New Delhi: Delhi’s buzzing beer market is not just about the big names. The latest sales figures, from 1 July 1 to 20 September, show that the capital’s beer-drinkers prioritise strong brews over brands, ThePrint has found.

The data, shared by Delhi government sources, listed the top 20 best-selling beers based on the number of bottles sold and showed that most of them belong to the “strong”, “super strong” or “extra strong” categories.

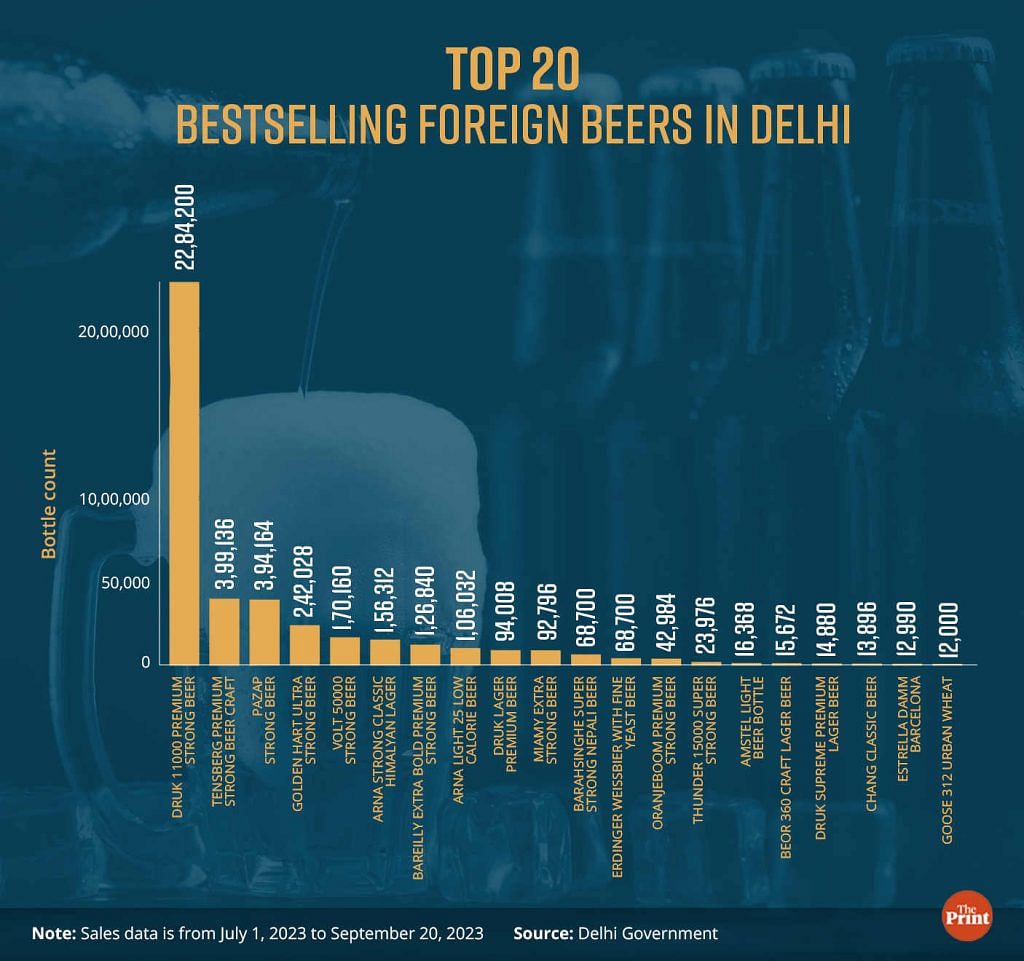

Tuborg’s Strong Danish beer is the best-selling Indian-made beer in Delhi, the data shows, with 41 lakh bottles sold during the 1 July-20 September period. Druk’s premium strong beer, imported from Bhutan, is the most popular foreign beer brand in the city, with 23 lakh bottles sold.

Other top brands on the list include stalwarts Kingfisher, Budweiser, and Bira 91, as well as a host of regional labels such as Medusa, Rockberg, Bee Young, Godfather, Bad Monkey, and Lone Wolf, with their stronger offerings performing best.

This trend extends to foreign-made beers, where, aside from Druk, the strong beers of brands such as Bareilly, Volt, and Golden Hart, top the list.

Vinod Giri, director general of the Confederation of Indian Alcoholic Beverage Companies (CIABC), told ThePrint that the strong beer category dominates the Indian market, constituting about 80 percent of beer sales in the country.

On the other hand, beers that are not classified as strong, such as lagers, wheat ale, and citrus-infused varieties, have lower demand.

For example, the data for Delhi showed that Druk’s lager beer sold only 14,880 bottles during the period, against the 22.84 lakh bottles of the brand’s “premium strong beer”.

Similarly, in the domestic list, popular brands such as Bira only had their extra strong beer on the top 20 best-selling list, while their citrus-infused beers and other varieties found no mention.

Describing the trend as “a bang for one’s buck”, Rahul Singh, former president and trustee of the National Restaurant Association of India, said that the affordable pricing of such beers plays a major role in their popularity.

In addition to the affordability, the evolving landscape of drinking culture in India is also noteworthy. The rise of innovative cocktails and unique drinking experiences is reshaping consumer preferences, as seen in the growing popularity of craft cocktails that blend local flavors with global trends.

“Apart from the affordable price, those who frequently buy these beers are not conscious of the taste. What they need is a strong beer just to get a kick out of it,” Singh told ThePrint. For such consumers, he added, brand is not a concern.

Also Read: ‘Can’t bottle or keg, sell to other businesses’ — what’s holding back Delhi’s microbrewery scene

Regional players trump national giants in Delhi

The three largest brewers in India — UB-Heineken, Carlsberg, and Anheuser-Busch InBev — control 85 percent of the country’s beer market, but in Delhi they have a smaller share than regional players, according to CIABC’s Giri.

“The shares of small regional players are disproportionately high in Delhi. Kingfisher, which has traditionally dominated the Delhi market, is no longer the largest brand, which could be partly due to a deliberate pullback,” he noted.

Giri also highlighted a shift in the retail landscape. He said that while private outlets also operated earlier, now all retail sales are happening through government vends.

“While the overall revenue figures may not indicate a fall, there are changes in brand availability on shelves and some popular brands seem to be not sufficiently available, thus limiting consumer choice,” he said.

Emphasising the need for a balanced excise policy, Giri said that the major players tend to stay out of markets where the sale of liquor is executed through government vends, citing the example of Tamil Nadu, where popular brands such as Budweiser and Kingfisher are not widely available.

According to Giri, the Delhi government needs to come out with a long-term excise policy that includes private retail along with government retail in order to encourage competition and improve demand-driven availability of products.

“The current policy is a stop-gap measure. It’s being extended from time to time just to keep business going. It is not a planned excise policy design to work for all stakeholders. In absence of a long-term excise policy, companies cannot make long-term plans. They need clarity on the policy front,” he told ThePrint.

He added: “Since Delhi’s operating margins anyway are not great, companies with a pan-India footprint have the option of prioritising other markets for supplies if faced with an uncertain regulatory environment in Delhi.

(Edited by Richa Mishra)

Also Read: Too unsafe for a nightlife? Why efforts to make Delhi a 24/7 city are proving slow-starters