The disproportionate concentration of bad loans in the government owned banking system has a major role to play in the crisis that India is presently facing.

In 2012, the State Bank of India (SBI) declared Kingfisher Airlines a non-performing asset (NPA). The SBI had the highest exposure, Rs 1,458 crore, among the consortium of banks that had loaned money to the airline.

Kingfisher’s total debt amounted to Rs 6,000 crore then. The task of recovering loans given to the company and prosecuting those who were involved in wrongdoing is still a work in progress.

The RBI’s December 2017 Financial Stability Report (FSR) says “there will be a complete erosion of the profits of the banking sector under the scenario of a default by the topmost three borrowers of each bank”.

The report also shows that more than four-fifths of banks’ NPAs are on account of large borrowers (See Chart 1). A large borrower is defined as one that has aggregate fund-based and non-fund based exposure of Rs 5 crore and more for scheduled commercial banks (SCBs).

These are two disparate facts about the current banking crisis in India. But they raise two similar questions. Would it have been possible for any person to borrow Rs 6,000 crore to start an airline like Vijay Mallya could? Will the government sit back and watch if banks face a potential collapse due to default of their large borrowers? The answer to both questions is a definite no.

Irrespective of whether or not malfeasance has led to the crisis of borrowers or lenders, their sheer size is bound to have played/play a role in their access/potential access to credit/bail-out. Banks gave out big-ticket loans because big borrowers inspired confidence that they would be able to pay back. Now that they cannot pay back, the government will have to infuse capital in banks and save them.

In 2017, the government announced a recapitalisation plan involving Rs 2.11 trillion for state-owned banks. While Rs 1.35 trillion out of this amount was to be raised by issuing recapitalisation bonds, the rest is to come from budgetary allocations and fundraising from markets.

The short point is the principle of ‘too big to fail’ is both the cause and result of India’s banking crisis.

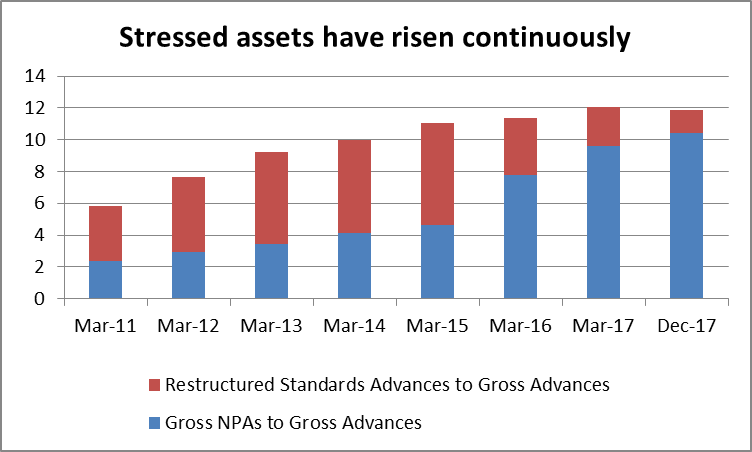

This argument gains even more strength when we look at how banks reacted when the NPA crisis started developing. Bad debt started mounting in India’s banking sector at the beginning of this decade itself. However, this was hidden through statistical jugglery. Instead of recognising their bad debts as NPAs, banks put them under the category of restructured loans. Things changed drastically when the RBI forced an asset quality review (AQR) in the second half of 2015. While the total share of bad loans has continued to increase at the same pace, most restructured loans joined the category of NPAs (See Chart 2).

Let us assume an individual borrows money from a bank to buy a car and starts faltering on EMI payments in a year. Would the bank recognise the loan as an NPA and initiate processes to recover the money or would it enter into a negotiation with the borrower to postpone payments for a while in the hope of recovering the loan?

The former is a more plausible action on part of the bank. For two broad reasons, this is unlikely to be the case if the defaulting borrower is sitting on a huge loan. Firstly, a big borrower has much more resources at his/her disposal to deal with the methods employed by a bank to recover debt. Secondly, the potential loss in case of default is much bigger than a car loan gone bad, hence the bank would be more amenable to giving a long rope to the borrower.

The argument of ‘too big to fail’ holds true for explaining bad loans in the banking system in general. The sub-prime crash that triggered the financial crisis in the US was a result of highly risky borrowing against portfolios of housing loans which were bound to face defaults sooner or later.

Because large funds and not individual house-buyers were dealing in these toxic securities, loans were given in the first place. Even though banks that collapsed were in the private sector, they had to be bailed out by using taxpayers’ money.

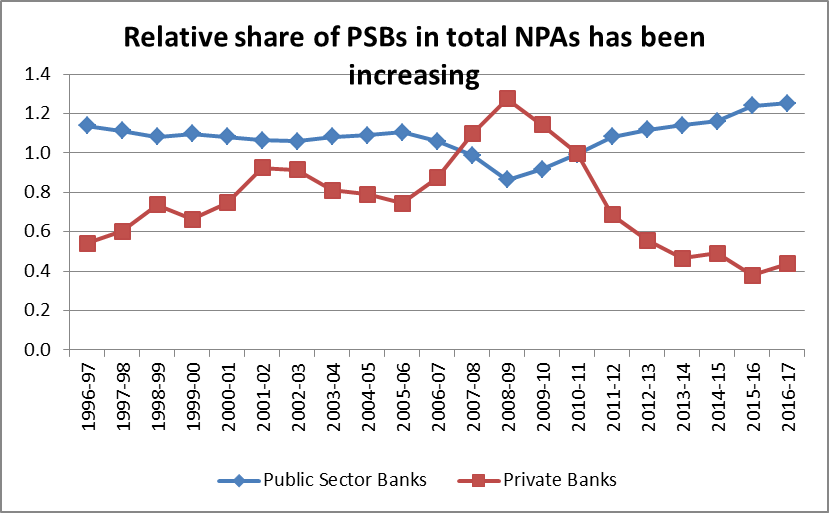

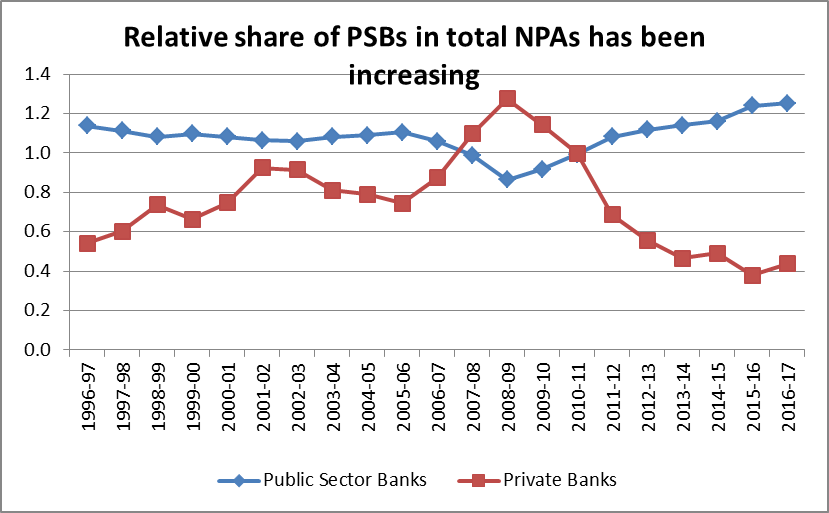

What is special about India’s banking crisis then? It is the disproportionate concentration of bad loans in the government-owned banking system. Gross NPAs as percentage of total advances stood at 13.5 per cent for public sector banks (PSBs) in September 2017.

The figure is less than four per cent for foreign and private banks. To be sure, one could argue that higher levels of NPAs in PSBs are due to their overall dominance in India’s banking industry (60-70 per cent), but comparing the relative share of NPAs can take care of this mismatch.

The relative share of NPAs in PSBs can be calculated by dividing the share of PSB NPAs in total NPAs by share of PSB advances in the sector’s total advances. This exercise shows that the PSBs have had a major role in the creation of India’s present banking crisis (See Chart 3).

What explains the disproportionate share of PSBs in NPAs? An earlier story by this author had pointed towards governance-related issues in PSBs that make them more vulnerable to frauds and losses. However, it would be wrong to say that only PSBs face corporate governance problems.

Recent events involving the ICICI Bank have shown that private banks are not immune to such practices. Is there something else that explains the concentration of bad loans in PSBs?

The next part of this data-journalism series will try and answer this question.

By special arrangement with ![]()