New Delhi: India is expected to maintain a pragmatic and diversified approach to crude oil imports through 2026, with Middle Eastern suppliers anchoring its energy basket while Russian crude remains deeply embedded despite US sanctions, market analysts have said.

Saudi Arabia, Iraq, the UAE and Kuwait are expected to dominate India’s crude slate due to the countries’ proximity, reliability and refinery compatibility. At the same time, Russian oil is likely to retain its position in India’s refining system, supported by existing contractual relationships, favourable pricing and refinery optimisation.

“As long as broader secondary sanctions are not enforced, India is expected to continue importing Russian barrels as economics support the case, albeit increasingly through indirect and less transparent channels, keeping these barrels structurally embedded in India’s crude basket,” said Sumit Ritolia, lead analyst for refining and modelling at Kpler, a global trade intelligence firm that tracks real-time energy flows.

Ritolia added that incremental volumes from the US and select Atlantic basin suppliers will add flexibility in 2026, acting as buffers rather than outright replacements for Russian or oil from the Middle East.

According to Ritolia, though India has demonstrated its ability to offset any reduction in Russian volumes with substitutes from Middle Eastern countries, it will come at a higher cost, reducing the margin offered by discounted Russian oil.

On the demand side, upcoming capacity additions are expected to raise India’s crude import requirements.

A refinery in Rajasthan is expected to start operations in the first half of 2026, along with expansions at existing plants in Haryana’s Panipat and Assam’s Golaghat, among others.

Also Read: India’s Russian oil imports are showing up in cryptic new places. The crude map stands redrawn

New Russian suppliers emerge

Following US’ sanctions on Russian oil majors Rosneft and Lukoil, which took effect on 21 November, Indian refiners are broadening both their supplier base and procurement channels. New Russian suppliers and opaque trading entities are stepping into the space previously dominated by Rosneft and Lukoil.

According to Ritolia, Indian refiners are increasingly turning towards non-sanctioned Russian producers.

“Alternative sellers such as Tatneft, Redwood Global Supply, Rusexport, Morexport, among others, are expanding their trading footprint and taking over the commercial role previously played by Rosneft and Lukoil,” Ritolia said.

“Russian oil itself is not sanctioned, the suppliers are. That is why non-designated producers can legally step in to fill part of the gap created by the Rosneft/Lukoil restrictions,” he added.

December decline

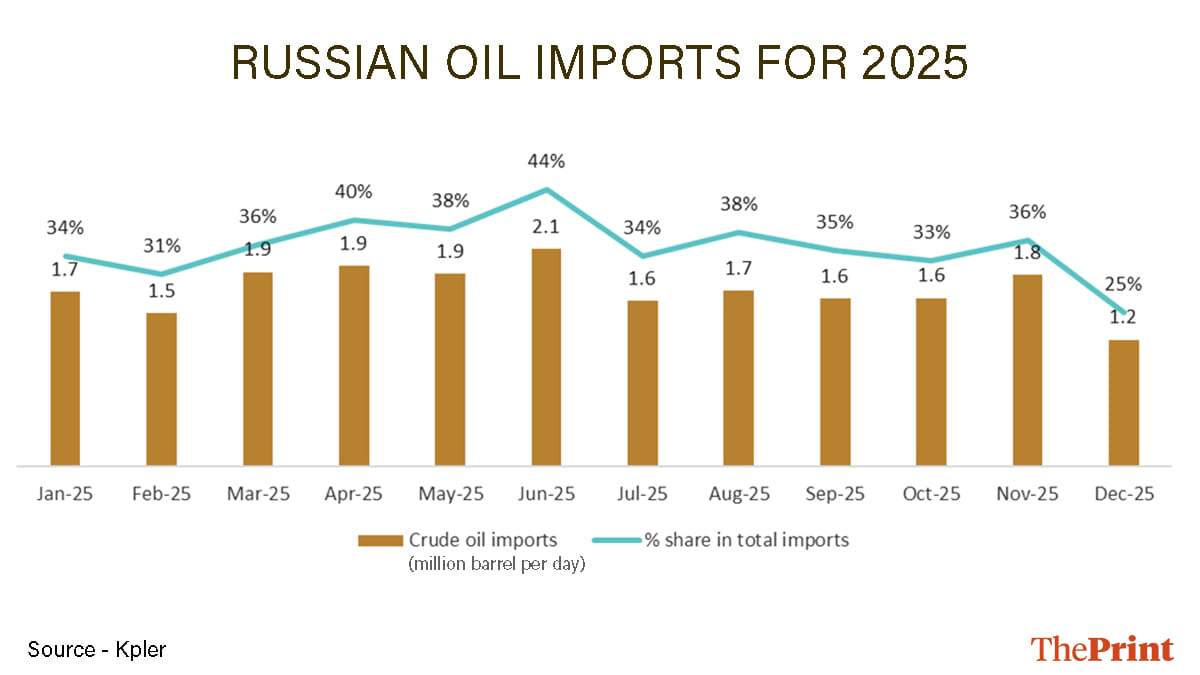

Despite Russian barrels coming through indirect channels, the impact of US sanctions was visible in December 2025.

According to Kpler estimates, Russian inflows dropped to around 1.2 million barrels per day (mbd) in the month, the lowest since December 2022 and down from 1.84 mbd in November 2025, a drop of 34.8 percent.

The fall was driven largely by major refiners such as Reliance Industries and New Mangalore refinery, which scaled back purchases after US sanctions came into effect.

Despite the decline, Russian oil accounted for a quarter of total oil imports, the highest for any trading partner but the lowest for Russia during the year.

Diversification strategy

To offset the decline in Russian oil, India increased purchases from the UAE, Saudi Arabia and Kuwait in December.

UAE supply grew by 131 percent to 592 thousand barrels per day (kbd), from 256 kbd in November, while Kuwait supplies jumped 63 percent from 178 kbd to 290 kbd over the same timeframe.

India also turned to the Americas. Brazil supplied 246 kbd of crude oil in December, while Mexico supplied 65 kbd, with both countries registering no purchases in November.

Also Read: Hugs, car rides, but no deals—Modi-Putin meet exposes weaknesses of both countries