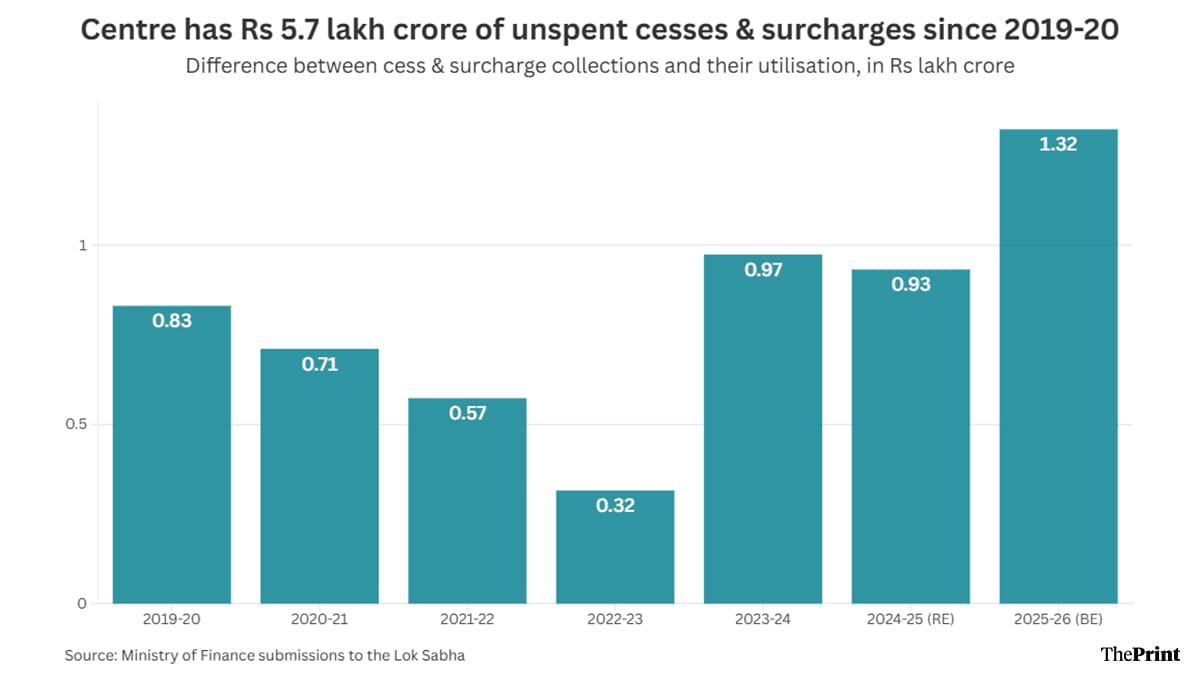

New Delhi: Nearly Rs 6 lakh crore in central government funds, collected through various cesses and surcharges since 2019-20, will remain unspent by the end of March 2026, an analysis of data it presented to Parliament reveals. In other words, the Centre has collected an excess of Rs 5.7 lakh crore from cesses and surcharges.

This is significant because state governments have accused the Centre of increasingly relying on cesses and surcharges since they don’t have to be shared with the states. Additionally, cesses and surcharges can only be used for the purpose for which they have been collected and cannot be diverted to other areas.

In response to a question in the Lok Sabha, Finance Minister Nirmala Sitharaman Monday provided data on the annual cess and surcharge collections by the Centre since 2014-15. She also provided the utilisation of these cess proceeds, but only since 2019-20.

A combination of stagnating utilisation and rising collections has meant that the amount lying unspent from these cesses and surcharges each year has been increasing. In 2019-20, the government’s collections exceeded its utilisation by Rs 83,000 crore. That surplus is expected to surge to Rs 1.32 lakh crore in 2025-26.

MPs Rao Inderjeet Singh and Abhishek Banerjee asked whether “the Government has used cess and surcharges to replace or complement other forms of taxes being levied under different sub-heads”, which Sitharaman denied.

“Government has not used cess and surcharges to replace existing taxes because these levies are intended for specific, targeted purposes and often serve as temporary funding mechanisms,” Sitharaman said in her answer.

“Cess and surcharges complement, rather than substitute, the existing tax structure, helping to raise funds for particular projects without disrupting the overall taxation system,” she added.

Also Read: Critical minerals push continues under Modi 3.0 with customs duty cut, more reforms

Ballooning cess & surcharge collections

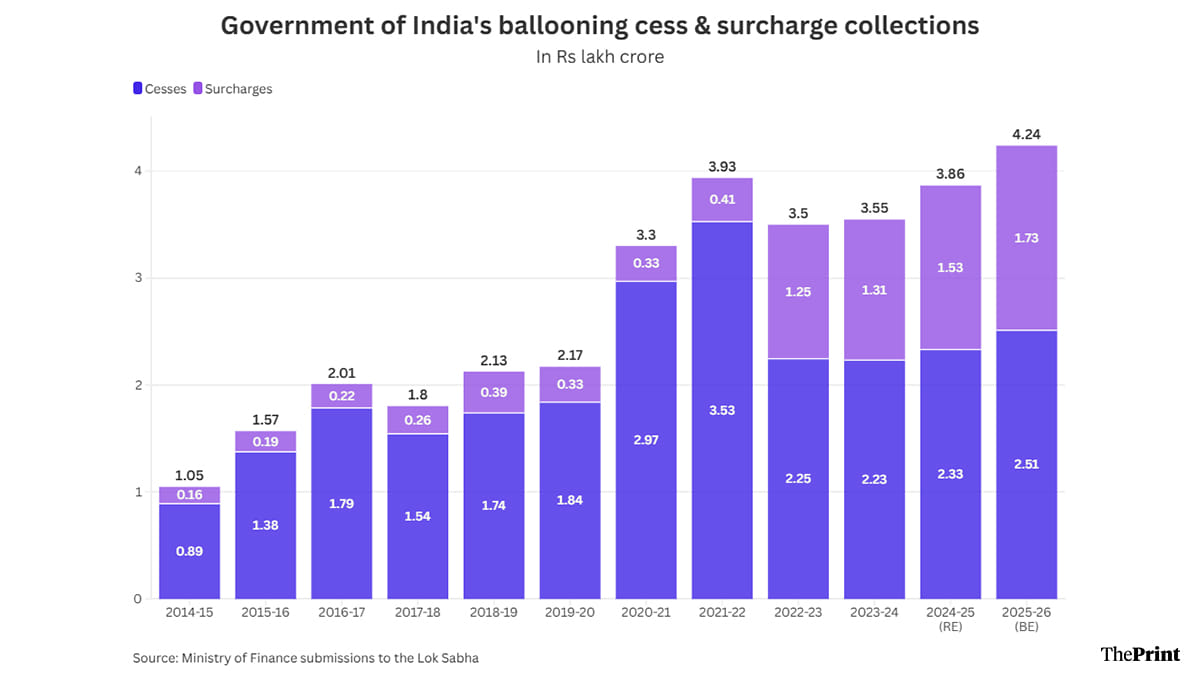

Until 2023-24, the central government had at least 13 cesses and four surcharges in place for the benefit of a range of sectors including agriculture (Agriculture Infrastructure & Development Cess), health and education (Health & Education Cess), infrastructure development (Road & Infrastructure Cess), and several others such as clean energy and sanitation.

From 2024-25 onwards, the government rationalised the number of cesses, bringing them down to seven, but kept the number of surcharges unchanged at four.

However, the data shows that, despite the reduction in the number of cesses, the total collections of the government from cesses and surcharges have been steadily increasing.

While the total collections from these two sources stood at just a little over Rs 1 lakh crore in 2014-15, the first year of the Modi government, it more than doubled to Rs 2.17 lakh crore by 2019-20, the first year of the Modi government’s second term.

In its third term, the Modi government expects cess and surcharge collections to grow even further to Rs 3.86 lakh crore in 2024-25 as per the revised estimates for that year, and Rs 4.24 lakh crore in the upcoming 2025-26.

However, a comparison of this data with what was presented in the Union Budget shows that, despite the growth in cess and surcharge collections, their share has not appreciably increased in the Centre’s gross tax collections.

From 8.4 percent in 2014-15 to 10.8 percent in 2019-20 and an estimated 9.9 percent in 2025-26, the share of cesses and surcharges in gross tax collections has barely changed over the 12-year period.

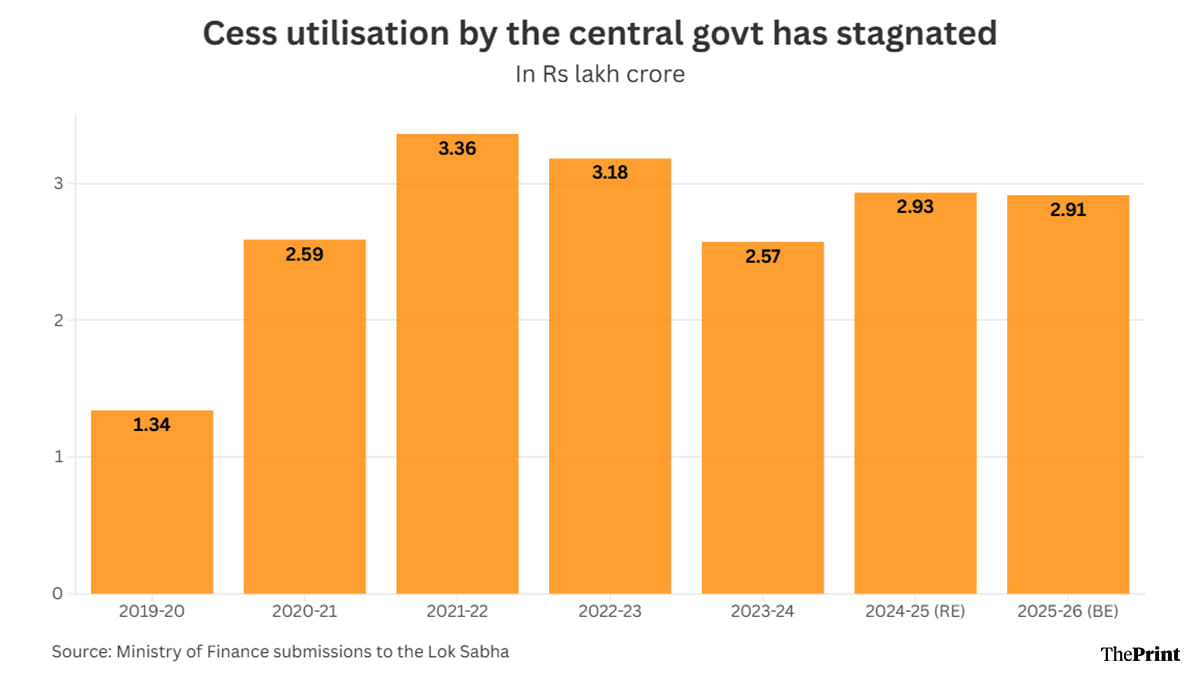

Cess utilisation has stagnated

The query posed to the Ministry of Finance asked for details of the utilisation of cesses and surcharges for the last five years. In response, the ministry provided the fund-wise allocations that were made from these sources of revenue.

The data shows that the cess utilisation by the central government has stagnated in the last few years. Where the government spent Rs 1.34 lakh crore from its cesses in 2019-20, this increased to Rs 3.36 lakh crore in 2021-22. However, it then declined to Rs 2.57 lakh crore in 2023-24, and is expected to remain around Rs 2.9 lakh crore in 2024-25 and 2025-26.

(Edited by Sanya Mathur)

Also Read: Women’s employment in India up, yet 89 mn urban women remain out of work