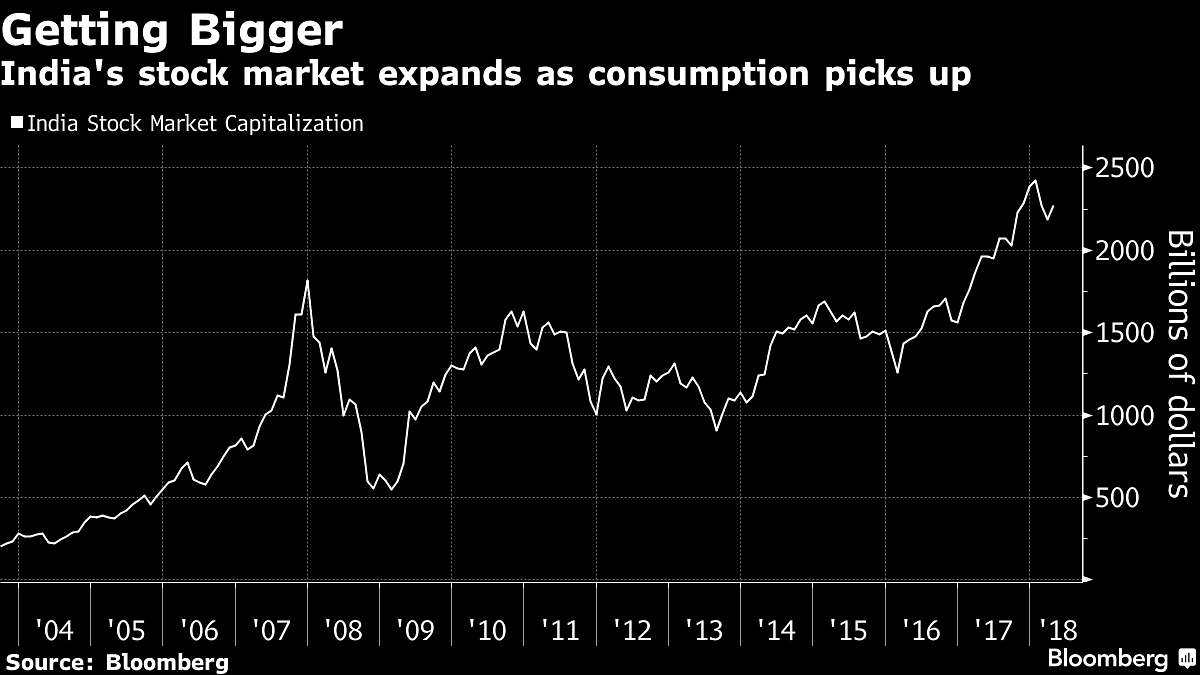

The country’s market value may have doubled to $2.3 trillion in five years but company earnings show only few have reaped the growth.

Sustained 7 percent-plus economic growth may sound like a great recipe for stock-market returns, but investors looking at a country like India still need to do their homework.

A quick look at the automobile industry shows why. While India’s vehicle production has climbed about 25-fold over the past quarter century, the two major players in the market as of the mid-1990s — Hindustan Motors Ltd. and Premier Ltd. — barely register today. It’s a cautionary tale that a rising economic tide doesn’t necessarily lift all boats, highlighted by local-market veteran Prateek Agrawal.

“Growth doesn’t mean that every stock you touch turns to gold — only a small section of companies have managed to actually participate in the India story,” Agrawal, chief investment officer at ASK Investment Managers Pvt. in Mumbai, said in an interview last week. “We always scan for firms that have grown consistently.”

While India’s market value has nearly doubled over the past five years, to $2.3 trillion, there aren’t many companies with significantly sized earnings. Fewer than 10 percent of the more than 5,000 companies had annual net earnings of at least 1 billion rupees ($15 million) on average in that period, data compiled by Bloomberg show.

Lacking much of an export base — a status likely to remain for some time to come — and with banking-sector troubles restraining private-sector capital spending, India’s consumption story is the most convincing to Agrawal, who’s been analyzing or investing in markets for almost a quarter century.

As much as about 75 to 80 percent of the 133 billion rupees that Agrawal oversees in five main portfolios are companies tied to consumption — such as automakers, financiers of home and tractor purchases, retail-sales products and white-goods makers. Each portfolio has holdings of about 20 stocks; the combined universe is not more than 75.

“We are very bullish on the India consumption theme, and it will get some tailwind ahead of the national elections next year as the government focuses on boosting rural incomes,” he said. ASK Investment anticipates average earnings growth for NSE Nifty 50 Index members to accelerate to as much as 18 percent in the financial year that started last month, from about 12 percent in the previous fiscal year.

-Bloomberg