New Delhi [India] August 7 (ANI): The Finance Bill 2024 was passed by Lok Sabha on Wednesday evening with a few amendments moved by the government.

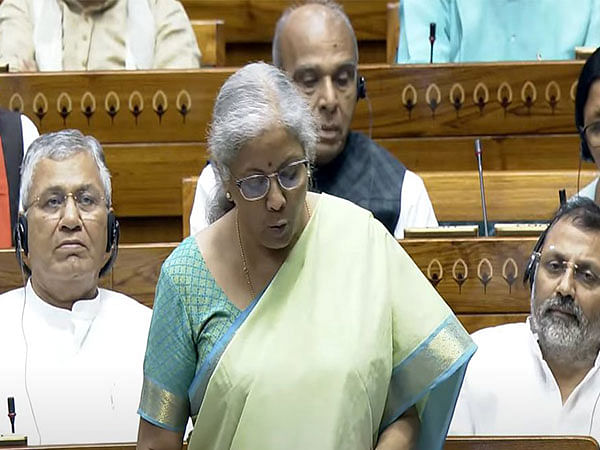

Replying to the debate, Finance Minister Nirmala Sitharman said the approach of the government has been to bring greater simplification of tax laws and procedures and enable growth and employment in the country. She responded to points made by members.

The Finance Minister clarified that in real estate, the roll over provisions have not been withdrawn and are applicable.

She said if the capital gain in a property transaction is invested in buying another one or two properties up to a maximum value of Rs 10 crore, no capital gain tax is required to be paid on such profits.

Capital gains can also still be invested in bonds which are notified under Section 54 of the Income Tax Act up to a maximum of Rs 50 lakh annually and save on taxes.

To give relief on budget proposals, Sitharaman also moved an amendment in the Finance Bill on the changes in the capital gains tax on property transactions.

The amendment implies that taxpayers can avail either a lower tax of 12.5 per cent without indexation or a rate of 20 per cent with indexation, if the property is acquired prior to July 23, 2024, the day union budget was presented in the Lok Sabha.

Sitharaman clarified that taxpayers can compute taxes under both provisions and choose to pay tax under the scheme where lower tax is applied.

Effectively, July 23, 2024, is now set as the cut-off date for the calculation of the capital gains versus the earlier cut-off of 2001.

Sitharaman said she has proposed these amendments as some members have raised hypothetical calculation to prove that under new provisions taxpayers will have to pay higher taxes.

The new tax proposals on capital gains tax was brought in to bring in parity among different asset classes like equities, mutual funds and real estate.

In the Finance Bill introduced on July 23, the Finance Minister had proposed a flat long term capital gains tax of 12.5 per cent with no indexation benefits, prior to it property transactions used to be taxed at 20 per cent with indexation benefit.

The minister also clarified that the grandfathering proposal will be allowed only for individual and Hindu Undivided Family (HUF) taxpayers and not for companies and Non Resident Individuals. They have to pay flat 12.5 per cent LTCG tax without indexation.

The proposed amendment will apply not only on real estate transactions but also on unlisted equity transactions, which are done before July 23, 2024. All such transactions will be taxed at 10 per cent long term capital gains instead of FY24-25 budget provision of 12.5 per cent tax.

With the opposition members demanding removal of GST on health insurance, Sitharaman said tax was there on medical insurance even before GST was introduced.

“There was already a Service Tax on medical insurance, before the GST was introduced. This is not a new tax, it was already there in all the states. Those protesting here, did they discuss regarding the removal of this tax in their states? Did they write to the Finance Ministers of their respective states about it and asked them to raise it in the GST Council where states have 2/3rd part? No, but they are protesting here. This is their double standards, this is their drama,” she said.

“Wrongful protests have happened recently, and comments have been passed on the basis of a news report which suggested that the ‘Centre has pocketed Rs. 24,529 crores of health insurance premiums alone’. This is incorrect and highly misleading. The GST rate of 18% on Health Insurance comprises of 9% CGST and 9% SGST. Thus, of the total collections of Rs 24,529 crores from Health Insurance in the last 3 years, Half of it, Rs. 12,264 crores, went straight to the states as SGST. It doesn’t even come to the Centre,” she added.

The minister said that apart from this, roughly 41 per cent of the Centre’s share of GST collection on Health Insurance is devolved back to the states again as part of Tax Devolution as per the Finance Commission’s formula.

Sitharaman said the New Income Tax Regime is simpler and offers lower income tax rates for individuals.

“It gives flexibility to the taxpayer to see where he wants to put his money in the absence of exemptions which is available in the Old Income Tax Regime. The Old Regime has not been dissolved and is still an alternative to the new tax regime. It still offers benefits of various deductions such as interest on home loan, etc. Individuals without business income can choose between regimes once and can revert back too. Hence, a choice has been provided to assesse,” she said.

For the previous Assessment Year 2023-24 till December 31, 2023, about 3.8 per cent of taxpayers opted for the New Tax Regime, which equates to 30.93 lakh individuals from a total of 7.98 crore ITRs filed in the categories of ITR-1 to ITR-4, she said.

“However, for the Assessment Year 2024-25 until July 31, 2024, there was a dramatic increase in adoption of the New Regime, with approximately 72.8 per cent of taxpayers choosing the New Tax Regime. This represents about 5.25 crore individuals out of a total of 7.22 crore ITRs filed in the same category.”

Sitharaman said this shows a substantial shift in taxpayer preference towards the New Tax Regime over the span of just one year.

“Taxpayers opting for the New Regime does not mean savings and investments are not happening in the economy by the middle-class. Due to growth in Fintech, better awareness, and ease of investment due to UPI, e-KYC, progressive regulations, investments in Mutual Funds have increased tremendously. On an average, 17.88 lakh new folios have been added every month in the last 5 years since June 2019. The number of unique Mutual Fund investors has grown from under 1 crore in 2014 to about 4 crore today,” she added.

The Finance (No.2) Bill, 2024 was passed after amendments moved by opposition were negatived.

Sitharaman said the vision of Prime Minister Narendra Modi has been to establish a simple, efficient and fair technology-driven taxation regime in the country.

“So, simplification and ease of compliance for the taxpayer has been the primary objective with which in the last 10 years, and this year, in the third term of PM Modi, the approach to taxation has been to simplify it, reduce the burden on taxpayer and make sure it is transparent and equitable,” she said.

“This year also, our approach has been that we bring in greater simplification of tax laws and procedures, and that we enable growth and employment in this country,” she added.Sitharaman presented the Union Budget in Parliament on July 23.

This is the first full budget of the NDA government led by PM Modi. The BJP-led alliance won a third successive term earlier this year. The Lok Sabha took up discussion on the Finance Bill after the Appropriation Bill for the central government’s expenditure for 2024-25 was passed by the House on Monday.

The Finance Bill will now be discussed by Rajya Sabha. The passage of bill will complete the budget process. (ANI)

This report is auto-generated from ANI news service. ThePrint holds no responsibility for its content.