A long-held belief of analysts in India is that the economy is supply-constrained. Demand isn’t even worth a footnote, while a temporary squeeze in the onion market deserves obsession because it could be inflationary.

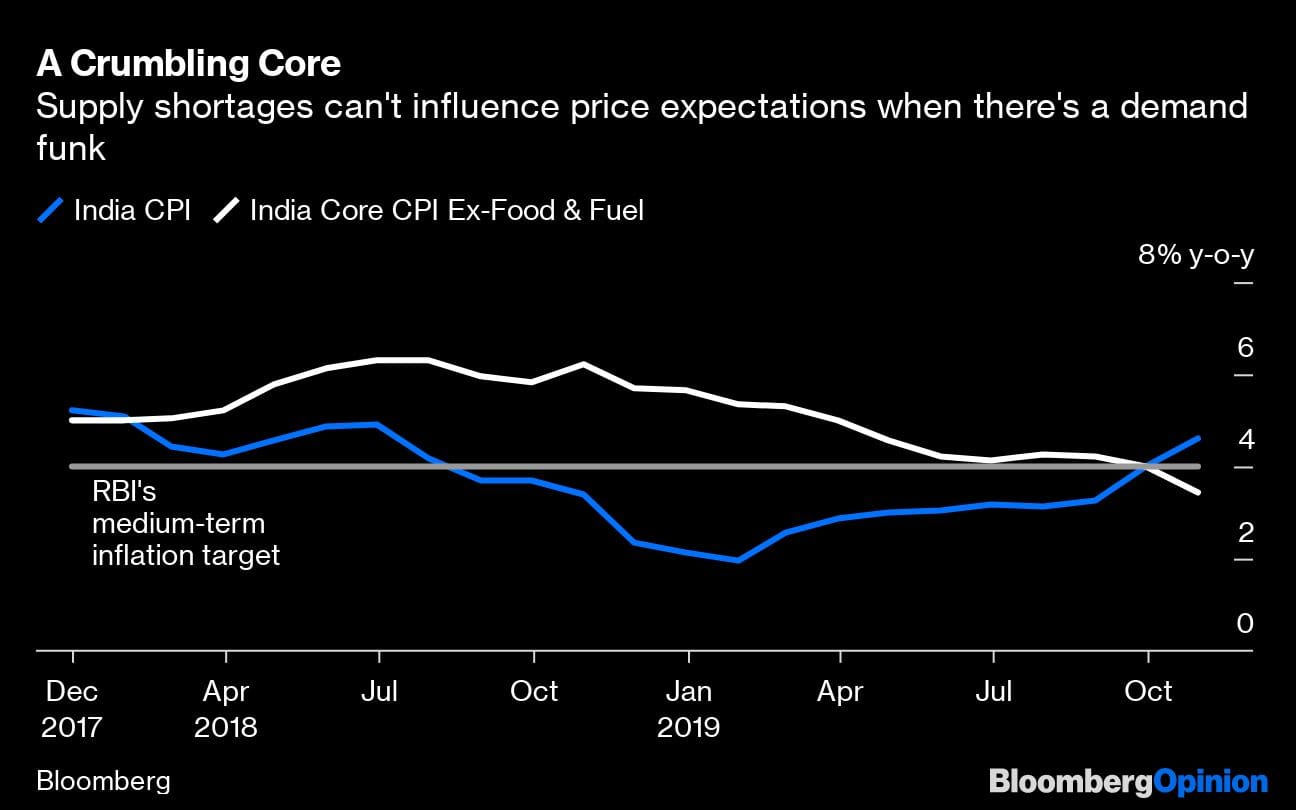

It’s increasingly obvious that this view is outdated. In October, inflation quickened more than expected to 4.62% because of, yes, an onion shortage. Yet core inflation, which strips out volatile commodity prices, slumped to 3.4%, the lowest since the current price series began in 2012.

One explanation is that people have less money to spend on other things after buying vegetables. Yet, as Mark Williams, chief Asia economist at Capital Economics puts it, a 1.1 percentage point drop in core inflation over three months is rare. “This weakness isn’t solely due to spending being diverted,” he says in a research note.

It’s a demand funk. Until about 2012, temporary supply shocks dominated. The starting point of production and transport is hydrocarbons, and India needs to import most of its crude oil. The government also has to pay farmers to feed 1.3 billion people. Because of the outsize dominance of food and fuel in consumption, price stability is ephemeral: A few months of high inflation could drastically impact consumers’ expectations.

Also read: Consumption expenditure fall hints at 10 percentage point rise in poverty between FY12 & FY18

Any gap between (runaway) headline and (soft) core inflation would typically close with the core moving toward the main indicator. But something has changed. The supply-dominated headline number is now more likely to shift toward the demand-led core figure, JPMorgan Chase & Co. research has shown. Slack in the economy — of which there’s plenty — has become much more important than a transient disruption in commodity supplies.

Therefore, despite consumer prices rising more than the central bank’s 4% target for the first time since mid-2018, the new consensus is that the economy is deflation-bound. That’s the reason most observers are shrugging off the October inflation rate as any kind of a speed limit on the central bank’s rate cuts.

Whether the five rate reductions this year will lift demand is a different story. Banks aren’t passing lower borrowing costs down the line. As of August, their weighted average lending charge was almost double the Reserve Bank of India’s repurchase rate. This record spread is a crisis-like situation, Credit Suisse AG strategist Neelkanth Mishra says.

It’s also a supply-side bottleneck, except more durable. The input missing from the production process is trust. In September last year, when I termed the collapse of infrastructure financier IL&FS Group as India’s mini-Lehman moment, lending by shadow banks was growing by 24%. It’s now collapsed to 7% because everyone’s worried about who will go bust next. Nonbank financiers’ funding sources have dried up. Meanwhile, state-run banks are dogged by $200 billion-plus in bad corporate loans, no matter how generously a cash-strapped government tries to recapitalize them.

Also read: Unreleased NSO survey data shows 3.7% fall in consumer spending for first time in 4 decades

Nomura’s Sonal Varma calls it a “triple balance sheet problem” shared by banks, shadow lenders and India Inc. In her estimate, GDP expansion may have slowed further to 4.2% in the September quarter from a six-year low of 5% in the previous three months. The potential growth rate, she says, is around 6.5%. The longer the deleveraging cycle lasts, the bigger the risk that this potential could ebb further.

How fast an economy can grow is measured from the supply side — by slapping together labor and capital inputs as well as productivity growth. But it’s here that demand is emerging as a constraint. Consumer spending fell in real terms in 2017-18, its first decline in four decades, the Business Standard reported Friday, citing an unreleased official survey. As Rathin Roy of the New Delhi-based National Institute of Public Finance and Policy has been arguing, the economy grows by producing what 150 million of the top income earners consume. When it comes to an inexpensive shirt that India’s workers can make for their billion-plus fellow citizens, Bangladesh does a better job.

India balked at the last minute from joining the 16-nation Regional Comprehensive Economic Partnership trade agreement because it can’t compete against China in making everyday things. Roy’s call for a meaningful minimum wage for workers in all Indian states rich and poor shows a sensible way to create sustainable demand. Make things well enough for a swelling home market, and eventually India will supply them to the world.

Satisfying the needs at the vast bottom of the socioeconomic pyramid will reduce slack. In an emerging market, confidence of entrepreneurs comes not from killer innovation but from knowing that producers can sell what they make. An undemanding India hurts everyone. – Bloomberg

. OMG Onion! It is every where. Now its shortage leads to inflation in India. What a country. Bet BIMARU states have not had enough yet. Sheesh, what a sick issue.

Let them eat the cake, ride maruti and use jio said the chaiwala.

India does have every thing, land is beautiful,products are fine,architectures are magnificent,but neither the people in power nor in opposition are okay, wrong policy, commercialization in favor of political gains have made this country importer based land from an exporter of unparalleled qualities,nothing could bring us finest economy,which could dictate on the dollaps of dollars,even could cross the present rates of dinars…… policy maker must thing on how to thrive by co-operative manner through encouraging local manufacturer with a model of global demand.