Insolvency and Bankruptcy Board chief says firms facing bankruptcy have paid creditors Rs83,000 crore to avoid insolvency.

India’s new bankruptcy law has instilled fear among delinquent borrowers and prompted several reluctant founders to repay outstanding debt due to the risk of losing their company, according to its insolvency regulator.

“There is a perceptible difference in the behavior of borrowers and lenders,” M.S. Sahoo, chairman of the Insolvency and Bankruptcy Board of India, said, referring to the period since the introduction of Insolvency and Bankruptcy Code in 2016. “The stakeholders know that the firm goes into liquidation if they fail to arrive at a resolution plan within the specified time.”

Companies facing bankruptcy petitions have reportedly cleared dues of as much as Rs83,000 crore ($12 billion) with creditors, Sahoo said in an interview at his New Delhi office last week. This will support growth by improving capacity utilization and rescuing failed businesses, he said.

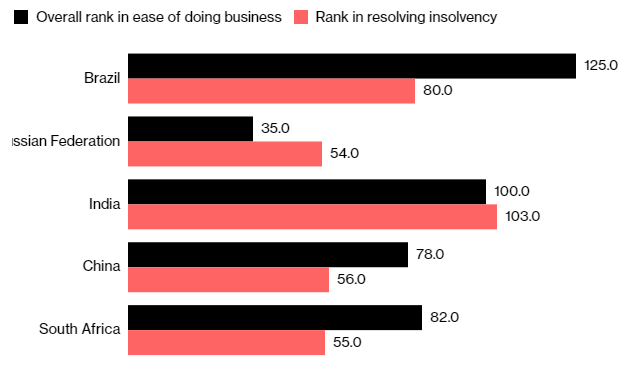

The insolvency code replaced a web of archaic laws, some dating back a 100 years, and helped India jump 30 points to make it to the top 100 countries in World Bank’s ease of doing business rankings. The new law is key for Prime Minister Narendra Modi to wipe out bad loans and boost growth in Asia’s third-largest economy.

The law empowers lenders to drag companies that have defaulted for 90 days on debt exceeding Rs 100,000 to the bankruptcy court which then places it under an administrator to examine a revival or an outright sale. If a plan is not worked out within three quarters, then the company’s assets get liquidated. The objective was to bring debt-laden companies back on their feet and help banks free up $210 billion of stressed assets for lending.

A report by the Reserve Bank of India estimates that gross bad-loan ratio may increase to 12.2 per cent by March 2019 from 11.6 per cent in the previous year, limiting bank’s ability to lend to businesses.

Next Phase

The government is also working to put in place, as early as next month, new rules to hold accountable individuals, who stood guarantee for loans to a company, in case of a default. The scope of the regulation would later be expanded to include individual businessmen and eventually every private citizen.

India is also planning regulations on cross-border insolvency to pursue foreign assets of a defaulting company. It is working on the model cross-border insolvency law adopted by the United Nations Commission on International Trade Law to harmonize cooperation between countries.

Work on that front has already begun, Sahoo said, adding the government would need to amend the law to incorporate the proposed changes.

Inching Up

India’s Ease of Doing Business ranking improved on new insolvency law

Even as the government tries to widen the scope of bankruptcy law, bitter court battles have bogged down efforts to clean up bad loans through the new code and companies are missing the 270-day deadline for resolution. The government is running against time to fix the legal and operational issues that keep cropping up and has tweaked the norms several times.

“If you are flying an aircraft at 30,000 feet and it has developed a snag, you don’t have the luxury to come down to the ground and repair it.” Sahoo said. “Laws need to be made as and when the market needs it. If you do not respond promptly the loss is much more.”-Bloomberg