New Delhi: The government’s decision last year to impose a 20 percent tax collected at source (TCS) on foreign expenditure by Indians, in a bid to curb their spending abroad, doesn’t seem to be working.

Budget travellers and high net worth tourists are both finding loopholes to get around this higher TCS, according to tourism industry experts.

Further, those buying real estate abroad under the government’s Liberalised Remittance Scheme (LRS) were anyway using trackable means of payment and so adjusting to the higher rate of TCS was simply a matter of restructuring their finances over the financial year to reduce any potential fiscal hiccups.

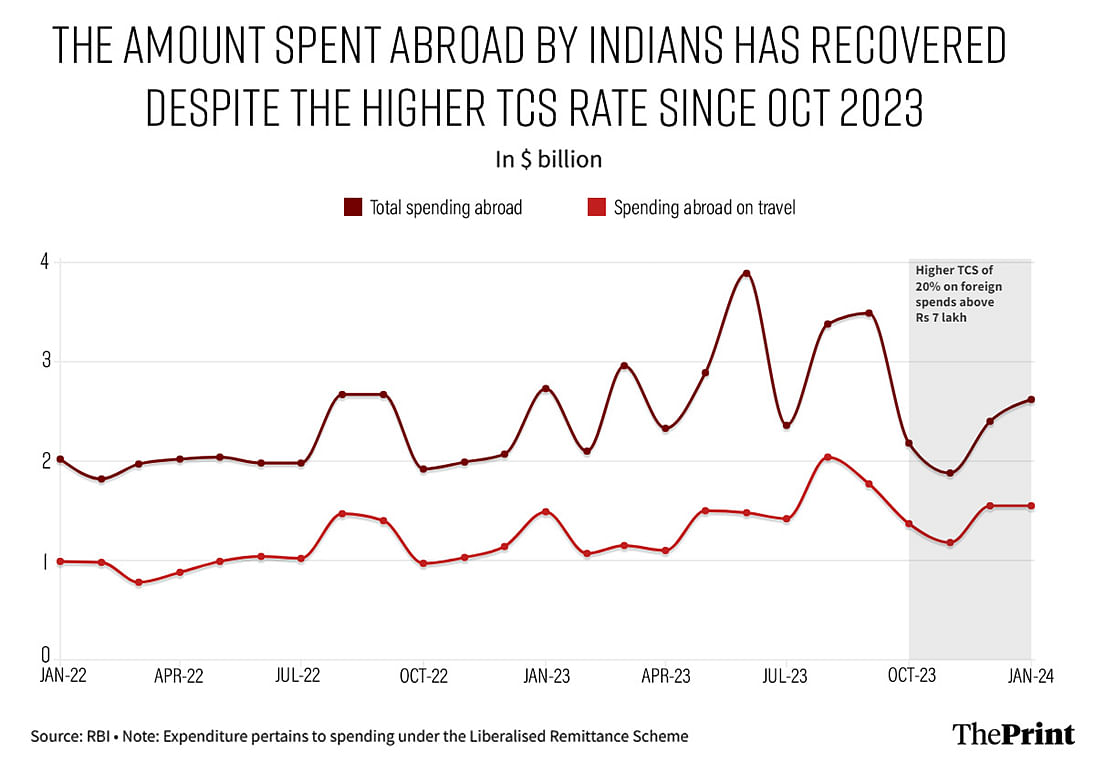

Data with the Reserve Bank of India (RBI) shows that not only is overall spending abroad recovering to historical levels, but foreign expenditure on travel and on the purchase of immovable property — two areas in particular the government is keen to curb — is also rising again.

Further, it has been confirmed to ThePrint that it was the rapid increase in foreign spending in the post-pandemic years, and especially in 2022-23, that pushed the government to try to curb this trend.

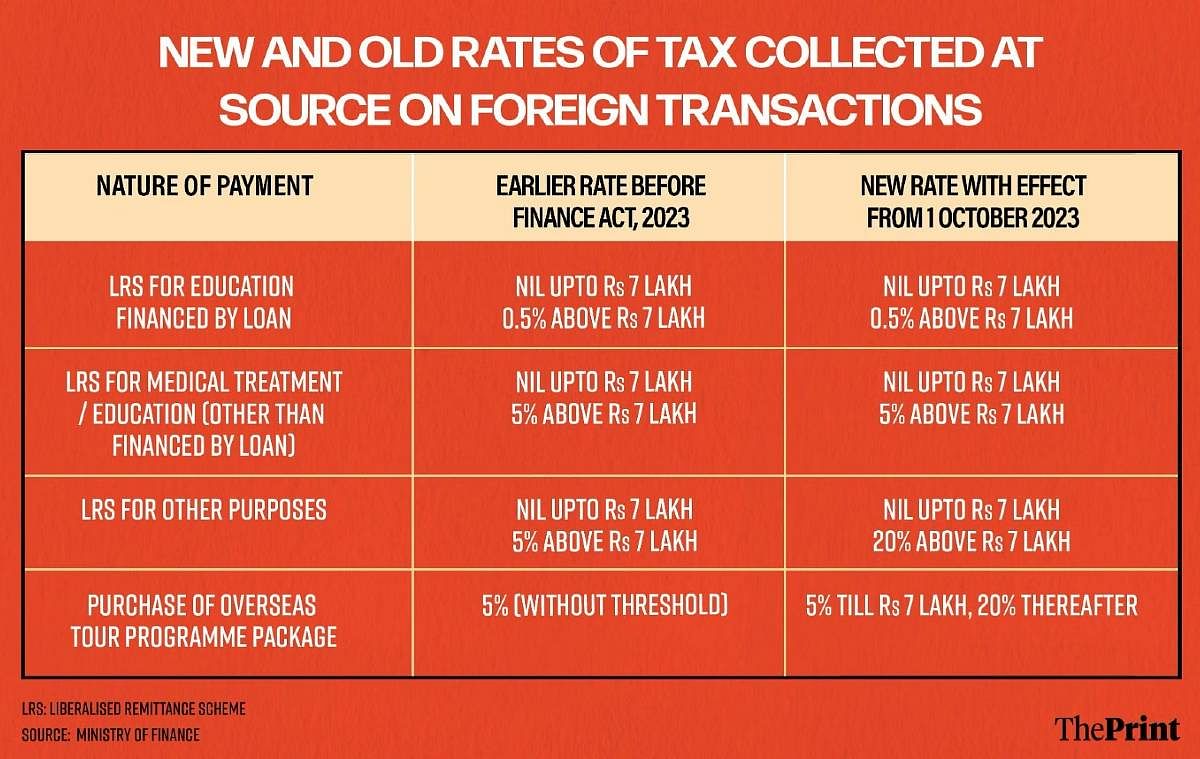

Budget 2023-2024, presented by Union Finance Minister Nirmala Sitharaman on 1 February last year, included a provision to hike the rate of TCS imposed on certain foreign transactions to 20 percent from the existing 5 percent. The decision also removed the existing threshold of Rs 7 lakh, below which the TCS would not apply.

After strong pushback from both its supporters and critics, the central government restored the Rs 7 lakh limit, but retained the rate hike to 20 percent. The only exception was for the purchase of tour programmes, for which a 5 percent TCS is applicable up to Rs 7 lakh and a rate of 20 percent thereafter.

However, according to experts in the tourism sector, the restoration of the Rs 7 lakh limit effectively defanged the 20 percent TCS and made it a non-issue for most tourists travelling abroad.

As for those looking to buy real estate, experts say that the TCS posed only a minor hiccup as it meant these prospective buyers had to juggle their finances initially.

A TCS is not a tax per se. It is refunded to the payer at the end of the financial year, or deducted from the amount of tax they have to pay. So, according to people in the real estate sector, prospective buyers of immovable property are simply accounting for this amount of capital being locked up, and are going ahead and buying the assets abroad in any case.

Also Read: No TCS on foreign debit & credit card transactions up to Rs 7 lakh, clarifies Union govt

Spending abroad rebounding strongly

The spending behaviour is showing itself in the numbers quite clearly.

Data with the RBI on the amount spent under the Liberalised Remittance Scheme — introduced in 2004 to facilitate foreign spending — shows that foreign spending by Indians dipped in October 2023 following the implementation of the higher TCS rate.

It fell to $2.2 billion by the end of October 2023 from $3.5 billion a month earlier. It fell further to $1.9 billion by the end of November that year. However, the level of spending abroad quickly began to rise again, reaching $2.6 billion by the end of January 2024, the latest period for which there is data.

This trend is mirrored in the spending abroad by Indians for the purpose of tourism. Tourism expenditure abroad reached $1.55 billion by January-end, the third-highest it has been in the last two years, and marginally higher than the previous two Januaries.

The reason for this recovery in tourism expenditure, in particular, is due to the restoration of the Rs 7 lakh limit.

“The limit of Rs 7 lakh for 20 percent TCS is on an individual basis,” Rajiv Mehra, President of the Indian Association of Tour Operators (IATO), explained. “Let’s say a husband and wife are travelling abroad together, so in a combined way they have an exemption of up to Rs 14 lakh, which is huge.”

Most travellers are willing to pay a TCS of 5 percent (applicable below that Rs 14 lakh combined threshold) for their tour packages, he added, pointing out that 90 percent of travellers fall in this category.

The other loophole that has been found is that those tourists who are willing to pay higher amounts are doing so through their corporate accounts, and pay a much lower Tax Deducted at Source (TDS) on such expenditure than the prevailing TCS rate.

“There is a luxury segment — people going on cruises and safaris — where the amounts being spent are high,” Mehra said. “But here the majority of the people have their offices paying for it and they pay 2 percent TDS and save on the TCS.”

“So, by and large, there is no difference in the way people are spending while taking overseas trips,” he said.

Ajay Prakash, Board Member of the Federation of Associations in Indian Tourism and Hospitality (FAITH), further explained that several countries are now offering liberalised visa regimes to woo high-spending Indian tourists, and so foreign travel by Indian has increased despite the TCS hike.

Spending on real estate dented but recovering

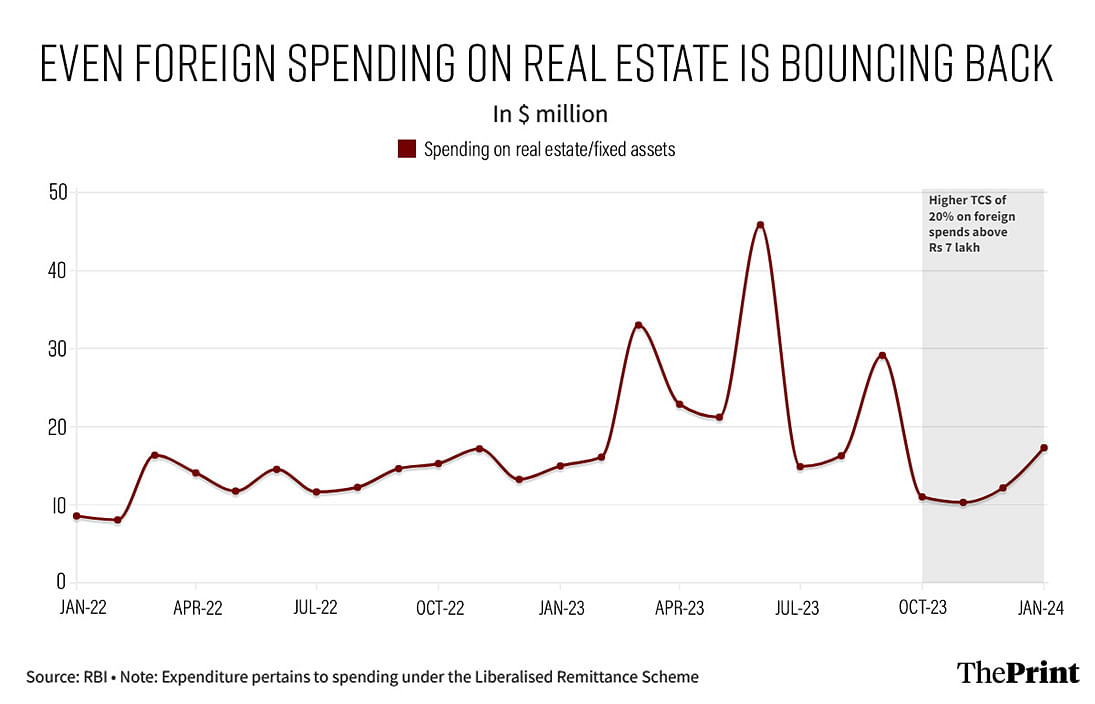

The RBI data shows that foreign expenditure on immovable property — real estate, in other words — did take a hit following the imposition of the 20 percent TCS in October 2023.

In total, Indians spent $50.8 million on the purchase of immovable assets abroad in the four months of October 2023 to January 2024. This is 16 percent lower than it was in the same four months in the previous corresponding period.

However, the data also shows that the spending trend is on an upward swing, at an accelerating rate. That is, it grew from $10.3 million in November 2023 to $12.2 million by the end of December that year, before jumping to $17.3 million by the end of January 2024.

“The people buying real estate abroad under the LRS were anyway paying for it through digital means, which could be tracked,” a director in a large real estate consultancy told ThePrint on the condition of anonymity. “It made no sense for the government to hike the TCS if they simply wanted to track these transactions.”

In other words, he said, this 20 percent TCS was not tracking those people who were using their black money in cash to buy property abroad.

“In any case, these people buying property abroad through the LRS are just accounting for the fact that their money will be locked up till the end of the financial year,” he added. “It’s simply a means of managing their cashflow for them, and soon you will see that foreign real estate purchases will spike towards the end of the financial year to minimise how long the TCS amount is locked up.”

What ‘spooked’ the government

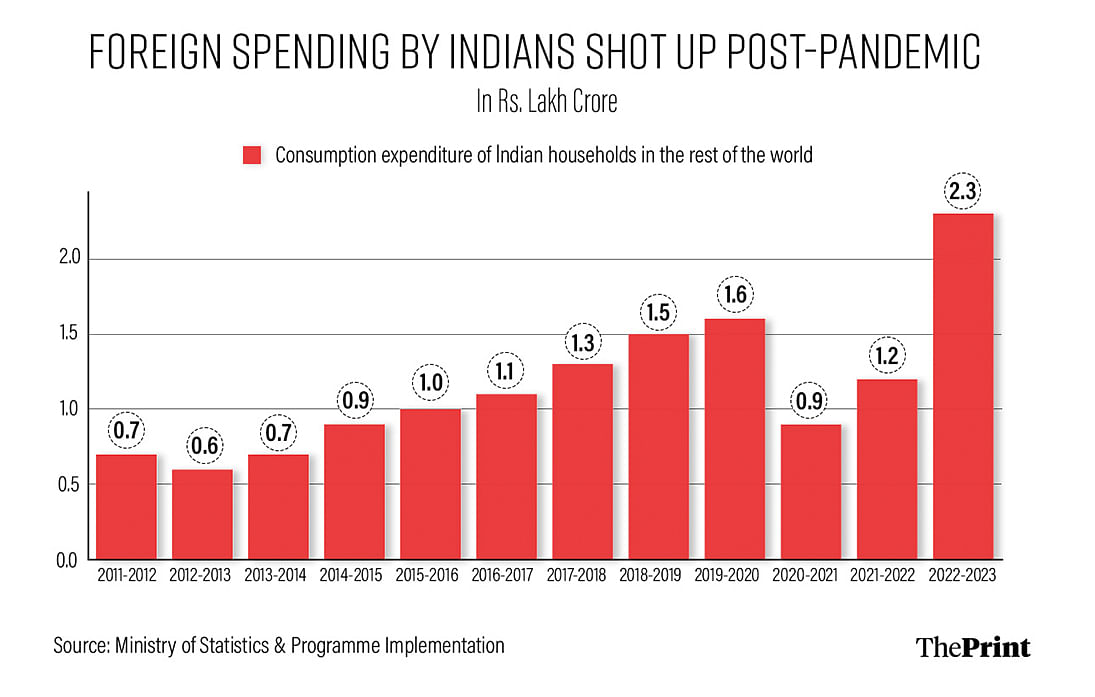

Data with the Ministry of Statistics and Programme Implementation shows that expenditure by domestic households incurred abroad grew very sharply following the easing of the COVID-19 pandemic, which, according to two senior officials in the ministry of finance, “spooked” the government and pushed it to impose curbs.

Foreign spending increased 33 percent to Rs 1.2 lakh crore in 2021-22, the year following the imposition of large-scale lockdowns around the world. This level was still below those seen pre-pandemic. The next year, however, saw a significant jump in foreign spending, by more than 90 percent to Rs 2.3 lakh crore.

“It is this spending abroad that ‘spooked’ the government, if that’s the term,” one official in the finance ministry told ThePrint. “The feeling was that this had to be curbed in some manner.”

When asked if the government feared a depletion of its foreign exchange reserves, another senior official in the ministry said that this was not the case.

“It was not the forex reserves, those were quite comfortable,” the second official said. “It was just that the government saw this number (foreign spending) growing very sharply, and wanted to impose some sort of control over it.”

(Edited by Nida Fatima Siddiqui)

Also Read: Indian banking system seeing improving health despite challenging global scenario, RBI report finds