New Delhi: The government of India, having found that its bet on sovereign gold bonds (SGBs) had led to a staggering 930 percent increase in its liabilities on this borrowing by 2023-24, has been scrambling to contain this burden by reducing import duties on gold and stopping the fresh issuance of such bonds.

An analysis of government trade data and its budget documents shows that while the Centre’s liabilities on SGBs have been rising rapidly, its receipts from these bonds have been small in comparison.

The bonds haven’t been able to slow India’s gold imports either, which had been one of the stated aims of the SGB scheme.

The reasons for the ballooning liabilities, which have the potential to grow to Rs 1.12 lakh crore by 2032, going by market estimates, are partly the design of the SGB scheme itself and partly the government’s own actions, such as its increase of gold import duties to 15 percent by July 2022.

In all this, ThePrint has learnt that there is displeasure in the Prime Minister’s Office (PMO) and the Union Ministry of Finance over the design of the SGB scheme.

The government launched the SGB scheme in 2015, under which people could buy gold bonds instead of physical gold. They earned returns from this investment if the price of gold increased over the five-year minimum period they had to hold the bonds. The full maturity period for the bonds is eight years. In addition, they earned interest at the rate of 2.5 percent on their investments, paid out every six months.

When asked during a post-Budget press conference on 1 February this year whether the government was discontinuing the SGB scheme, Finance Minister Nirmala Sitharaman said: “Yes, in a way.”

Economic Affairs Secretary Ajay Seth, in the same press conference, provided more details on why the government was cooling off on SGBs. “The recent experience has been that this (SGBs) has been a fairly high-cost borrowing for the government. As a result, the government has chosen not to follow that path,” Seth explained.

The government has not issued any SGBs in 2024-25, and the budget documents show it will not be issuing any in 2025-26 either.

“The government’s liabilities on gold bonds have grown far faster than the income it has generated from them, and this liability will carry on till at least 2032, so there is some discomfort in the PMO and the Ministry of Finance over the design of these bonds,” a senior government official in the know of the matter told ThePrint.

How the govt bet on gold bonds

The stated aim of the SGB scheme, as laid out in a government communication in 2015, was that it would help in reducing the demand for physical gold by shifting a part of the physical gold purchased every year to gold bonds.

“Since most of the demand for gold in India is met through imports, this scheme will, ultimately, help in maintaining the country’s current account deficit within sustainable limits,” it stated.

The release added that the benefit to the government would be in lower costs of borrowing, since the 2.5 percent interest to be paid on SGBs would be much lower than the 8-9 percent rate of interest on other forms of government borrowing.

However, all of this also hinged on gold prices remaining stable for a long period of time. The way the scheme was designed, the government would not only have to pay 2.5 percent interest on the gold bonds, but would also have to repay the bond holder at the current price of gold, not the price at which the bonds were bought.

“The assumption in the government at the time was that the price of gold would increase, but at a low and manageable level and so the government’s liabilities on these bonds would be contained,” a former government official, who had been in the finance ministry during the early years of the SGB scheme, told ThePrint on the condition of anonymity.

In fact, the government also went several steps further in trying to make SGBs more enticing. In 2017, for example, it significantly hiked the maximum amount of bonds that people could buy, from 0.5 kg worth of gold to 4 kg worth of gold.

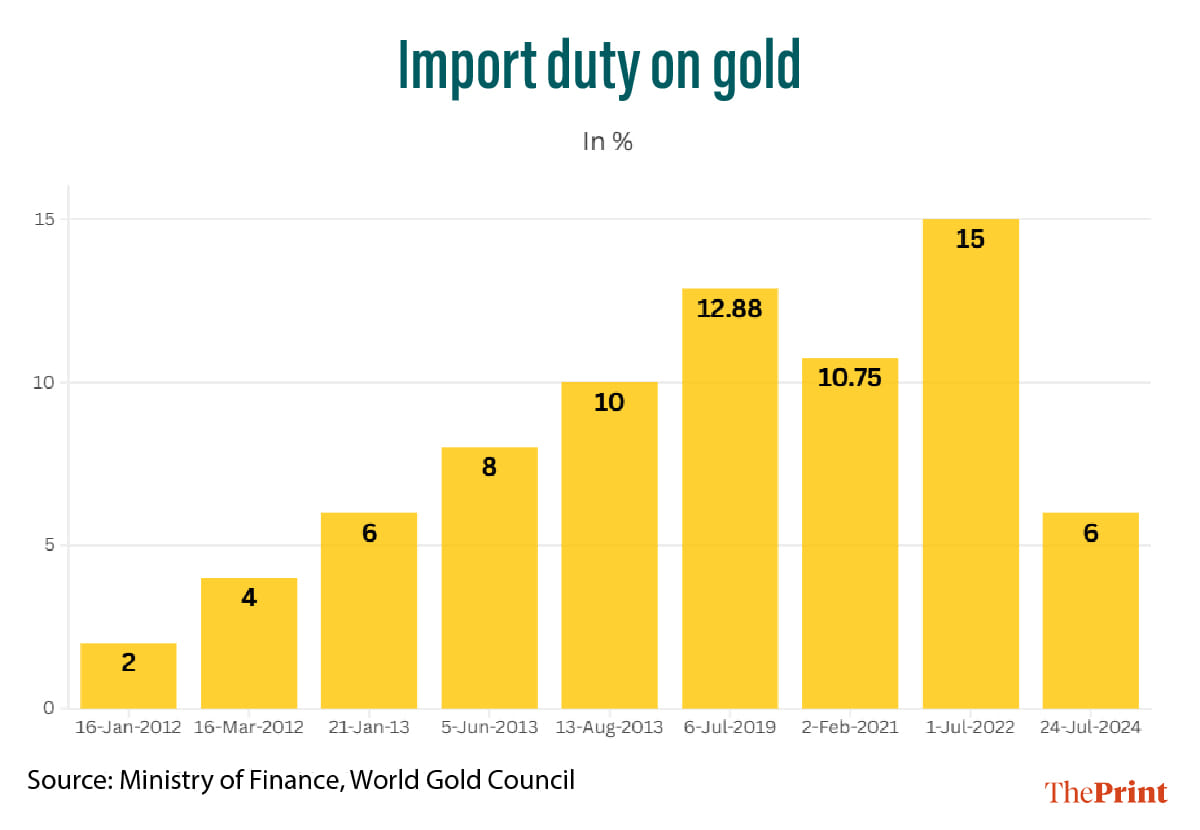

The government also hiked the import duty on gold significantly. The first hike was in July 2019, when the import duty was raised to 12.88 percent from 10 percent. It was subsequently brought down to 10.75 percent in the February 2021 Budget, but was then again hiked sharply to 15 percent in July 2022. The thinking was that making imported physical gold more expensive would encourage people to buy gold bonds.

However, in a bid to check the rising price of gold, and the resultant growth in its liabilities, the government in July 2024 slashed the import duty on gold to 6 percent.

The RBI has also announced the dates for premature redemption of the gold bonds so far issued.

How the SGB bet failed

However, as it turns out, a combination of these import duty hikes and global uncertainty meant that the price of gold has risen far faster over the last few years than the government bet on.

So, while the price of 10 grams of gold stood at Rs 31,640 in March 2019, just 1.3 percent higher than the year before, it jumped to Rs 42,450 by March 2020—a 34 percent increase in just one year.

Since then, uncertainties around the Russia-Ukraine war and the Israel-Palestine conflict have further driven up gold prices, compounded by the government’s decision to impose a 15 percent import duty on gold in July 2022.

The price of gold is currently at about Rs 84,450 per 10 grams, more than 2.7 times what it was in March 2017.

Although one of the stated aims of the SGB scheme was to curtail gold imports, this has not come to pass. Gold imports rose to $46.2 billion in 2021-22 from $27.5 billion in 2016-17. They have since fallen, to $37.4 billion in 2024-25, but are still far higher than when the SGB scheme was launched.

The rising price of gold has also meant that the government’s liabilities on account of the SGB scheme have ballooned. Where its liabilities stood at Rs 6,664 crore in 2017-18 on account of this scheme, this figure stood at Rs 68,598 crore by 2023-24—a whopping 930 percent increase, budget documents showed.

The total liabilities have fallen since, to Rs 60,566 crore in 2024-25, but that’s because no new bonds have been issued this fiscal. Similarly, these liabilities are budgeted to drop further to Rs 55,056 crore in 2025-26 as the government continues to slam the brakes on fresh SGB issuances.

With 61 gold bond tranches yet to be redeemed, the government’s liability is expected to rise to Rs 1.12 lakh crore by 2032, given the current gold prices, according to market estimates.

The govt’s bad bets continue

The other element of discomfort for the government, the senior government official told ThePrint, was that the receipts from these bonds have been far lower than the liabilities. This, he explained, was because the receipts are a factor of the price of gold at the time when the bonds were bought, and the liabilities are a factor of the price at redemption.

For the bonds so far issued, the price at which they were issued was far lower than the current price of gold.

“But now, that the price of gold has risen, and the receipts from these bonds could have been higher, the government has lost its nerve and stopped the bonds,” the official lamented. “It is unlikely that gold will continue to keep rising like this, and may even fall once the Russia-Ukraine war is resolved.”

If the government had issued bonds when gold prices were high and had to repay them later when the prices fell, then it might even have made a profit, albeit a nominal one counting the 2.5 percent interest rate, the official explained.

The original design of the SGB scheme had a provision for the creation of a Gold Reserve Fund, which would bear the risk of gold price changes.

“The benefit to the government is in terms of reduction in the cost of borrowing, which will be transferred to the Gold Reserve Fund,” the government’s 2015 communication had said.

However, now that no SGBs are being issued, there are no such “benefits” for the government, and so there’s no money left to transfer to this fund.

So, while the government was able to transfer Rs 3,552.80 crore to this fund in 2023-24, it was able to hike this amount substantially to Rs 28,605.73 crore in 2024-25. But, after a year of no new bond receipts, it has budgeted just Rs 697.19 crore to this fund, according to budget documents.

Any payments it needs to make over and above this will have to come from other resources that were not originally earmarked for this purpose.

(Edited by Nida Fatima Siddiqui)

Also Read: Modi govt rethinks Gold Monetisation Scheme, feels it’s too expensive, hasn’t achieved aim

Excellent news indeed!

The Modi government has sucked the Indian middle class dry over the last decade. High income taxes coupled with high GST rates have life difficult for the great Indian middle class.

But as far as the SGB is concerned, it seems that the Indian middle class has got the better of the Modi government. And that’s great news indeed!

Hope the Union government continues with further tranches of the SGB in the days to come.