New Delhi: The Niti Aayog has recommended fully decriminalising 12 offences under the newly enacted Income Tax Act 2025. It has also suggested retaining criminal liability for 17 offences only when fraudulent intent is established, while maintaining criminal provisions exclusively for six serious offences.

According to the federal think tank’s Tax Policy Working Paper Series-II released here Friday, decriminalising the 12 offences would not only help in reducing litigation but also foster a culture of trust and cooperation between taxpayers and administration, resulting in higher voluntary compliance.

There is a need to shift away from fear-based enforcement to trust-based governance, says the Niti Aayog paper titled Towards India’s Tax Transformation: Decriminalisation and Trust–Based Governance.

While the Niti Aayog welcomed the Income Tax Act 2025 as a step in the right direction, it suggested that to fully realise its potential as a reform, there is a need to establish a trust between citizens and State, rather than invoking fear of criminal prosecution.

The series highlights that while the Income Tax Act of 2025 omits several outdated offences, it continues to criminalise 35 actions and omissions across 13 provisions.

The report underlines the need to distinguish fraud from honest error, suggesting that 17 other offences mentioned in the act should retain criminal liability only if fraudulent intent is proven. The Aayog has recommended retaining criminal provisions in only six offences, where there is deliberate and serious misconduct.

According to the report, the new act excessively relies on criminal law for minor, technical and procedural non-compliance. There are 25 offences listed in the new IT act that carries a mandatory minimum imprisonment of up to six months. Thirteen offences carry a maximum imprisonment of seven years.

Section 477 of the act (failure to pay tax collected at source) mandates criminal prosecution. According to Niti Aayog, criminalising this offence is disproportionate as the failure to pay does not threaten public safety, national security or law and order. The Aayog recommends omitting this section from the act, and deal with the offence by imposing a penalty.

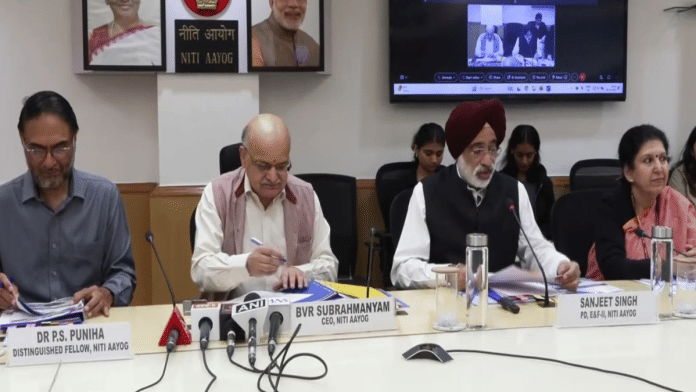

“If India has to become Viksit Bharat by 2047, we need to have a tax system which is world class, which promotes compliance, which is easy, which is fair, which is just and which promotes compliance with tax laws rather than makes it so complicated that people are not deterred, but actually fail somewhere or the other, more unknowingly rather than knowingly,” Niti Aayog CEO B.V.R. Subrahmanyam said at the launch of the paper.

He further added that if the crime has to be determined in the court of law, then there should not be any mandatory minimum imprisonment in the act. If there is a provision for mandatory minimum imprisonment, then the judge loses the flexibility to give a judgement.

Presently, the Income Tax Act presumes a “culpable mental state”, and the burden of proof falls on taxpayers. The think tank recommends shifting the “burden of proof” with regards to fraudulent intent upon tax authorities rather than taxpayers, similar to criminal law.

“Normally, in a typical criminal litigation in a court of law, the burden of proof is on the police to prove that there was an offence. Similarly, we are (suggesting) reversing it back, saying it should be on tax authorities,” said Subrahmanyam.

To assist tax officers, the Niti Aayog has come up with a set of pre-prosecution questions or guidance notes to determine the wilful intent of a taxpayer. According to Subrahmanyam, these guidance notes are designed to ensure that all civil remedies have been exhausted before invoking criminal prosecution.

The report says that at the heart of the reforms proposed is the recognition that excessive regulation, especially the use of criminal law for minor or technical non-compliance, generates fear, uncertainty, and a trust deficit between citizens and the State. “While the Income Tax Act, 2025 is a significant modernization, its full transformative potential hinges on also addressing the current overuse of criminal law in enforcing tax compliance.”

This is a second report in Niti Aayog’s Tax Policy Working Paper series. The Tax Policy Working Paper Series–1 released last week proposed an optional presumptive taxation regime for foreign companies operating in India with an aim to reduce litigation.

Subrahmanyam said overall there will be 12 such working papers that will be released till December.

(Edited by Ajeet Tiwari)

Also Read: Modi govt withdraws Income Tax Bill 2025, Sitharaman likely to introduce updated bill next week