Houston/New York: Indian Prime Minister Narendra Modi’s imminent visit to the U.S. energy capital is fueling speculation the second most-populous nation will further tap America’s shale gas bonanza.

Modi is scheduled to address upwards of 50,000 people at a sold-out event at Houston’s NRG Stadium on Sept. 22 that’s billed by organizers as the largest-ever turnout for a foreign elected leader on U.S. soil.

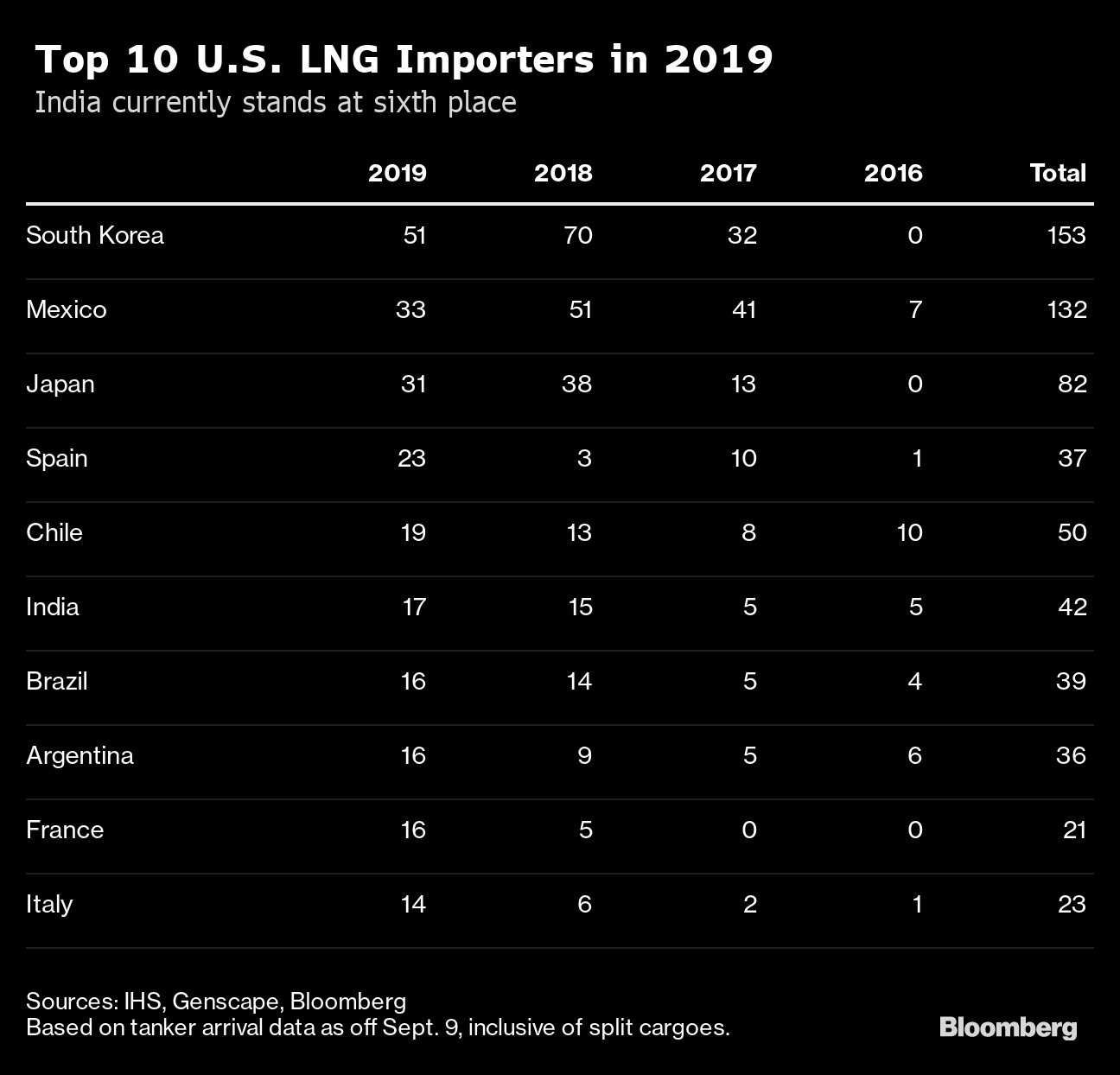

Energy investors, however, are keenly focused on what happens behind the scenes. A long-running trade war between Washington and Beijing has meant China hasn’t imported any American supply since February. The dispute has also put plans for new export terminals at risk. By contrast, India is open to making purchases, and the nation is already the sixth-largest buyer of U.S. liquefied natural gas.

India “has the potential to become an enormous market” for U.S. gas, said Charlie Riedl, executive director of the Center for Liquefied Natural Gas. “Based on the broader aspiration to move people out of energy poverty and to enhance manufacturing, this all points to emerging opportunities.”

The three-hour gathering — branded as “Howdy Modi!” — at the home of the National Football League’s Houston Texans is scheduled to include a “cultural program” that will be followed by an address by the Indian leader, according to event organizers. The event comes just weeks after Modi sat with Russia’s Vladimir Putin to explore shipping Arctic natural gas to the subcontinent.

Did you participate yet?

The deadline is Sept 14 at 11:59pm!

Don't miss this opportunity to extend the most creative and warm welcome to PM @narendramodi

Remember:

1.Include friends and family

2.Wear traditional outfits

3.Tag @howdymodi and use #HowdyModi and #NAMOste pic.twitter.com/FTSb99VjrD

— Texas India Forum (@howdymodi) September 12, 2019

Heightening expectations is the timing of Modi’s Texas pilgrimage: it will come only a few days after Gastech, one of the world’s premier methane-industry confabs.

Still, India has been slower than some other economies to divorce itself from coal, and that may be a hindrance to gas-import arrangements, said Madeline Jowdy, an analyst at S&P Global Platts.

“I am so skeptical of India,” Jowdy said. “’I’m not saying that Indian companies can’t and won’t invest” in gas imports, but coal is entrenched and supports a lot of jobs.

Tellurian Inc., which is developing a $28 billion liquefied natural gas terminal in Louisiana, is optimistic. The company is seeking to finalize a deal to sell an equity stake in the project to India’s Petronet LNG Ltd., Chief Executive Officer Meg Gentle said in a Sept. 5 interview in New York. The firms signed a memorandum of understanding in February for the Driftwood LNG terminal.

State-controlled Gail India Ltd. was among the early buyers of U.S. LNG, locking in a 20-year contract for supply from Cheniere Energy Inc.’s Sabine Pass terminal in Louisiana. The South Asian nation took in 4.7% of the LNG that has has been exported since early 2016, according to data compiled by Bloomberg. – Bloomberg

Also read: Deal with Reliance allows Saudi Aramco to hold on to its grip over Indian oil market