Mumbai: India’s business titans are facing a worrying new development: in recent weeks, shadow lenders have been cutting them off from a key financing channel.

Company founders have long fueled dreams to expand their business empires with loans they get by pledging stakes in their firms. But recent scares have prompted at least two major shadow banks to turn off the faucet in the past month, the longest dry spell in six years, people familiar with the matter say.

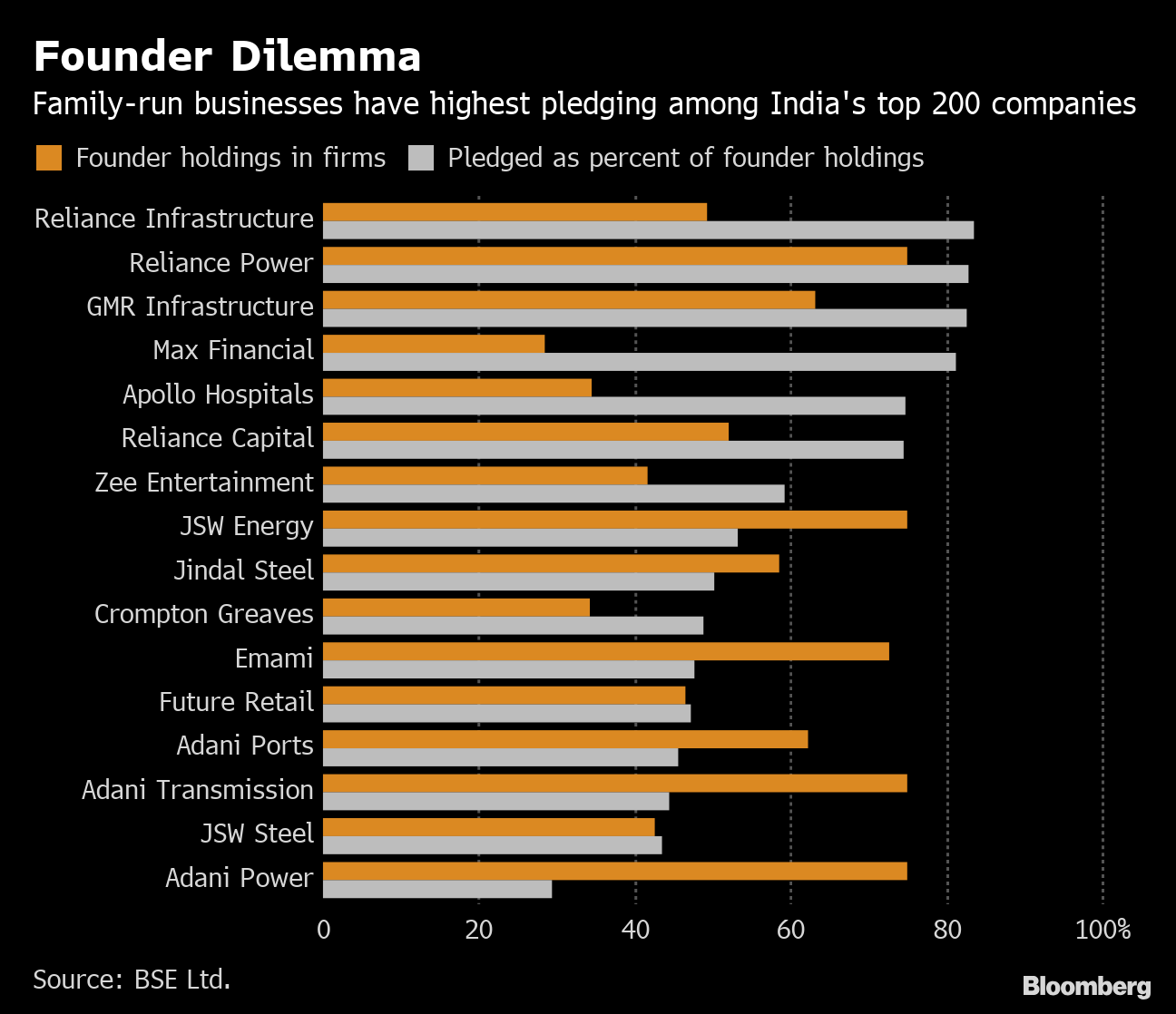

Observers say the amount of such share-pledged loans, currently at about 1 trillion rupees ($14 billion), will shrink further, raising risks of a broader fallout. Business chiefs around the world including Elon Musk at Tesla Inc. and Larry Ellison at Oracle Corp. have used their shares to access cash for personal ventures. In China, the practice has led to margin call-induced stock routs and lenders fighting in courts to reclaim funds in the case of defaults. Read more about that here.

The twist in India is that founders have relied on such funds to bankroll risky attempts to build business groups into bigger conglomerates, often with forays into real estate. They may be forced to refinance through more expensive channels if the pledged-share loan market keeps contracting. Such strains would hurt India’s credit market, still jittery after shock defaults by the IL&FS group last year.

What Spooked Indian Lenders?

The matter came to a head last month with these cases: Lenders sold shares in tycoon Anil Ambani’s companies after the value of collateral plummeted. The billionaire’s conglomerate called the sales “illegal, motivated and wholly unjustified,” and filed a suit against one of the lenders. Media tycoon Subhash Chandra’s Essel Group signed a pact with its lenders last month that prevents them from selling shares of the group’s listed firms until Sept. 30. Lenders won’t classify the group’s borrowings secured by shares as bad debts even if the stock prices fall, according to the pact. Offering stock as collateral for loans can be an easy way to obtain cash in good times when stock prices are rising. But when shares fall, and lenders seek additional collateral to cover the declines, owners who have most of their wealth tied up in their companies may not be able to meet those calls.

How Bad is the Situation?

Two lenders who frequently extended loans to founders backed by pledged shares haven’t done any for at least the last month, according to people with knowledge of the matter, who asked not to be identified because the details are private. The last time they went so long without doing such loans was in 2013, they said. The total outstanding amount of such share-pledged loans has dropped 20 percent from a year ago to 1 trillion rupees, according to Edelweiss Financial Services. It’s set to shrink another 30-40 percent in the coming year, said Ajay Manglunia, head of fixed-income at the firm. Brickwork Ratings India, which rates more such debt than any other local firm, has also seen requests for such credit reviews dry up over the last month.

If the funding channel keeps drying up, one silver lining could be less damage from margin calls. There’s currently still a lot at stake. Founders at 820 companies have pledged 2.3 trillion rupees of shares as collateral against their borrowings, according to the latest data.

“I hope founders of Indian firms learn a lesson from this and only look to this mode of raising funds as a last resort as it has implicit risk,” said Manish Sonthalia, chief investment officer of portfolio management services at Motilal Oswal Asset Management Co. in Mumbai.-Bloomberg

Also read: India Inc facing cost overrun to comply with Modi govt’s push to curb corruption