New Delhi: India’s crude oil imports from Russia are set for a steep decline in December, with arrivals expected to slide to nearly 1.0 million barrels per day (mbpd)—almost half of the 1.8 mbpd in November, according to market analysts.

This sharp fall comes in the wake of sanctions imposed by the US Treasury’s Office of Foreign Assets Control (OFAC) which targeted two specific Russian oil majors—Lukoil and Rosneft. Announced on 22 October, the sanctions took effect from 21 November and have already begun reshaping trade patterns.

“Based on current loadings and voyage activity, we expect December arrivals to be in the range of 1.0 mbpd. This aligns with our earlier view that, in the short term, Russian flows could ease toward approximately 800 thousand barrels per day (Kbpd) before stabilising,” Sumit Ritolia, lead analyst for refining and modelling at Kpler, a global trade intelligence firm that tracks real-time energy flows, told ThePrint.

But the slump, Ritolia emphasised, is a temporary setback driven largely by sanctions-related disruptions rather than any shift in India’s strategic preferences. “As long as broader secondary sanctions aren’t applied, India is likely to continue importing Russian crude through more indirect and less transparent routes,” he said.

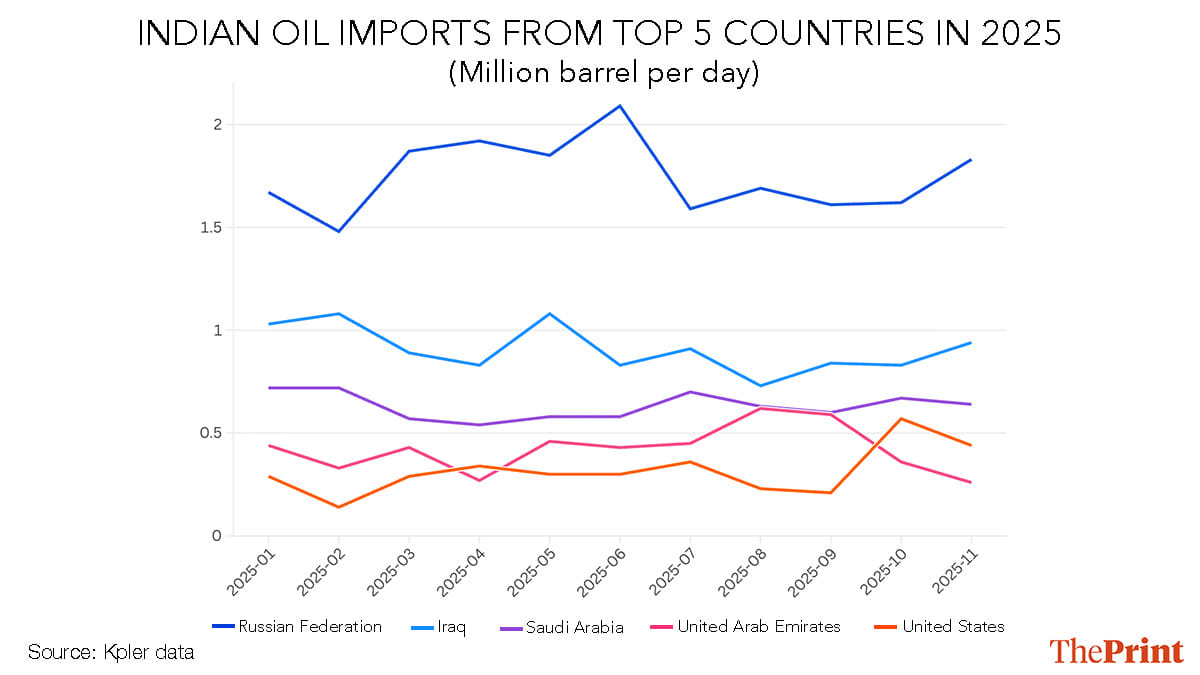

The Kpler data shows that Indian oil imports from Russia for November remained strong. Imports hit about 1.8 mbpd—the highest since June 2025—and accounted for more than 35 percent of India’s total crude basket.

According to Ritolia, the oil flows were even higher, touching nearly 1.9-2.0 mbpd in the weeks leading up to the 21 November sanctions deadline, as Indian refiners rushed to turn around vessels and lock in discounted barrels before restrictions kicked in.

Private Indian refiner Nayara Energy, which depends exclusively on Russian crude, imported nearly 400,000 bpd from September to 27 November. Rosneft owns 49 percent stake in Nayara Energy, formerly known as Essar Oil Limited.

India’s heavy reliance on Russian oil has been shaped by economics as much as geopolitics. Moscow’s substantial discounts—offered as a buffer against Western sanctions after the 2022 Russia-Ukraine war—made Russian oil far more competitive than other suppliers.

Ritolia said that both geopolitical signalling and cost considerations remain central to India’s position. It cannot be seen bending to US pressure, and Russian oil does continue to offer unmatched value.

Refiners shift to non-designated entities

According to Ritolia, Indian refiners that were earlier importing from designated companies Lukoil and Rosneft, have begun shifting their oil purchases to non-designated Russian companies using opaque trading channels for spot purchases.

“Indian buyers have already started to shift towards non-designated Russian entities and opaque trading channels to keep Russian oil flowing,” he said.

Non-designated entities could be subsidiaries of firms like Lukoil or Rosneft, or they could be independent companies with stakes in different oil fields. It is very hard to determine final ownership, as corporate structures around Russia’s crude movements have become very opaque, explained Ritolia.

While Russian oil itself is not sanctioned, certain entities are. It gives Indian buyers room to navigate through compliant suppliers as long as discounts remain attractive.

Ritolia said that Russian exporters too are adjusting rapidly to the situation. “The cargo is being routed through ship-to-ship (STS) transfers near Mumbai, mid-voyage diversions, and longer multi-port routes aimed at preserving flows while widening discounts,” he added.

Broadening the supplier basket

To compensate for the softening of Russian oil imports, Indian refiners are boosting intake from a broader mix of suppliers.

Purchases from Iraq, Saudi Arabia, the United Arab Emirates, Kuwait, Argentina, Colombia, Guyana and North American suppliers are expected to rise in the coming weeks, said Ritolia.

The diversification is already visible in trade data. India imported 64 Kbd from Ghana and the Republic of Congo in November—the highest in 24 months and the first such inflow in three months, according to Kpler data.

Kuwait, too, saw a dramatic surge in oil exports to India, with shipments jumping 176 percent in November to 178 Kbd, the highest in a year. Other suppliers including Iraq, Nigeria and Colombia also recorded an increase.

Ritolia added that this widening of supplier pool is not a sign of India stepping back from Russian crude but rather a strategic reshuffling to maintain flexibility.

(Edited by Viny Mishra)

Also read: On agenda for Putin’s New Delhi visit: S-400s, small nuclear reactors, oil trade amid US sanctions