New Delhi: Export of non-basmati rice from India declined by over 37 per cent between April and November of 2019 as compared to the corresponding period in 2018, data with the Agricultural and Processed Food Products Export Development Authority (APEDA) has revealed.

The data, accessed by ThePrint, shows India managed to export only 31,41,000 metric tonnes (MT) of non-basmati rice during the April-November period last year, compared to the 50,48,000 MT it did during the corresponding period in 2018.

The rice exported was worth Rs 9,028 crore, a huge drop from the Rs 14,060 crore during the same period in 2018.

The decline, according to the data, is due to some top importers of Indian rice completely shunning the country last year.

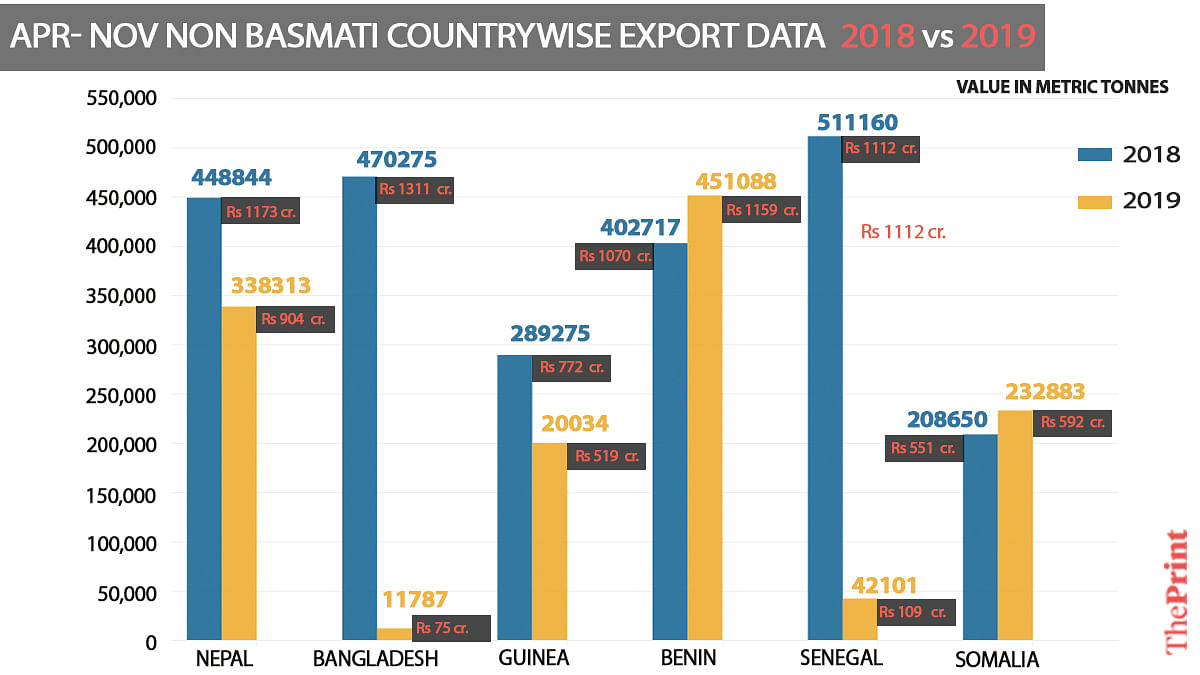

For instance, Bangladesh imported 4,70,275 MT of non-basmati rice valued at Rs 1,311 crore between April and November 2018. During the same period in 2019, the country imported just 11,787 MT of rice valued at a mere Rs 75 crore.

This decline in exports would result in an annual loss of around Rs 8,000 to Rs 10,000 crore in 2019-20, according to the All India Rice Exporters Association (AIREA).

Also read: Modi govt wants Bangladesh to buy imported onions after states withdraw demand

Cheap Chinese produce hurting exports

Exporters are now blaming ‘cheap Chinese produce’ and the ‘high’ minimum support price (MSP) for non-basmati rice for the decline.

According to Vinod Kaul, executive director of the All India Rice Exporters Association, cheap Chinese rice along with the Narendra Modi government’s withdrawal of export incentives has led to the drastic drop in non-basmati exports.

The association has warned that Indian exports could witness a demand decline of 50 per cent in African markets alone as the Chinese rice is way cheaper.

“Africa is one of India’s major non-basmati markets for Indian rice and also a price-sensitive one,” Kaul said. “The government has also withdrawn the 5 per cent Merchandise Exports from India Scheme (MEIS), which was available from 2 November 2018 to 25 March 2019. The withdrawal of MEIS has made Indian produce expensive compared to other exporting counterparts such as China, Thailand and Vietnam.”

In the African markets, the price of 1 quintal rice from China is Rs 2,129 while the price of rice from India is Rs 3,479 a quintal, Kaul added.

The decline isn’t just confined to the African countries. The APEDA data shows that even neighbours Nepal and Bangladesh, among the top importers of Indian rice, are also staying away from the produce.

Between April and November 2018, Senegal, Bangladesh and Nepal were the three top importers buying 5,11,160 MT, 4,70,275 MT and 4,48,844 MT non-basmati rice, respectively, from India.

During the same period in 2019, however, Nepal imported over 1 lakh MT less at 3,38,313 MT, while Senegal and Bangladesh saw even drastic drops. Senegal only imported 42,101 MT of Indian non-basmati rice while Bangladesh took in even fewer Indian rice, importing a mere 11,787 MT (see graphic).

Exporters blame MSP for the high prices

Exporters are also blaming the MSP for the high export price of Indian non-basmati rice.

Rakesh Kumar, owner of the Delhi-based Adinath Global Exports, told ThePrint that a high MSP has led to rise in export prices of Indian rice.

“Due to MSP, our rates are higher,” he said. “China is exporting non-basmati rice at Rs 21,200-22,700 a tonne while our price is around Rs 24,800-26300 for the same quantity of rice.”

The central government buys normal paddy crop at an MSP of Rs 1,815 per quintal. The MSP for grade A paddy crop is Rs 1,835 per quintal.

Kumar added that shipping costs also hurt Indian exporters. “It costs us up to Rs 93,600 to ship a single container whereas the cost in competing countries such as Thailand is only Rs 49,661. This puts us way behind the competition.”

Also read:Dilute Essential Commodities Act to boost investment, govt panel suggests

Good position in Indian market