Mumbai: Nearly every four out five small businesses in India availed the loan repayment moratorium that the banks offered earlier this year, indicating the stress the sector faced after a nationwide lockdown was imposed in March to curb the spread of the novel coronavirus.

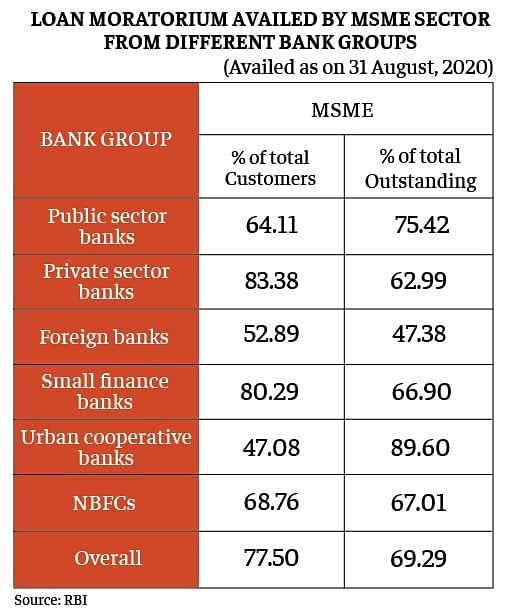

According to the Trend and Progress of Banking in India 2019-20 report released by the Reserve Bank of India (RBI) Tuesday, 77.5 per cent of MSMEs were granted loan moratorium by lenders, which was 69.29 per cent of the total exposure of the financial sector to these players.

While private banks saw 83.38 per cent of the MSME clients opting for the moratorium (62.99 per cent in terms of exposure), public sector banks (PSBs) extended the same facility to 64.11 per cent of their customers (75.42 per cent of total exposure).

This is the first time the RBI has put out comprehensive data on loan moratorium by collating information from 12 PSBs, 21 private sector banks, 42 foreign banks, 39 urban cooperative banks, 10 small finance banks and 73 non-banking financial companies (NBFCs).

To offer relief from the economic stress due to the pandemic, the RBI had allowed banks to offer moratorium on interest payment from March to August. It also allowed a standstill clause of asset classification for the period, which means a loan would remain standard for a bank and not turn NPA even if repayment was not made between March and August.

The data also showed that 42.62 per cent of individuals opted for loan moratorium for retail products like home loan and car loan. Around 41 per cent of the total of such loans were under moratorium.

As far as the corporate sector is concerned, only 31.31 per cent companies availed the facility, which was 34.28 per cent of the sector’s total loans.

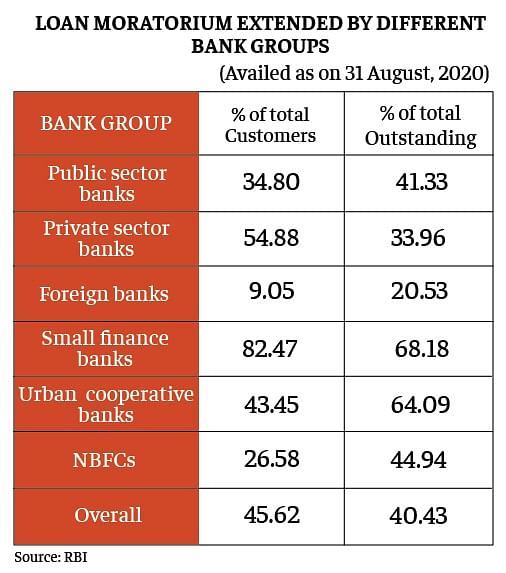

As a bank group, 82.87 per cent of small finance banks customers availed the facility, which was 68.18 per cent of the loan outstanding, followed by private sector banks, showed the data. It also said that 54.88 per cent of private bank customers did not pay their dues during the March-August period, which was 33.96 per cent of their total exposure.

Overall, 45.62 per cent of the total customers of banks and NBFCs availed the moratorium, which was 40.43 per cent of the financial sector loans.

Also read: Indian economy could be most resilient in south, southwest Asia subregion, says UN report

NPA trend reversal?

While the data showed that a large number of individuals and businesses opted for the moratorium, the number of entities that availed loan restructuring facility, which the central bank allowed subsequently, was much lower.

After the moratorium ended in August, the RBI allowed a one-time debt recast scheme for banks where restructuring was allowed without classifying the loan as non-performing. Since lenders offered the debt recast facility to a much smaller number of entities, bad loans could zoom in the coming quarters.

The gross non-performing assets of the banks have been falling after reaching the peak in March 2018. The trend could now see a reversal.

“When we talk to banks and NBFCs, they disclosed had it not for the standstill on asset classification, NPAs could have been higher by 60 to 100 bps,” said Karthik Srinivasan, group head, financial sector ratings, ICRA.

“We expect restructuring done by banks and NBFCs are still at a lower level. The recast window is open till 31 December. We will get better clarity when these entities announce their Q3 numbers,” he said. “NPA numbers have come down in December partly driven by moratorium and standstill of asset classification. And true stress will be visible in the next one or two quarters.”

The rating agency expects loan restructuring volume to be lower at 2.5-4.5 per cent as compared to its previous estimate of 5-8 per cent.

Also read: Ten ways Covid has changed the world economy forever

Asset quality questions

The central bank has also sounded caution on asset quality of banks. While scheduled commercial banks’ gross non-performing assets (GNPA) ratio declined from 9.1 per cent at the end of March 2019 to 8.2 per cent at the end of March 2020 and further to 7.5 per cent at the end of September, but the ratio is expected to worsen further.

“The modest GNPA ratio of 7.5 per cent at end-September 2020 veils the strong undercurrent of slippage,” the RBI said in the report.

The regulator added accretion to NPA would have been higher in the absence of an asset standstill that was provided by the RBI as a relief to the economic stress due to the pandemic. “…the asset quality of the banking system may deteriorate sharply, going forward,” the RBI said.

ICRA expects the gross NPAs and net NPAs for the banks to likely rise in near term to 10.1-10.6 per cent and 3.1-3.2 per cent, respectively, by March 2021 from 7.9 per cent and 2.2 per cent, respectively, as of September (ICRA estimate).

The rating agency expects asset quality pressure to moderate only by the end of 2021-22.

Also read: Pandemic exposes hurdles of credit market as borrowers shun tighter regulations