New Delhi: As the second Modi government prepares to present its first Budget Friday, the Army has asked the Ministry of Defence to factor in taxes on arms and equipment imports, as well as its expenses on salaries and pensions before presenting its demands to the finance ministry which will decide the outlay.

The Army has told the ministry that these expenses eat into its budget outlay, shrinking the corpus to procure arms and equipment crucial to modernisation efforts and maintaining existing assets, sources told ThePrint.

All the three services have to currently pay customs duty as well as GST on defence imports. While the landmark tax reform, introduced in July 2017, subsumed several taxes, it doesn’t cover basic customs duty.

According to the sources, the Army has argued that the additional integrated GST (IGST, applicable on inter-state purchases and imports/exports) component has further affected its procurement budgets. An Army officer told ThePrint that GST comprised about 12 per cent of the force’s capital budget (for purchases), totalling around Rs 7,000 crore-8,000 crore annually.

The defence ministry, they said, had also been asked to factor in the expenses borne by the Army on initiatives such as the Ex-servicemen Contributory Health Scheme (ECHS), which was launched in 2003 for all three services and is estimated to run up a tab of Rs 5,000 crore this year alone.

“The Army has sought the ministry’s attention on these aspects. A lot of the defence budget for revenue and capital outlay goes into the extra taxes and in the ECHS, leaving the forces with little money for fresh acquisitions and maintenance,” a top Army official told ThePrint.

“Even the ECHS turns out to be a huge amount considering the number of officers, who also come through the short service commission,” the official added.

The defence budget is categorised under four heads — defence pensions, capital outlay (for arms and other acquisitions), revenue (for salaries and schemes like the ECHS), and miscellaneous (including administrative expenses).

Sources said that the finance ministry could either give the Army an exemption, a rate reduction or refund on the two different taxes being paid, or just put these expenses under a separate head.

Also read: India is second largest arms importer with 9.5% of global share: SIPRI report

‘Little for fresh acquisitions’

Lt Gen. Satish Dua, who handled Budget matters closely as the Chief of Integrated Defence Staff before retiring in October last year, said defence equipment should be exempt from taxes as they were bought for national security.

“A few years ago, (only) customs duty was imposed on defence purchases. Then, the GST was added,” he told ThePrint. “The armed forces are not business houses or individuals, so these taxes should ideally not be levied by the government on defence equipment purchased by them,” he said.

“These taxes form a big chunk of the defence budget and hit the armed forces when it comes to fresh acquisitions or their modernisation, thus affecting the country’s preparedness,” he added.

Former defence secretary Shashikant Sharma, who retired in 2013, long before the GST kicked in, said most additional costs and duties were usually factored in when budgets were made.

“It is true that the defence budget as percentage of the GDP has gone down,” he added. “But if the GDP has grown, the growth in (defence) budget may not (always) be commensurate.”

Another senior Army official told ThePrint that the defence outlay, which stood at 1.5 per cent of the GDP in 2018-19, should be gradually increased to 2 per cent over a period of five years.

“While an increase in the defence budget in terms of absolute numbers is a welcome move, the budget still does not satisfy the minimum requirements of a modern military,” the official said. “Inflation and rupee depreciation more than neutralise the increased allocations.”

According to the official, the lack of funds hinders the progress of proposals, keeping the Army from addressing deficiencies, maintaining its assets, and modernising.

With higher manpower, Army most affected

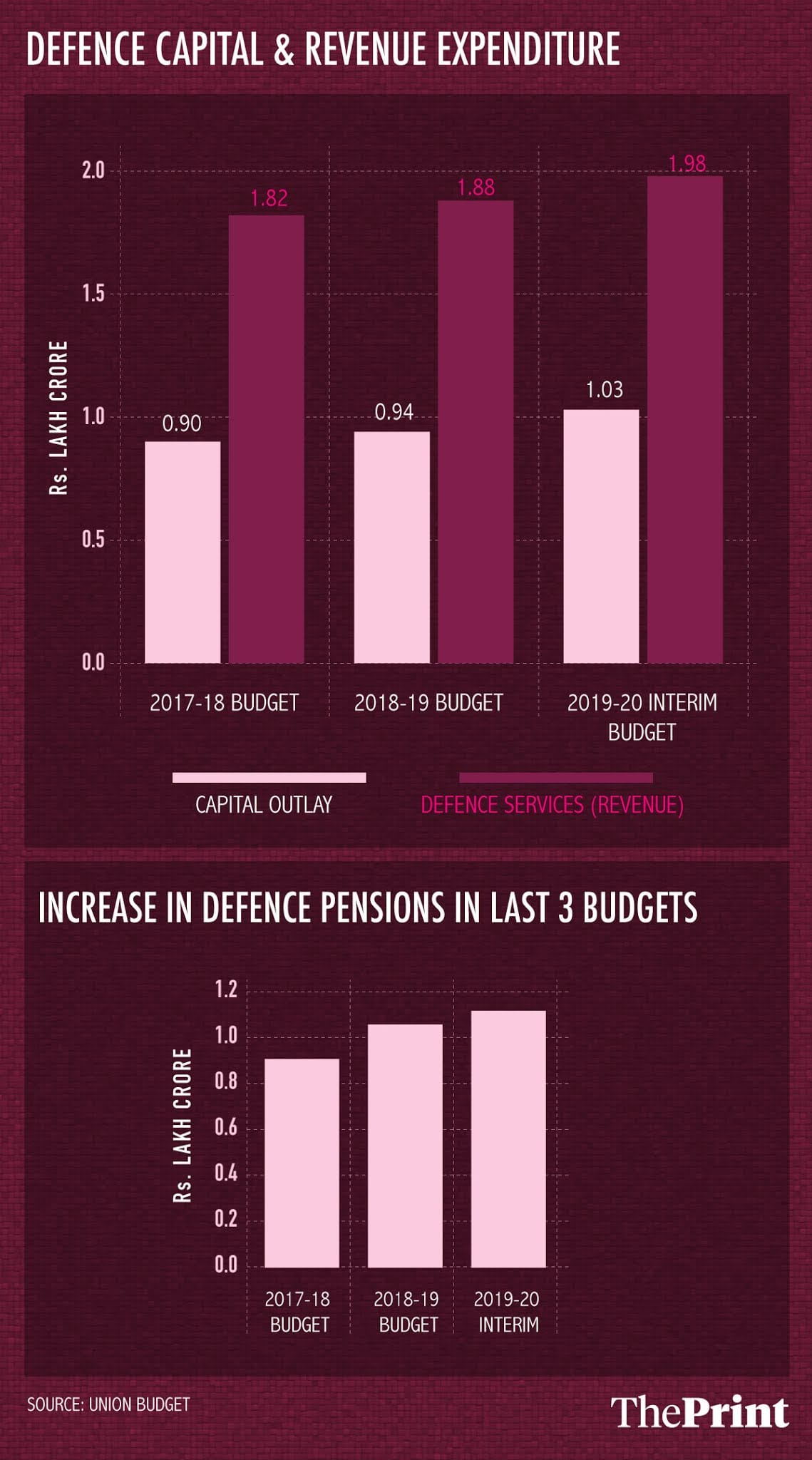

The interim budget for 2019-20, announced this February, allocated nearly Rs 3.02 lakh crore for defence services’ capital and revenue expenditure. This alone formed 10 per cent of the total budget outlay of Rs 27.84 lakh crore. In 2018-19, Rs 2.87 lakh crore was spent on defence revenue and capital outlay.

This total excludes two components of the defence budget: Pensions, which comprise about 25 per cent of the defence budget, and miscellaneous expenses.

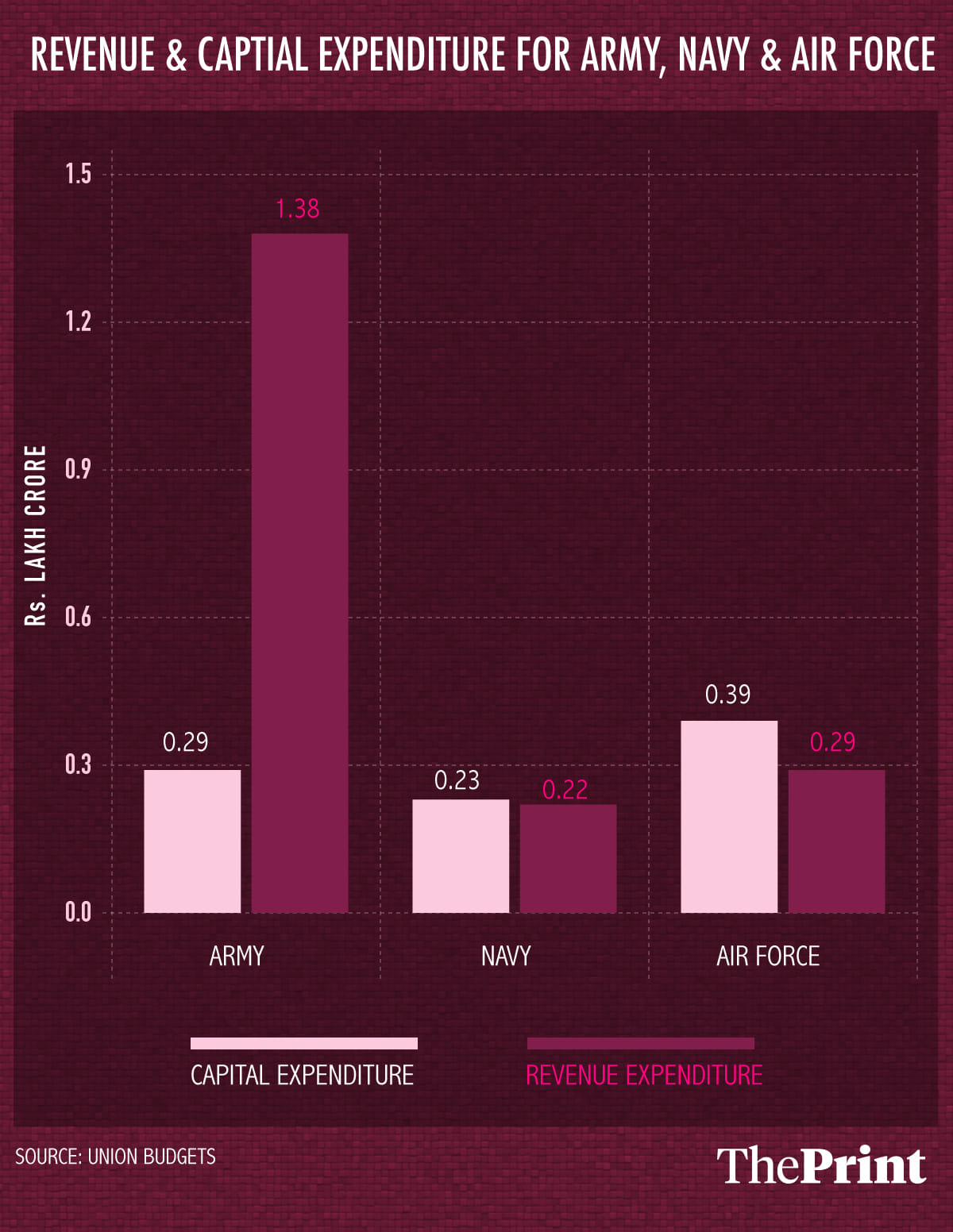

Army sources said they had the biggest bite taken out of their budget on account of revenue expenses since they had many more personnel than the Navy and the Air Force. While the Army has around 13 lakh personnel, the IAF has nearly 1.5 lakh and the Navy around 50,000.

For instance, the Army was allocated Rs 1.38 lakh crore under the revenue head in the 2019-20 interim budget, against a capital outlay of Rs 0.29 lakh crore.

The ratio of revenue and capital expenditure, meanwhile, is more proportionate for the Navy and the Air Force. The revenue outlay carved out for the Navy in the interim budget stood at Rs 0.22 lakh crore and the capital outlay at Rs 0.23 lakh crore. For the IAF, the revenue outlay was Rs 0.29 lakh crore and the capital outlay is Rs 0.39 lakh crore.

“The allocation on capital outlay for the Army thus turns out to be meagre and can barely cater to the committed liabilities as well as all planned new schemes,” the second official quoted above said, adding that a non-lapsable defence capital fund account is “the need of the hour”.

Also read: Narendra Modi govt wants a strong military, but its defence budget can’t guarantee that

This report has been updated with additional information

I would like to point out to the writer, that the Officers coming from the Short Service Commission DO NOT GET ANY BENEFITS FROM ECHS. They DO NOT DRAW PENSION. Kindly correct your facts before posting articles. Please refer to Letter dated 14 November, 2018 from Department of Ex Servicemen Welfare under Defense Ministry.