By Yuka Obayashi

TOKYO (Reuters) – Oil prices eased on Friday, extending losses from the two previous days and heading for a weekly decline, as softening U.S. economic data and a rise in U.S. gasoline inventories raised concerns about a recession and slower global oil demand.

Brent futures for June delivery were down by 14 cents, or 0.2%, at $80.96 a barrel at 0101 GMT. West Texas Intermediate crude (WTI) for June delivery slid 12 cents, or 0.2%, to $77.25 a barrel.

Both benchmarks slid by more than 2% to their lowest level since late March on Thursday amid fears of a possible recession, and were on track for a weekly drop of about 6%.

“Market sentiment remained bearish after the weak U.S. economic data, along with expectations of interest rate hikes, fuelling worries over a recession that could dent oil demand,” said Hiroyuki Kikukawa, president of NS Trading, a unit of Nissan Securities.

“WTI is expected to trade in the $75-$80 range for the next week as investors try to figure out if U.S. gasoline demand will increase toward the summer driving season, and if China’s oil demand will really pick up in the second half of the year,” Kikukawa said.

Economic data showed weekly jobless claims rose last week, indicating the U.S. labour market may be starting to show signs of slowing as the lag effect of multiple interest rate hikes by the Federal Reserve takes hold, fanning concerns about a slowdown in fuel demand.

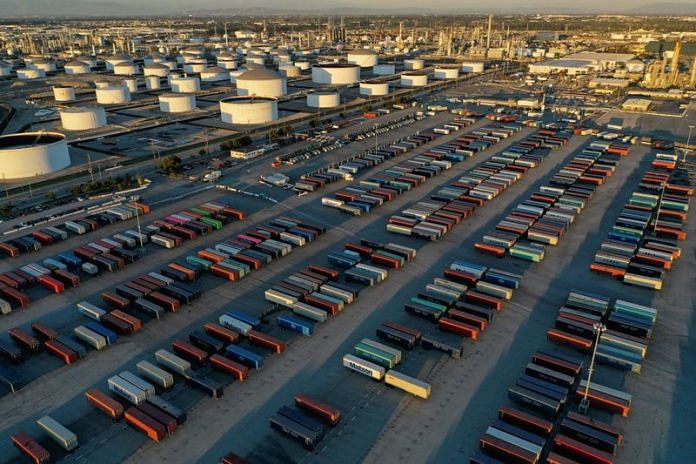

U.S. crude oil inventories last week fell more than forecast as refinery runs and exports rose, while gasoline stockpiles jumped unexpectedly on disappointing demand, Energy Information Administration data showed on Wednesday.

Meanwhile, China may cut quotas for refined oil products exports in a second batch for 2023 as domestic demand improves while the need to boost its economy through oil products abates, a Reuters survey showed.

On the supply side, oil loading from Russia’s western ports in April is likely to rise to the highest since 2019, above 2.4 million barrels per day, despite Moscow’s pledge to cut output, trading and shipping sources said.

(Reporting by Yuka Obayashi; Editing by Kenneth Maxwell)

Disclaimer: This report is auto generated from the Reuters news service. ThePrint holds no responsibilty for its content.