New Delhi: The widening gap between India’s private banks and their state-backed peers is expected to be laid bare this earnings season with investors looking for further signs that players such as HDFC Bank Ltd. are better placed to step up lending when the country’s second coronavirus wave subsides.

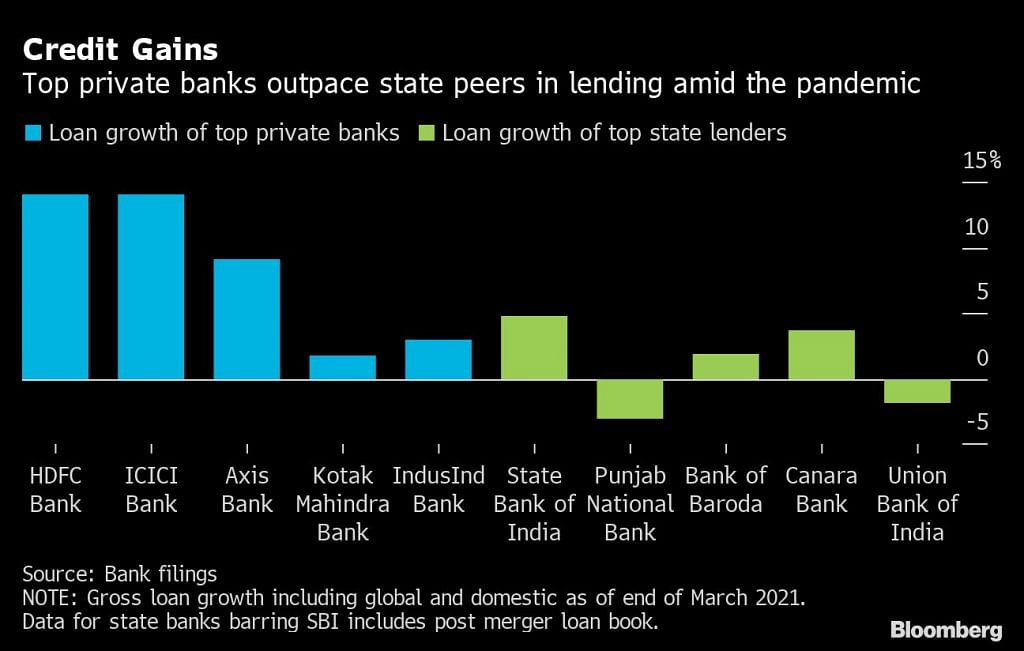

Many shareholders will be on the lookout for indications that private lenders have enhanced already stronger buffers to give them more wiggle room to step up lending in an eventual recovery. One metric is key — private sector banks’ market share in terms of loans surged about 36% in 2020 from about 21% five years ago.

Although the relaxing of regulations on asset quality and low interest rates will likely help prop up profit, it may only be a short reprieve. Stressed loans remain elevated and credit growth is hovering near a six-decade low — all of which could deteriorate even more once lenders are able to classify those loans as non performing from 2023.

“We expect banks with a strong franchise, robust balance sheet and governance to outpace peers in an environment impacted by the pandemic,” said Bloomberg Intelligence analyst Rena Kwok.

With all eyes on quarterly results that began with HDFC Bank on Saturday, here are some key metrics to monitor showing how state lenders are lagging behind:

When the coronavirus returned in April with a second wave, businesses and jobs were slammed with ensuing lockdowns just as the economy began to recover from the initial onset of the pandemic last year. That prompted the Reserve Bank of India to extend a debt restructuring package as the restrictions on activity curbed lending and exacerbated a cash crunch for businesses.

Most recent data shows India’s top three private banks lent nearly three times the average industry rate in the quarter of March, while maintaining better asset quality than their state peers. Kwok says she is looking for any further deterioration in asset quality in upcoming results that may be masked beneath improved earnings.

Also read: Why RBI isn’t very concerned about current increase in inflation — former dy governor explains

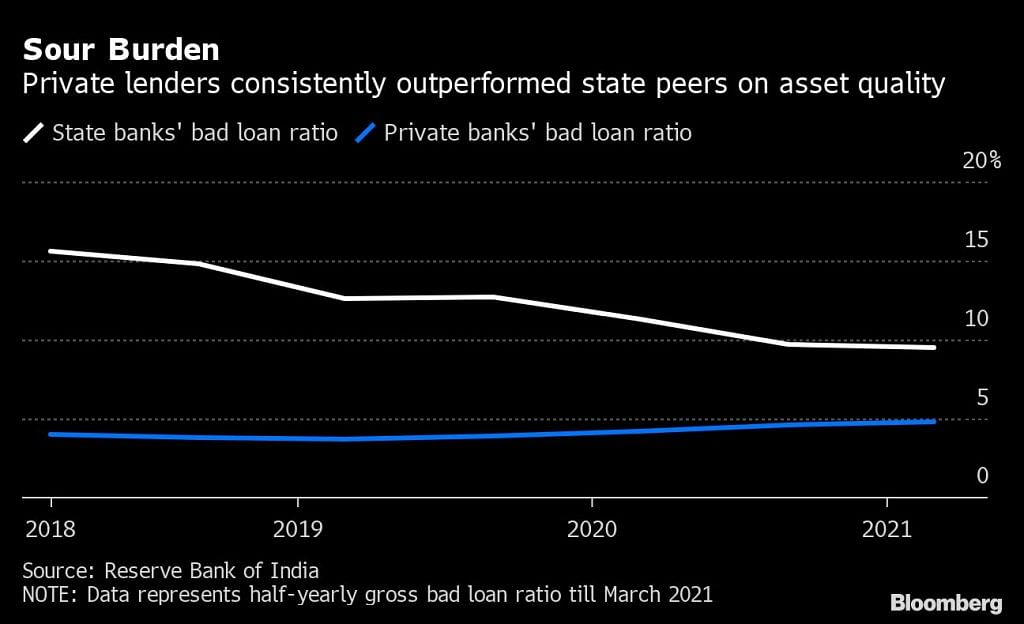

Bad loans

State bank bad-loan ratios remain elevated compared to their private peers despite declines in recent years. Apart from the largest lender State Bank of India, the other four top state banks’ bad-loan ratios were in a 9% to 14% range, compared to 1.3% at the end of March for top private lender HDFC Bank, the lowest among banks. That metric for SBI stood at 4.98%, better than state peers. HDFC Bank, the first major lender to kick off earnings season, registered a bad loan ratio of 1.47% at the end of June, it said Saturday.

“There’s considerable stress on the ground,” said Saswata Guha, senior director of financial institutions at Fitch Ratings Ltd. in India. “The numbers don’t reflect the true picture. Asset quality risks are suppressed under the regulatory relaxations which are likely to manifest over a protracted time-frame well after March 2023.”

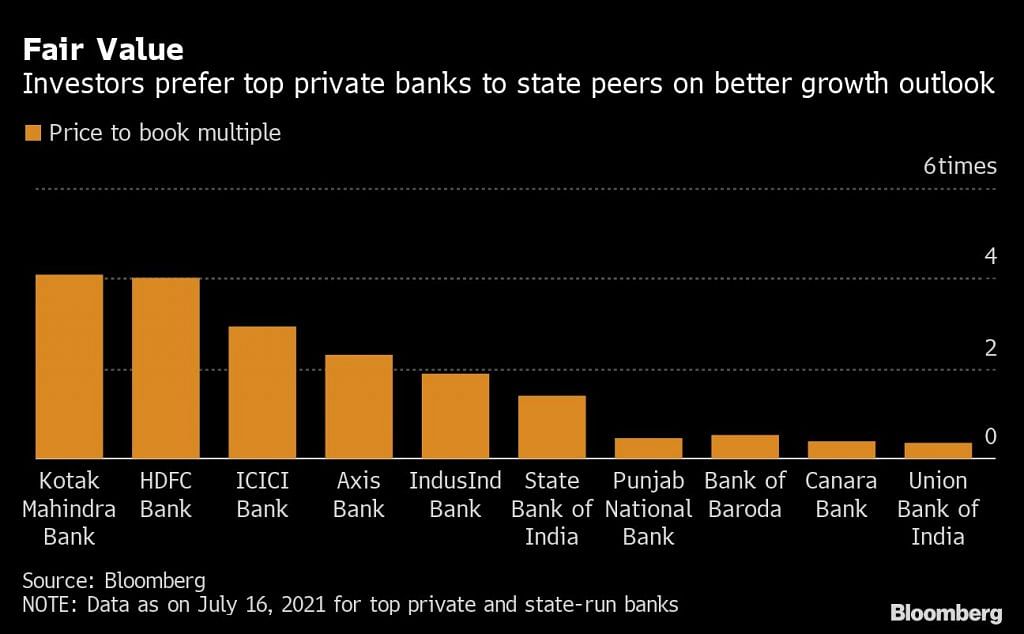

Valuation gap

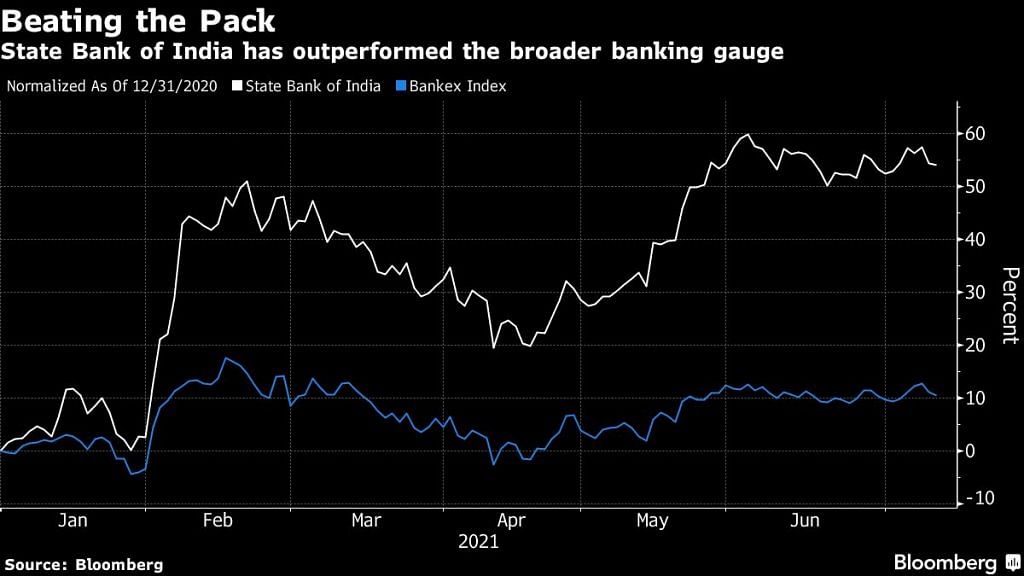

Private banks’ price-to-book ratios, a gauge of a firm’s value to investors, were more than twice that of state lenders reflecting the confidence they enjoy on the back of strong capital buffers. The relatively higher quality of those loan books also helped them to eat into the market share of most state banks, barring State Bank of India.

The outlier is State Bank of India. Shares of the Mumbai-based lender surged 56% this year, outperforming peers after the lender controlled its loan slippages, stepped up bad loan buffers even as credit growth slowed down sharply. Investors will be looking for guidance on fresh bad loans and provisioning for the quarter just ended.

“The severe second wave will hurt banks’ asset quality in the retail and small and medium enterprises loan segment,” said Alka Anbarasu, senior credit officer of financial institutions at Moody’s Investors Service Inc. This will “delay improvements to the asset quality that has been underway in the past two-three years.” –Bloomberg

Also read: Modi govt finally sets up bad bank hoping to tackle NPA mountain, boost credit flow