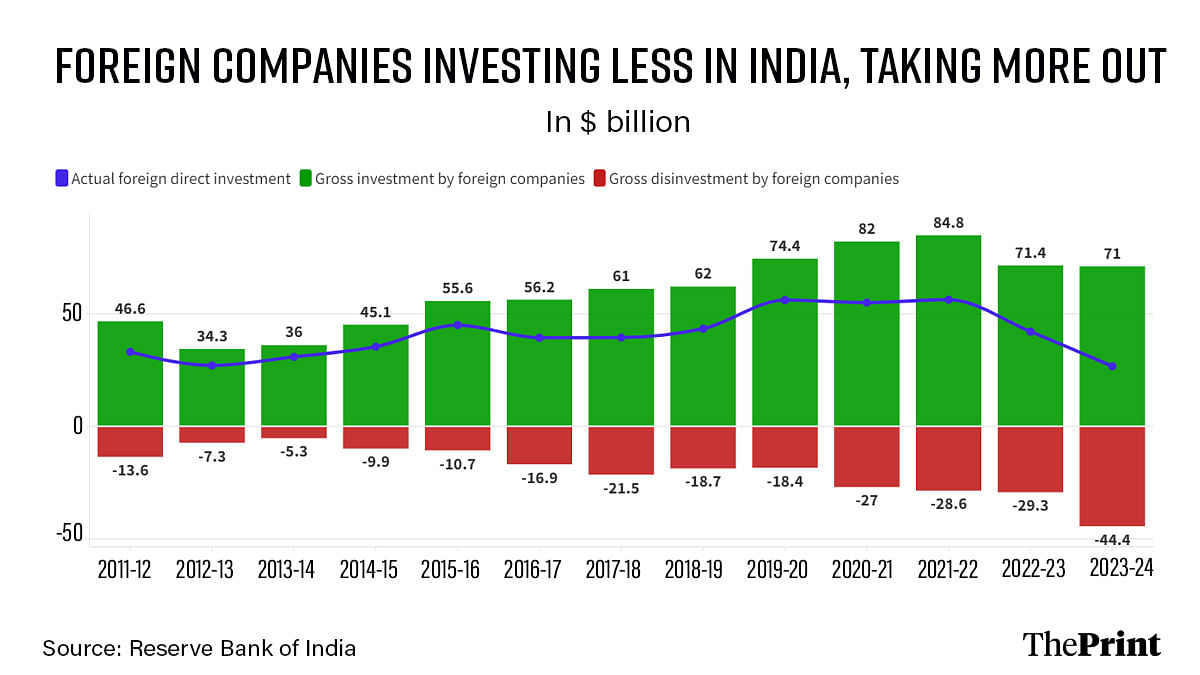

New Delhi: Not only are foreign investors injecting less money into India than they used to, they are also increasingly taking their money out of the country.

Actual foreign direct investment (FDI) into India fell to $26.6 billion in FY 2023-24, down 37 percent from the previous fiscal, according to data released by the Reserve Bank of India (RBI) Tuesday evening. The number is at its lowest since 2006-07.

An analysis by ThePrint found that the major reason for the fall in the value of actual FDI in India is the surge in the amount that foreign companies pulled out of the country, which grew to $44.4 billion during 2023-24, up 51 percent from the previous year.

This is the highest amount that foreign companies have taken out in a single year, since at least 2011-12, when the RBI started releasing this data.

Actual FDI into India is the difference between how much money foreign companies are investing in the country (gross investments), and how much they are taking out, called repatriation or disinvestments.

What’s happening in India is that inflow of foreign investments into the country is falling, while the outflow is increasing.

Also Read: Why FDI in India is lowest in 16 yrs — no real ease of doing business, ill-considered treaty moves

Less coming in, more going out

Gross foreign investments into India stood at $71 billion in the last fiscal, marginally lower than $71.4 billion in 2022-23.

However, foreign companies repatriated or disinvested $44.4 billion in 2023-24, which meant that the actual direct investment into the country was only $26.6 billion.

The amount invested has been falling for two consecutive years now, but the amount being taken out has been rising for longer than that.

The amount repatriated or disinvested by foreign companies in India stood at $18.4 billion in the pre-pandemic year, FY 2019-20. Since then, it has been steadily increasing — $27 billion in the pandemic year 2020-21, $28.6 billion in 2021-22, and $29.3 billion in 2022-23.

Over the last financial year, however, the amount taken out has surged, to $44.4 billion.

(Edited by Mannat Chugh)

Also Read: Modi govt gives reason for slowdown in India’s FDI inflows. But he’s missing a larger problem

You have chosen not to analyse the avenues of repatriation of funds by foreign companies. I guess it could be repatriation of profits earned by these companies from their operations here. Does it mean taking away the invested amount or discontinuation of the operations. Its quite natural for foreign companies to repatriate profits periodically. Doesn’t it MEAN THAT THE MORE AMOUNT THEY INVEST IN INDIA IS FETCHING THEM MORE PROFITS ?

It cannot be portrayed as a bleak scenario. As You are a hate Modi media, You are under compulsion to portray it so.