India’s annual budget has brought home to markets the unpleasant reality of fiscal dominance, in which the central bank ends up prioritizing deficit financing over its primary function of controlling inflation.

That’s a risky situation to be in. As a former central banker has described it, fiscal dominance is “A Theory of Everything in India” — or at least everything that goes bad eventually, like during the Federal Reserve’s 2013 “taper tantrum” when rupee-denominated assets were heavily sold.

While consumer prices aren’t currently a concern, a tumbling currency is. Foreigners are dumping both local stocks and sovereign debt. Neither equity nor bond investors will likely change their mind after going through the government’s latest spending priorities and borrowing plan.

Although the budget didn’t mention US President Donald Trump, his 50% tariffs on Indian exports did cast a shadow. Prime Minister Narendra Modi’s gamble on domestic tax cuts to blunt the edge of Washington’s actions have left his administration with a serious revenue hole. There is some effort to rein in public spending, but the upshot is this: To make the numbers add up, the Modi government intends to borrow a record 17.2 trillion rupees ($187 billion) by selling bonds. With debt vigilantes punishing fiscal adventurism even in an advanced economy like Japan, there is a danger of spooking investors just when they needed to be calmed.

Enter fiscal dominance. The Reserve Bank of India will have to buy a big chunk of the 18% jump in borrowing from the market. If it doesn’t, interest costs may go up — not just for New Delhi but also the 28 state governments that have their own resource crunch. That isn’t all. Team Modi is expecting 3.2 trillion rupees of dividends from state-owned financial institutions. The RBI, which paid a record 2.7 trillion rupees in May 2025, will be on the hook for another bumper harvest.

Even before Sunday’s budget, the bond market was on edge, with the 10-year yield rising to 6.73% last week, the highest since March 2025.

Neither the cut in the consumption tax, nor an income-tax relief for the middle class in last year’s budget, has moved the needle on the all-important nominal gross domestic product, the basis of tax revenue and corporate profits. Foreign investors have pulled a net $14 billion out of local stocks over the past year. Even net foreign direct investment, a more patient source of capital, has turned negative.

Market participants who worked Sunday, hoping to find some policy initiatives that would reignite confidence, got a rude shock: an increase in the transaction tax on trading derivatives, where the reverse was expected.

Bond and currency traders are unlikely to take a more cheery view. New Delhi is switching its fiscal target from the annual budget deficit to reducing its debt-to-GDP ratio over the next five years. But not only is nominal GDP slowing, tax collections aren’t responding well to economic activity. “We do not expect significant progress on debt reduction,” Christian de Guzman, a Moody’s Ratings analyst, said after the budget.

Other than that, the budget was mostly about feel-good homilies, like developing “full-stack” intellectual property in semiconductor manufacturing. That’s still a long way off. There was also a mention of rare-earth corridors — along the seaboard — to reduce India’s dependence on China for permanent magnets, supplemented by tax cuts on the imported equipment needed for mineral processing. But without a plan to negotiate the environmental tensions implicit in digging up the coastline, there’s no point in even thinking of the announcement as policy.

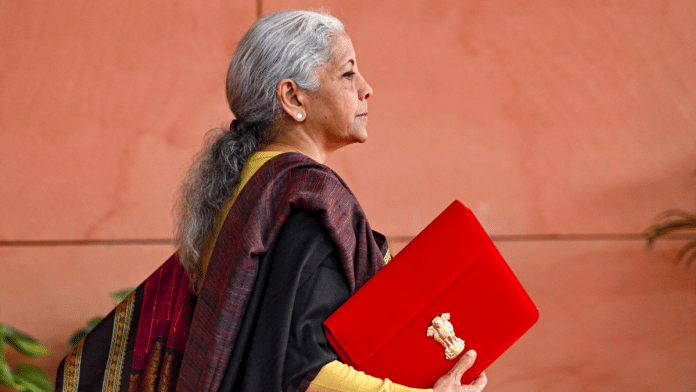

Climate activists face a more pressing disappointment. Finance Minister Nirmala Sitharaman cut the allocation for pollution control. She clearly wasn’t moved by the warning from Gita Gopinath, a former top International Monetary Fund official, that the foul air of Indian cities is more damaging than any tariff imposed so far — and urging her home country to tackle it on a “war footing.”

A 21-year tax holiday to any company using India to offer cloud services globally may accelerate the plans that the likes of Alphabet Inc., Microsoft Corp. and Amazon.com Inc. have already announced. But their data centers, through which they want to capture a billion internet users’ AI queries, will only guzzle power and water without creating too many new jobs.

On employment and labor productivity, India’s two biggest challenges, the budget appears to be moving away from a previous internship program that has bombed. Instead, it promised to set up “content creator labs” in schools and colleges. That’s just as well. Why should the youth while away their hours doing meaningless “timepass,” as they say colloquially, when they could be making reels — or adding to AI slop?

As New York University professor Viral Acharya, a former Indian central bank deputy governor, has pointed out, fiscal dominance hurts India in several different ways. For instance, to create the elbow room for a 9% increase in infrastructure investment, New Delhi will need to twist the arms of state-owned firms for higher dividends. That could push them to delay their own capital expenditure and hiring plans.

As investors start adding up the numbers, they may not like the math that stares back at them.

This column reflects the personal views of the author and does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Andy Mukherjee is a Bloomberg Opinion columnist covering industrial companies and financial services in Asia. Previously, he worked for Reuters, the Straits Times and Bloomberg News.

Disclaimer: This report is auto generated from the Bloomberg news service. ThePrint holds no responsibility for its content.

Also read: India’s love-hate relationship with foreign capital holds it back. What Budget 2026 hints at

It is normal for socialist India to spook investors.

What’s new from Andy mukherjee it is always doom and gloomy from him for the last …years