New Delhi: The central government’s shift to a new Just-in-Time project management and accounting system since 2021 has led to substantial savings, reduced money lying idle and unspent, and brought greater transparency and accountability for central ministries as well as state governments.

The Single Nodal Agency (SNA) model was launched by the government in July 2021 for Centrally Sponsored Schemes—funded by the Centre and states and implemented by the latter.

Under the SNA model, each state has to appoint a nodal agency for each Centrally Sponsored Scheme. This agency then is the only one that will receive all the funds from both the Centre and the state for that particular scheme. All the implementing agencies have to spend from this account.

This system has also meant that the Centre can transfer money to the states for a particular scheme exactly when they need it, or ‘just in time’, rather than having to park funds in bank accounts for the full financial year and risk having large portions lying unused.

“The main benefit of this system is that it allows the disbursement of money only when there is actual need for it,” explained Radhika Pandey, an associate professor at the National Institute of Public Finance and Policy. “Earlier, money used to sit idle in state governments’ bank accounts. Now that is no longer the case. There is little scope for wastage.”

This, Pandey said, was also leading to savings for the government since the money goes for the intended purpose only, at the time that it is needed.

Such Just-in-Time models are a commonly accepted practice in business management, where goods are produced only in response to real demand by customers rather than in anticipation of future orders.

In fact, Finance Minister Nirmala Sitharaman Saturday said that the SNA system had led to a saving for the Centre of Rs 11,000 crore since 2021-22. She added that the Treasury Single Account system—which is a similar accounting model for autonomous bodies—had led to an additional saving of Rs 15,000 crore since 2017-18.

The Treasury Single Account System (TSA), a system in autonomous bodies, has alone saved more ₹15,000 Crore in interest costs since 2017-18. This has been done without any additional burden on the taxpayers.

Single Nodal Agency (SNA) has saved more than Rs. 11,000 Crore since… pic.twitter.com/znFKYwWNKC

— Nirmala Sitharaman Office (@nsitharamanoffc) March 1, 2025

As of now, the minister said that the unspent balances in more than 15 lakh bank accounts had been consolidated into just 4,500 nodal bank accounts, which greatly enhanced the transparency of government finances.

“Just-in-Time fund release has made sure we don’t borrow much more than we need,” Sitharaman said, while speaking at the 49th Civil Accounts Day celebrations Saturday. “We have already shown one concrete measure through which we know that if we manage Just-in-Time release, I don’t need to borrow and keep borrowing just to get them parked somewhere.”

Also Read: India’s manufacturing growth dips to 14-month low in February due to cooling demand

50% of unused funds linked to 6 schemes

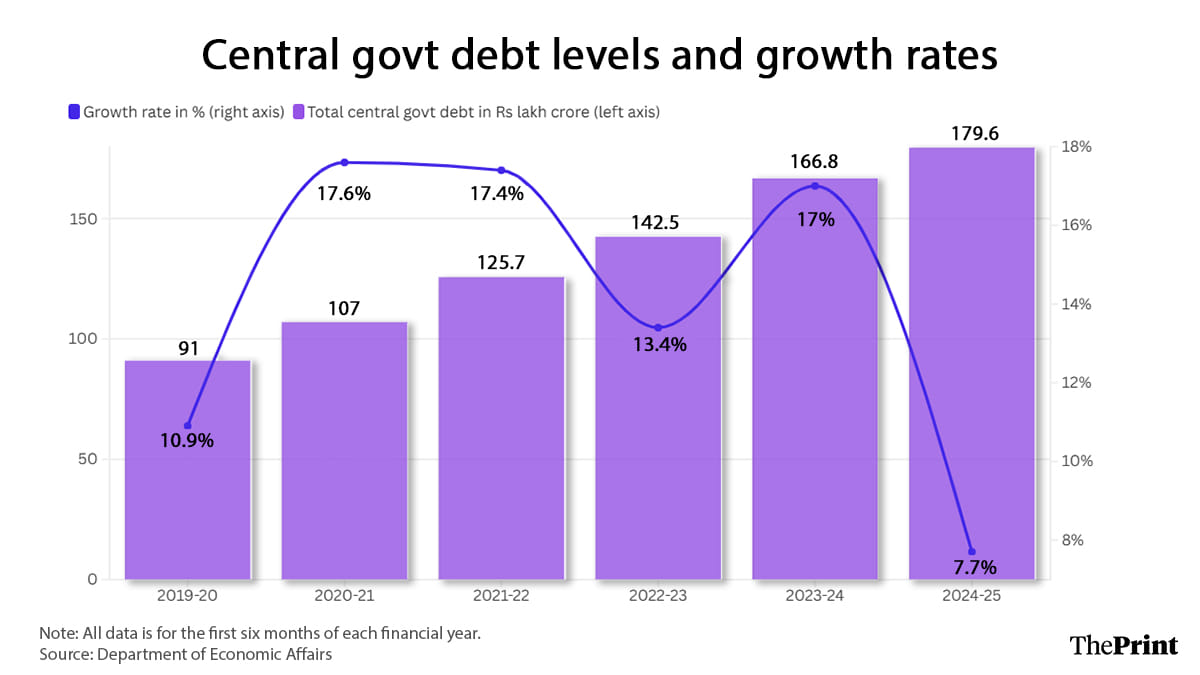

The growth rate in the central government’s debt levels has certainly slowed down significantly in this financial year, data from the Department of Economic Affairs shows.

The COVID-19 pandemic had led to a spike in India’s debt levels, with the Centre’s total debt jumping 17.6 percent to Rs 107 lakh crore by the first half of financial year 2020-21. It then grew another 17.4 percent to Rs 125.7 lakh crore by the first half of 2021-22.

This figure was at Rs 179.6 lakh crore in the first half of 2024-25, the latest period for which the government has released data. It represents just a 7.7 percent increase over the same period of the previous year.

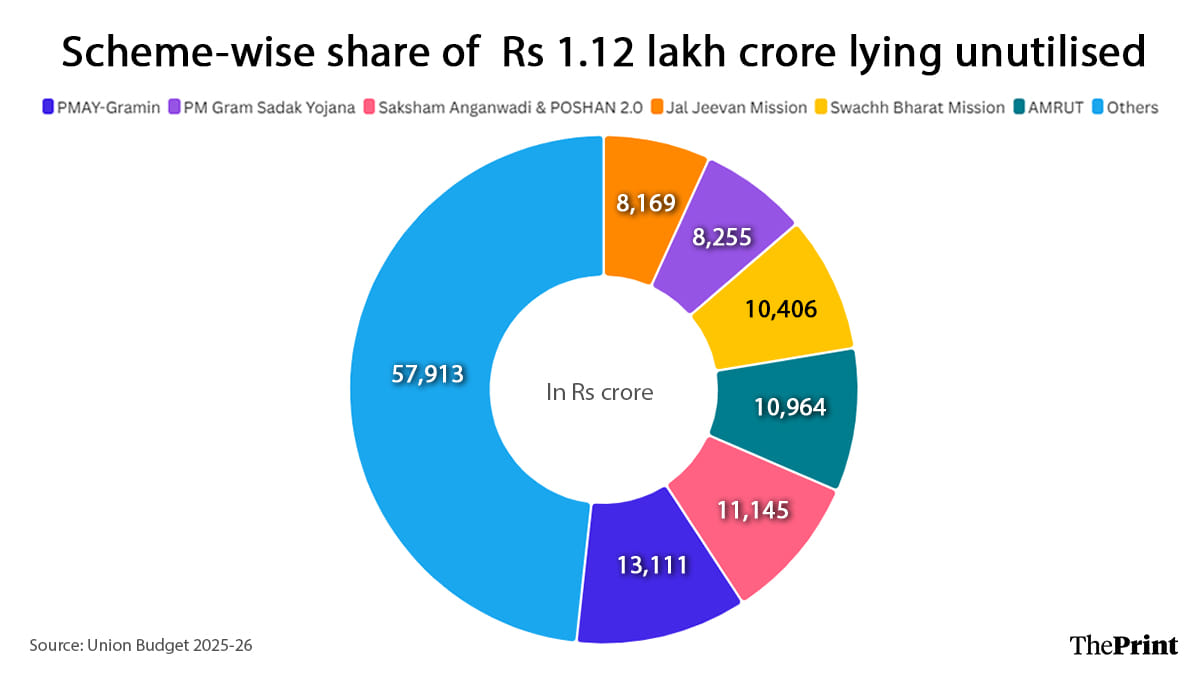

The Union Budget presented by Sitharaman on 1 January this year also, for the first time, contained disclosures on the status of these SNA accounts. The data shows that there are Rs 1.19 lakh crore of funds lying unused in SNA bank accounts of states.

The data further shows that more than 50 percent of these unused funds are lying in the accounts pertaining to just six Centrally Sponsored Schemes—Pradhan Mantri Awas Yojana – Gramin (10.9 percent), Saksham Anganwadi and POSHAN 2.0 (9.3 percent), AMRUT Urban Rejuvenation Mission – 500 Cities (9.1 percent), Swachh Bharat Mission (8.7 percent), PM Gram Sadak Yojana (6.9 percent), and Jal Jeevan Mission (6.8 percent).

However, apart from the realised gains from the implementation of the SNA model, the government and the Reserve Bank of India have also had to face an unexpected outcome from this need-based approach, Pandey explained.

“An unintended consequence of this is that it is having implications for the banking sector’s liquidity,” she said. “A potential source of comfort for bank liquidity was that this Centrally Sponsored Scheme money used to sit in public sector bank accounts. That is no longer there, so the RBI has to take more aggressive measures to boost liquidity.”

The level of liquidity in the financial system affects the ability of banks to lend money, with a shortage leading to constrained credit outgo.

(Edited by Sanya Mathur)

Also Read: Modi govt’s bet on its PSUs is failing. Their stocks are down 30% in 5 months against 13% Sensex dip