central bank’s 6% upper tolerance limit for seven out of nine months this fiscal year, price pressures are seen picking up after the growth-boosting budget and amid higher oil prices.

The RBI lowered the inflation outlook to 4.5% for next fiscal year, down from 5.3% in the current year. The central bank sees gross domestic product growth slowing to 7.8% next fiscal, down from a 9.2% expansion estimated by the government this year.

“Taking into consideration outlook for inflation and growth, in particular the comfort provided by improving inflation outlook, the uncertainties related to omicron and global spillovers, the MPC was of the view that continued policy support is warranted for a durable and broad based recovery,” Das said.

He also announced new decisions on liquidity:

- One of them involves a curtailment to the hours when reverse repo, and MSF windows can be availed — a return to pre-pandemic methods of managing liquidity

- He says variable repo, reverse repo of 14-day will be main liquidity tool while auctions of longer maturity will be conducted as needed – Bloomberg.

Also read: India headed for steep fuel price hike after state polls end next month, Deloitte says