New Delhi: In the exclusive focus on petroleum prices over the past few weeks, another factor driving up retail inflation has largely been missed — edible oils.

The June retail inflation figure was at 6.26 per cent — above the Reserve Bank of India’s target of 6 per cent. While fuel inflation was 12.68 per cent during the month, edible oil inflation was at 34.78 per cent.

The prices of edible oil have been driving up inflation for the past few months.

Whether it is oils like mustard, groundnut or palm, which are consumed domestically, or commercially used soybean and sunflower oils, these edible oils have seen a sharp rise in prices in the last six months despite government efforts to cool off rates by reducing high tax levies.

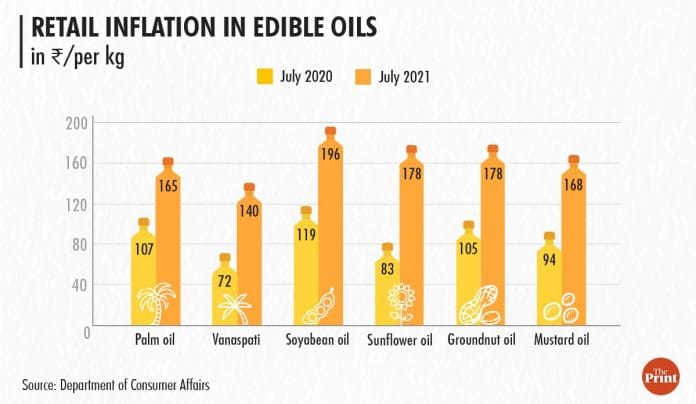

This particular segment started seeing inflation with a surge in prices of imported edible oils, particularly palm oil, which touched its highest price in more than a decade. Other major imported edible oils such as soybean and sunflower oil followed closely, with their retail prices swaying beyond Rs 150/kg, according to the Department of Consumer Affairs.

The jump in edible oil prices has pushed up food and other inflation in the country.

This can be gauged from the fact that the price of vanaspati, a cheaper substitute for ghee or butter derived from palm oil and mostly consumed by low-income families in the country for frying and cooking, has doubled to Rs 140/kg on 1 July 2021 from Rs 72/kg on 1 July 2020.

The prices of a variety of products derived from edible oil, primarily palm oil, such as commercial instant food items like chips and instant noodles, pizza dough, shaving cream, toothpaste, lotions, lipsticks and other personal care and cosmetics items have also risen in the same measure.

Also read: Erratic monsoon hits cereal, pulses, oilseed sowing in top producing states amid inflation

Government moves, but prices unaffected

The impact of edible oil price rise on other items is similar to how petroleum rates affect inflation all over the industrial and agricultural chain. However, there is one exception.

While the government heavily taxes both petroleum products and edible oils, it made some effort to provide relief in the case of the latter by allowing tax-related concessions.

In an order issued this month, the Narendra Modi government reduced import duty on crude palm oil to 30.25 per cent by cutting 5 per cent basic duty. The import duty on refined palm oil was also reduced to 41.25 per cent from the earlier 49.5 per cent.

Despite such moves, the high prices of edible oils are yet to cool off. Even the prices of oils such as mustard and groundnut, which are mainly produced domestically, have soared to the level of their imported and commercially-used counterparts.

This is because edible oil is a highly substitutable product, and such price volatility pushes consumers to cheaper alternatives.

Price pressure to continue

Moreover, mustard and groundnut oil faced domestic consumption pressure amid stringent Covid-19 lockdowns as home-cooked food saw higher utilisation of these oils.

While the retail prices of mustard have shot up from Rs 94/kg in July 2020 to Rs 168/kg this July, the groundnut oil prices have also surged from Rs 105/kg to Rs 178/kg in the same period.

The high rates are unlikely to cool off anytime soon as India meets more than half of domestic demand through imports. In the international market, prices of edible oils have jumped sharply due to various factors.

The soybean oil price has surged due to efforts of making renewable biodiesel fuel from it in the US, Brazil and other countries.

Other factors include bulk buying of soybean by China, labour issues plaguing palm produce in Malaysia, adverse weather impact on palm and soya producing areas, along with high export duties on crude palm oil.

Suresh Nagpal, chairman, Central Organisation for Oil Industry and Trade, told ThePrint, “Bulk buying of soybean by China, adverse weather in sunflower oil-producing areas such as Ukraine have pushed crude palm oil prices too along with these two commodities prices.”

He added, “Mustard oil is widely consumed in many states due to its taste and aroma, which kept its demand high despite a decent crop. Even in Covid-19 mustard was proposed as medicinal properties which further pushed its prices.”

(Edited by Amit Upadhyaya)

Also read: After second wave, patchy monsoon rains are raising growth and inflation worries for India