India’s top hedge fund is unwinding its cash position and is bullish about a bounce in equities after this month’s slump.

Mumbai: India’s top hedge fund has stopped hoarding cash and started buying shares again, expecting a bounce in the South Asian nation’s equities.

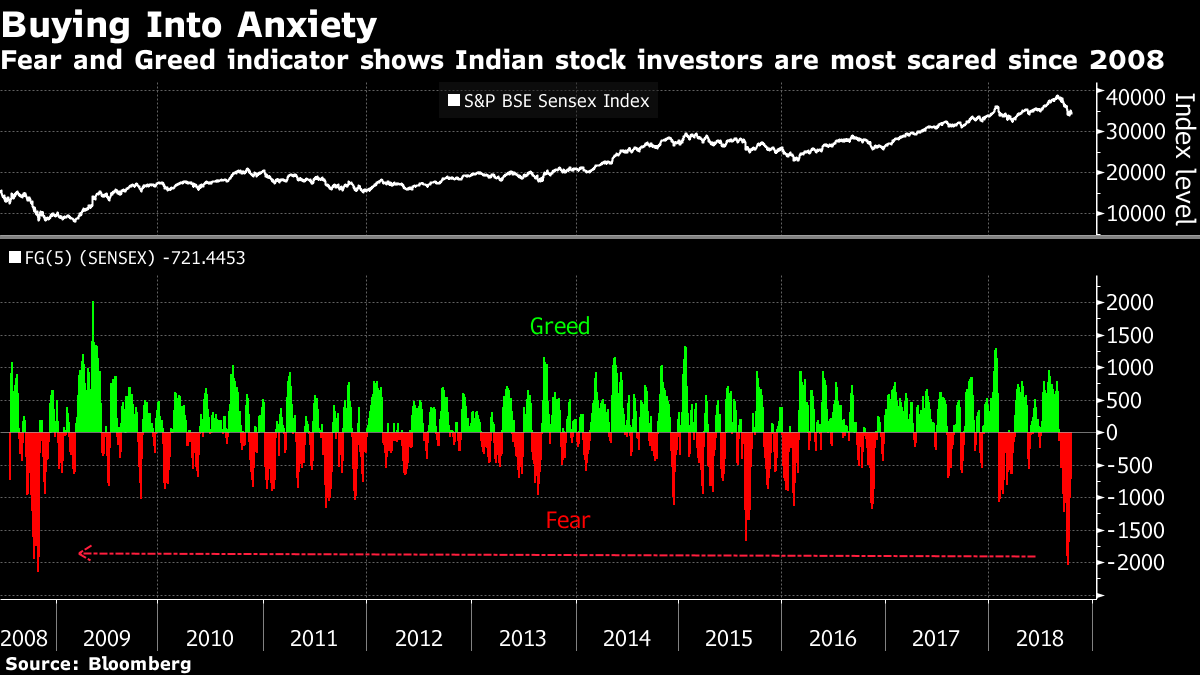

The Avendus Capital Alternate Strategies’ Absolute Return Fund is increasing investments after benchmark indexes slumped due to surging oil prices, higher borrowing costs and defaults at a local shadow lender. The intensity of selling for the S&P BSE Sensex Index last week hit levels not seen since the height of the 2008 financial crisis. That’s pushed Avendus to start unwinding its cash position, which reached a record 65 percent of assets in September.

“We are deploying our cash as this market is poised for a short-term rebound,” said Andrew Holland, chief executive officer at Avendus, in an interview last week. “We have turned the most bullish in at least the past six months.”

Avendus Absolute Return Fund was set up in March 2017 and is the nation’s biggest hedge fund with $600 million in assets. Holland declined to say how much cash had been deployed as of last week.

“Whether this rebound will be sustainable will depend on the intensity of the global factors,” he said. “We will continue to deploy cash into every stocks decline as long as there are no structural problems.”