New Delhi: The issue of loan write-offs and waivers is once again in the news, driven by the latest RTI disclosure by Canara Bank that it has written off loans worth Rs 1.29 lakh crore over the last 11 years.

However, the discussion surrounding this not only erroneously conflates loan write-offs with loan waivers, but also misses the significant improvement in public sector banks’ write-off behaviour.

Following the disclosure by Canara Bank, several opposition leaders and political commentators — including lawyer Prashant Bhushan and CPI(M) general secretary Sitaram Yechury — took to social media to slam the government over the supposed “loot” of public money as a result of loan write-offs by public sector banks. Even Congress spokespersons and leaders seem to have mistaken written-off loans for waived-off ones.

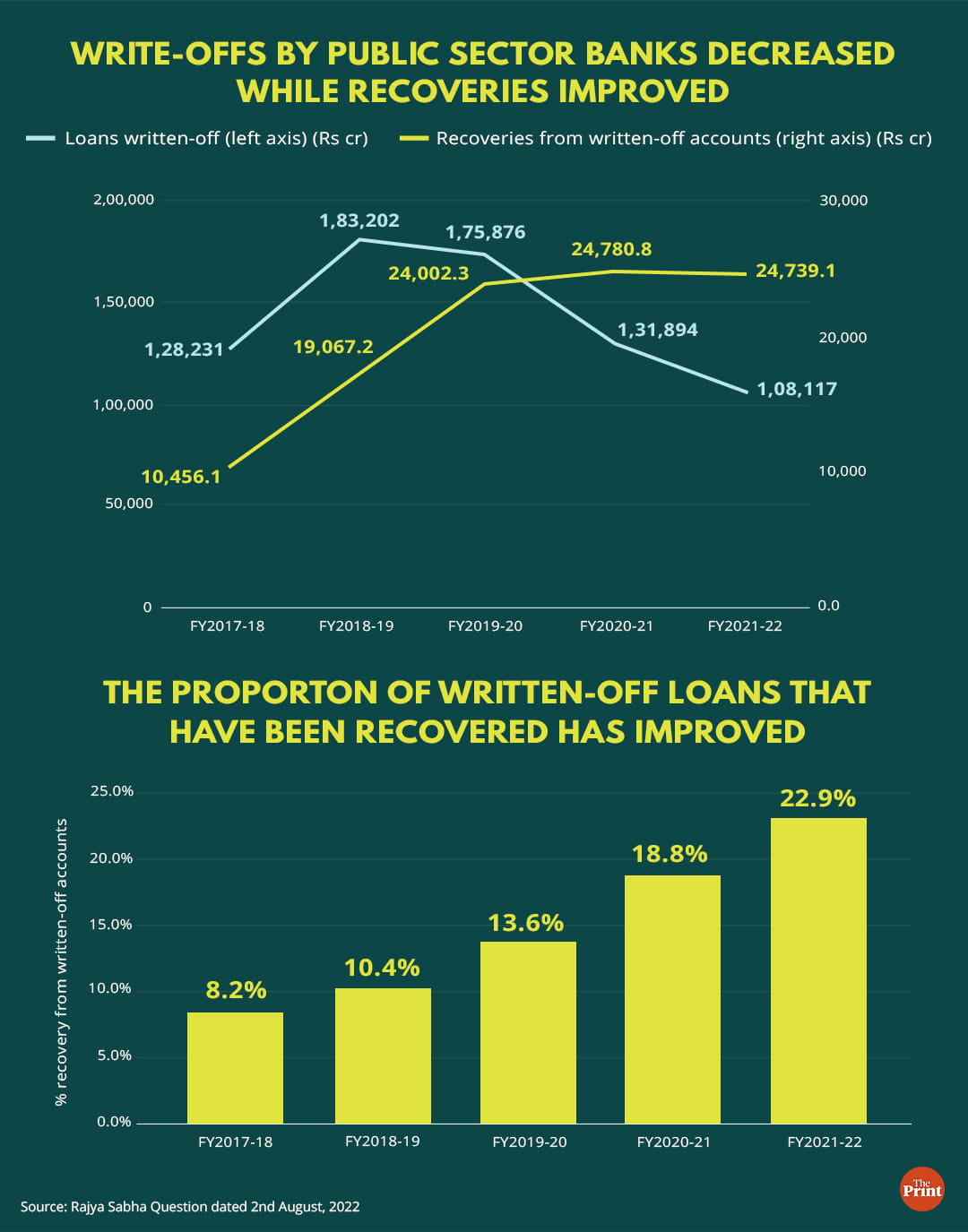

Data provided by Minister of State for Finance Bhagwat Karad in a written reply to the Rajya Sabha on 2 August shows that in the last five years, the amount written off by public sector banks decreased steadily to Rs 1.08 lakh crore in financial year 2021-22 after initially rising to Rs 1.83 lakh crore in 2018-19.

Simultaneously, the amount recovered from written-off loans increased to Rs 24,739.1 crore in 2021-22 from Rs 10,451.14 crore in 2017-18. This reduction in written-off amounts coupled with an increase in recoveries has meant that recoveries increased to 22.9 per cent in 2021-22 from 8.2 per cent in 2017-18 as a proportion of written-off loans.

While this is still a low percentage of recovery, it is good news for the public banking system that recoveries have been improving over the last few years, two of which were severely hit by the Covid-19 pandemic.

Also Read: Have ‘enough’ stocks of grains, could sell wheat in open market if needed, Modi govt says

Waivers vs write-offs

Loan waivers are a process where the liability of a person or entity is removed. That is, the loan does not need to be paid back. These are mostly in the form of farm loan waivers ordered by either state or central governments, often as a political tool to woo the farm vote.

A write-off is a technical requirement for banks, according to the Reserve Bank of India’s rules, where the banks first make provisions for the bad loan in question, and then move the remaining amount off the balance sheet. This is advantageous for banks as it increases their ability to lend.

“As per RBI guidelines and policy approved by bank boards, non-performing loans, including, inter-alia, those in respect of which full provisioning has been made on completion of four years, are removed from the balance-sheet of the bank concerned by way of write-off,” MoS Karad had said in his written reply to a question posed by Congress leader Mallikarjun Kharge in the Upper House on 2 August.

Another reason why waivers and write-offs are not generally comparable is because the beneficiaries are different. In a waiver, the beneficiaries are the banks and the borrowers. In a write-off, the beneficiary is only the bank. The borrower does not benefit from their loans being written off.

In other words, the recovery of waived off loans does not arise, as the process itself is meant to erase the debt. So, when a government announces a waiver, it pays the bank directly and the borrower freed from debt. The recovery of written-off loans, however, is an ongoing process and does not stop when the loans are moved off the bank’s balance sheet.

“Banks evaluate/consider the impact of write-offs as part of their regular exercise to clean up their balance-sheet, avail of tax benefit and optimise capital, in accordance with RBI guidelines and policy approved by their Boards,” Karad had said in his Rajya Sabha reply.

“As borrowers of written-off loans continue to be liable for repayment and the process of recovery of dues from the borrower in written-off loan accounts continues, write-off does not benefit the borrower,” he’d explained.

Overall, loan waivers are considered a superior option, at least from a financial perspective, because they mean that the bank is paid back in full and the debtor — most often a poor farmer — is freed from the debt burden, Madan Sabnavis, chief economist at Bank of Baroda, told ThePrint.

“If the government says that it is waiving off a farm loan of Rs 100, then the government is supposed to pay the bank that Rs 100 so that the liability of the borrower is completely erased,” Sabnavis explained. “As far as the bank is concerned, the loan is paid back on time. That’s why a waiver is a superior option for the bank.”

In contrast, in a write-off, the bank not only has to make provisions for the bad loan, which impacts its profits, but the recovery process must also continue.

However, while waivers might be beneficial in terms of the finances of both the bank and the borrower, there are some downsides to the process as well.

“In case of a waiver, there is always a moral hazard which is that there is always an advantage to not paying back the bank if the borrower knows that there is a waiver going to be announced by the government,” Sabnavis said.

“Waivers are usually for farm loans. So, if a farmer, even one who usually pays back the loan on time, knows that there is an election coming and that the chances of a waiver being announced are high, then he will stop paying back the loan in expectation of that waiver,” he added.

Also Read: Can financial decisions be free of emotion? Why it’s not the case in Indian households

Do loan waivers work?

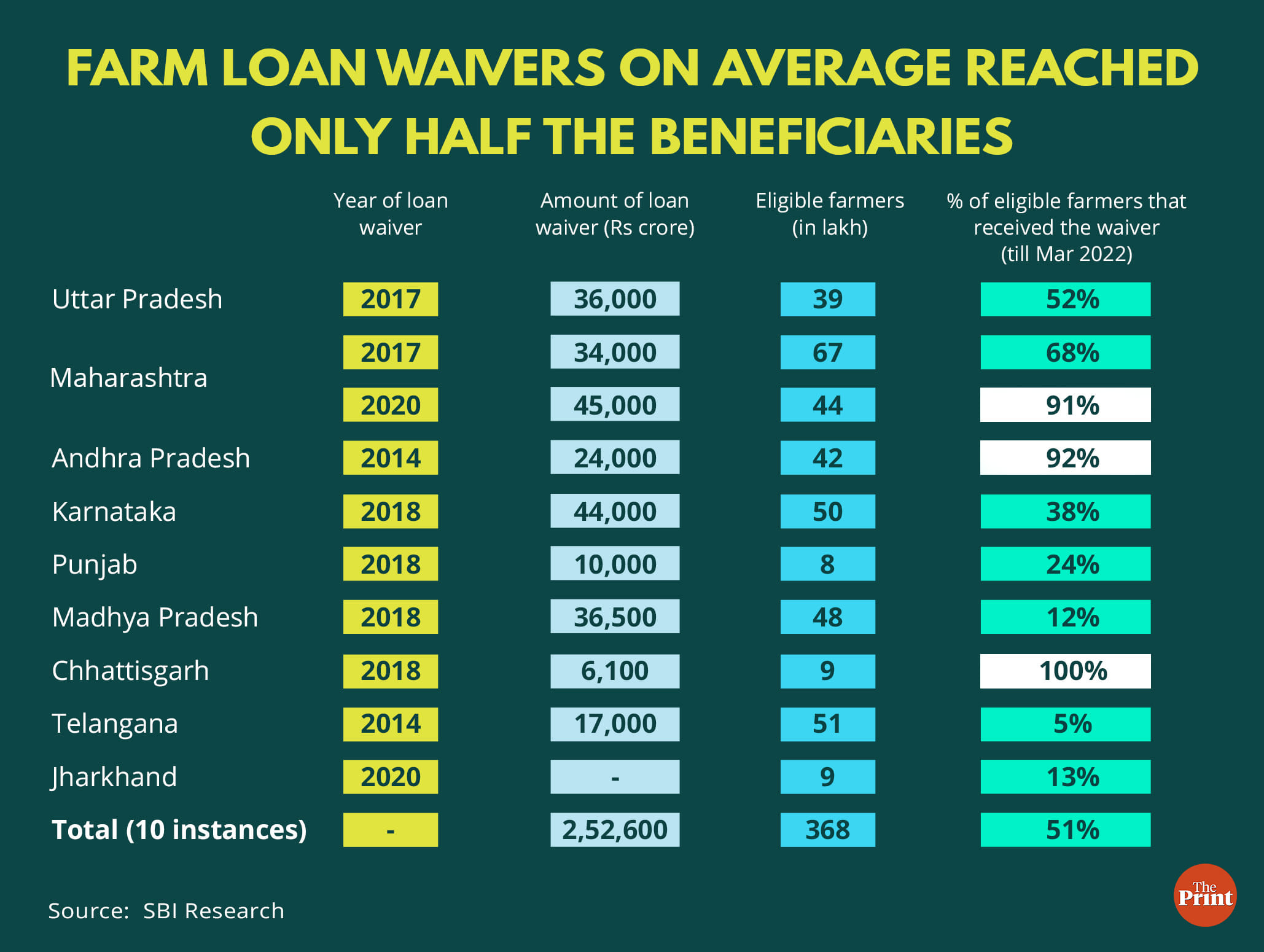

A July ‘Special Report on Agriculture’ by the State Bank of India found that farm loan waivers announced by eight state governments since 2014 have been largely unsuccessful in benefiting the farmers themselves. However, the study, which covered nine states, does point out that some states have performed better than others in terms of having the benefits reach the intended recipients.

“Despite much hype and political patronage, farm loan waivers by states have failed to bring respite to intended subjects, sabotaging credit discipline in select geographies and making Banks/FIs wary of further lending,” the report said.

It further stated that since 2014, out of around 3.7 crore eligible farmers, only around 50 per cent of them received the loan waiver amount (till March 2022), though in some of the states more than 90 per cent of farmers received the debt waiver amount. Essentially, a ‘self goal’ inflicted by the state on its subjects.

SBI’s calculations show that only 5 per cent of the 51 lakh farmers eligible in Telangana for the waiver the state government announced in 2014 actually received the benefit, whereas 92 per cent of the eligible beneficiaries in Andhra Pradesh received the benefit from the waiver announced that same year.

“Possible reasons for low percentage could be: (a) rejection of claims by state governments, (b) limited or low fiscal space, and (c) change in government in subsequent years,” the report added.

(Edited by Theres Sudeep)

Also Read: Old data, changing methodology — why number of Indians under poverty line is a mystery