New Delhi: The Economic Survey has projected India’s GDP growth in the range of 6.8 to 7.2 per cent in 2026-27. The Economic Survey 2025–26 was tabled in Parliament Thursday. It is the government’s most comprehensive report card on the Indian economy and it also sets the intellectual framework for the Union Budget.

In this explainer, ThePrint takes you through 10 key takeaways from the Survey.

1. India remains the fastest-growing major economy

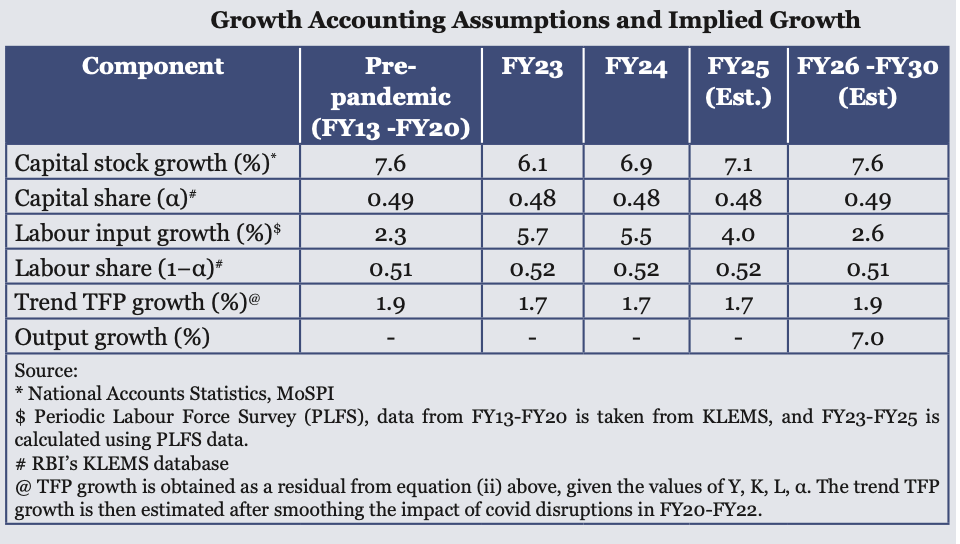

India’s economy is estimated to grow 7.4 percent in FY26, with Gross Value Added growth at 7.3 percent. The Survey also revises India’s potential medium-term growth rate upward to about 7 percent, from around 6.5 percent three years ago.

This revision is significant because it reflects changes in the economy’s capacity, not just a good year.

What stands out to me is that growth is no longer being described as policy-driven or temporary. The Survey is effectively saying India’s growth ceiling has moved up, but only if reforms continue.

2. Growth is expected to remain resilient in FY27

India’s GDP growth for FY27 is projected to be in the range of 6.8-7.2 percent, even as the global economy remains fragile.

The Survey repeatedly cautions that the world economy is entering a period of permanent uncertainty—from geopolitics to trade and capital flows.

Yet, India is described as “relatively better off” due to its domestic market size, macro stability, and strategic autonomy. This is not optimism, it’s calibrated realism. The Survey is saying India can grow steadily, but not by ignoring global risks, only by managing them better than others.

3: Inflation has been decisively brought under control

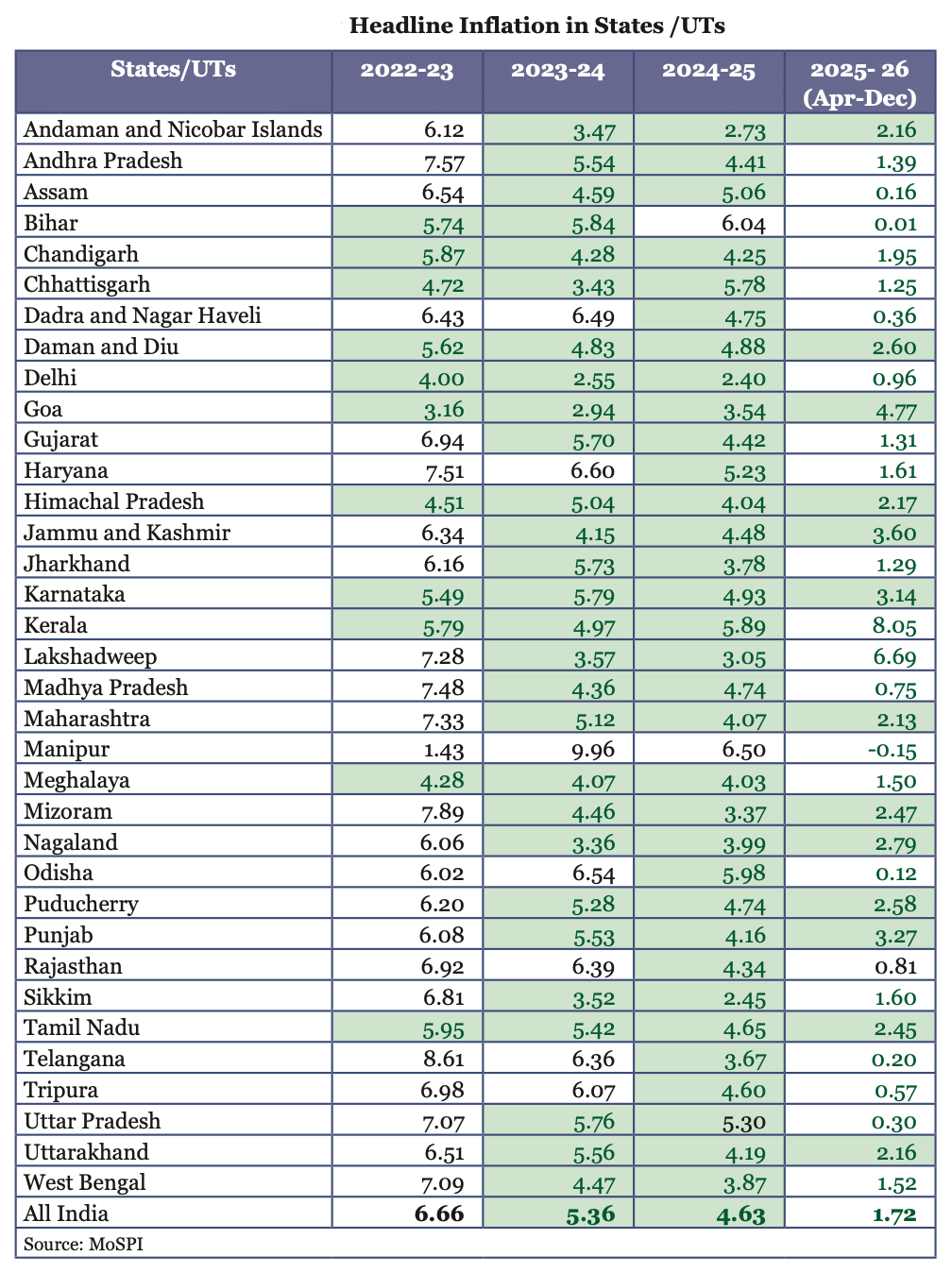

India’s average headline Consumer Price Index (CPI) inflation between April and December 2025 was just 1.7 percent, the lowest since the CPI series began.

The decline was driven mainly by food and fuel prices, which together account for 52.7 percent of the CPI basket. Crucially, inflation has fallen without a collapse in demand.

This matters because it tells us inflation has been controlled through supply improvements, not economic pain. That’s the difference between stability that lasts and stability that cracks later.

4: India is in a rare ‘Goldilocks’ macroeconomic phase

Low inflation and strong growth have allowed monetary policy to turn supportive.

In December 2025, the Reserve Bank of India cut the policy rate to 5.25 percent, describing the economy as being in a “Goldilocks” phase—not too hot, not too cold.

This is an unusual alignment, especially for a large emerging economy.

What’s important here is not just the rate cut, but the confidence behind it. It signals that policymakers believe growth can continue without reigniting inflation.

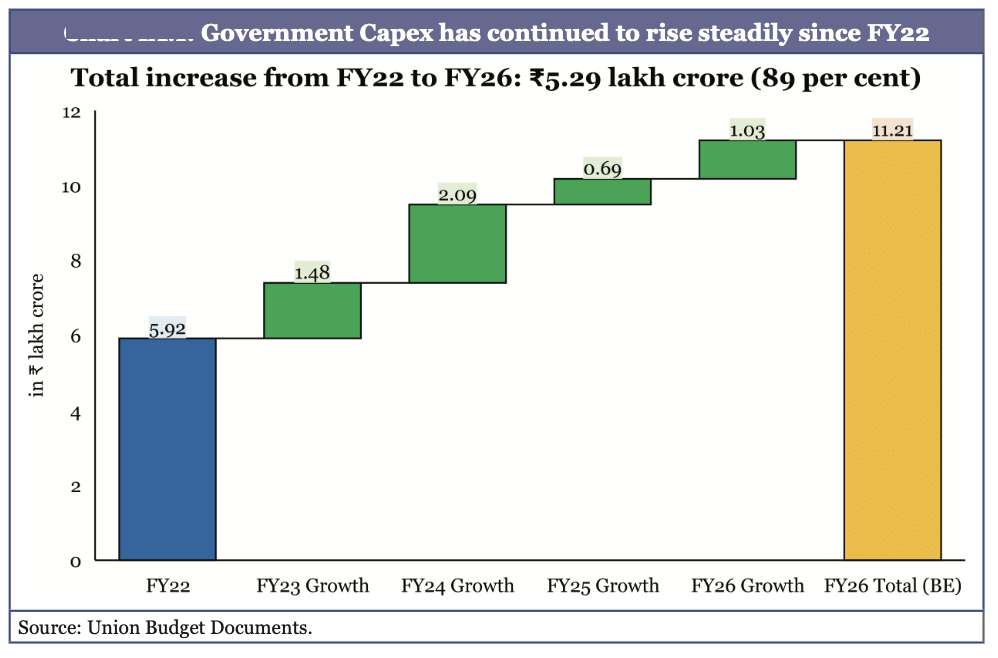

5. Government capital expenditure has risen at a historic scale

Government capital expenditure has increased nearly 4.2 times, from Rs 2.63 lakh-crore in FY 18 to Rs 11.21 lakh-crore in FY26 (Budget Estimates). Effective capital expenditure in FY26 stands at Rs 15.48 lakh crore.

Infrastructure is now clearly positioned as the central driver of medium-term growth.

This is no longer counter-cyclical spending—it’s structural. The real test will be whether this public investment consistently crowds in private investment.

6. Infrastructure outcomes are now visible across sectors

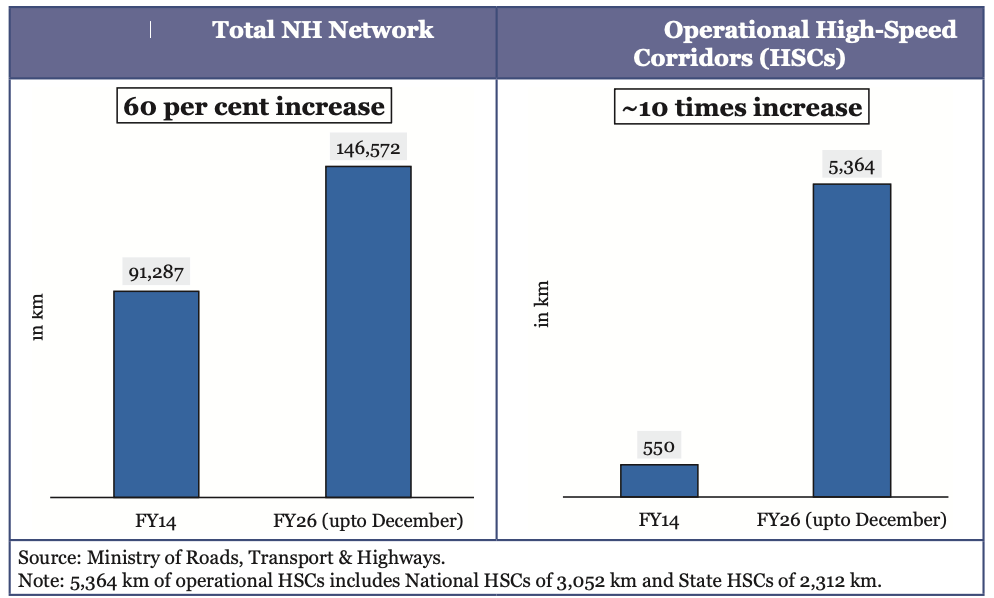

The national highway network expanded by about 60 percent, from 91,287 kilometres in FY14 to 1,46,572 kilometres in FY26.

Operational high-speed corridors increased nearly ten-fold, from 550 kilometres to 5,364 kilometres. The number of airports increased from 74 in 2014 to 164 in 2025.

Infrastructure only matters when it shows up in productivity – not press releases. The scale here suggests India is finally building networks, not isolated assets.

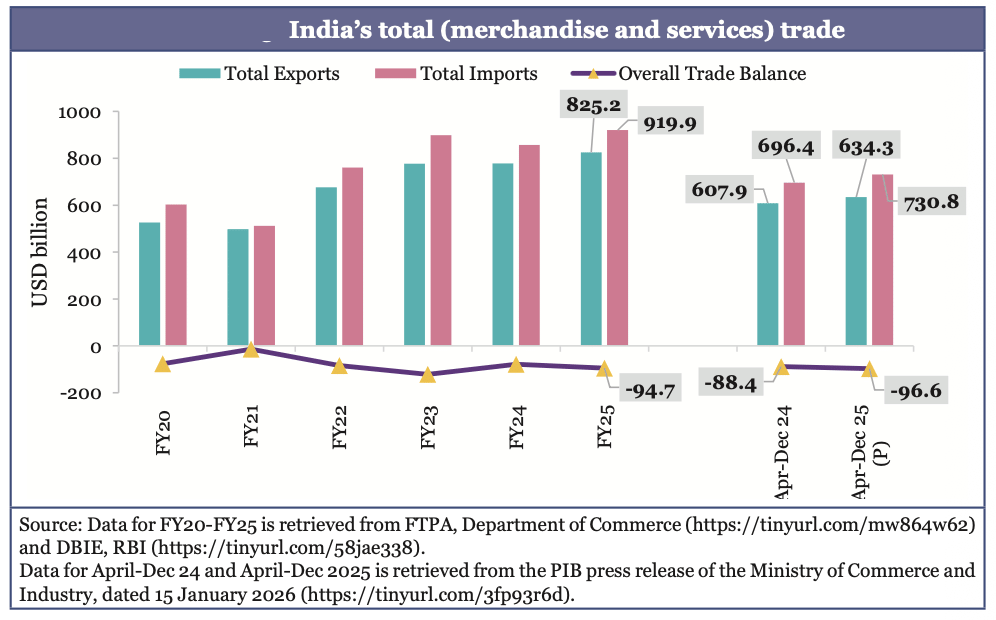

7 . Exports hit record highs, led by services

India’s total exports reached a record $825.3 billion in FY25, growing 6.1 percent year-on-year. This growth was driven mainly by services exports, while merchandise trade continues to face global headwinds.

The Survey also highlights India’s expanding network of free trade agreements.

Services are stabilising India’s external account, but they cannot carry it alone forever. That’s why manufacturing competitiveness remains the unresolved piece of the puzzle.

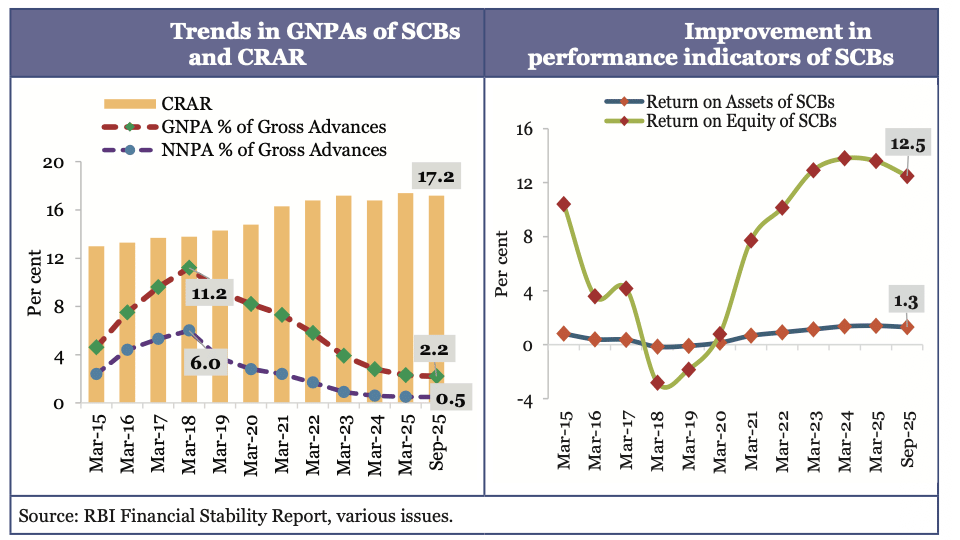

8. The banking system is in its strongest shape in decades

Gross Non-Performing Assets fell to 2.2 percent, while net NPAs declined to 0.5 percent by September 2025.

Bank credit growth accelerated to 14.5 percent year-on-year. This combination – clean balance sheets and strong credit growth – is rare.

Healthy banks don’t guarantee growth, but weak banks guarantee stagnation. This is one of the most underappreciated positives in the Survey.

9: Employment policy is shifting toward formalisation and security

The Survey highlights the implementation of the four Labour Codes, which now formally recognise gig and platform workers. Draft rules were published in December 2025, expanding social security and benefit portability.

The emphasis is on quality of employment, not just job counts.

India’s employment challenge is no longer just creating jobs – it’s creating secure jobs. Labour reform will matter more in execution than in legislation.

10: Climate action is now core economic policy – but finance is constraint

The Survey makes it clear that climate action is central to India’s development strategy, not an environmental afterthought. However, it also states that climate finance remains the binding constraint, and domestic resources alone are insufficient.

India argues that higher climate ambition must be matched by global finance and technology flows. This is climate realism, not climate retreat. The Survey is arguing for ambition that is economically and socially sustainable.

The Economic Survey 2025-26 presents an economy that is stronger, more resilient, and more self-aware than before.

But it also makes one thing clear: India’s biggest challenge now is execution—turning growth into jobs, infrastructure into productivity, and ambition into outcomes.

That is the real test ahead of the Union Budget.

(Edited by Ajeet Tiwari)

Also Read: India among top 5 for expanding research in critical technologies, despite low R&D investment